Probe Reprocessing Market Size, Share & Trends Analysis Report By Probe Classification (Critical, Semi-Critical), By Probe Type (Convex Probes, Linear Probes), By Product, By Method, By End Use, By Region, And Segment Forecast, 2025 - 2030

- Report ID: GVR-4-68040-490-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Probe Reprocessing Market Size & Trends

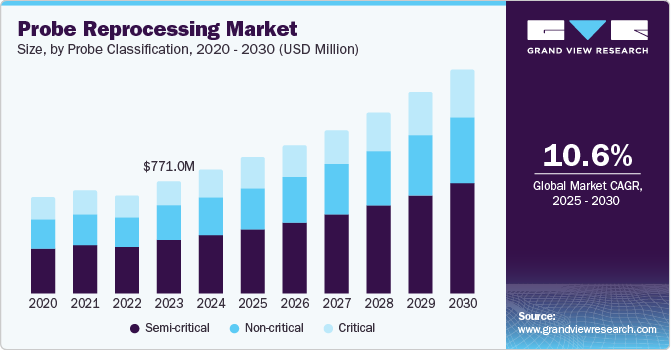

The global probe reprocessing market size was valued at USD 844.87 million in 2024 and is anticipated to grow at a CAGR of 10.55% from 2025 to 2030. The growth can be attributed to the increasing prevalence of Hospital-acquired Infections (HAIs), growing awareness about the importance of infection control, and stringent regulatory guidelines set by health authorities. With the rise in the use of medical probes in diagnostic imaging, endoscopy, and other procedures, the demand for proper cleaning, disinfection, and sterilization of these devices has significantly increased to prevent cross-contamination.

The rising demand for ultrasound procedures is projected to drive the growth of the probe reprocessing industry in the coming years. There is also an increasing need for research on the utilization of ultrasound technologies. For example, a study published by the National Library of Medicine in August 2022 analyzed ultrasound usage within the radiology department at Tygerberg Hospital (TBH). This study compared ultrasound volumes from 2013 to 2019, revealing a 12% increase in utilization. Ultrasound remained the second-most frequently performed specialized imaging procedure after computed tomography.

Moreover, the growing use of echocardiograms-ultrasound-based examinations of the heart-for cardiac diagnostics, driven by the rising prevalence of cardiovascular diseases, is expected to fuel the demand for ultrasound procedures. According to data released by MedStar Health in January 2024, over 7 million echocardiograms are conducted annually in the U.S. As a result, the rising need for cardiac ultrasound is anticipated to increase the demand for phased array or cardiac probes, further driving the need for probe reprocessing solutions to meet this growing demand.

In addition, technological advancements, including the development of high-level disinfectants and automated probe reprocessing systems, are expected to further propel market expansion. Key industry players, such as CS Medical LLC and Nanosonics, are introducing innovative solutions. For instance, in November 2022, Nanosonics launched four new products targeting the UK and Ireland markets: the Wireless Probe Holder, AuditPro, Soluscope Serie-TEE, and the UPS Bracket. AuditPro is a digital infection control management solution designed to enhance traceability and compliance. It is available in tailored versions such as the AuditPro Digital Logbook and AuditPro Infection Control Management Solution.

Moreover, the increasing emphasis on automation in probe reprocessing is expected to create significant opportunities for industry participants. Automated systems are gaining traction due to several advantages, including minimizing the risk of human error and inconsistencies across disinfection cycles, reducing the need for manual staff involvement, lowering personal protective equipment (PPE) requirements, improving compliance with standard operating procedures (SOPs), and streamlining workflows for easier scalability across healthcare departments.

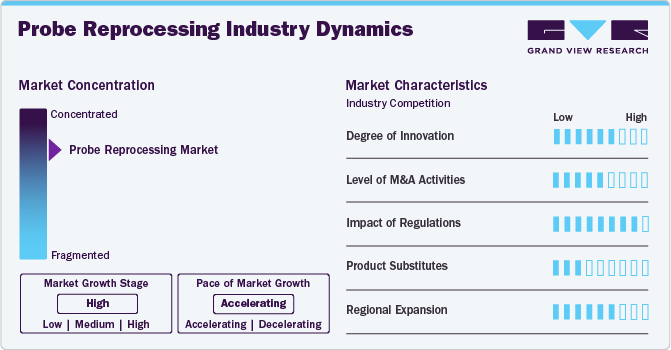

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The probe reprocessing market is characterized by a high degree of growth due to the increasing prevalence of hospital-acquired infections (HAIs).

The market is experiencing high levels of innovation driven by advancements in high-level disinfectants, automated reprocessing systems, and digital infection control management solutions. Companies operating in the market are continuously developing technologies to enhance efficiency, ensure compliance, and reduce human error. Advanced and automated traceability solutions like AuditPro and integrated reprocessing platforms are reshaping operational workflows in healthcare facilities.

Regulatory bodies, such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA), play a pivotal role in shaping the industry by enforcing strict standards for infection control and device safety. Compliance with guidelines from organizations like the Centers for Disease Control and Prevention (CDC) and the International Organization for Standardization (ISO) has become essential for product development and market approval, further driving regulatory adherence in probe reprocessing solutions.

The availability of single-use probes and disposable covers offers a potential substitute for traditional reprocessing methods. However, high costs and environmental concerns limit widespread adoption, keeping demand strong for advanced reprocessing solutions.

Industry players are actively focusing on regional expansion to capture untapped growth opportunities in developing markets and comply with localized regulatory requirements. The Asia-Pacific region, in particular, is becoming a focus due to increasing healthcare expenditure, rising ultrasound procedure volumes, and growing awareness of infection control. Furthermore, companies are increasingly investing in developing novel disinfection and reprocessing technologies. For instance, in May 2022, Germitec, an industry player, completed a financing round of USD 11.75 million. This new funding will support the company's growth and further develop its innovative disinfection technologies. Thus, such financing is anticipated to support the expansion strategies over the forecast period.

Probe Classification Insights

The semi-critical sterilizers segment held the largest revenue share of around 47.23% in 2024, and is expected to grow at the highest CAGR during the forecast period. Semi-critical probes, which come into contact with mucous membranes and non-intact skin, are expected to grow in the probe reprocessing market due to increasing awareness of infection control practices. These probes pose a moderate risk of transmitting infections if not properly disinfected. Several regulatory bodies are further increasing their emphasis on reprocessing semi-critical probes to ensure patient safety, encouraging healthcare facilities to adopt probe reprocessing instruments.

The non-critical segment is expected to grow at a substantial rate over the forecast period. As healthcare providers and regulatory bodies place greater emphasis on patient safety, even devices that come into contact with intact skin, such as ultrasound probes, are preferred to be reprocessed before use. Non-critical devices pose a lower risk than critical or semi-critical probes. Still, cross-contamination concerns, especially in high-patient turnover settings, increase the need for thorough disinfection protocols. These devices usually require low-level disinfection methods and non-germicidal detergents for sterilization

Probe Type Insights

Transesophageal (TEE) probes held the largest market share of around 26.95% in 2024. The transesophageal echocardiogram (TEE) probe is an important tool in modern cardiology, providing detailed imaging of the heart and surrounding structures. The increasing demand for accurate cardiovascular diagnostics is anticipated to increase the focus on enhancing the safety and efficiency of TEE probe reprocessing. Moreover, the rising prevalence of cardiovascular disease further increases the demand for these probes in healthcare organizations.

The phased array/cardiac probes segment is expected to grow at the highest CAGR of 14.03% during the forecast period. The increasing prevalence of heart-related conditions is expected to boost the demand for effective diagnostic tools. Phased array probes are particularly well-suited for cardiac imaging because they provide high-resolution images with rapid acquisition times, enabling clinicians to make timely and informed decisions. This capability is essential in emergency departments where quick diagnostics can be lifesaving, thereby driving the adoption of these probes in hospitals and specialized clinics.

Product Insights

The instruments segment held the largest market share of around 43.92% in 2024, and is expected to grow at the highest CAGR during the forecast period. Probes, especially those used in diagnostic and interventional procedures, come into direct contact with patients and must be cleaned and sterilized. Instruments such as automated reprocessors, UV-C Disinfectors, Manual Reprocessors/Soaking Stations, and Ultrasound Probe Storage Cabinets play a crucial role in ensuring consistent and thorough decontamination of the probes. The shift toward more complex and minimally invasive procedures has further increased the need for enhanced reprocessing instruments, especially those that can sterilize probe materials without impacting their integrity and functionality.

The service segment is expected to grow at a substantial rate over the forecast period. The services segment of the probe reprocessing market is projected to grow significantly due to the increasing complexity of reprocessing guidelines and the rising focus on infection control. As healthcare facilities increase efforts to meet rigorous regulatory standards, they often lack internal resources and expertise to ensure compliance, which is anticipated to boost the demand for the service segment in the coming years.

Method Insights

The high-level disinfection segment held the largest market share of around 42.72% in 2024, and is expected to grow at the highest CAGR during the forecast period. High-level Disinfection (HLD) is primarily used to eliminate a broad spectrum of pathogens, including bacteria, viruses, and fungi, that might not be addressed through low-level disinfection. Another reason for growth in this segment is technological advancements in HLD methods. Moreover, newer HLD products are often compatible with a wide range of probe materials, avoiding the risk of probe damage during reprocessing.

Intermediate level disinfection segment is expected to grow at a substantial rate over the forecast period. The intermediate method is anticipated to experience growth due to its balance between efficacy and operational flexibility. Unlike other probe reprocessing methods, which can require extensive setup, intermediate methods offer a more streamlined approach that remains effective for devices such as ultrasound probes. This makes intermediate methods attractive for healthcare facilities that need to prioritize both efficiency and patient safety without the requirement of extensive resources on equipment that doesn't necessitate high-level sterilization.

End use Insights

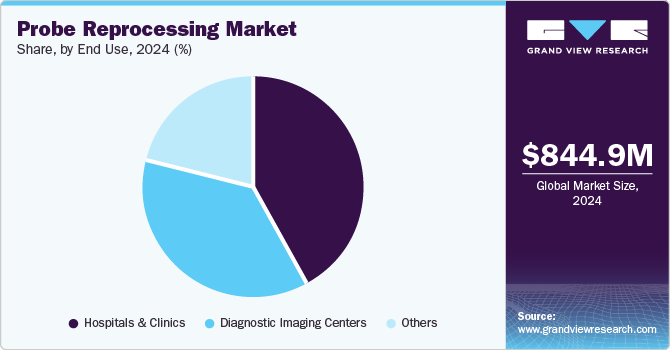

Hospitals and clinics held the largest market share of around 41.69% in 2024. Hospitals and clinics are increasingly prioritizing stringent sterilization protocols to reduce the risk of HAIs. With more patients receiving care in hospital settings, the demand for efficient and reliable reprocessing systems has increased. Clinics aiming to maintain high standards of care while managing operational costs are focusing on reprocessing solutions that streamline workflows and enhance productivity

The diagnostic imaging centers segment is anticipated to grow with the fastest CAGR during the forecast period. The growth of diagnostic imaging centers can be primarily attributed to the increasing demand for high-quality imaging services. As healthcare systems worldwide continue to prioritize early and accurate diagnosis, diagnostic imaging centers are becoming crucial healthcare facilities for various medical procedures.

Regional Insights

North America probe reprocessing market dominated the global industry with a share of 36.74% in 2024. This dominance can be attributed to the rising number of surgical procedures, growing demand for minimally invasive procedures, and regulatory support and guidance. According to an article published by the University of Wisconsin System in May 2024, approximately 15 million Americans undergo surgery yearly.

U.S. Probe Reprocessing Market Trends

The probe reprocessing market in the U.S. held a significant market share in 2024. The increasing launch of probe reprocessing products and the rising number of surgical procedures are anticipated to support the market growth. The U.S. has seen a significant increase in cosmetic surgery in recent years, which is expected to support the market growth. For instance, according to a study published by the National Library of Medicine in September 2024, nearly 45,000 rhinoplasties were performed in the U.S. in 2022.

Canada probe reprocessing market held a significant market share in 2024. The market is anticipated to grow significantly due to the increasing incidence of Hospital-acquired Infections (HAIs) and the rising number of surgical procedures. According to data published by the Government of Canada in June 2024, the incidence of Vancomycin-resistant Enterococcus (VRE) Bloodstream Infections (BSIs) and Carbapenemase-producing Enterobacterales (CPE) infections increased in the Canadian acute care hospitals participating in a national sentinel network from 2018 to 2022.

Europe Probe Reprocessing Market Trends

The probe reprocessing market in Europe is experiencing significant growth. The market is driven by the growing prevalence of HAIs, increasing demand for medical imaging, and the rising number of older individuals across the region. According to data published by the European Centre for Disease Prevention and Control (ECDC) in May 2024, approximately 4.3 million patients in hospitals in the EU/EEA are affected by HAIs yearly.

The UK probe reprocessing market is anticipated to show significant growth due to the increasing launch of new products and healthcare institutions' rising adoption of reprocessing and medical device disinfectant solutions. Established healthcare providers are incorporating advanced probe reprocessing technologies. For instance, in April 2022, Walsall Healthcare NHS Trust installed trophon2 devices from Nanosonics, automating the HLD of ultrasound probes.

The probe reprocessing market in Germany is experiencing significant growth. The increasing emphasis on medical device disinfection and the growing number of surgical procedures are expected to drive the demand for probe reprocessing products in Germany. A significant number of surgeries, including cosmetic and aesthetic procedures, utilize probes. For instance, according to the VDÄPC-Association of German Aesthetic-Plastic Surgeons, rhinoplasty procedures in Germany saw a 2.3% increase in 2021 compared to 2020.

Asia Pacific Probe Reprocessing Market Trends

The probe reprocessing market in Asia Pacific is experiencing rapid growth due to the rising healthcare budgets and government initiatives aimed at enhancing healthcare infrastructure in countries such as China, India, and Japan. As healthcare systems in the region face challenges with increasing medical waste and the need for cost-effective solutions, the adoption of reprocessed medical devices has increased significantly.

China probe reprocessing market is growing at a lucrative growth rate, with the rise in Methicillin-resistant Staphylococcus aureus (MRSA) cases, which is a significant driver of China's market. MRSA is a hospital-acquired infection that poses severe challenges for healthcare facilities due to its resistance to common antibiotics. The increasing prevalence of MRSA in China has prompted healthcare institutions to adopt stringent sterilization practices, creating a higher demand for reliable low-temperature sterilization solutions to ensure the safety of medical instruments and reduce infection risks.

Latin America Probe Reprocessing Market Trends

The probe reprocessing market in Latin America is experiencing significant growth. The market is expected to witness substantial growth owing to the region's increasing focus on healthcare quality and infection control. Many countries in Latin America, such as Brazil and Argentina, are investing more in their healthcare systems, leading to the modernization of facilities and the adoption of advanced medical technologies. This has driven healthcare providers to invest in advanced reprocessing systems for ultrasound, endoscopic, and other diagnostic probes.

Middle East and Africa Probe Reprocessing Market Trends

The probe reprocessing market in the Middle East and Africa is experiencing growth driven by well-established healthcare infrastructure, developments in healthcare infrastructure, and the rising awareness of infection control practices. Significant investments in modernizing healthcare facilities have allowed hospitals to adopt advanced reprocessing technologies in Saudi Arabia, South Africa, and the UAE. In addition, with increasing medical tourism and the expansion of state-of-the-art diagnostic centers, there is a growing need for effective probe sterilization systems to meet international hygiene standards, reduce HAIs, and ensure patient safety in the region.

Saudi Arabia probe reprocessing market is driven by the government's significant investment in healthcare infrastructure, including hospitals, clinics, and medical facilities. The market in Saudi Arabia is experiencing substantial growth, driven by an increasing awareness of infection control and the rising incidence of HAIs. For instance, the updated 2023 surveillance manual published by the Ministry of Health in Saudi Arabia emphasizes the importance of strict disinfection protocols for medical devices to mitigate infection risks.

Key Probe Reprocessing Company Insights

Key market players are focusing on the launch of innovative types of ultrasound probes, growth strategies, and technological advancements. For instance, in June 2023, Tristel Plc announced that the U.S. Food and Drug Administration (FDA) approved Tristel ULT, their innovative high-level disinfectant designed specifically for ultrasound probes. These advancements in the probe reprocessing market are anticipated to boost the market growth over the forecast period.

Key Probe Reprocessing Companies:

The following are the leading companies in the probe reprocessing market. These companies collectively hold the largest market share and dictate industry trends.

- Nanosonics

- CIVCO Medical Solutions

- Tristel Plc

- Ecolab

- Germitec

- CS Medical LLC

- ASP (Fortive Corporation)

- Steelco S.p.A.

- Metrex Research, LLC

- STERIS

Recent Developments

-

In September 2024, The U.S. FDA granted its first-ever De Novo classification for an ultraviolet radiation disinfection chamber device to Germitec’s Chronos. This chemical-free UV-C high-level disinfection (HLD) device is designed to disinfect external ultrasound and endocavitary probes, offering an effective, fast, and environmentally friendly alternative to traditional chemical-based disinfection methods. The FDA’s approval marks a significant milestone in advancing UV-C technology for medical device hygiene.

-

In June 2023, Tristel Plc announced that the U.S. Food and Drug Administration (FDA) has approved Tristel ULT, their innovative high-level disinfectant designed specifically for ultrasound probes. It is a disinfectant foam formulated for use on endocavity transrectal and transvaginal probes, as well as skin surface transducers that may come into contact with non-intact skin during procedures. This approval highlights Tristel ULT as a market-leading solution for safely disinfecting these medical devices.

-

In February 2023, CS Medical reported a strategic collaboration with the Association for Professionals in Infection Control and Epidemiology (APIC) for 2023. This collaboration aims to enhance infection prevention practices by leveraging CS Medical's expertise in medical device disinfection and APIC's leadership in infection control.

Probe Reprocessing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 927.50 million |

|

Revenue forecast in 2030 |

USD 1.53 billion |

|

Growth Rate |

CAGR of 10.55% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Segment Scope |

Probe classification, probe type , product type, method, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, & MEA |

|

Country scope |

U.S., Canada ,Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Key companies profiled |

Nanosonics, CIVCO Medical Solutions, Tristel Plc, Ecolab, Germitec, CS Medical LLC, ASP (Fortive Corporation), Steelco S.p.A., Metrex Research, LLC, STERIS |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Probe Reprocessing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global probe reprocessing market report on the basis of probe classification, probe type, product type, method, and end use and region:

-

Probe Classification Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-Critical

-

Non-Critical

-

Critical

-

-

Probe Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Convex Probes

-

Linear Probes

-

Transesophageal (TEE) Probes

-

Phased Array/Cardiac Probes

-

Endocavitary Probes

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Automated Reprocessors

-

UV-C Disinfectors

-

Manual Reprocessors/Soaking Stations

-

Ultrasound Probe Storage Cabinets

-

-

Consumables

-

Formulations

-

Disinfectant Liquids

-

Disinfectant Wipes

-

Disinfectant Sprays

-

-

Detergent

-

Enzymatic Detergents

-

Non-enzymatic Detergents

-

-

-

Service

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterilization

-

High-Level Disinfection

-

Intermediate Level Disinfection

-

Low-Level Disinfection

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global probe reprocessing market size was estimated at USD 844.87 million in 2024 and is expected to reach USD 927.50 million in 2025.

b. The global probe reprocessing market is expected to grow at a compound annual growth rate of 10.55% from 2025 to 2030 to reach USD 1.53 billion by 2030.

b. North America held the dominant market share in 2024 with a market share of more than 36.74% owing to the presence of key market players, growing product launches in the U.S., and favorable regulations.

b. Some key players operating in the global probe reprocessing market include Nanosonics, CIVCO Medical Solutions, Tristel Plc, Ecolab, Germitec, CS Medical LLC, ASP (Fortive Corporation), Steelco S.p.A., Metrex Research, LLC, STERIS.

b. Key factors driving the market growth include the increasing prevalence of Hospital-acquired Infections (HAIs), growing awareness about the importance of infection control, and stringent regulatory guidelines set by health authorities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."