Privileged Access Management In Healthcare Market Size, Share & Trends Analysis Report By Solution Type, By Deployment (Cloud, On-Premise, Hybrid), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-270-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

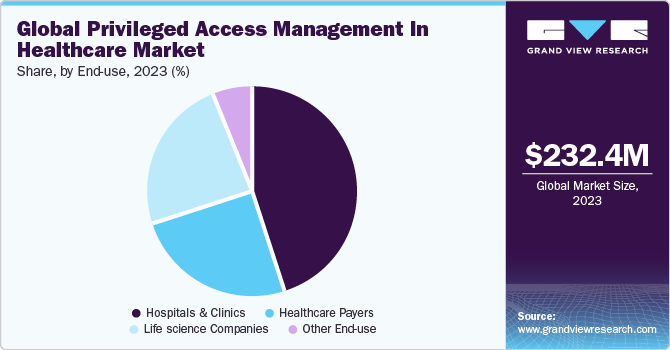

The global privileged access management in healthcare market size was estimated at USD 232.4 million in 2023 and is projected to grow at a CAGR of 11.3% from 2024 to 2030.The market is primarily driven by rising concerns over cybersecurity threats within healthcare. PAM solutions empower organizations to efficiently oversee and supervise privileged access to vital systems & sensitive data, thereby reducing the risk of unauthorized entry and potential data breaches. Moreover, the growing adoption of cloud technologies and the increasing digitalization of patient records & medical information are contributing to market expansion.

Escalating concerns over cyber threats are a significant driver fueling the healthcare market growth. The healthcare sector is a prime target for cyberattacks due to the highly sensitive nature of patient data and critical infrastructure, healthcare organizations are increasingly prioritizing the implementation of robust security measures to protect against cyber threats.

Instances of data breaches and ransomware attacks in the healthcare industry increase awareness about the vulnerabilities within the sector, compelling healthcare providers to invest in advanced security solutions like Privileged Access Management (PAM). The PAM solutions enable organizations to effectively manage and monitor privileged access to critical systems and sensitive data, mitigating the risk of unauthorized access & potential data breaches.

The increasing adoption of cloud computing across the globe has transformed the healthcare industry. The industry is one of the most challenging to transform, as it comprises highly sensitive and personalized information. Cloud computing is changing the way nurses, doctors, and clinics deliver quality & cost-effective services to patients.

The rapid adoption of cloud technology in healthcare is driven by its numerous benefits, including enhanced decision-making, increased efficiency, reduced costs, improved data security and privacy, advanced analytics capabilities, and streamlined processes. Providers stand to gain from cloud integration through improved procure-to-pay processes, granting real-time data access and minimizing manual interventions. According to a 2022 survey article by Amazon Web Services, Inc., 95% of healthcare providers intend to transition more than half of their applications to the cloud within three years, which highlighted the rapid acceleration of cloud adoption among healthcare leaders.

The COVID-19 pandemic had a positive impact on the market growth within the healthcare sector. With the sudden shift to remote work and increased reliance on digital platforms for healthcare services, the need to secure privileged access to critical systems and patient data has become more pronounced than ever before.

One significant impact is the accelerated adoption of telemedicine and remote healthcare services, leading to an expansion of digital infrastructure within healthcare organizations. This rapid digital transformation has heightened the importance of robust PAM solutions to ensure secure access to sensitive patient information and protect against cyber threats.

Survey/Case Study Insights

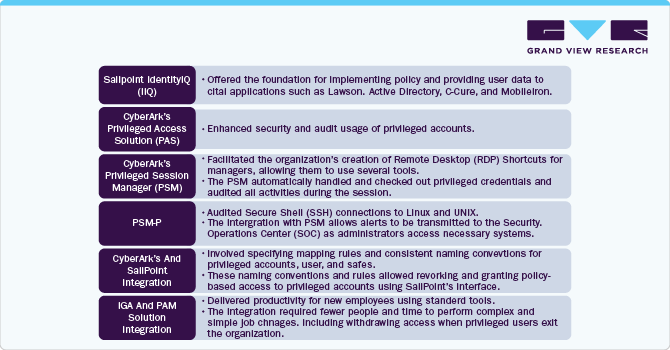

A California-based healthcare organization supporting over 8,000 workers implemented an integrated IGA and PAM solution.

Challenges

-

No central view of users and privileges

-

No standard approval workflow for access requests

-

Access to privileged account passwords was not audited, and passwords were not consistently rotated

-

Lack of a managed identity life cycle

Solution

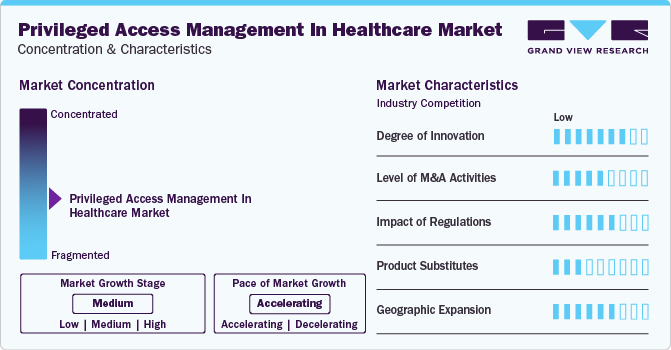

Market Concentration & Characteristics

PAM solutions use several advanced technologies, such as cloud computing, analytics, and AI. According to a Keeper Security December 2023 survey, 82% of respondents favor transitioning their on-premises PAM solutions to the cloud. Moreover, cloud adoption expands the attack surface for cyber threats, including unauthorized access attempts and data breaches.

Mergers and acquisitions (M&A) have been a significant factor in this market, with companies seeking to strengthen their offerings, expand their market presence, or acquire specialized technology and expertise. For instance, in February 2024, Delinea announced a definitive agreement to acquire Fastpath. This acquisition is a step in Delinea's strategy to strengthen its position in the cybersecurity space.

The impact of regulation is high in the market. Some of these regulations include the Health Insurance Portability and Accountability Act (HIPAA), the Sarbanes-Oxley Act (SOX), and the Payment Card Industry Data Security Standard (PCI DSS). Whereas, in Europe, the General Data Protection Regulation (GDPR) is one of the most significant regulations that organizations must adhere to when it comes to managing privileged access to sensitive data.

The threat of substitute products is expected to be low in the global market over the forecast period. PAM offers functionalities designed to meet the specific needs of the healthcare industry. Role-based Access Control (RBAC) and Identity and Access Management (IAM) can be considered as used as substitutes but are not direct alternatives to the PAM solutions, resulting in a lower threat of substitutes.

The players in the PAM industry undergo geographic expansion through strategic initiatives, such as mergers, acquisitions, partnerships, and launching a new facility in a new location. It helps the companies to expand their product portfolio and customer base, resulting in a stronger position in the global industry.

Solution Type Insights

Based on solution types, the privileged account and session management services (PASM) segment held the market with the largest revenue share of 38.41% in 2023, which can primarily be attributed to factors such as technological advancements and the increasing awareness of telehealth. Furthermore, the growing demand to counter cybercrime by restricting access to privileged accounts and monitoring user activities to safeguard data from unauthorized access attempts propel the adoption of PASM services among healthcare organizations.

The privileged elevation and delegation management (PEDM) segment is expected to experience at the fastest CAGR of 12.01% over the forecast period. PEDM solutions are specifically focused on elevating and delegating privileges in a controlled manner. By limiting the number of privileged user accounts and sessions, PEDM effectively reduces an organization's attack surface, thereby significantly reducing vulnerable vectors for cybercriminals. This aspect is anticipated to drive market growth over the forecast period.

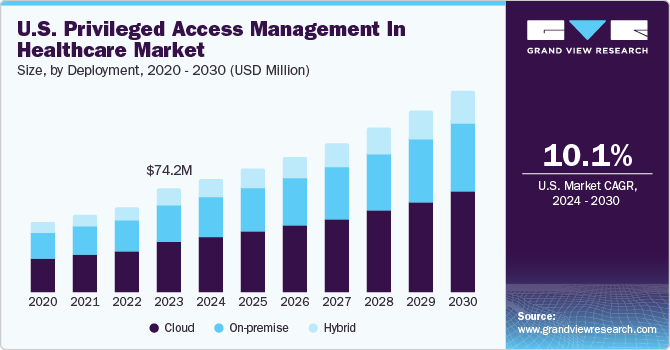

Deployment Insights

Based on type, the cloud-based segment led the market with the largest revenue share of 48.96% in 2023. Cloud-based PAM solutions enhance overall security by minimizing the likelihood of human error and accidental data breaches, ensuring that only authorized users can execute sensitive tasks. They also deliver expert maintenance for patches & upgrades and implement new features. In addition, these solutions offer secure architecture, data encryption, & advanced threat management, providing increased visibility and control over privileged access activities to detect and prevent potential risks.

The hybrid segment is projected to exhibit at the fastest CAGR of 11.9% during the forecast period. Hybrid PAM solutions provide a balanced approach, utilizing both on-premise infrastructure for controlling sensitive data and cloud-based services for scalability, cost-effectiveness, and enhanced security measures, such as multifactor authentication and privileged session monitoring.

End-use Insights

Based on end-use, the hospitals and clinics segment led the market with the largest revenue share of 43.15% in 2023, driven by factors such as the increasing implementation of advanced technology within hospitals for data storage and management of sensitive information. PAM plays a crucial role in mitigating risks and addressing audit findings. Hospitals and clinics lead in the effective management of privileged access, ensuring the security of sensitive data and compliance with industry regulations. This ensures a secure environment for patient information and operational integrity through the deployment of PAM solutions.

The life sciences companies segment is anticipated to witness at the fastest CAGR of 12.20% over the forecast period. By integrating PAM solutions into their security infrastructure, life sciences companies can enhance data protection measures, ensure compliance with regulatory standards, and uphold integrity in their operations.

Regional Insights

North America dominated the privileged access management in healthcare market with the largest revenue share of over 39.0% in 2023. The key attributing factors for the market growth are increasing frequency & sophistication of cyberattacks, which has led to a greater need for robust security solutions and stringent regulatory requirements as well as compliance standards, which make it important for organizations to implement effective PAM solutions to protect sensitive data & meet regulatory requirements. Furthermore, the rising adoption of cloud-based services and the Internet of Things (IoT) is driving the market growth in North America, as these technologies have increased the attack surface for cybercriminals.

U.S. Privileged Access Management In Healthcare Market Trends

The privileged access management in healthcare market in the U.S. held the largest market share in 2023. This can be attributed to increasing investments in cybersecurity technologies by government and industry, driven by rising cyber threats & regulatory pressures, which have contributed to the market growth in the U.S. For instance, In June 2022, the U.S. announced new spending bills for the fiscal year 2023, including an allocation of USD 15.6 billion for cybersecurity. However, organizations are allocating more resources to strengthen their security posture, with PAM being a key component of their cybersecurity strategies.

Europe Privileged Access Management In Healthcare Market Trends

The privileged access management in healthcare market in Europe held the second-largest share in 2023. Increasing government initiatives to continued R&D in PAM in healthcare are another key factor driving the market growth. In March 2024, the governments of British Columbia and Canada collaborated to fund around USD 37 million for 14 projects to improve access to high-speed internet for communities across British Columbia. These factors are expected to boost the market growth over the forecast period.

The UK privileged access management in healthcare market is expected to grow at a significant CAGR over the forecast period. The growing number of cyberattacks in the UK is also a high-impact rendering driver for PAM in healthcare in the UK. According to the UK Official Statistics Cyber Security Breaches report, nearly 32% of UK businesses reported suffering a breach or cyberattack in 2023. More than 700 cyber incidences per month on average were reported in 2020. Such factors are expected to drive the market growth over the forecast period.

Asia Pacific Privileged Access Management In Healthcare Market Trends

The privileged access management in healthcare market in Asia Pacific is anticipated to witness at a lucrative CAGR over the forecast period. This can be attributed to the adoption of EHRs, telemedicine, and other digital health solutions. With increased digitalization comes a greater need for robust security measures to protect sensitive patient data, making PAM solutions essential.

The China privileged access management in healthcare market is expected to grow at a significant CAGR over the forecast period. Increasing government initiatives in China are expected to support market growth. For instance, in February 2024, the Ministry of Industry and Information Technology (MIIT) in China revealed a strategy aimed at enhancing data security across the nation's industrial sector.

Latin America Privileged Access Management In Healthcare Market Trends

The privileged access management in healthcare market in Latin America is anticipated to grow at a significant CAGR over the forecast period. This can be attributed to the increasing rising cybersecurity threats and growing adoption of digital health in the region.

Middle East & Africa Privileged Access Management In Healthcare Market Trends

The privileged access management in healthcare market in Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. Healthcare organizations in the region strive to protect sensitive patient data and ensure the security and integrity of their digital infrastructure, such factor propel the market growth.

Key Privileged Access Management In Healthcare Company Insights

Key players operating in the global market are Bravura Security Inc; Delinea; Imprivata, Inc.; CyberArk Software Ltd.; ARCON; One Identity LLC.; and Saviynt Inc. These players are engaged in various strategies, such as the launch of new services, mergers & acquisitions, and partnerships & collaborations to increase their market share.

Key Privileged Access Management In Healthcare Companies:

The following are the leading companies in the privileged access management in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Bravura Security Inc.

- Delinea

- Imprivata, Inc.

- (Thoma Bravo acquired Imprivata in September 2016)

- CyberArk Software Ltd.

- ARCON

- One Identity LLC.

- Saviynt Inc.

Recent Developments

-

In March 2024, Delinea announced quantum-safe encryption on its platform which is a significant development in cybersecurity. This encryption leverages algorithms resistant to attacks from quantum computers, protecting sensitive secrets and credentials

-

In February 2024, CyberArk Software Ltd. announced the release of Privilege Cloud version 14.1, which is expected to offer flexible tools to define advance rules for better accuracy along with automated account onboarding. This PASM solution is designed to ensure well-defined and secure account management

-

In September 2023, CyberArk announced its new Artificial Intelligence Center of Excellence (COE) to leverage AI to enhance identity security, focusing on privileged access management

Privileged Access Management In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 256.5 million |

|

Revenue forecast in 2030 |

USD 488.1 million |

|

Growth rate |

CAGR of 11.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution type, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Denmark; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Bravura Security Inc.; Delinea; Imprivata, Inc.; (Thoma Bravo acquired Imprivata in September 2016); CyberArk Software Ltd.; ARCON; One Identity LLC.; Saviynt Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Privileged Access Management In Healthcare Market Report Segmentation

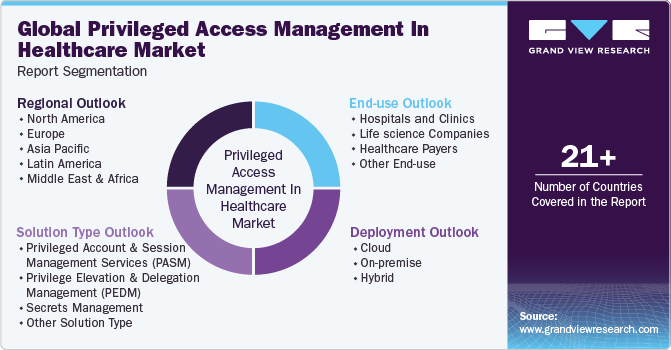

This report forecasts revenue growth at the global, regional, and country-level and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the privileged access management in healthcare market report based on solution type, deployment, end-use, and region:

-

Solution Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Privileged Account And Session Management Services (PASM)

-

Privilege Elevation And Delegation Management (PEDM)

-

Secrets Management

-

Other Solution Type

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Life science Companies

-

Healthcare Payers

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global privileged access management in healthcare market size was estimated at USD 232.4 million in 2023 and is expected to reach USD 256.5 million in 2024.

b. The global privileged access management in healthcare market is expected to grow at a compound annual growth rate of 11.3% from 2024 to 2030 to reach USD 488.1 million by 2030

b. North America dominated the market for privileged access management and accounted for the largest revenue share of over 39.0% in 2023. The market's growth is attributed to key factors, including the rising frequency and sophistication of cyberattacks, which have heightened the demand for robust security solutions. In addition, stringent regulatory requirements and compliance standards underscore organizations' importance in implementing effective Privileged Access Management (PAM) solutions. These measures are crucial for safeguarding sensitive data and ensuring compliance with regulations.

b. Some key players operating in the privileged access management in healthcare market include Bravura Security Inc.; Delinea; Imprivata, Inc.; (Thoma Bravo acquired Imprivata in September 2016); CyberArk Software Ltd.; ARCON; One Identity LLC.; Saviynt Inc

b. Key factors that are driving the market growth include the rising concern over cyber threats, the widespread adoption of cloud technologies, and the increasing digitalization of patient records and medical information

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."