- Home

- »

- Homecare & Decor

- »

-

Private Security Services Market Size, Industry Report, 2030GVR Report cover

![Private Security Services Market Size, Share & Trends Report]()

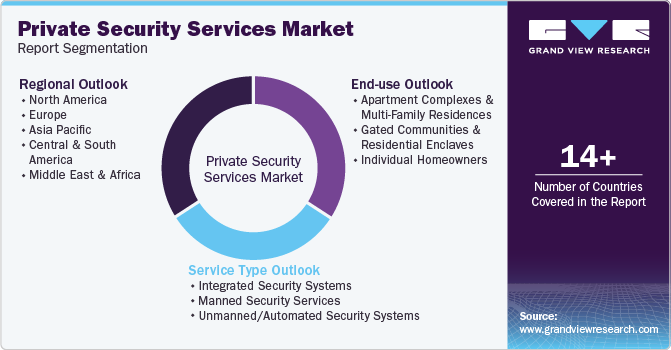

Private Security Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Manned Security Services, Unmanned/Automated Security Systems, Integrated Security Systems), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-508-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Private Security Services Market Summary

The global private security services market size was estimated at USD 4.62 billion in 2024 and is projected to reach USD 8.00 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030.The private security services industry is experiencing significant growth, particularly within the residential sector, as individuals increasingly seek reliable solutions to protect their homes.

Key Market Trends & Insights

- North America accounted for a global revenue share of around 58% in 2024.

- U.S. held a dominant 75% share of the North American market.

- By service type, integrated security systems accounted for about 59% of the overall private security services market in 2024.

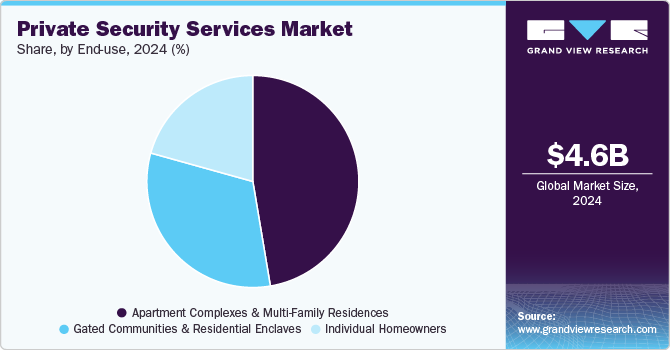

- By end use, the use of private security services in apartment complexes and multi-family residences accounted for a share of about 46% of the overall private security services industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.62 Billion

- 2030 Projected Market Size: USD 8.00 Billion

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

Heightened concerns over personal safety, property protection, and the rising need for a sense of security have driven this demand. As crime rates climb and threats evolve, homeowners are turning to private security services to mitigate potential risks, making these services a crucial aspect of residential safety.

In gated communities and residential enclaves, the need for private security services has grown substantially. These communities, often home to families or individuals prioritizing safety, depend on advanced security solutions such as restricted access and multi-entry point surveillance. The demand for specialized services like 24/7 patrols, surveillance systems, and access control measures has surged, highlighting the growing reliance on the security services industry to maintain peace of mind and safety for residents.

The private security services industry also plays an essential role in safeguarding multi-family residences, where security concerns have increased due to higher population density and urbanization. To meet the unique needs of residents in such environments, the residential security services industry is adapting with keyless entry systems, video monitoring, and on-site security personnel. These tailored solutions provide a safe and secure living environment for residents, ensuring personalized protection in high-density settings.

Individual homeowners are increasingly investing in residential security services to protect their families and properties. From alarm systems and surveillance cameras to personal security guards and emergency response services, the market offers a wide range of options. With concerns about burglary, home invasions, and property crimes rising, private security services have become a priority for homeowners looking to secure their living spaces. The FBI's revised violent crime rate in 2024 underscores the growing need for advanced and smarter security solutions to protect homes against emerging threats.

Consumer Surveys & Insights

In July 2024, TurboTenant, Inc. surveyed over 3,000 Americans to uncover the home safety features they lack but desire. Nearly half of the respondents expressed a wish for improved safety features in their homes, apartments, or complexes. Additionally, one-third of Americans indicated they would be willing to pay over USD 100 extra in monthly rent for enhanced security. The accompanying graph highlights the most sought-after security features among homeowners.

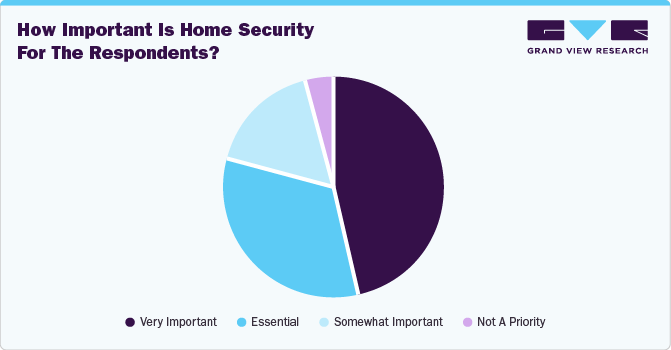

In 2024, Top Rail Fence surveyed 1,023 U.S. respondents to gain insights into home security practices. Home security emerged as a top priority, with 47% of respondents stating it is very important and nearly as many viewing it as essential. Among male respondents, 50% considered home security very important, compared to 45% of females. Homeowners are increasingly adopting advanced security systems and preventive measures to protect their properties and enhance peace of mind.

Service Type Insights

Integrated security systems accounted for about 59% of the overall private security services market in 2024. These systems combine human labor with advanced automated technologies, such as surveillance cameras, real-time data feeds, and remote monitoring, to enhance security effectiveness. This service type is dominant in the residential security market due to its ability to seamlessly blend human decision-making with cutting-edge technology, offering real-time monitoring and rapid response capabilities. It helps address challenges like labor shortages or budget constraints by leveraging technology to fill gaps in security personnel. The integration of features like remote surveillance, loudspeakers, and automated alerts further enhances safety and convenience, making it a cost-effective and efficient solution for homeowners.

Demand for manned security services is expected to increase at a CAGR of 10.6% from 2025 to 2030 as residential properties increasingly prioritize visible deterrents, rapid response, and expert monitoring. The presence of trained guards acts as a powerful deterrent to criminals, reducing the likelihood of incidents. Guards can quickly respond to emergencies, minimizing damage and harm. Additionally, their vigilance ensures effective access control and verification, preventing unauthorized access and enhancing overall security.

Demand for unmanned/automated security systems is expected to rise at a CAGR of 10.1% from 2025 to 2030. These services integrate technologies like CCTV cameras, access control, alarms, and analytics to provide round-the-clock monitoring and protection without the need for human intervention. The demand for these systems will rise due to their cost-effectiveness, ability to offer real-time updates, and advanced features like facial recognition and automated reporting, which ensure efficient monitoring and rapid responses.

End Use Insights

The use of private security services in apartment complexes and multi-family residences accounted for a share of about 46% of the overall private security services industry in 2024. Private security services in apartment complexes and multi-family residences are in high demand due to the need for deterrence against vandalism, theft, and property damage. Security guards provide rapid response to incidents, ensuring tenant safety and minimizing damage to property. They also offer essential monitoring in high-risk areas, such as parking lots and mailrooms, preventing break-ins and theft.

Demand for private security services by individual homeowners is anticipated to rise at a CAGR of 10.7% from 2025 to 2030. This is due to the growing need for protection against increased risks associated with wealth, such as theft, trespassing, and personal safety threats. As affluent individuals prioritize the preservation of their privacy and exclusivity, they will seek advanced security measures to safeguard their homes, valuable assets, and personal privacy. With the continued desire for safe, secluded properties and high-value assets, the implementation of sophisticated security systems and on-site security personnel will become a necessity, further driving the demand for private security services.

Regional Insights

The private security services industry in North America accounted for a global revenue share of around 58% in 2024. The demand for security services in residential applications across North America is expected to grow as the economy recovers, leading to increased consumer spending and corporate profits. Rising crime rates, shifting security needs, and heightened concerns about personal safety will drive homeowners to invest more in private security. As businesses expand and residential areas see a surge in high-net-worth individuals, the need for advanced security systems and services to protect properties and ensure peace of mind will continue to rise, contributing to the overall growth of the industry.

U.S. Private Security Services Market Trends

In 2024, the private security services industry in the U.S. held a dominant 75% share of the North American market. This can be attributed to rising crime concerns and the increasing adoption of advanced security technologies, such as surveillance cameras and access control systems. As individuals seek greater protection for their homes and personal safety, the demand for sophisticated security solutions will rise. Additionally, the growing trend of outsourcing security needs to specialized firms, along with economic growth, will contribute to the expansion of residential security services across the country.

Europe Private Security Services Market Trends

The private security services industry in Europe accounted for about 26% of the overall market in 2024. This is anticipated to be driven by the low current penetration rate among households, highlighting significant untapped potential. Countries with established home security industries, such as Spain, France, and Sweden, are expected to outpace the European average in growth. Additionally, the rising adoption of interactive security services and smart home products will further accelerate the demand for residential security solutions across Europe.

Asia Pacific Private Security Services Market Trends

The private security services industry in Asia Pacific is set to grow at a CAGR of 11.9% from 2025 to 2030. This is due to increasing concerns about personal safety amid rising investments and economic activities. As the region becomes a hub for global business and trade, the demand for robust security measures, including private security services, is heightened to protect assets and individuals in both urban and politically sensitive areas. Additionally, the integration of advanced technologies and localized security strategies is driving the adoption of residential security solutions.

Key Private Security Services Company Insights

The private security services industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Allied Universal, Securitas AB, GardaWorld, and SECOM CO., LTD., among others. Market players are differentiating through expansions and mergers to cater to evolving consumer preferences.

Key Private Security Services Companies:

The following are the leading companies in the private security services market. These companies collectively hold the largest market share and dictate industry trends.

- Allied Universal

- Securitas AB

- GardaWorld

- SECOM CO., LTD.

- Titan Security Group

- Control Risks Group Holdings Ltd

- Off Duty Officers, Inc

- National Security Service LLC

- CITIGUARD

- American Global Security

Recent Developments

-

In November 2024, Westminster Security Group expanded to Dubai, establishing a new subsidiary to meet the growing demand for premium private security services in the UAE. The firm offers a range of specialized services, including residential security, bodyguards, security chauffeurs, counter-surveillance teams, and support for high-risk individuals and families, including yacht protection.

-

In June 2022, Allied Universal expanded its global footprint through the acquisition of three companies in New York, the Netherlands, and Denmark. The largest company, International Protective Service Agency (IPSA), based in New York, provided security and event services across New York and New Jersey. The European acquisitions, CQB Beveiliging B.V. in the Netherlands and Kronjyllands Vagtservice A/S in Denmark strengthened Allied Universal’s patrol and response operations under its international arm, G4S.

Private Security Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.00 billion

Revenue forecast in 2030

USD 8.00 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Japan; South Korea; Australia & New Zealand; South Africa; UAE; Brazil; Argentina

Key companies profiled

Allied Universal; Securitas AB; GardaWorld; SECOM CO., LTD.; Titan Security Group; Control Risks Group Holdings Ltd; Off Duty Officers, Inc; National Security Service LLC; CITIGUARD; American Global Security

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Private Security Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the private security services market report on the basis of service type, end use, and region.

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integrated Security Systems

-

Manned Security Services

-

Unmanned/Automated Security Systems

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apartment Complexes & Multi-Family Residences

-

Gated Communities & Residential Enclaves

-

Individual Homeowners

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global private security services market was estimated at USD 4.62 billion in 2024 and is expected to reach USD 5.00 billion in 2025.

b. The global private security services market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 8.00 billion by 2030.

b. North America dominated the private security services market in 2024 with a share of about 58%. The demand for security services in residential applications across North America is expected to grow as the economy recovers, leading to increased consumer spending and corporate profits.

b. Key players in the private security services market are Allied Universal; Securitas AB; GardaWorld; SECOM CO., LTD.; Titan Security Group; Control Risks Group Holdings Ltd; Off Duty Officers, Inc; National Security Service LLC; CITIGUARD; American Global Security.

b. Key factors that are driving the private security services market include rising safety concerns, technological advancements, evolving threat landscapes, and inadequacies in public security resources.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.