- Home

- »

- Healthcare IT

- »

-

Privacy Management Software In Healthcare Market Report, 2030GVR Report cover

![Privacy Management Software In Healthcare Market Size, Share & Trend Report]()

Privacy Management Software In Healthcare Market Size, Share & Trend Analysis Report By Deployment (On-premise, Cloud), By Application, By End-use (Healthcare Provider, Healthcare Payer), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

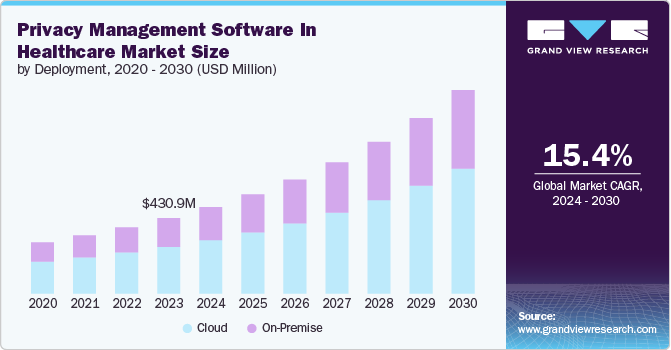

The global privacy management software in healthcare market size was estimated at USD 430.88 million in 2023 and is anticipated to grow at a CAGR of 15.4% from 2024 to 2030. This growth is driven by the increasing need to comply with stringent data privacy regulations and protect sensitive patient information. As healthcare organizations adopt digital solutions and electronic health records (EHRs), the risk of data breaches and cyber threats escalates, necessitating robust privacy management systems.

The market is expanding as more healthcare providers recognize the importance of safeguarding patient data to maintain trust and avoid hefty penalties associated with non-compliance. Continuous advancements in privacy management technologies further contribute to market growth by offering more efficient and comprehensive solutions. For instance, in July 2023, Thales introduced a Data Security Platform as a Service, offering users seamless integration with a partner ecosystem of security vendors. The platform supports enterprise storage, servers, databases, applications, and cloud environments.

Privacy management software market in healthcare need to comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., the General Data Protection Regulation (GDPR) in Europe, and other regional data protection laws. These regulations mandate strict data privacy and security measures to ensure better utilization in the healthcare industry. Privacy management software streamlines compliance by providing tools for data mapping, consent management, risk assessments, and incident response, enabling organizations to efficiently manage their obligations and demonstrate accountability.

In addition, the rising incidence of data breaches in the healthcare sector significantly drives the demand for privacy management software. Breaches can result in substantial financial losses, reputational damage, and loss of patient trust. Privacy management software assists healthcare organizations in identifying vulnerabilities, monitoring data access, and responding swiftly to security incidents. By implementing robust privacy management solutions, healthcare providers can mitigate the risks associated with data breaches and enhance their overall cybersecurity posture.

Furthermore, advancements in technology are propelling the growth of the privacy management software market in healthcare. Innovations such as artificial intelligence (AI), machine learning, and blockchain are being integrated into privacy management solutions to enhance their capabilities. For instance, in December 2022, OneTrust unveiled the Trust Intelligence Platform, creating a new technology category aimed at addressing critical business challenges related to trust and transparency. This platform provides organizations with comprehensive visibility across all trust domains, leverages AI and regulatory intelligence for informed actions, and uses automation to integrate trust as a core design principle.

Deployment Insights

The cloud segment held the largest share of 62.0% in 2023. Cloud-based solutions offer scalability, flexibility, and cost-efficiency, enabling healthcare organizations to manage privacy compliance effectively. These platforms facilitate real-time data access, seamless integration with existing systems, and enhanced security features. As healthcare providers increasingly adopt cloud technologies, the demand for cloud-based privacy management software is expected to surge, driving market expansion in this segment.

Application Insights

The data discovery & mapping segment held the largest share of 25.0% in 2023. This growth is propelled by healthcare organizations' increasing need to comprehensively understand and manage their data assets. For example, in April 2023, IMO introduced IMO Studio, a cloud-based platform aimed at supporting a comprehensive data quality approach in healthcare. The platform provides consolidated access to clinical terminology and standardized reference data, facilitates data normalization, optimizes provider workflows, and effectively manages value sets.

Data discovery and mapping tools play a crucial role in identifying the location of sensitive patient data, tracking its flow within organizations, and managing access permissions. These capabilities are essential for regulatory compliance, risk management, and safeguarding data privacy. As healthcare providers embrace more digital solutions, the demand for robust data discovery and mapping tools continues to grow, further driving market expansion.

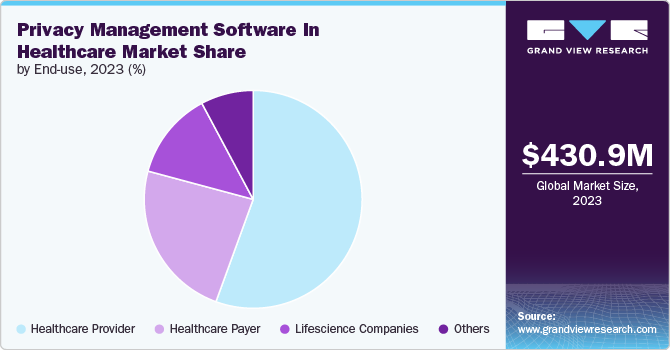

End-use Insights

In 2023, the healthcare provider segment dominated with the largest share at 55.5%, driven by substantial investments in data privacy and security. Healthcare providers prioritize protecting patient information, prompting increased adoption of advanced software solutions.

The lifesciences companies segment is expected to experience the fastest growth. This growth is fueled by the industry's heightened focus on data protection and regulatory compliance. Life sciences companies manage extensive volumes of sensitive data related to drug development, clinical trials, and patient health information. Robust privacy management software solutions play a critical role in ensuring compliance with global regulations such as GDPR and HIPAA, managing complex data environments effectively.

Investments in advanced software technologies are fostering innovation in data privacy strategies, supporting ongoing market expansion.

Regional Insights

North America Privacy Management Software In Healthcare Market Trends

In 2023, the North America privacy management software in healthcare market accounted for a dominant share of 46.3%. This growth is driven by key trends such as stringent regulatory compliance, increasing cybersecurity threats, and the adoption of advanced technologies like AI and blockchain. Notable market players including OneTrust, Thales, and Imperva stood out with innovative solutions tailored to meet regulatory requirements and bolster data security.

For instance, in January 2022, OneTrust announced a collaboration with the Microsoft Intelligent Security Association (MISA), a coalition of software vendors and managed security service providers dedicated to tackling evolving privacy and security challenges. Through this partnership, OneTrust facilitates the automation of data subject access requests (DSARs) for Microsoft 365 customers across their entire ecosystem. These advancements are designed to address ongoing privacy challenges in healthcare and effectively safeguard sensitive patient information.

U.S. Privacy Management Software In Healthcare Market Trends

Privacy management software in healthcare market in the U.S. is anticipated to experience growth driven by several key factors, particularly the growing importance of robust data protection measures. According to the HHS, there has been a notable rise in cybercrimes associated with healthcare data breaches. In 2023, 526 out of 713 reported breaches were categorized as "hacking" or "IT incidents." A major breach in 2021 compromised protected health information (PHI) from over 45.7 million patient records, highlighting the critical necessity for advanced privacy management solutions.

Europe Privacy Management Software In Healthcare Market Trends

Privacy management software in healthcare market in Europe is propelled by stringent regulations such as the General Data Protection Regulation (GDPR). Enforced by entities such as the European Data Protection Board (EDPB), GDPR mandates robust data protection measures. This regulatory environment has driven healthcare organizations to adopt advanced privacy management solutions to ensure compliance and safeguard patient data effectively.

Asia Pacific Privacy Management Software In Healthcare Market Trends

Asia Pacific region is witnessing the fastest growth in the privacy management software in healthcare market, driven by increasing demand for data protection and the expansion of the healthcare industry. As healthcare providers in the region adopt digital solutions, the need for robust privacy management solutions grows accordingly. The expanding healthcare sector, supported by technological advancements and heightened investment, further accelerates the adoption of privacy management software to ensure data security and regulatory compliance.

Latin America Privacy Management Software In Healthcare Market Trends

In Latin America, the privacy management software in healthcare market is experiencing notable growth, supported by increased investment in data protection technologies. Key drivers include rising cybersecurity threats, stringent data protection regulations, and the expansion of digital healthcare infrastructure. Enhanced funding for privacy management solutions enables healthcare organizations to meet regulatory requirements and safeguard patient data effectively, fostering market expansion in the region.

MEA Privacy Management Software In Healthcare Market Trends

The privacy management software in healthcare market in MEA is experiencing growthdue to the adoption of advanced technologies and increasing healthcare needs. As digital healthcare solutions expand, the demand for robust data protection measures rises. Advanced privacy management software helps healthcare organizations in the MEA region ensure data security and compliance, addressing the growing need for secure patient information handling.

Key Privacy Management Software In Healthcare Company Insights

The competitive scenario in the privacy management software in healthcare market is high, featuring notable players such as Caralegal; metricstream; Onetrust; Collibra; Logicgate; Salesforce; TrustArc; Securiti; BigID; SAP; Spirion; DataGrail holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Privacy Management Software In Healthcare Companies:

The following are the leading companies in the privacy management software in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Caralegal

- metricstream

- Onetrust

- Collibra

- Logicgate

- Salesforce

- TrustArc

- Securiti

- BigID

- SAP

- Spirion

- DataGrail

- Osano

Recent Developments

-

In March 2024, VentureBlick announced the launch of Discovery, an innovative networking platform aimed at connecting healthcare innovators, advisors, investors, distributors, partners, and service providers globally.

-

In March 2024, TrustArc and Privya.ai introduced an integrated data automation platform for privacy and AI governance. In addition, TrustArc achieved Google partner certification for its Cookie Consent Manager, enhancing its capabilities in managing cookie compliance.

-

In December 2023, Thales announced the early completion of its acquisition of Imperva. This significant milestone positions Thales as a global provider in cybersecurity, boasting over 5,800 cybersecurity experts across 68 countries. The company anticipates generating USD 2.60 billion in cybersecurity revenue in 2024, encompassing both civil and defense activities, with expectations for double-digit growth moving forward.

Privacy Management Software In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 493.35 million

Revenue forecast in 2030

USD 1,162.89 million

Growth rate

CAGR of 15.4% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Caralegal; metricstream; Onetrust; Collibra; Logicgate; Salesforce; TrustArc; Securiti; BigID; SAP; Spirion; DataGrail; Osano

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Privacy Management Software In Healthcare Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the privacy management software in healthcare market report on the basis of offering, application, end-use and region.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Discovery & Mapping

-

Data Subject Access Request (DSAR)

-

Privacy Impact Assessment (PIA)

-

Consent & Preference Management (CPM)

-

Incident & Breach Management

-

Vendor & Third Party Risk Management

-

Other Application

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Provider

-

Healthcare Payer

-

Lifescience Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global privacy management software in healthcare market size was estimated at USD 430.88 million in 2023 and is expected to reach USD 493.35 million in 2024.

b. The global privacy management software in healthcare market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 1,162.89 million by 2030.

b. North America dominated the privacy management software in healthcare market with a share of 28.9% in 2019. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the privacy management software in healthcare market include Caralegal; metricstream; Onetrust; Collibra; Logicgate; Salesforce; TrustArc; Securiti; BigID; SAP; Spirion; DataGrail

b. Key factors driving market growth include the increasing need to comply with stringent data privacy regulations and protect sensitive patient information. As healthcare organizations adopt digital solutions and electronic health records (EHRs), the risk of data breaches and cyber threats escalates, creating a demand for robust privacy management systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."