Printable Self-adhesive Vinyl Films Market Size, Share & Trends Analysis Report By Manufacturing Process, By Thickness (Thick, Thin), By Type, By Substrate, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-574-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

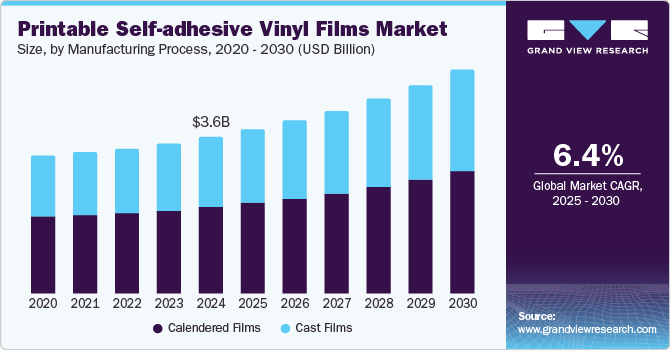

The global printable self-adhesive vinyl films market size was valued at USD 3.56 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2030. Growing demand for fleet graphics due to the increasing presence of commercial vehicles on roads and extensive adoption of these solutions in the sign & graphics industry are expected to remain primary drivers of market expansion. Printable self-adhesive vinyl films are flexible and highly versatile and are made from vinyl and removable adhesives such as acrylic. They are used to make signs, logos, and advertising campaigns for business promotion, as well as propagate information to mass audiences using watercraft graphics, floor graphics, and other tools. These films have witnessed significant growth in their usage in fleet graphics, window & floor graphics, and car wraps.

The accelerated growth of the signage and advertising business, as brands increase their investments in promotional materials to boost visibility, encouraged significant advancements in the printable self-adhesive vinyl films industry. The demand for personalized products such as custom stickers, wall decals, and personal vehicle wraps has seen a noticeable surge in recent years. Organizations aim to promote their products and services on vehicles, shops, and other commercial buildings, and printable vinyl films help them create unique and customized designs. Custom signage, vehicle wraps, and storefront decals by companies help businesses reach their target audience more effectively and efficiently deliver their message. Additionally, increased awareness regarding these materials has made them popular in Do-It-Yourself (DIY) projects, with individuals using printable self-adhesive vinyl for home décor, crafting, and hobby applications.

Printable self-adhesive vinyl is available in calendered and cast films with distinct benefits. For instance, cast films do not shrink with age, have extended life & durability, are available in thinner gauge, and are cost-effective. The material is known for its durability and ability to withstand harsh weather conditions, making it ideal for outdoor advertising, vehicle wraps, and other external applications. Apart from signage and décor, these vinyl films are also used for product labeling, safety signage, branding, and other commercial uses, expanding their demand across retail, healthcare, and logistics industries. Major players compete based on product development and form strategic partnerships with regional companies to address new market entry challenges. The use of e-commerce platforms has provided another avenue for market expansion. These channels offer custom print-on-demand products such as custom stickers, labels, and wall art, with the trend being supported by the ease of online customization tools and increased customer preference for personalized products.

Manufacturing Process Insights

The calendered films segment accounted for the largest revenue share of 55.4% of the global printable self-adhesive vinyl films industry in 2024. Calendered films are produced using a process known as calendaring, and the raw materials are based on specific formulations during the mixing and extrusion process as per applications. The increased range of formulations and availability of new pigments have expanded the color options in this segment, aiding market growth. Compared to cast films, calendered films offer a thicker and stiffer texture for easy handling. Moreover, they are known for their higher performance on flat, simple, moderate curves, abrasion resistance, and cost-effectiveness. Calendered films are extensively used for applications, including sunshade visors, floor graphics, preplaced lettering, and window decals, among others.

The cast films segment is expected to expand at the highest CAGR in the global market during the forecast period. Cast films are ideally used in vehicle wrapping as they are long-lasting and thinner than calendered films. These films are recommended for providing the substrate with a paint-look finish, which would last for an average lifetime of 5-12 years. Cast films are highly durable and resistant to environmental factors such as UV rays, water, and temperature changes. This makes them ideal for long-term outdoor applications such as vehicle wraps and outdoor signage that need to withstand the outside environment.

Thickness Insights

The thick (more than 3 mils) self-adhesive vinyl films segment accounted for the largest revenue share in the global market in 2024. Calendered vinyl films are usually manufactured with a higher thickness to ensure stiffer films for easy handling. Materials with this thickness are typically used in applications where durability, conformability, and strength are key considerations. These thicker films offer additional benefits over thinner films, such as increased resistance to wear, tear, and environmental factors. They are often considered heavy-duty or premium options and are chosen for more demanding applications. These applications include vehicle wraps, vehicle decals, and truck graphics, as thick films ensure greater conformability over complex shapes and can be applied to both flat and curved surfaces, such as cars, trucks, trailers, and buses.

The thin film segment, which includes films between 2-3 mils of thickness, is expected to advance at the highest CAGR from 2025 to 2030 in the global market. Thin films offer higher dimensional stability since vinyl is cast on the casting sheet in a relaxed state. Their relatively lower thickness makes it easier to apply to curved or irregular surfaces without lifting, bubbling, or wrinkling. Such films are ideal for use in applications on compound curves, such as vehicle fenders, motorcycle helmets, rivets, corrugations, and others. Thin films are applied on fleet vehicles, recreational vehicles, boats, and other surfaces that require a paint-like finish.

Type Insights

The opaque segment held the largest revenue share in the global market for printable self-adhesive vinyl films in 2024. Opaque films do not allow light transmission through the surface due to the presence of pigments, which reflect the light on the graphics to the viewer. These films are generally used in retail establishments to notify customers regarding useful information, such as discounts, clearance sales, and hours of operation. Such graphics are inexpensive, capture customer attention, and are easily replaceable per business requirements. They are further used for vehicle wraps and vehicle decals, creating full-color designs that provide a distinct appearance to cars, trucks, vans, and buses. The opacity ensures the printed design is vibrant and sharp without interference from the vehicle's underlying surface color.

The translucent self-adhesive vinyl films segment is expected to advance at the fastest CAGR during the forecast period. Unlike opaque vinyl films, translucent films provide a softer and semi-transparent effect, allowing for backlighting, such as in illuminated signage or lightbox displays. Translucent films are used extensively in backlit and building signage, as backlit graphics encounter various environmental stresses. Other applications include taxi top signage, mall and airport terminal advertising, menu boards, and canopy fascia, which also use translucent films. The fast-expanding advertising industry is expected to drive the demand for these types of films in the coming years.

Substrate Insights

The plastics substrate segment accounted for a leading revenue share in the overall printable self-adhesive vinyl films industry in 2024. The product application on plastic substrate depends on the type of plastic and its chemical composition. Polyvinyl chloride (PVC) is the most common plastic substrate used in self-adhesive vinyl films. It is a flexible, durable, and cost-effective material that can be used for both indoor and outdoor applications. PVC substrates are available in various finishes, including glossy, matte, and satin, and are highly resistant to environmental conditions, such as rain, temperature fluctuations, and UV rays. Such properties make PVC vinyl ideal for vehicle wraps, outdoor signage, and window decals.

The floor substrate segment is expected to expand at the fastest CAGR in the market from 2025 to 2030. The floor substrate in printable self-adhesive vinyl films refers to the type of vinyl material used specifically for applications where the film will be applied directly to the floor. This substrate is designed to withstand constant high foot traffic, environmental exposure, and wear and tear, making it essential for creating durable, long-lasting floor graphics and signs. Floor graphics are used to capture customer attention and provide directions, brand promotion, and information sharing. Such substrates are used in theatres, retail shops, hospitals, offices, and other workplaces.

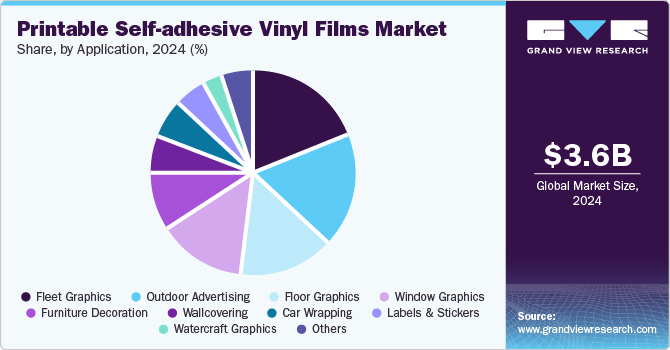

Application Insights

The fleet graphics segment accounted for a leading revenue share in the global market for printable self-adhesive vinyl films in 2024. Increasing demand among organizations for effective advertising that leaves an impression on the customer is driving segment growth. Businesses can print their logo, brand colors, contact information, and promotions on their fleet vehicles to boost consumer awareness. Companies with vehicle fleets can transform their vehicles into mobile billboards. Fleet owners can utilize vehicles to promote their brand on the go, providing a significant return on investment (ROI). The cost-effectiveness and long lifespan of vinyl wraps make them an attractive option for businesses seeking to maximize their advertising budget.

Meanwhile, the exhibition panels segment is expected to advance at the fastest CAGR during the forecast period. The growth in the frequency of trade events, conventions, and exhibitions has compelled businesses participating in these events to utilize attractive and durable promotional tools, creating demand for self-adhesive vinyl films. Printable self-adhesive vinyl films provide a high level of flexibility in terms of design and size, allowing companies to create personalized graphics for booths, signage, backdrops, and other display elements. Additionally, the affordability of these vinyl films makes them an attractive choice for businesses.

Regional Insights

North America accounted for a substantial revenue share in the global printable self-adhesive vinyl films industry in 2024. The presence of a high volume of commercial fleets in regional economies such as the U.S. and Canada and the availability of major retail chains and hypermarkets have created major growth avenues for companies developing printable self-adhesive vinyl films. Advertising campaigns utilize fleet graphics to reach a wider audience, leading to higher utilization of printable self-adhesive vinyl films for outdoor promotions. Moreover, the presence of established market players, including 3M, AVERY DENNISON, and Arlon Graphics, competing with local companies and start-ups has brought several positive developments in the regional market.

U.S. Printable Self-adhesive Vinyl Films Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, owing to the extensive availability of commercial fleets in the economy, making fleet graphics a profitable tool for companies to advertise their solutions. The country also hosts various major global exhibitions and trade events across domains such as healthcare, technology, chemicals, and consumer goods. This encouraged businesses to constantly avail themselves of the services of local manufacturers of self-adhesive vinyl films to attract a larger audience to their booths. The flexibility and customizability of printable vinyl make it a preferred material for such temporary displays and campaigns.

Asia Pacific Printable Self-adhesive Vinyl Films Market Trends

The Asia Pacific printable self-adhesive vinyl films market accounted for a leading global revenue share of 39.5% in 2024, owing to the rising product demand in fast-growing economies such as India and China. The high population in leading regional economies presents better opportunities for brands to generate more daily impressions, leading to cost-effective marketing. The growth in the region has been further strengthened by the extensive adoption of strategic advertising tools by regional companies that necessitate the use of these films. Moreover, government initiatives to promote tourism using printable self-adhesive vinyl for fleet graphics on commercial vehicles, including buses and trucks, have propelled the demand for these films across the region.

China Printable Self-adhesive Vinyl Films Market Trends

China accounted for the largest revenue share in the regional market in 2024 and is expected to maintain its position during the forecast period. The economy has witnessed a significant rise in e-commerce activities in the past few years, which has driven the need among brands to adopt effective advertising and promotional techniques to reach target customers. As a result, companies have opted for advertisement strategies such as labels & stickers, fleet graphics, floor graphics, watercraft graphics, and exhibition panels to boost customer awareness regarding their products and services. As these solutions are easily replaceable and removable, companies find it convenient for brands to generate different campaigns.

Europe, Middle East & Africa Printable Self-adhesive Vinyl Films Market Trends

The Europe, Middle East & Africa (EMEA) region is expected to advance at a substantial CAGR in the global market from 2025 to 2030. The market demand is being driven by the extensive use of car-wrapping films by regional customers. Europe is one of the largest producers of motor vehicles, which creates huge opportunities for market expansion, as printable self-adhesive vinyl films find widespread applications in both car wrapping and fleet graphics. Besides, the growing urbanization and establishment of several major global brands in Middle Eastern economies such as UAE and Saudi Arabia have provided opportunities for regional companies to provide advanced solutions that can help brands improve their visibility.

GCC countries accounted for the largest revenue share in the regional industry in 2024. Economies in the Gulf Cooperation Council (GCC), which includes Saudi Arabia, Qatar, Kuwait, and others, witnessed rapid and sustained modernization over the past two decades, including the construction of malls, hospitals, and renowned structures such as the Burj Khalifa. This, in turn, has boosted the demand for printable self-adhesive vinyl films for wall, wood, floor, and other interior applications. Furthermore, a steady growth in advertising spending in these countries due to the presence of several multinational brands has aided in exponential market expansion in recent years.

Key Printable Self-adhesive Vinyl Films Company Insights

Some major companies involved in the global printable self-adhesive vinyl films industry include 3M, AVERY DENNISON, and LINTEC, among others.

-

3M is an American multinational conglomerate that operates across various sectors, including safety, industrial, consumer products, and healthcare. The company develops a range of products such as adhesives and sealants, coatings, automotive parts, electronic materials, films and sheeting, PPE, signage & marking, and tapes. In the films & sheeting segment, 3M offers graphic film solutions, including the 3M Print Wrap Film IJ180mC:10UR, the 3M Scotchlite Reflective Graphic Film 5000, the 3M Envision Flexible Substrate FS-1, the 3M Controltac Changeable Graphic Film with Comply Adhesive 3500C, and the 3M Scotchcal Graphic Film IJ3650, among others.

-

LINTEC is a Japanese manufacturer of adhesive-based products, offering products such as adhesive papers and films for labels and seals, shatter-proof window films, automotive adhesive products, and adhesive sheets for outdoor signs. The company develops self-adhesive vinyl films that are highly transparent, allowing for clear visibility through unprinted areas and making them ideal for window graphics and signage applications.

Key Printable Self-adhesive Vinyl Films Companies:

The following are the leading companies in the printable self-adhesive vinyl films market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Avery Dennison Corporation

- LX Hausys

- LINTEC Corporation

- HEXIS S.A.S.

- Arlon Graphics, LLC

- Metamark (UK) Ltd.

- ORAFOL Europe GmbH

- Flexcon Company, Inc.

- Achilles Corporation

Recent Developments

-

In April 2024, ORAFOL announced the expansion of its operations in the Asia Pacific region by establishing a sales company in New Zealand. The company’s new Auckland branch has been set up to address the growing regional demand for specialty plastics and premium films. Through this development, ORAFOL has been able to provide its extensive range of solutions to graphics product retailers in the country, along with catering to the needs of customers for adhesive tape systems and reflective solutions.

-

In March 2024, Arlon Graphics announced the launch of its VITAL non-PVC product range to address the graphics industry's quality and sustainability requirements. The range, which includes the DPF V9700 cast polyurethane film, and the Series V3370 cast polyurethane gloss overlaminate, was introduced at the FESPA Global Print Expo Amsterdam 2024. These products have been indicated for fleet vehicle branding and partial or full vehicle wraps.

Printable Self-adhesive Vinyl Films Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.74 billion |

|

Revenue forecast in 2030 |

USD 5.10 billion |

|

Growth rate |

CAGR of 6.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in million square meters, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Manufacturing process, thickness, type, substrate, application, region |

|

Regional scope |

North America, Europe Middle East & Africa (EMEA), Asia Pacific, Latin America |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, GCC Countries, South Africa, China, Japan, India, Australia, Brazil, Argentina |

|

Key companies profiled |

3M Company; Avery Dennison Corporation; LX Hausys; LINTEC Corporation; HEXIS S.A.S.; Arlon Graphics, LLC; Metamark; ORAFOL Europe GmbH; Flexcon Company, Inc.; Achilles Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Printable Self-adhesive Vinyl Films Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global printable self-adhesive vinyl films market report based on manufacturing process, thickness, type, substrate, application, and region:

-

Manufacturing Process Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Calendered Films

-

Monomeric

-

Polymeric

-

-

Cast Films

-

-

Thickness Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Thin (2-3 mils)

-

Thick (More than 3 mils)

-

-

Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Transparent

-

Translucent

-

Opaque

-

-

Substrate Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Floor

-

Plastics

-

Glass

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Fleet Graphics

-

Watercraft Graphics

-

Car Wrapping

-

Floor Graphics

-

Labels & Stickers

-

Window Graphics

-

Exhibition Panels

-

Outdoor Advertising

-

Furniture Decoration

-

Wallcovering

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Latin America

-

Brazil

-

Argentina

-

-

Europe, Middle East & Africa (EMEA)

-

U.K.

-

Germany

-

GCC Countries

-

South Africa

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."