Primary Water And Wastewater Treatment Equipment Market Size, Share & Trends Analysis Report By Equipment (Primary Clarifier), By Application (Municipal, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-818-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

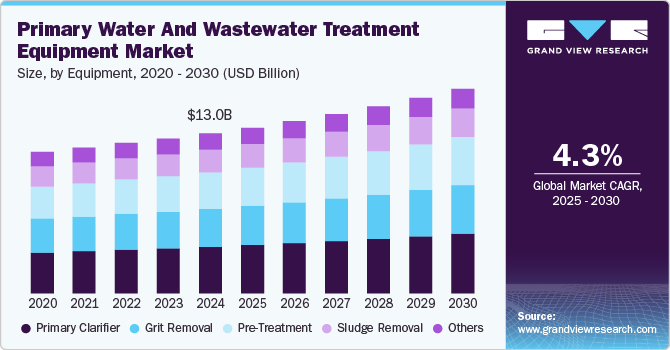

The global primary water and wastewater treatment equipment market size was estimated at USD 13.02 billion in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. This growth is attributed to the rapid urbanization, increasing population, and rising water scarcity, which necessitate effective treatment solutions. In addition, stringent government regulations regarding wastewater management and emissions propel market demand. Furthermore, the expansion of industrial sectors, particularly in developing regions, also contributes significantly to the need for advanced primary water and wastewater treatment equipment, ensuring compliance with environmental standards and promoting sustainable practices.

Primary water and wastewater treatment equipment encompasses technologies designed to purify water and manage wastewater effectively, ensuring sustainable water resources. The escalating global issue of water scarcity is significantly influenced by climate change, increasing population, and ineffective water management practices. Changes in climate lead to prolonged droughts and diminishing freshwater supplies, while a growing population heightens the demand for this limited resource. Unsustainable extraction of groundwater and inefficiencies in agricultural and industrial water use exacerbate these challenges.

There is a persistent need for advanced water treatment systems that can optimize management and enhance the recycling and reuse of water. These technologies play a crucial role in promoting sustainable practices, helping communities mitigate the impacts of water scarcity. In addition, as urbanization continues to rise, the pressure on existing water infrastructure intensifies. The influx of people into cities creates an urgent requirement for clean water and sanitation, often outpacing the development of necessary infrastructure.

Furthermore, this situation necessitates significant investments in upgrading and expanding treatment facilities to meet the growing demands. Advanced primary water and wastewater treatment equipment is vital in these enhancements, allowing manufacturers to improve capacity and efficiency while ensuring a reliable supply of clean water. By integrating these solutions into urban planning, cities can better address their water needs, fostering a more sustainable future centered around effective resource management. Emphasizing innovative treatment technologies supports environmental sustainability and equips communities to adapt to the changing climate, ultimately enhancing resilience against future challenges related to water scarcity.

Equipment Insights

The primary clarifier dominated the global primary water and wastewater treatment equipment industry and accounted for the largest revenue share of 29.0% in 2024. This growth is attributed to the increasing urban population, which heightens the demand for effective water treatment solutions. In addition, as cities expand, the volume of wastewater generated rises, necessitating efficient systems to remove suspended solids and contaminants. Furthermore, stringent regulations aimed at improving water quality further propel the adoption of primary clarifiers, as they play a crucial role in ensuring compliance with environmental standards.

The pre-treatment equipment is expected to grow at a CAGR of 4.8% over the forecast period, owing to the need for efficient removal of large solids and contaminants from wastewater are key drivers of growth. In addition, the rising industrial activities generate significant volumes of wastewater that require effective pre-treatment to protect downstream processes and equipment. Furthermore, advancements in technology, including enhanced screening products, contribute to lower operational costs and improved efficiency. Moreover, as industries increasingly focus on sustainability and regulatory compliance, the demand for pre-treatment equipment continues to rise, solidifying its importance in the overall water treatment landscape.

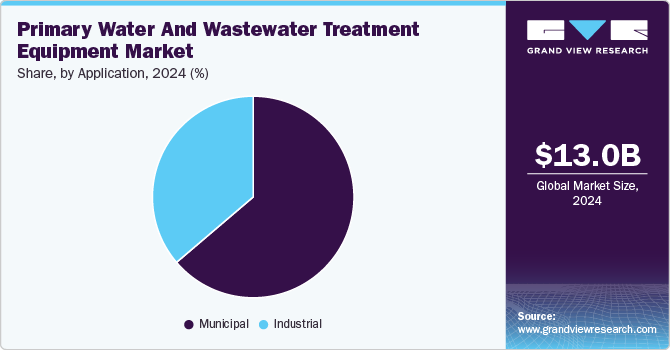

Application Insights

The municipal application led the market and accounted for the largest revenue share of 63.8% in 2024, primarily driven by the increasing urbanization and the subsequent demand for clean water and sanitation services. In addition, as populations in urban areas expand, municipalities are compelled to invest in upgrading their water treatment infrastructure to meet these rising needs. Furthermore, stringent government regulations aimed at improving water quality further drive the adoption of advanced treatment solutions, ensuring compliance and enhancing public health.

The industrial application segment is expected to grow at a CAGR of 4.7% from 2025 to 2030, owing to the rising need for efficient water treatment solutions across various sectors, including manufacturing and energy production. Industries are increasingly focusing on sustainability and regulatory compliance, which necessitates the implementation of advanced water treatment technologies. Furthermore, the growing awareness of environmental impacts and the importance of water reuse also contribute to the demand for effective wastewater management systems. Moreover, as industries expand, the need for specialized treatment solutions becomes critical, driving investments in innovative water treatment equipment.

Regional Insights

North America primary water and wastewater treatment equipment market is expected to grow significantly over the forecast period, primarily due to aging infrastructure that requires significant upgrades to meet modern standards. Increased federal funding for water infrastructure projects enhances investment opportunities in advanced treatment technologies. Furthermore, growing public awareness about water quality issues drives demand for effective solutions that ensure safe drinking water and proper wastewater management.

U.S. Primary Water and Wastewater Treatment Equipment Market Trends

The growth of the primary water and wastewater treatment equipment market in U.S. is driven by aging infrastructure that necessitates significant upgrades to meet modern water quality standards. In addition, increased federal funding, particularly through initiatives such as the Clean Water State Revolving Fund, supports investments in advanced treatment technologies. Furthermore, stringent regulations aimed at reducing water pollution compel municipalities and industries to adopt innovative solutions. Moreover, the rising public awareness of environmental issues further fuels demand for efficient and sustainable water treatment systems across the country.

Asia Pacific Primary Water and Wastewater Treatment Equipment Market Trends

The Asia Pacific primary water and wastewater treatment equipment market dominated the global market and accounted for the largest revenue share of 35.5% in 2024. This growth is attributed to rapid urbanization and industrialization. As cities expand, the demand for clean water and efficient wastewater management systems rises sharply. Furthermore, governments are implementing stricter environmental regulations to address pollution concerns, further driving investments in advanced treatment technologies. Moreover, the combination of a large population and increasing awareness of water conservation emphasizes the need for effective water treatment solutions, fostering market growth.

The primary water and wastewater treatment equipment market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by substantial government investments in infrastructure aimed at combating severe water pollution. In addition, the implementation of stringent environmental regulations has led to a heightened focus on improving water quality. Furthermore, the increasing industrial activities generate significant volumes of wastewater, necessitating advanced treatment solutions such as membrane filtration and reverse osmosis systems.

Latin America Primary Water and Wastewater Treatment Equipment Market Trends

Latin America primary water and wastewater treatment equipment market is expected to grow at a CAGR of 4.6% over the forecast period, owing to the region's expanding industrial sector, particularly in oil and gas. Countries such as Brazil and Argentina are investing in modernizing their water treatment infrastructure to support economic development and improve public health. Furthermore, increasing urbanization necessitates enhanced sanitation facilities, leading to greater demand for effective wastewater management solutions.

Europe Primary Water and Wastewater Treatment Equipment Market Trends

The primary water and wastewater treatment equipment market in Europe held a significant revenue share in 2024, driven by stringent EU regulations aimed at improving water quality and sustainability. In addition, the emphasis on environmental protection encourages investments in innovative treatment technologies that enhance efficiency and reduce operational costs. Furthermore, the rising awareness of climate change impacts drives the adoption of advanced solutions for water recycling and reuse.

Key Primary Water And Wastewater Treatment Equipment Company Insights

Key companies in the global primary water and wastewater treatment equipment industry include Xylem, Inc., Pentair plc., Evoqua Water Technologies LLC, and ohers. These companies adopt several strategies to enhance their competitive edge. These include investing in research and development to innovate advanced treatment technologies, forming strategic partnerships and collaborations to expand market reach, and focusing on sustainability initiatives to meet regulatory requirements. Furthermore, companies emphasize customer-centric approaches by providing tailored solutions and improving service offerings.

-

Pentair plc manufactures a wide range of products, such as filtration systems, membrane elements, and submersible pumps designed for both municipal and industrial applications. Operating in the water management segment, the company focuses on enhancing water quality and efficiency, addressing the needs of various industries while promoting sustainable practices in water usage and wastewater management.

-

Ecolab Inc. develops advanced chemical treatment programs, monitoring systems, and equipment designed to optimize water use and improve operational efficiency across multiple sectors. The company operates primarily in the water treatment segment, catering to municipal facilities and industrial sectors by providing tailored solutions that ensure compliance with environmental regulations while enhancing sustainability in water management practices.

Key Primary Water And Wastewater Treatment Companies:

The following are the leading companies in the primary water & wastewater treatment equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Xylem, Inc.

- Pentair plc.

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Ecolab Inc.

- DuPont

- Calgon Carbon Corporation

- Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION)

- Veolia Group

- Ecologix Environmental Systems, LLC

- Parkson Corporation

- Lenntech B.V.

- Samco Technologies, Inc.

- Koch Membrane Systems, Inc.

- General Electric

- Ovivo

View a comprehensive list of companies in the Primary Water And Wastewater Treatment Market

Recent Developments

-

In February 2023, Evoqua Water Technologies entered into a definitive agreement to sell its slurry services and carbon reactivation division to DESOTEC. With this deal, Evoqua can focus on its principal water and wastewater treatment equipment business. With a supply agreement for reactivated carbon with DESOTEC, the transaction, which is estimated to be worth USD100 million, ensures ongoing servicing and covers sites in Pennsylvania and California.

-

In January 2023, Xylem announced the acquisition of Evoqua Water Technologies in a significant USD 7.5 billion all-stock transaction. This acquisition aims to enhance Xylem's portfolio in primary water and wastewater treatment equipment, combining both companies' strengths to address global water challenges. The merger created a leading provider of innovative water solutions, solidifying Xylem's position in the industry and expanding its capabilities in sustainable water management practices.

Primary Water And Wastewater Treatment Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.50 billion |

|

Revenue forecast in 2030 |

USD 16.68 billion |

|

Growth rate |

CAGR of 4.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Equipment, application, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, Australia, South Korea, Germany, UK, France, Italy, Norway, Finland, Brazil, Argentina, Venezuela, Saudi Arabia, UAE, Egypt. |

|

Key companies profiled |

Xylem, Inc.; Pentair plc.; Evoqua Water Technologies LLC; Aquatech International LLC; Ecolab Inc.; DuPont; Calgon Carbon Corporation; Toshiba Water Solutions Private Limited (TOSHIBA CORPORATION); Veolia Group; Ecologix Environmental Systems, LLC; Parkson Corporation; Lenntech B.V.; Samco Technologies, Inc.; Koch Membrane Systems, Inc.; General Electric; Ovivo. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Primary Water And Wastewater Treatment Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global primary water and wastewater treatment equipment market report based on equipment, application, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Clarifier

-

Sludge Removal

-

Grit Removal

-

Pre-Treatment

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Municipal

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Norway

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

Venezuela

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."