- Home

- »

- Pharmaceuticals

- »

-

Primary Immunodeficiency Disorders Market Report, 2030GVR Report cover

![Primary Immunodeficiency Disorders Market Size, Share & Trends Report]()

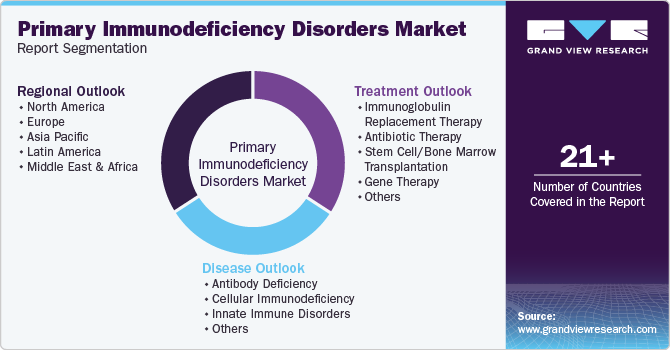

Primary Immunodeficiency Disorders Market Size, Share & Trends Analysis Report By Disease (Antibody Deficiency, Cellular Immunodeficiency, Innate Immune Disorders), By Treatment, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-444-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

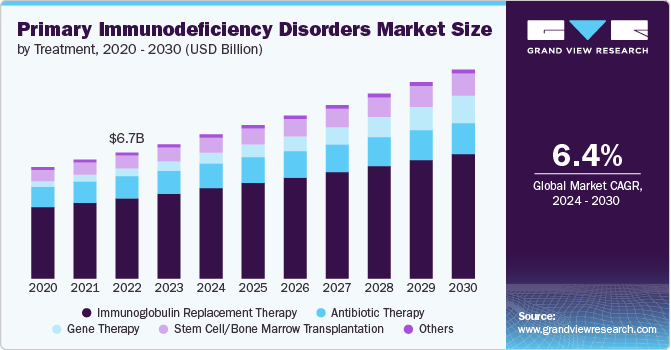

The global primary immunodeficiency disorders market size was valued at USD 7.15 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The market is experiencing significant growth due to several factors. The rising incidence of PID, coupled with greater awareness among healthcare professionals and the public, is driving demand for effective treatments. Advances in biotechnology, such as innovative gene therapies and biologics, are expanding the available treatment options and improving patient outcomes. Additionally, increased research funding is fueling the development of new therapies, further propelling market expansion and offering enhanced management strategies for these complex disorders.

Primary immunodeficiencies (PIDs) affect over 6 million people worldwide, with a significant number-70-90%-remaining undiagnosed. The prevalence of PIDs is about 1 in 10,000 people globally, though this figure is likely an underestimate due to missed diagnoses. For instance, in France, the prevalence is reported to be 4.4 cases per 100,000 inhabitants. The vast majority of PIDs are not diagnosed promptly, which can lead to increased vulnerability to infections, autoimmunity, and other serious health issues. The challenge of diagnosing PIDs is compounded by the wide range of symptoms and the variety of PID types, making early and accurate identification critical but often difficult. The high prevalence and significant undiagnosed rate of primary immunodeficiencies highlights a substantial market opportunity. As awareness and diagnostic tools improve, demand for advanced treatments and care solutions is expected to drive substantial growth in the PID industry.

In April 2023, Irish Primary Immunodeficiencies Association (IPIA) endorsed a new position statement from IPOPI advocating that primary immunodeficiency diseases (PIDs) causing significant disease burden should be recognized as disabilities. This recognition would ensure that affected patients receive long-term financial and practical assistance. The statement received support from various PID organizations. IPIA forwarded this statement to Ireland's Health Minister to push for official recognition of PIDs as disabilities, aiming to improve patient support and public awareness. Endorsing IPOPI’s statement for recognizing PIDs as disabilities boosts industry growth by increasing awareness, attracting funding, expanding treatment options, and fostering industry collaboration. This recognition leads to greater demand for specialized healthcare services and investments in PID research and support.

Furthermore, in June 2024, Nicholas L. Hartog, MD, Fellow of the American Academy of Allergy, Asthma & Immunology (FAAAAI), and FACAAI emphasizes the critical role of genetic testing in diagnosing primary immunodeficiencies (PIs). With over 450 monogenic primary immunodeficiencies, precise genetic testing is essential for distinguishing these conditions and guiding treatment. Despite challenges such as insurance coverage and interpreting results, genetic testing offers definitive diagnoses and improves patient management. Clinicians should test for PIs in cases of common variable immune deficiency (CVID) or unexplained symptoms. Programs like navigate APDS support access to testing and counseling, emphasizing the need for genetic testing as a best practice in primary immunodeficiency care. Advancements in genetic testing for primary immunodeficiencies (PIDs) are set to drive industry growth by improving diagnostic accuracy and reducing misdiagnoses.

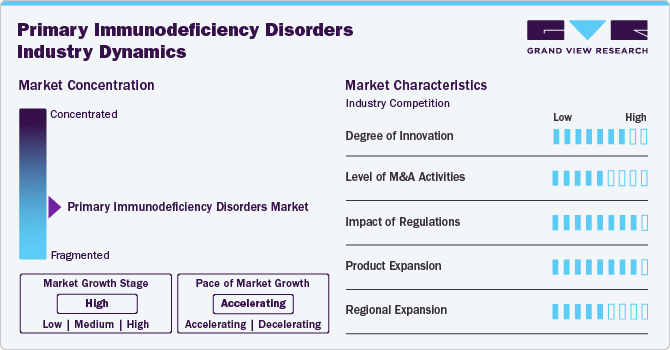

Market Concentration & Characteristics

The market is marked by a high degree of innovation through advancements in genetic testing and personalized medicine. Cutting-edge technologies, such as next-generation sequencing, are enhancing diagnostic accuracy and enabling early detection of over 450 monogenic disorders. Innovative treatments, including targeted therapies and novel biologics, are improving patient outcomes and offering more tailored approaches to management. Programs like navigate APDS facilitate access to comprehensive genetic testing and counseling, further driving progress. These innovations are transforming the industry by advancing diagnosis, treatment, and patient care in primary immunodeficiencies.

Regulations set stringent standards for the approval of therapies, which can affect the speed of market entry and innovation. They also influence pricing and accessibility, which directly impacts industry dynamics and patient care. While regulations ensure safety and efficacy, they also create barriers that can delay the availability of new treatments and diagnostics. Thus, their impact is significant, shaping the overall growth and development of the market. Additionally, guidelines from organizations like the FDA and EMA drive standards for quality and efficacy, ultimately impacting industry growth and patient outcomes in the primary immunodeficiency sector.

The level of mergers and acquisitions (M&A) activities in the market is moderate to high. The market's growing demand for personalized and effective treatments also fuels M&A, as larger firms look to strengthen their competitive positions and expand their market share. Moreover, in June 2024, Grifols' subsidiary Biotest received FDA approval for Yimmugo, an intravenous immunoglobulin for treating primary immunodeficiencies, with U.S. launch expected in late 2024. This follows its 2022 European release and aligns with Grifols' strategy to enhance its plasma-derived therapies and market presence. The acquisition of Biotest has expanded Grifols' plasma supply and product portfolio significantly.

Product expansion in the market for primary immunodeficiency disorders is driven by innovations like Grifols' Yimmugo, an FDA-approved intravenous immunoglobulin launched in Europe in 2022 and expected in the U.S. in late 2024. The industry is also seeing advancements with additional plasma-derived therapies in development, such as fibrinogen concentrates and polyvalent immunoglobulins. This growth reflects a broader trend of increasing treatment options and improved patient care. Companies are expanding their portfolios to address diverse patient needs and enhance therapeutic efficacy, thus fueling industry growth.

The regional expansion of the primary immunodeficiency disorders market is marked by increasing international market presence. Companies are actively seeking to enter new regions by obtaining regulatory approvals and forming strategic partnerships. This global push is driven by rising awareness of primary immunodeficiencies and the growing demand for advanced therapies. Expanding into underserved areas enhances market access and improves patient outcomes worldwide, reflecting a broader commitment to addressing diverse regional needs.

Treatment Insights

The immunoglobulin replacement therapy segment held the largest share of 63.18% in 2023. This therapy provides essential antibodies to patients with deficiencies in their immune system, such as those with common variable immunodeficiency (CVID) or congenital immunodeficiencies. Its widespread use is driven by its efficacy in preventing infections, improving quality of life, and the growing prevalence of immunodeficiencies. Advances in formulation and administration, including subcutaneous options, have enhanced patient compliance and convenience. Additionally, the robust pipeline of immunoglobulin products and ongoing research into improving their efficacy and safety support market growth.

The antibiotic therapy segment held the second largest revenue share in 2023 due to its crucial role in managing and preventing infections in immunocompromised patients. As these individuals are highly susceptible to bacterial infections, effective antibiotic treatments are essential. Advances in antibiotic formulations and the development of new, targeted antibiotics are enhancing treatment efficacy and minimizing resistance. Increased awareness of primary immunodeficiency disorders and expanding patient populations drive the demand for effective antibiotic therapies. Additionally, improved diagnostic tools enable timely intervention, further boosting the industry growth for antibiotics.

Disease Insights

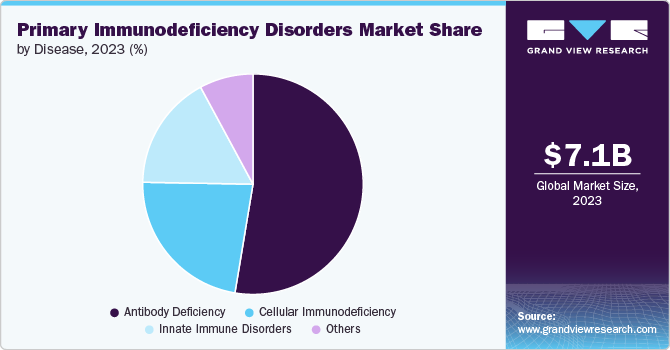

The antibody deficiencies segment held the largest share of 52.62% in 2023, due to their prevalence and significant impact on patient health. These deficiencies, such as common variable immunodeficiency (CVID) and specific antibody deficiency (SAD), are among the most common types of primary immunodeficiencies, accounting for a substantial portion of cases. They are characterized by a reduced ability to produce antibodies, leading to frequent and severe infections. The high demand for effective treatments, including intravenous and subcutaneous immunoglobulin therapies, drives industry growth. Additionally, advancements in diagnostics and therapies specifically targeting antibody deficiencies have increased their prominence in the market.

Cellular immunodeficiency is projected to grow fastest over the forecast period due to increasing awareness and advancements in targeted therapies. Conditions like severe combined immunodeficiency (SCID) and Wiskott-Aldrich syndrome require specialized treatments, such as gene therapy and stem cell transplants, which are gaining traction. Innovations in cellular therapies and growing research funding are driving improvements in diagnosis and management. Additionally, rising patient awareness and demand for personalized medicine are fueling industry expansion for cellular immunodeficiencies.

Regional Insights

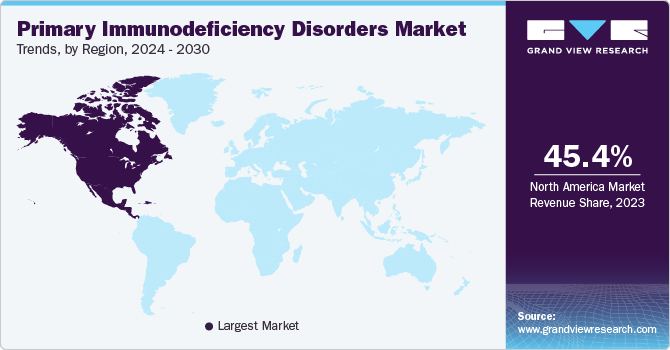

North America primary immunodeficiency disorders market dominated the overall global market and accounted for the 45.39% revenue share in 2023 due to advanced healthcare infrastructure, high awareness, and robust research and development capabilities. The region benefits from leading biotechnology and pharmaceutical companies, enabling rapid innovation and access to cutting-edge treatments. Additionally, favorable regulatory environments and substantial healthcare spending contribute to the market's growth. High prevalence rates of primary immunodeficiency disorders, along with strong support from patient advocacy groups, further bolster North America's leadership in this global market.

U.S. Primary Immunodeficiency Disorders Market Trends

The U.S. primary immunodeficiency disorders market held the largest share of the North America market in 2023 due to advanced healthcare infrastructure, robust research and development activities, and a high prevalence of immune disorders. The presence of leading biopharmaceutical companies, comprehensive insurance coverage, and well-established treatment protocols further bolster the market. Additionally, the U.S. benefits from strong regulatory support and a high level of awareness among healthcare providers and patients, contributing to its market leadership.

Europe Primary Immunodeficiency Disorders Market Trends

The Europe primary immunodeficiency disorders market is experiencing notable growth driven by increasing awareness and diagnosis rates, advancements in genetic testing, and the introduction of innovative therapies. Expanding healthcare access and supportive regulatory frameworks also contribute to the market’s expansion. Additionally, the rise in collaboration between research institutions and biopharmaceutical companies is fostering the development of new treatments, further fueling market growth.

The UK primary immunodeficiency disorders market is one of the major markets in the region due to its advanced healthcare infrastructure, high diagnostic capabilities, and significant investments in research and development. The presence of leading biopharmaceutical companies and a strong focus on innovative therapies and treatments also contribute to its prominence. Additionally, robust support from healthcare policies and increasing patient awareness drive market growth.

Primary immunodeficiency disorders market in Germany is growing due to its advanced healthcare system, strong research focus, and substantial investments in biopharmaceutical innovations. The country’s robust infrastructure supports early diagnosis and treatment, enhancing market expansion.

Asia Pacific Primary Immunodeficiency Disorders Market Trends

The Asia Pacific primary immunodeficiency disorders market is experiencing robust growth. The region's growth is driven by factors such as increased R&D incentives granted by governments in developing economies such as China and India, which enable R&D and commercialization of technologically new products. Furthermore, it is expected that the high accessibility of the target group brought about by the prevalence of chronic illnesses will support growth in the upcoming years.

The China primary immunodeficiency disorders market is expanding rapidly due to increased awareness and improved diagnostic capabilities for immunodeficiency disorders. Increased healthcare investment and government initiatives support advanced treatment options and research. The growing patient population, coupled with rising healthcare spending, further drives demand for effective therapies. Additionally, the expansion of healthcare infrastructure and the introduction of innovative treatments contribute significantly to the market's growth in China.

Primary immunodeficiency disorders market in Japan is set to grow rapidly due to advancements in diagnostic technologies, increasing healthcare investments, and a rising patient population. Enhanced treatment options and supportive healthcare policies also drive market expansion.

Latin America Primary Immunodeficiency Disorders Market Trends

The Latin America primary immunodeficiency disorders market has seen significant growth due to increased awareness, improved access to advanced treatments, and greater investment in pharmaceutical innovations. Enhanced healthcare infrastructure and rising research investments also contribute to this growth.

The Brazil primary immunodeficiency disorders market is notably expanding due to the increasing prevalence of these conditions and growing awareness among healthcare professionals. Enhanced healthcare infrastructure, better diagnostic capabilities, and rising access to advanced treatments are also contributing to market growth. Government initiatives and investments in research and pharmaceutical innovations further support the expansion, addressing the needs of the growing patient population.

MEA Primary Immunodeficiency Disorders Market Trends

The MEA primary immunodeficiency disorders market holds major growth opportunities, as a majority of the market is driven by rising awareness, improved healthcare infrastructure, and increased investment in healthcare. The growing prevalence of primary immunodeficiency disorders and expanding access to innovative treatments are also contributing to the market's growth. Government initiatives to enhance healthcare services and support research further bolster the market potential in the region.

The Saudi Arabia primary immunodeficiency disorders market is expanding rapidly due to increased awareness about these disorders and advancements in diagnostic and treatment technologies. Government investments in healthcare infrastructure, along with improved access to innovative therapies, are driving this growth. Additionally, rising healthcare spending and a growing population with access to specialized care contribute to the market's rapid expansion.

Key Primary Immunodeficiency Disorders Company Insights

The competitive scenario in the market is highly competitive, with key players such as Baxter International, CSL Behring, Takeda Pharmaceutical, Octapharma, Biotest, Grifols, and Kedrion Biopharma holding significant positions. These companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Primary Immunodeficiency Disorders Companies:

The following are the leading companies in the primary immunodeficiency disorders market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter International, Inc.

- CSL Behring LLC

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Biotest AG

- Grifols S.A.

- Kedrion Biopharma Inc.

- Bio Products Laboratory Ltd.

- LFB S.A.

- ADMA Biologics

- Astellas Pharma Inc.

- Abbott Laboratories

Recent Developments

-

In April 2024, X4 Pharmaceuticals announced that the FDA approved its drug mavorixafor, branded as Xolremdi, for treating WHIM syndrome, a rare primary immunodeficiency. Mavorixafor, a CXCR4 receptor antagonist, improves white blood cell counts and reduces infection rates in patients. In a phase 3 study, it significantly increased neutrophils and lymphocytes, reduced infections by 60%, and decreased antibiotic use. The drug addresses a long-overlooked area of immune disorders and will be available for patients aged 12 and older. X4 Pharmaceuticals plans to continue educating healthcare providers and expanding diagnostic efforts.

-

In April 2023, Takeda's Hyqvia received FDA approval for treating children aged 2 to 16 with primary immunodeficiency (PI). This expanded approval allows for a convenient, monthly subcutaneous treatment, improving options for pediatric patients. The decision follows successful Phase 3 trial results, demonstrating a reduction in serious bacterial infections and comparable safety to adult use. This advancement offers families a less frequent treatment alternative and could drive growth in the primary immunodeficiency therapy market.

-

In April 2023, CSL Behring received FDA approval for Hizentra 50 mL prefilled syringes, designed for treating primary immunodeficiency in patients aged 2 years and older, as well as chronic inflammatory demyelinating polyneuropathy (CIDP). This subcutaneous immune globulin (SCIg) treatment is notable for its convenience and ease of self-administration, distinguishing it as the only SCIg approved for CIDP. Hizentra is the most prescribed self-infused SCIg for primary immunodeficiency in the U.S. and will soon join the company's range of prefilled syringes and vials.

Primary Immunodeficiency Disorders Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.69 billion

Revenue forecast in 2030

USD 11.14 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease, treatment

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Baxter International; CSL Behring; Takeda Pharmaceutical; Octapharma; Biotest; Grifols; Kedrion Biopharma; Bio Products Laboratory; LFB; ADMA Biologics; Astellas Pharma; Abbott Laboratories.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Primary Immunodeficiency Disorders Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the primary immunodeficiency disorders market report on the basis of disease, treatment and region.

-

Disease Outlook (Revenue, USD Million; 2018 - 2030)

-

Antibody Deficiency

-

Cellular Immunodeficiency

-

Innate Immune Disorders

-

Others

-

-

Treatment Outlook (Revenue, USD Million; 2018 - 2030)

-

Immunoglobulin Replacement Therapy

-

Antibiotic Therapy

-

Stem Cell/Bone Marrow Transplantation

-

Gene Therapy

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global primary immunodeficiency disorders market size was estimated at USD 7.15 billion in 2023 and is expected to reach USD 7.69 billion in 2024.

b. The global primary immunodeficiency disorders market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 11.14 billion by 2030.

b. North America primary immunodeficiency disorders market dominated the overall global market and accounted for the 45.39% revenue share in 2023 due to advanced healthcare infrastructure, high awareness, and robust research and development capabilities.

b. Some key players operating in the primary immunodeficiency disorders market include Baxter International, CSL Behring, Takeda Pharmaceutical, Octapharma, Biotest, Grifols, Kedrion Biopharma, Bio Products Laboratory, LFB, ADMA Biologics, Astellas Pharma, and Abbott Laboratories.

b. Key factors that are driving the primary immunodeficiency disorders market growth include rising incidence of primary immunodeficiency disorders, coupled with greater awareness among healthcare professionals and the general public.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."