Pressure Vessels Market Size, Share & Trends Analysis Report By Material (Titanium, Steel), By Product Type (Boiler, Nuclear Reactor), By End-use (Oil & Gas, Power Generation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-028-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Pressure Vessels Market Size & Trends

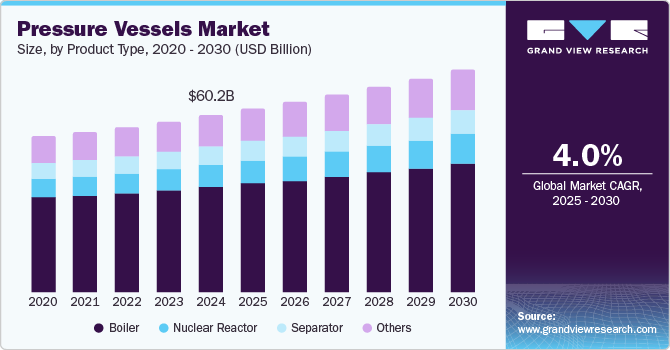

The global pressure vessels market size was valued at USD 60.24 billion in 2024 and is anticipated to grow at a CAGR of 4.0% from 2025 to 2030. This growth is attributed to the expansion of the chemical and petrochemical industries significantly increases the demand for pressure vessels, as they are essential for various processes including storage and transportation of chemicals. In addition, the rising need for energy, particularly in the oil and gas sector, alongside stricter safety regulations, is propelling market growth. Furthermore, advancements in renewable energy technologies and investments in infrastructure are also contributing to the increasing demand for pressure vessels globally.

The integration of sensors and Internet of Things (IoT) technology into pressure vessels significantly enhances safety and operational efficiency, while also creating new market opportunities. Continuous monitoring of critical parameters such as pressure and temperature allows for immediate detection of any deviations from normal conditions. In cases of abnormal readings, these systems can send instant alerts to operators, facilitating quick responses to avert potential accidents.

In addition, the ability to connect pressure vessels with other IoT-enabled equipment streamlines operations and improves overall system performance. Remote monitoring and control capabilities reduce the need for on-site personnel, thereby increasing flexibility. Furthermore, the oil and gas industry is a major driver of demand for pressure vessels, as they are crucial for various upstream activities including the separation, storage, and transportation of extracted resources. Advanced techniques in enhanced oil recovery require specialized vessels that can withstand high pressures and temperatures.

Moreover, as global demand for chemicals rises across multiple industries, the need for pressure vessels in production facilities continues to grow, prompting expansions in existing plants and the establishment of new ones.

Material Insights

The steel segment dominated the global pressure vessels industry and accounted for the largest revenue share of 29.7% in 2024. This growth is attributed to its cost-effectiveness and robust properties. In addition, steel, particularly carbon and stainless steel, offers excellent corrosion resistance, high tensile strength, and durability, making it a preferred choice for various industries. Furthermore, its recyclability and ability to withstand extreme conditions further enhance its appeal. As industrial activities expand globally, the demand for steel pressure vessels in sectors such as oil and gas, chemicals, and power generation continues to rise, driving market growth.

The titanium segment is expected to grow at a CAGR of 4.8% over the forecast period, owing to its exceptional strength-to-weight ratio and resistance to corrosion and high temperatures. These properties make titanium an ideal material for pressure vessels used in harsh environments, particularly in the oil and gas and chemical industries. Furthermore, the increasing focus on safety and compliance with stringent regulations necessitates the use of high-quality materials such as titanium. Moreover, the growing adoption of advanced manufacturing techniques enhances the feasibility of using titanium in pressure vessels, thereby expanding its market opportunities.

Product Type Insights

The boiler segment led the market and accounted for the largest revenue share of 59.4% in 2024, primarily driven by the increasing demand for efficient energy generation and industrial processes. In addition, boilers are essential for various applications, including power generation and heating, and their ability to operate under high pressure enhances their performance. Furthermore, the rising focus on supercritical power generation technologies and the expansion of thermal power plants also contribute to the demand for advanced boiler systems, solidifying their position as a key product type in the market.

The nuclear reactor segment is expected to grow at the fastest CAGR of 5.4% from 2025 to 2030, due to the growing need for clean and sustainable energy sources. As countries seek to reduce carbon emissions and enhance energy security, investments in nuclear power plants are increasing. Furthermore, nuclear reactors require specialized pressure vessels that can withstand extreme conditions, ensuring safe and efficient energy production. Moreover, the global push for energy diversification and the rising acceptance of nuclear power as a viable alternative to fossil fuels are significant factors propelling the growth of this segment within the pressure vessel market.

End-use Insights

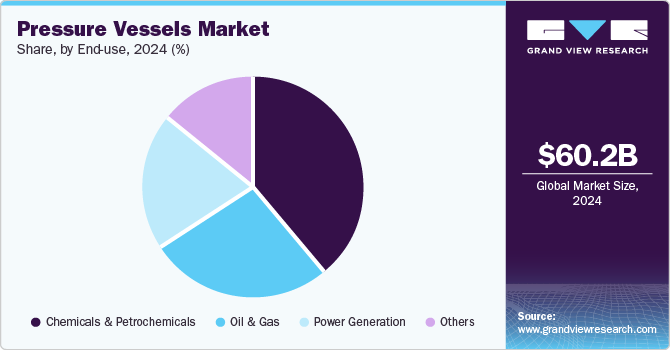

The chemicals and petrochemicals segment held the dominant position in the market, with the largest revenue share of 38.6% in 2024, driven by the rising demand for various chemicals and plastics. In addition, as the industry expands, pressure vessels are essential for processes such as chemical reactions, distillation, and storage, ensuring safety and efficiency. Furthermore, stricter safety regulations also necessitate high-quality pressure vessels that can withstand corrosive substances and extreme conditions, further propelling market growth.

The power generation sector is expected to grow at a CAGR of 5.0% over the forecast period, owing to the need for efficient energy production and sustainability. Pressure vessels are critical components in thermal and nuclear power plants, facilitating processes such as steam generation and heat exchange. In addition, the global shift towards cleaner energy sources and the expansion of renewable energy projects are driving investments in new power generation facilities, thereby boosting the demand for advanced pressure vessels that meet stringent safety and performance standards.

Regional Insights

The Asia Pacific pressure vessels market dominated the global market and accounted for the largest revenue share of 36.1% in 2024. This growth is attributed to the rapid industrialization and increasing energy demands. In addition, countries such as India and China are heavily investing in energy infrastructure, particularly in power generation and chemical processing facilities, which drives the demand for pressure vessels. Furthermore, the expansion of the oil and gas sector, along with investments in renewable energy projects, also propels market growth as these industries require reliable pressure vessels for various applications.

China Pressure Vessels Market Trends

The pressure vessels market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by its status as a global manufacturing hub. The government's commitment to enhancing energy infrastructure, especially in coal and nuclear power generation, is driving demand for high-quality pressure vessels. Furthermore, advancements in technology and increased foreign investments are fostering local production capabilities, making China a key player in the global pressure vessel market.

Middle East & Africa Pressure Vessels Market Trends

The Middle East and Africa pressure vessels market is expected to grow at the fastest CAGR of 4.5% over the forecast period, owing to the expansion of the oil and gas sector. In addition, increased investments in refining and petrochemical facilities are boosting the demand for pressure vessels, which are essential for safe storage and transportation of hydrocarbons. Furthermore, ongoing infrastructure development projects and government initiatives aimed at diversifying economies are further propelling market growth. Moreover, the region's focus on renewable energy sources also creates new opportunities for pressure vessel applications in emerging energy sectors.

Europe Pressure Vessels Market Trends

The pressure vessels market in Europe held the significant revenue share in 2024, due to stringent safety regulations and a focus on upgrading aging infrastructure. Furthermore, the region's commitment to sustainability and renewable energy sources is also contributing to market expansion, as new power generation facilities require advanced pressure vessels. Moreover, the chemical and petrochemical sectors are thriving in Europe, further driving demand for high-quality pressure vessels.

North America Pressure Vessels Market Trends

North America pressure vessels market is expected to experience a substantial growth over the forecast period, primarily due to rising industrial activities across sectors such as oil and gas, chemicals, and power generation. In addition, the increasing adoption of natural gas as a cleaner fuel alternative is driving demand for specialized pressure vessels. Furthermore, ongoing investments in nuclear power generation facilities enhance market opportunities as these reactors require high-quality pressure vessels to ensure safety and efficiency.

The growth of the pressure vessels market in the U.S. is expected to be driven by significant investments in energy infrastructure and industrial activities. The country's focus on enhancing its oil and gas production capabilities drives demand for reliable pressure vessels. Furthermore, the increasing emphasis on safety regulations within industries such as chemicals and power generation further propels the need for advanced pressure vessels that meet stringent standards.

Key Pressure Vessels Company Insights

Key companies in the global pressure vessels industry include Babcock & Wilcox Enterprises, Inc., Samuel, Son & Co., Alloy Products Corp., and others. These companies are employing numerous strategies focused on new product developments and strategic partnerships to enhance their competitive edge. In addition, these firms are investing in research and development to innovate advanced pressure vessel designs that meet evolving industry standards.

-

Samuel, Son & Co. specializes in the fabrication of a wide range of pressure vessels and tanks for various industrial applications. The company manufactures products that cater to sectors such as oil and gas, chemicals, and power generation. With advanced engineering capabilities, the company focuses on producing custom and standard pressure vessels, ensuring compliance with industry standards. Their extensive product offerings include air receivers, process tanks, and specialized vessels designed to meet diverse operational requirements.

-

Abbott Pressure Vessels provides high-quality solutions tailored to meet the needs of various industries. The company focuses on the design and manufacturing of pressure vessels used in applications such as chemical processing, oil and gas, and water treatment. Company’s expertise lies in creating custom-engineered pressure vessels that adhere to stringent safety regulations and quality standards.

Key Pressure Vessels Companies:

The following are the leading companies in the pressure vessels market. These companies collectively hold the largest market share and dictate industry trends.

- IHI Corporation

- Babcock & Wilcox Enterprises, Inc.

- Pressure Vessels (India)

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Samuel, Son & Co.

- Alloy Products Corp.

- Abbott Pressure Vessels

- Doosan Corporation

- Bharat Heavy Electricals Limited

- LARSEN & TOUBRO LIMITED

- MERSEN PROPERTY

- Xylem

- Tinita Engg Pvt. Ltd

- WCR Inc.

Recent Developments

-

In April 2024, Babcock & Wilcox (B&W) announced a significant contract to upgrade renewable energy boilers in Southeast Asia, valued at over USD 7 million. This project involves enhancing three waste-fueled boilers at a waste-to-energy power plant, focusing on new pressure parts and advanced combustion equipment to boost steam production and efficiency while minimizing emissions. The upgrade reflects B&W's commitment to supporting sustainable energy solutions and improving operational longevity in the region's waste-to-energy sector.

-

In June 2023, Larsen & Toubro (L&T) established a cutting-edge Heavy Wall Pressure Vessel facility, in aligned with the Saudi Vision 2030 and IKTVA initiative, in Saudi Arabia. This state-of-the-art facility, located in the Royal Commission Jubail Industrial Area, aims to enhance local manufacturing capabilities for heavy wall thicknesses and complicated metallurgy.

Pressure Vessels Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 62.44 billion |

|

Revenue forecast in 2030 |

USD 75.82 billion |

|

Growth Rate |

CAGR of 4.0% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, product type, end-use, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, Australia, Germany, UK, France, Italy, Brazil, Argentina, Saudi Arabia, South Africa |

|

Key companies profiled |

IHI Corporation; Babcock & Wilcox Enterprises, Inc.; Pressure Vessels (India); MITSUBISHI HEAVY INDUSTRIES, LTD.; Samuel, Son & Co.; Alloy Products Corp.; Abbott Pressure Vessels; Doosan Corporation; Bharat Heavy Electricals Limited; LARSEN & TOUBRO LIMITED; MERSEN PROPERTY; Xylem; Tinita Engg Pvt. Ltd; WCR Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pressure Vessels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global pressure vessels market report based on material, product type, end-use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Titanium

-

Nickel & Nickel Alloys

-

Tantalum

-

Steel

-

Carbon Steel

-

Stainless Steel

-

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Boiler

-

Nuclear Reactor

-

Separator

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemicals & Petrochemicals

-

Oil & Gas

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Italy

-

Germany

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."