- Home

- »

- Drilling & Extraction Equipments

- »

-

Pressure Pumping Market Size, Share Report, 2025, Industry OutlookGVR Report cover

![Pressure Pumping Market Size, Share & Trends Report]()

Pressure Pumping Market Size, Share & Trends Analysis Report By Type (Hydraulic Fracturing, Cementing), By Well Type (Horizontal, Vertical, Directional), By Region, Vendor Landscape, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-367-6

- Number of Report Pages: 96

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2017 - 2025

- Industry: Bulk Chemicals

Industry Outlook

The global pressure pumping market size was valued at USD 53.1 billion in 2016. It is expected to register a CAGR of 4.1% over the forecast period. Increasing demand for primary energy in power generation, transportation, and household activities is one of the key trends stimulating market growth.

Asia Pacific is projected to exhibit strong demand for pressure pumping in the near future due to rapid industrialization, which has led to an increase in the demand for oil. In addition, efforts undertaken by various governments in the region to reduce dependence on oil imports and boost indigenous oil production are anticipated to provide a tremendous upthrust to the overall market.

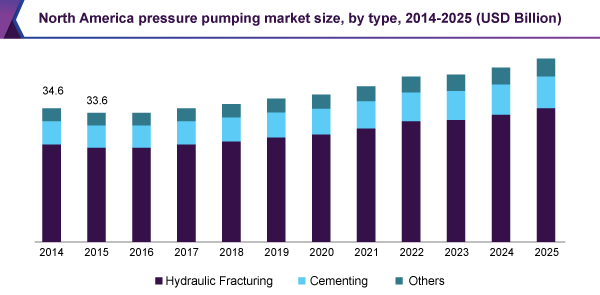

The global market is estimated to be dominated by North America in terms of revenue. Rise in upstream oil and gas investments in the U.S. in 2017 is likely to be a key factor contributing to the growth of the market over the forecast period. Upstream oil and gas investments in the U.S. witnessed an upswing of nearly 53% in 2017 as compared to 2016.

In terms of market penetration, the hydraulic fracturing segment exhibits the highest growth potential on account of surging demand for natural gas coupled with increasing acreage of shale basins.

Type Insights

Hydraulic fracturing dominated the market in 2016, accounting for 76.7% of the global revenue. The adoption of hydraulic fracturing is the highest in North America and the trend is poised to continue until 2025. As per the U.S. Energy Information Administration, tight oil and gas production in the U.S. is expected to increase to 21 million barrels per day by 2040. This, in turn, is estimated to create an upswing in the demand for pressure pumping in the coming years.

Cementing accounted for just over 14.0% of the global revenue in 2016. Consistent demand for drilling activities in the U.S. and stable oil prices is projected to keep the demand for cementing services strong over the forecast period. However, an increasing number of drilled but uncompleted wells in the U.S. could hinder growth over the forecast period.

The decline in the oil prices in 2014 affected the market adversely, as the capital expenditure plunged. Specifically, huge cuts in capital expenditure on exploration and production (E&P) and layoffs influenced industry dynamics to a large extent. However, stable prices in 2017 and an upswing in upstream oil & gas investments are anticipated to stabilize the demand for pressure pumping operations over the forecast period.

Well Type Insights

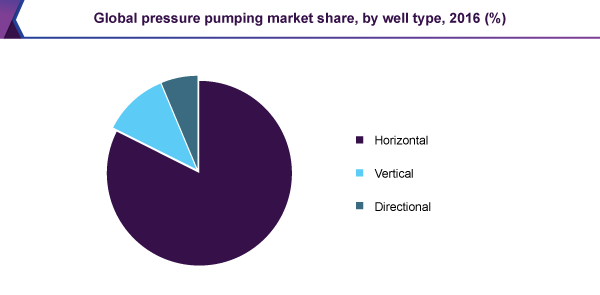

Horizontal well type dominated the global pressure pumping market and accounted for 82.4% of the global value in 2016. Increasing productivity, technological advancements, and advantages offered by horizontal wells are likely to be a key factor contributing to the growth of the market.

The global demand for vertical wells was valued at USD 5.9 billion in 2016 and is poised to rise at a CAGR of 3.6% from 2017 to 2025. Declining prices of vertical wells are expected to turn in favor of developing countries such as India, Argentina, and Algeria, where their demand is projected to witness a spike. Drilling cost pertaining to vertical depth declined from nearly USD 200 per foot in 2012 to nearly USD 100 per foot in 2016, leading to an upsurge in demand.

In 2015, nearly 77% of the most productive oil wells in the U.S. were horizontal. This type of well drilling offers much stronger stable points in a horizontal extent as compared to the vertical thickness. The significant growth of horizontal wells is estimated to influence the demand for pressure pumping operations positively over the forecast period.

Regional Insights

In terms of revenue, North America is the largest regional market and accounted for 63.0% of the market in 2016. It is anticipated to dominate the market throughout the forecast period owing to the presence of a strong oilfield services industry in the U.S. and Canada.

Asia Pacific is likely to register a CAGR of 5.5% from 2017 to 2025 owing to various initiatives undertaken by research institutes to arrange conferences for educating individuals and spreading awareness regarding well-type technologies in the region. Moreover, the number of wells drilled in the region witnessed a significant boost in 2017. For instance, the number of new wells drilled in China increased from nearly 15,800 in 2016 to nearly 17,000 in 2017.

Europe is poised to experience a CAGR of 3.6% from 2017 to 2025. The market in Europe is still in its developmental phase and has witnessed several setbacks due to moratoriums and bans by several national governments as well as non-governmental regulatory bodies in the last few years. For instance, France has banned hydraulic fracturing in the country and the German government has passed several acts and amendments to control hydraulic fracturing.

The MEA market was valued at USD 5.1 billion in 2016 and is expected to post a CAGR of 3.2% during the forecast period. The Middle East oil and gas sector is gradually accepting foreign investment. For instance, in 2017, Iran’s state-owned oil and gas company, National Iranian Oil Company (NIOC) awarded Total with a contract to develop the South Pars field. The South Pars/North Dome Gas-Condensate field is the world’s largest gas field. Thus, increasing foreign investments are projected to stir up the demand for pressure pumping in the region.

Pressure Pumping Market Share Insights

Major industry participants are concentrating on the development of superior extraction processes to achieve high yield. Companies are providing customized product offerings to their clients to achieve a substantial market share. Some of the prominent companies operating in the market are Baker Hughes; Schlumberger Limited; Halliburton; C&J Energy Services, Inc.; Calfrac Energy Services Ltd.; Trican; and Superior Energy Services, Inc.

Several vendors are developing products for fracturing operations that can provide high efficiency and productivity while having a minimal impact on the environment. The vendors are also trying to reduce labor requirements by implementing real-time job optimization and inventory management to improve productivity.

Many global players in the industry are acquiring fleets of regional players to expand their fleet sizes. For instance, Schlumberger Limited acquired a pressure pumping fleet of Weatherford in 2017. Similarly, Patterson-UTI Energy acquired a pressure pumping fleet of Seventy Seven Energy Inc. in 2018.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2015

Forecast period

2017 - 2025

Market representation

Revenue in USD Million & CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Russia, U.K., China, Australia, Brazil, Argentina, U.A.E, Algeria

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, & country levels, and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global pressure pumping market report based on type, well type, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Hydraulic Fracturing

-

Cementing

-

Others

-

-

Well Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Horizontal

-

Vertical

-

Directional

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Russia

-

The U.K.

-

-

Asia Pacific

-

China

-

Australia

-

-

CSA

-

Brazil

-

Argentina

-

-

MEA

-

U.A.E

-

Algeria

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."