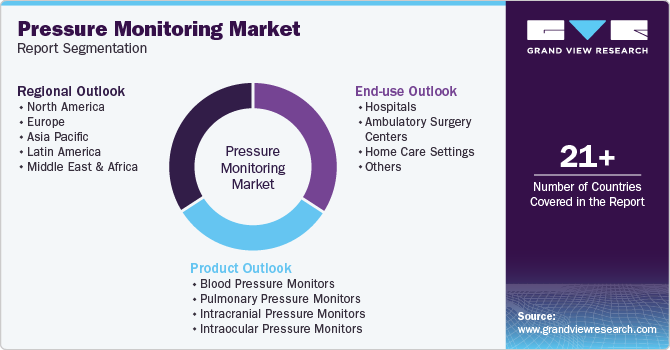

Pressure Monitoring Market Size, Share & Trends Analysis Report By Product (Blood Pressure Monitors, Pulmonary Pressure Monitors, Intracranial Pressure Monitors, Intraocular Pressure Monitors), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-828-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Pressure Monitoring Market Size & Trends

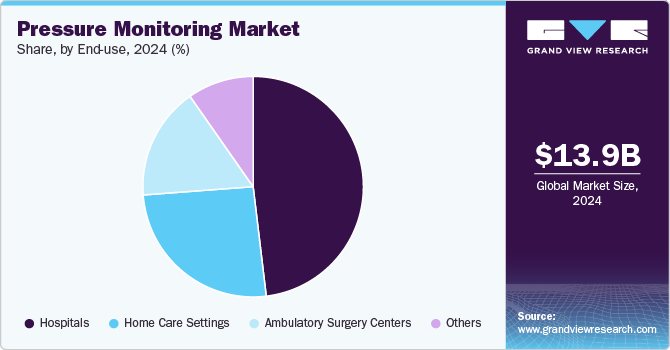

The global pressure monitoring market size was estimated at USD 13.9 billion in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2030. The increasing prevalence of chronic diseases, such as hypertension, cardiovascular diseases, and respiratory disorders, has significantly boosted the demand for pressure monitoring devices. Hypertension alone affects over a billion people worldwide, necessitating regular monitoring to manage the condition effectively.According to an article published by WHO, in March 2023, 1.28 billion adults aged 30-79 worldwide suffer from hypertension, with the majority residing in middle-income countries. In addition, it is estimated that 46% of the population with hypertension are not aware of their condition.

Chronic diseases often require lifelong management, including frequent pressure monitoring to prevent complications. As the global population ages and the incidence of chronic conditions rises, the need for reliable and efficient pressure monitoring solutions becomes more critical. According to a Medscape report in April 2024, hypertension is the most prevalent primary diagnosis in the U.S. It affects about 86 million adults aged 20 and older and is a significant risk factor for stroke, vascular disease, myocardial infarction, and chronic kidney disease. This trend is anticipated to sustain the market's upward trajectory as healthcare providers and patients seek effective ways to manage chronic illnesses.

In addition, global rise in cardiovascular diseases (CVDs), including arrhythmias and heart failure, is driven by sedentary lifestyles, poor diets, and an aging population. These trends increase the prevalence of heart-related issues, fueling the demand for advanced pressure monitoring devices to support early detection and effective management of cardiovascular conditions. A CDC article published in October 2024 highlights the critical need for advanced pressure monitoring devices. These devices are vital for early detection and management of hypertension, a major risk factor for heart diseases, enabling better prevention and treatment of cardiovascular conditions.

Furthermore, innovations such as wireless connectivity, integration with digital health platforms, and miniaturization of devices have made pressure monitoring more efficient and user-friendly. These advancements have broadened the application scope, allowing for more accurate and real-time monitoring of various conditions. For instance, in November 2024, Aktiia's continuous blood pressure monitoring (CBPM) bracelet received approval from Health Canada and was introduced to the Canadian market. This marks the company's initial expansion beyond its operations in Europe.

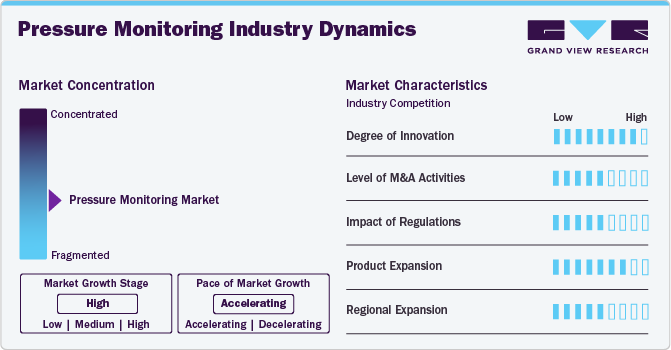

Market Concentration & Characteristics

The pressure monitoring industry is characterized by a high degree of innovation, driven by advancements in sensor technology, wireless connectivity, and integration with digital health platforms. Innovations such as non-invasive monitoring, miniaturized devices, and real-time data analytics have enhanced accuracy, convenience, and patient outcomes, significantly contributing to market growth and expanding the scope of applications.

The industry has seen a medium level of mergers and acquisitions (M&A) activity, as major players seek to enhance their technological capabilities and market reach. For instance, in April 2024, OMRON Healthcare, Co., Ltd. acquired Luscii Healthtech, a player in the digital health and remote consultation service platforms industry. These strategic acquisitions aim to integrate advanced technologies, expand product portfolios, and penetrate new markets, thereby driving innovation, improving competitive positioning, and fostering overall market growth.

Regulations in the industry play a crucial role in ensuring device safety, efficacy, and quality. Compliance with stringent standards set by regulatory bodies like the FDA and EMA fosters trust and reliability. However, navigating these regulatory frameworks can also pose challenges, potentially slowing innovation and market entry for new products.

Product expansion in the industry is high, driven by continuous innovation and the growing demand for advanced monitoring solutions. Companies are developing new devices with enhanced features, such as wireless capabilities and real-time data tracking, to meet diverse healthcare needs. For instance, in July 2024, Georgia-based IoT company KORE, specializing in supporting organizations with scalable solutions, partnered with Australia’s mCare Digital, a technology provider focused on independent living. They have introduced the mCareWatch 241, a smartwatch designed for virtual patient monitoring.

The industry's regional expansion is moderate, with significant growth observed in emerging markets across Asia-Pacific, Latin America, and the Middle East. Increasing healthcare investments, rising awareness of chronic diseases, and improvements in healthcare infrastructure drive this expansion, enabling broader access to advanced pressure monitoring technologies and fueling overall industry growth.

Products Insights

The pulmonary pressure monitors segment led the market with the largest revenue share of 46.3% in 2024, driven by the increasing prevalence of pulmonary diseases such as pulmonary hypertension and chronic obstructive pulmonary disease (COPD). Recent product launches featuring advanced monitoring technologies enhance early diagnosis and disease management. For instance, in August 2024, Prevounce Health launched its first blood oxygen device, the Pylo OX1-LTE, designed for remote patient monitoring (RPM). This clinically validated, cellular-connected device provides key benefits for patients with chronic respiratory conditions like COPD or asthma and those dealing with COVID-19 or undergoing treatments requiring heart rate monitoring.

The blood pressure monitors segment is anticipated to grow at the fastest CAGR of 9.6% over the forecast period, driven by the increasing prevalence of cardiovascular diseases and hypertension. Technological advancements, such as advanced cellular blood pressure monitoring, have enhanced patient compliance and monitoring accuracy. For instance, in October 2024, Withings Health Solutions, a leading name in connected health, introduced the BPM Pro 2, an advanced cellular blood pressure monitor designed to elevate patient-centered care. This device offers precise measurements while featuring a unique Patient Insights tool that collects contextual data about patients' daily activities, providing healthcare providers with a comprehensive view of their overall health.

End-use Insights

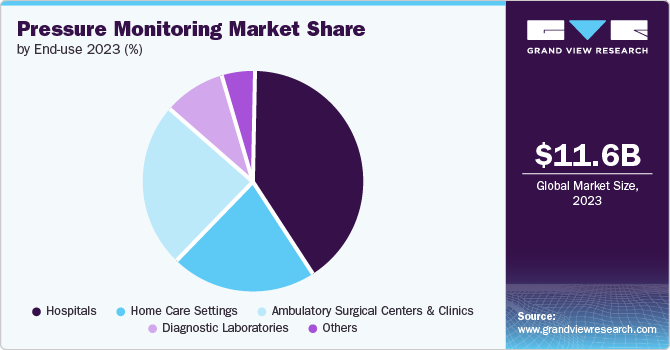

The hospitals dominated the market with the largest revenue share of 48.1% in 2024 due to the rising prevalence of chronic diseases and increasing recognition of asymptomatic elevated blood pressure (BP) in inpatient settings. According to the American Heart Association (AMA) article published in May 2024, a systematic review of nine studies revealed that asymptomatic elevated BP is present in 50% to 72% of hospitalizations, underscoring the importance of continuous BP monitoring for early detection and intervention. In addition, a multihospital study involving 224,265 adults admitted for reasons unrelated to hypertension found that 10% had markedly elevated BP, further emphasizing the need for accurate and reliable pressure monitoring solutions in hospitals. These findings highlight a growing demand for advanced BP monitoring devices that can support the timely identification and management of elevated BP, contributing to improved patient outcomes and driving market growth.

The ambulatory surgery centers segment is expected to experience the fastest CAGR of 9.3% over the forecast period. Ambulatory Surgery Centers (ASCs) have emerged as a pivotal component of the healthcare ecosystem, offering outpatient surgical procedures that prioritize cost efficiency, shorter recovery times, and patient convenience. The growing demand for minimally invasive surgeries, with advancements in medical technology, has significantly driven the expansion of ASCs worldwide. For instance, in October 2023, Dozee, a leader in AI-driven remote patient monitoring (RPM), launched Dozee Pro Ex, an advanced ambulatory patient monitoring solution designed to ensure uninterrupted care and enhance patient outcomes.

Regional Insights

North America pressure monitoring market dominated the global market and accounted for a 38.9% share in 2024, driven by the increasing incidence of CVD and rising prevalence of high blood pressure. According to the American Heart Association (AMA) article published in June 2024, cardiovascular disease (CVD) affects a significant portion of the U.S. population, with more than 184 million individuals-accounting for over 61% of residents estimated to develop some form of the condition.

This prevalence highlights the critical need for effective monitoring and management solutions to address the growing burden of CVD. Advanced pressure monitoring technologies play a pivotal role in improving patient outcomes and reducing the risks associated with these chronic conditions by facilitating early detection and continuous tracking of vital parameters such as blood pressure.

U.S. Pressure Monitoring Market Trends

The pressure monitoring market in the U.S. is anticipated to grow over the forecast period, driven by continuous innovation and the efforts of key market players. Companies like Medtronic, Philips Healthcare, and GE Healthcare are at the forefront of developing advanced pressure monitoring devices with enhanced accuracy, connectivity, and user-friendliness. Innovations such as wireless technology and integration with digital health platforms are improving patient outcomes and compliance.

For instance, in April 2023, Cadence and Providence introduced a remote patient monitoring program to enhance quality and access to home-based care. Two successful clinic launches in Washington have shown strong patient engagement and medication adherence among those with congestive heart failure and hypertension. Additionally, the increasing prevalence of hypertension and other chronic conditions is fueling demand for these cutting-edge monitoring solutions.

Europe Pressure Monitoring Market Trends

The European pressure monitoring market is anticipated to experience significant growth during the forecast period due to the high prevalence of hypertension, which affects a substantial portion of the adult population.According to a study published by ScienceDirect in December 2023, hypertension affects over 30% of the population in France. Increasing awareness about cardiovascular health and the need for regular monitoring drive demand for advanced pressure monitoring devices, enhancing early diagnosis and management of hypertension across the region.

Various factors influence the pressure monitoring market in the UKdue to the increasing prevalence of cardiovascular disorders and rising incidence of high blood pressure. According to the Gov. UK article published in March 2024, high blood pressure, High blood pressure, often referred to as the "silent killer," affects around 32% of adults in the UK, with approximately 4.2 million people in England remaining undiagnosed due to the condition's lack of noticeable symptoms.

This widespread prevalence and the high number of undiagnosed cases highlight the urgent need for advanced pressure monitoring solutions to aid in early detection and effective management. As hypertension awareness continues to rise, innovative monitoring technologies are becoming increasingly vital, driving the expansion of the pressure monitoring industry.

Germany pressure monitoring market is expected to grow over the forecast period due to the increasing incidence of high blood pressure and rising CVD cases. According to the Frontiers Media S., article published in June 2024, a study conducted across 336 medical practices in Germany between 2013 and 2022 involving over 750,000 patients annually. This trend underscores the importance of continued efforts to improve blood pressure monitoring and management to address undiagnosed or underdiagnosed cases.

The pressure monitoring market in Italy is expected to grow over the forecast period. The increasing prevalence of cardiovascular diseases (CVD) in Italy, which remains the leading cause of mortality, morbidity, and disability, is driving the demand for pressure monitoring devices. According to the Frontiers article published in April 2024, in Italy, the prevalence of CVD is nearly two-fold higher than the global prevalence (12.9% vs. 6.6%). Contributing factors include widespread smoking, physical inactivity, modest adherence to the traditional Mediterranean diet, and high rates of overweight/obesity, hypertension, and dyslipidemia.

Asia Pacific Pressure Monitoring Market Trends

The Asia Pacific pressure monitoring market is experiencing significant growth, driven by the rising elderly population. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, around 697 million people aged 60 and above will reside in the Asia-Pacific region, accounting for nearly 60% of the world's elderly population. This demographic is particularly vulnerable to cardiovascular diseases, and the growing number of older adults is driving an increased need for advanced monitoring devices to support effective management and care.

The pressure monitoring market in China has grown over the forecast period. China's increasing cardiovascular disease burden fuels the demand for pressure monitoring solutions. According to the NCBI article published in December 2023, China faced a significant challenge, with approximately 330 million individuals suffering from cardiovascular diseases (CVD) in 2022. The sheer volume of patients underscores the urgent requirement for effective arrhythmia monitoring solutions. As the prevalence of CVD continues to rise, the demand for reliable and advanced monitoring devices in China is expected to grow. This surge is driven by the need to improve and manage cardiovascular health outcomes for millions across the country.

Japan pressure monitoring market is expected to witness rapid growth over the forecast due to significant technological innovations and rising hypertension cases. According to the Springer Nature Limited article published in October 2024, hypertension remains one of the most widespread health conditions in Japan, impacting an estimated 43 million people. This prevalence underscores the critical need for adequate blood pressure monitoring solutions to support early diagnosis and ongoing management. With the aging population and increasing focus on preventive healthcare, the demand for advanced pressure monitoring technologies is expected to grow, driving innovation and expansion within the pressure monitoring industry.

The pressure monitoring market in India is growing over the forecast period. Rising cases of CVD and increasing hypertension cases drive the growth of the market. According to the Health Policy Watch article published in April 2024, In India, hypertension affects approximately 28% of adults aged 18 and above, with a staggering 70% of cases remaining undiagnosed, according to a recent large-scale study.

In addition, 90% of individuals living with hypertension either do not receive treatment or find their treatment ineffective in maintaining normal blood pressure levels. This highlights a significant gap in hypertension management, emphasizing the need for accessible and reliable pressure monitoring solutions. The growing awareness of hypertension and the importance of early detection are expected to drive the demand for advanced pressure monitoring devices, fueling the growth of the pressure monitoring industry.

Latin America Pressure Monitoring Market Trends

The Latin American pressure monitoring market is growing over the forecast period. Rising CVD cases and increasing hypertension cases drive the growth of the market. According to the Fundacion Favaloro article published in November 2024, hypertension is a leading cause of cardiovascular-related deaths in Latin America, accounting for over two million fatalities annually, with nearly one million of these occurring before the age of 70. This statistic underscores the urgent need for effective blood pressure monitoring solutions to aid in the early detection and management of the condition.

The pressure monitoring market in Brazil is growing over the forecast period. Government initiatives and increasing healthcare expenditure aimed at improving cardiac care infrastructure drives the market's growth. For instance, in September 2023, the Brazilian government, alongside various institutions, introduced initiatives to improve care and outcomes for patients with cardiovascular diseases (CVD).

A notable example is the partnership between Mount Sinai and the Brazilian Clinical Research Institute, which focuses on advancing CVD research and medical education. These collaborative efforts demonstrate a strong commitment to raising healthcare standards, driving innovation, and expanding expertise in managing CVD, thereby highlighting the importance of advanced pressure monitoring technologies in Brazil's healthcare landscape.

Middle East and Africa Pressure Monitoring Market Trends

The Middle East and Africa pressure monitoring market is driven by the rising incidence of high blood pressure and cardiovascular diseases. Increased awareness and demand for effective monitoring solutions are fueling market expansion. Advances in technology and more excellent healthcare investment further support the development and adoption of pressure monitoring devices in the region.

Saudi Arabia pressure monitoring market is expected to grow over the forecast period. The rising incidence of CVD cases and hypertension incidence drive the growth of the market. According to the article published by BMC (CVD) in March 2024, In Saudi Arabia, cardiovascular disease (CVD) affects 1.6% of individuals aged 15 and older, reflecting the proportion of the population dealing with heart-related conditions and associated disorders.

This statistic offers valuable insight into the country's health challenges, emphasizing the significance of addressing cardiovascular issues. The prevalence of CVD underscores the need for adequate health interventions and advanced pressure monitoring solutions to improve diagnosis, management, and overall cardiovascular health outcomes in the region.

Key Pressure Monitoring Company Insights

Key players operating in the industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Pressure Monitoring Companies:

The following are the leading companies in the pressure monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Philips Healthcare

- GE Healthcare

- Welch Allyn, Inc.

- Medtronic

- Dragerwerk

- Omron Healthcare Welch Allyn, Inc.

- A&D Medical Inc.

- SunTech Medical, Inc.

- American Diagnostics Corp.

- Withings

- Briggs Healthcare

- Rossmax International Ltd.

- Spacelabs Healthcare Inc.

Recent Developments

-

In August 2023, EPIC Health, Detroit's community-centered health system, and OMRON Healthcare announced a new partnership to tackle health disparities and lower the risk of heart attacks and strokes in underserved Detroit neighborhoods. The initiative will introduce VitalSight, OMRON's inaugural remote patient monitoring service tailored for individuals with high blood pressure, particularly those suffering from uncontrolled Stage 2 hypertension.

-

In July 2024, Lindus Health and Aktiia announced the initiation of a clinical trial to assess user satisfaction with Aktiia's optical blood pressure monitoring (OBPM) device among individuals with hypertension.

-

In January 2024, Pylo Health unveiled the release of two advanced patient devices: the Pylo 200-LTE weight scale and the Pylo 900-LTE blood pressure monitor.

Pressure Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 15.1 billion |

|

Revenue forecast in 2030 |

USD 22.8 billion |

|

Growth rate |

CAGR of 8.7% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Philips Healthcare; GE Healthcare; Welch Allyn, Inc.; Medtronic; Dragerwerk; Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corp.; Withings; Briggs Healthcare; Rossmax International Ltd.; Spacelabs Healthcare Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pressure Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pressure monitoring market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Pressure Monitors

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitors

-

Ambulatory Blood Pressure Monitors

-

Blood Pressure Transducers

-

Instrument & Accessories

-

-

Pulmonary Pressure Monitors

-

Pulse Oximeters

-

Spirometers

-

Capnographs

-

-

Intracranial Pressure Monitors

-

Intraocular Pressure Monitors

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pressure monitoring market size was estimated at USD 13.9 billion in 2024 and is expected to reach USD 15.1 billion in 2025.

b. The global pressure monitoring market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 22.8 billion by 2030.

b. North America dominated the pressure monitoring market with share of 38.9% in 2024. This is attributable to the rapid adoption of sedentary lifestyles, technological advancements, and presence of key market players.

b. Some key players operating in the telemedicine market include Philips Healthcare; Welch Allyn; GE Healthcare; Drägerwerk AG & Co. KGaA; Medtronic; Becton, Dickinson and Company; Nonin Medical Inc.; A&D Medical; NIHON KOHDEN CORPORATION; Smiths Medical; Icare Finland Oy; Essilor; and NIDEK CO., LTD.

b. Key factors that are driving the market growth include increasing prevalence of high blood pressure, launch of wearable devices, and rising ageing population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."