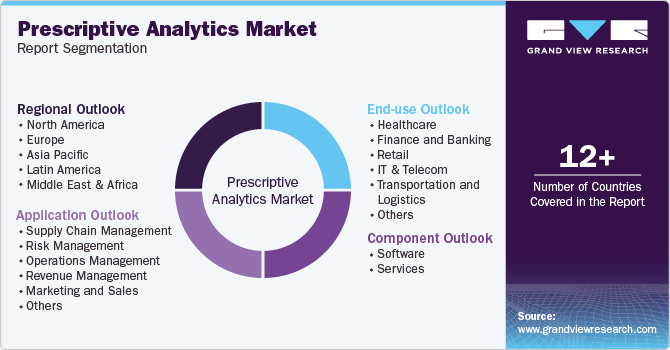

Prescriptive Analytics Market Size, Share & Trends Analysis Report By Component (Software, Services), By Application (Risk Management, Marketing & Sales), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-441-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Prescriptive Analytics Market Size & Trends

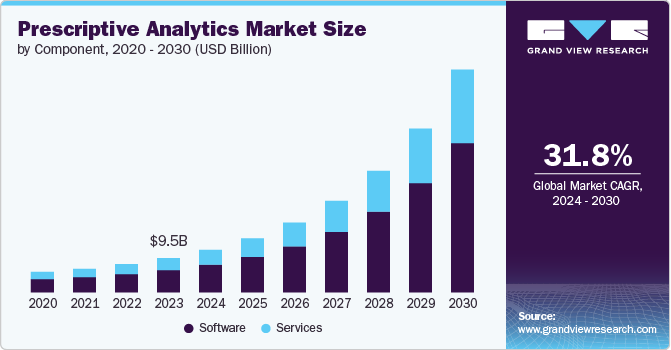

The global prescriptive analytics market size was estimated at USD 9.53 billion in 2023 and is projected to grow at a CAGR of 31.8% from 2024 to 2030. The market is experiencing significant growth driven by the increasing demand for advanced data analytics solutions across various industries. Businesses increasingly recognize the value of data-driven decision-making, and prescriptive analytics provides actionable recommendations by analyzing large datasets, predicting outcomes, and suggesting optimal decisions. This demand is further fueled by advancements in artificial intelligence, machine learning, and big data technologies, which enhance the capabilities of prescriptive analytics solutions.

As organizations seek to optimize operations, reduce costs, and improve customer experiences, adopting prescriptive analytics tools is becoming essential. The growing volume of data businesses generate and the need for real-time decision-making push more companies to invest in these solutions. Consequently, the market sees robust investment from established players and new entrants, driving competition and innovation. Integrating prescriptive analytics into cloud-based platforms also expands accessibility, further contributing to market growth.

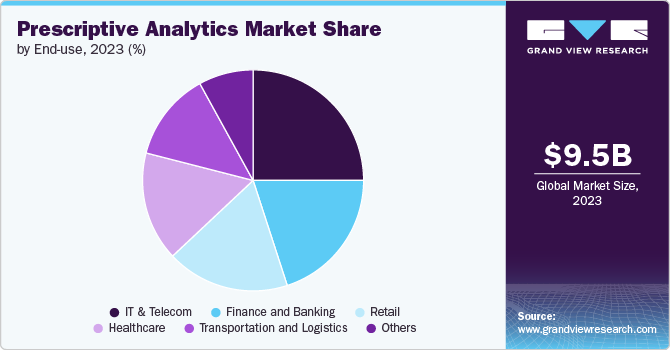

Industry-specific applications are also driving market growth. In the healthcare sector, prescriptive analytics transforms patient care by providing personalized treatment recommendations and optimizing resource allocation. Retailers use prescriptive analytics to enhance inventory management, pricing strategies, and customer experiences. Financial institutions use these tools for risk management, fraud detection, and investment optimization. Manufacturing companies employ prescriptive analytics to streamline supply chains and improve production efficiency. The energy sector is utilizing prescriptive analytics for demand forecasting and grid optimization. Government agencies are adopting these solutions for public safety and resource allocation. This widespread adoption across diverse industries is contributing to the rapid market expansion.

The increasing integration of these tools with advanced technologies such as IoT and edge computing is propelling market growth. As IoT devices proliferate across industries, they generate vast amounts of real-time data that must be analyzed and acted upon quickly. When integrated with IoT, prescriptive analytics enables businesses to make immediate, data-driven decisions that optimize operations, reduce downtime, and enhance overall efficiency. For instance, in smart manufacturing, prescriptive analytics can predict equipment failures and recommend maintenance actions before issues arise, minimizing production disruptions. Similarly, in the energy sector, IoT-enabled prescriptive analytics can optimize energy usage and reduce waste, leading to cost savings and environmental benefits.

Component Insights

Software led the market and accounted for 65.12% of the global revenue in 2023. The software segment dominates the market because it provides the essential tools and platforms that enable businesses to perform advanced data analysis, model scenarios, and generate actionable insights. These software solutions are at the core of prescriptive analytics, offering robust capabilities such as optimization algorithms, predictive modeling, and decision automation. The customization and scalability offered by prescriptive analytics software allow organizations to customize solutions to their specific needs, making it a critical component of their data strategy. Moreover, continuous advancements in AI and machine learning are enhancing the functionality of these software platforms, further driving their adoption. As a result, the software segment remains the primary driver of value in the market.

The services segment is projected to grow significantly over the forecast period. The services segment is growing rapidly due to the increasing demand for expert consultation, implementation, and support to maximize the benefits of prescriptive analytics solutions. Businesses often require guidance on effectively integrating prescriptive analytics into their existing systems and workflows, which fuels the need for professional services. Moreover, as companies adopt more sophisticated analytics tools, there is a growing need for training and ongoing support to ensure users can fully utilize these capabilities. Managed services, which provide ongoing management and optimization of analytics platforms, are becoming more popular as organizations seek to outsource these complex tasks to specialists. This growing reliance on expert services to achieve desired outcomes is driving the expansion of the services segment within the market.

Application Insights

The supply chain management segment accounted for the largest market revenue share in 2023. The supply chain management segment dominates the market because it heavily relies on analytics decision-making to optimize complex, interconnected processes such as inventory management, demand forecasting, and logistics. Prescriptive analytics provides supply chain managers with actionable recommendations to minimize costs, reduce delays, and enhance overall efficiency, which is crucial in a globalized economy. The ability to anticipate disruptions and make proactive adjustments is particularly valuable, especially in manufacturing and retail industries where supply chain efficiency directly impacts profitability. The growing adoption of IoT and real-time data in supply chain operations further amplifies the need for advanced analytics to process and act on vast amounts of information. As a result, prescriptive analytics has become vital for maintaining competitive advantage in supply chain management.

The operations management segment is predicted to foresee significant growth in the forecast period due to the increasing need for businesses to optimize their internal processes, improve resource allocation, and enhance productivity. As organizations face mounting pressure to reduce operational costs and improve efficiency, prescriptive analytics offers solutions to identify bottlenecks and optimize resource utilization. Incorporating prescriptive analytics in operations management allows companies to make informed decisions that enhance overall operational performance, from production schedules to workforce management. Moreover, the rise of Industry 4.0 and smart manufacturing initiatives drive demand for analytics tools to optimize operations in real time. This growing focus on operational excellence and agility fuels market expansion within the operations management segment.

End-use Insights

The IT & telecom segment accounted for the largest market revenue share in 2023 because it operates in a highly data-intensive environment where real-time decision-making and optimization are critical. Telecom companies use prescriptive analytics to manage network performance, optimize bandwidth, and enhance customer experiences by predicting and addressing issues before they impact service quality. The sector relies on vast, complex data sets, including customer usage patterns and network metrics, making advanced analytics essential for maintaining service reliability and competitiveness. Moreover, the need to reduce operational costs and efficiently manage resources in a rapidly evolving technological landscape drives the demand for prescriptive analytics in IT and Telecom. As these companies strive to innovate and improve their service offerings, prescriptive analytics remains a key tool in achieving these goals.

Finance and banking is projected to grow significantly over the forecast period due to the sector's increasing focus on risk management, fraud detection, and personalized customer experiences. Financial institutions are utilizing prescriptive analytics to predict market trends, optimize investment strategies, and enhance compliance with regulatory requirements. The ability to analyze vast amounts of financial data and generate actionable insights helps banks and financial firms mitigate risks and make more informed decisions. Moreover, prescriptive analytics is being used to offer personalized financial products and services, improving customer engagement and loyalty. As the finance and banking industry continues evolving with digital transformation, the demand for advanced analytics solutions drives growth in this segment.

Regional Insights

North America dominated the market and accounted for a 36.18% share in 2023.Prescriptive analytics is growing in North America as the region's businesses increasingly seek to utilize advanced data tools to remain competitive in a dynamic market. Canada and Mexico, in particular, are seeing growth due to their efforts in modernizing industries such as manufacturing and energy, where prescriptive analytics helps optimize operations and reduce costs. The region's strong emphasis on innovation, with numerous research institutions and tech hubs, supports developing and implementing advanced analytics solutions. Moreover, collaboration within North America is driving the adoption of prescriptive analytics to streamline supply chains and improve efficiency across industries.

U.S. Prescriptive Analytics Market Trends

The prescriptive analytics market in the U.S. is expected to grow significantly over the forecast period.Prescriptive analytics is expanding rapidly in the U.S. due to the country's leadership in technology innovation and widespread adoption across key industries such as healthcare, finance, and retail. American companies increasingly invest in prescriptive analytics to enhance decision-making, improve customer experiences, and gain competitive advantages in a highly digital economy. The presence of major tech giants and analytics software providers headquartered in the U.S. accelerates the development and deployment of these advanced tools.

Europe Prescriptive Analytics Market Trends

The prescriptive analytics market in Europe is driven by the region’s strong emphasis on data privacy, regulatory compliance, and sustainable business practices. European companies, particularly in industries like finance and manufacturing, are adopting prescriptive analytics to optimize operations while adhering to strict regulations such as GDPR. The region’s focus on digital transformation and Industry 4.0 initiatives also propels the adoption of advanced analytics tools to enhance efficiency and innovation.

Asia Pacific Prescriptive Analytics Trends

The prescriptive analytics market in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is experiencing significant growth in prescriptive analytics, largely due to the rapid digitalization and economic expansion in countries such as China, India, and Japan. Businesses in this region are increasingly adopting prescriptive analytics to optimize supply chains, improve operational efficiency, and enhance customer experiences in highly competitive markets. The rise of e-commerce and the integration of AI in various industries are further driving the demand for advanced analytics solutions. Moreover, government initiatives promoting smart cities and digital infrastructure are boosting the adoption of prescriptive analytics in urban planning and public services. The region’s focus on utilizing technology for economic growth and innovation is a key factor in the expanding market in Asia Pacific.

Key Prescriptive Analytics Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In January 2024, Amnet Digital, a U.S.-based data, analytics, and AI solutions company, introduced Swift Insights, an AI-powered analytics platform developed to help businesses make informed decisions through intuitive dashboards and advanced reports. Utilizing Generative AI and large language models (LLMs), Swift Insights enables organizations to uncover new growth opportunities and enhance decision-making in key areas such as customer acquisition, retention, and loyalty.

Key Prescriptive Analytics Companies:

The following are the leading companies in the prescriptive analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Amnet Digital

- Amazon Web Services, Inc.

- International Business Machines Corporation

- Microsoft

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Sisense Inc.

- Tableau Software LLC

Recent Developments

-

In January 2024, SAP SE introduced new AI-driven capabilities to enhance retail operations and customer experiences, including advanced demand forecasting, replenishment solutions, and order management tools. These innovations utilize SAP Business AI technology and data integration to drive profitability, improve customer loyalty, and support retailers in adapting to rapid market changes.

-

In January 2024, Microsoft introduced new generative AI and data solutions through Microsoft Cloud for Retail, enhancing personalized shopping experiences, store operations, and marketing campaigns. These innovations, including copilot templates and advanced analytics, aim to unify retail data, improve customer engagement, and drive revenue opportunities by utilizing AI across the entire shopper journey.

-

In April 2023, Deloitte, a UK-based professional services firm, announced a multi-party engagement with HighByte, Amazon Web Services, Inc., and Element Analytics to develop a new data management offering that integrates AWS’s Industrial Data Fabric with Deloitte’s smart manufacturing platform. This collaboration aims to help manufacturers overcome challenges related to siloed and disjointed data systems, enabling more informed business decisions and accelerating digital transformation.

-

In January 2023, Unifi Inc., an aviation services company in the U.S., implemented an advanced safety risk analytics model developed with Microsoft Azure and Artis Consulting to enhance ground handling operations. This model utilizes Azure AI, Machine Learning, and Power BI to predict safety risks and provide prescriptive actions, achieving a 94 percent accuracy rate in its predictive component.

Prescriptive Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.83 billion |

|

Revenue forecast in 2030 |

USD 61.92 billion |

|

Growth rate |

CAGR of 31.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Accenture plc; Amnet Digital; Amazon Web Services, Inc.; International Business Machines Corporation; Microsoft; Oracle Corporation; SAP SE; SAS Institute Inc.; Sisense Inc.; Tableau Software LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Perspective Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prescriptive analytics market report based on component, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Supply Chain Management

-

Risk Management

-

Operations Management

-

Revenue Management

-

Marketing and Sales

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Finance and Banking

-

Retail

-

IT & Telecom

-

Transportation and Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global prescriptive analytics market size was estimated at USD 9.53 billion in 2023 and is expected to reach USD 11.83 billion in 2024.

b. The global prescriptive analytics market is expected to grow at a compound annual growth rate of 31.8% from 2024 to 2030 to reach USD 61.92 billion by 2030.

b. North America dominated the prescriptive analytics market with a share of 36.3% in 2023. This is attributable to its advanced technological infrastructure, a high concentration of leading analytics firms, and strong adoption of AI-driven solutions across various industries.

b. Some key players operating in the prescriptive analytics market include Accenture plc, Amnet Digital, Amazon Web Services, Inc., International Business Machines Corporation, Microsoft, Oracle Corporation, SAP SE, SAS Institute Inc., Sisense Inc., and Tableau Software LLC.

b. Key factors driving the market growth include increasing advancements in AI and machine learning technologies, the growing need for business optimization and efficiency, and the widespread adoption of predictive and prescriptive analytics across industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."