- Home

- »

- Consumer F&B

- »

-

Prenatal Vitamin Supplement Market Size Report, 2030GVR Report cover

![Prenatal Vitamin Supplement Market Size, Share & Trends Report]()

Prenatal Vitamin Supplement Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Capsules/Tablets), By Nature (Organic), By Distribution Channel (Pharmacy & Drug Stores), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-536-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prenatal Vitamin Supplement Market Summary

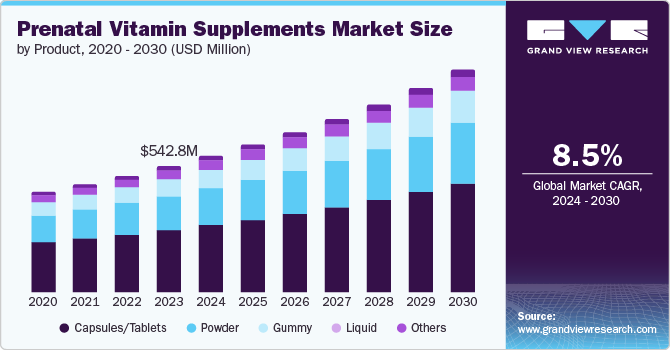

The global prenatal vitamin supplement market size was estimated at USD 542.8 million in 2023 and is projected to reach USD 957.7 million by 2030, growing at a CAGR of 8.4% from 2024 to 2030. Increasing awareness about healthy eating habits and proper medication among pregnant women is the major factor driving the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, capsules/tablets accounted for a revenue of USD 542.8 million in 2023.

- Capsules/tablets is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 542.8 million

- 2030 Projected Market Size: USD 957.7 million

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

The overweight and sedentary lifestyle of pregnant women increases the deficiency of minerals and vitamins. In addition, malnutrition in infants, increasing incidence of other congenital disabilities, and increasing awareness about the benefits of prenatal supplements are some of the factors driving the market.

AI-powered prenatal vitamins are reducing congenital disabilities and driving market growth, along with rising awareness among women about proper nutrition during pregnancy. According to the recommendations by the U.S. Centre for Disease Control and Prevention (CDC), different folic acid doses based on health and family history: 400 mcg daily for all women and pregnant women and 4,000 mcg daily for women with previous neural tube defect-affected pregnancies or seizure disorders. Spina bifida and anencephaly, common neural tube defects, can occur early in pregnancy, highlighting the importance of pre-emptive supplementation.

The rising incidence of various congenital disabilities is fuelling the prenatal vitamin supplement market as expectant mothers seek to mitigate risks and ensure healthier pregnancies. According to the World Health Organization (WHO), congenital disabilities tragically claim the lives of an estimated 410,000 children globally each year, with 240,000 newborns and 170,000 children between 1 month and 5 years old.

Product Insights

Capsules/Tablets dominated the market and accounted for a share of 49.6% in 2023. This is due to increased demand for capsules, as doctors prefer to prescribe capsules due to their longer shelf life. Furthermore, the fact that the capsules are easy to dissolve with gastric juices is expected to stimulate greater demand for these prenatal vitamin supplements among consumers. For instance, in October 2023, Lemme Mama, a prenatal vitamin, was released by Lemme. It packs over 25 nutrients to support mom's health and baby's development from preconception to postpartum.

Gummy is expected to register the CAGR of 9.5% during the forecast period. This increase can be attributed to various flavours, making them more palatable and appealing compared to traditional tablets or capsules. Additionally, increasing awareness about the importance of prenatal nutrition drives expectant mothers to seek convenient and enjoyable supplementation options.

Nature Insights

The conventional segment dominated the market in 2023. This dominance can be attributed to affordability of conventional tablets as compared to other alternatives such as gums, making them a cost-effective option for a wide range to expectant mothers. For instance, in November 2023, Needed, a science-based perinatal nutrition company, secured USD 14 million in funding to develop new products, expand educational resources, and launch Needed Labs for clinical research.

The organic segment is expected to grow at the fastest CAGR of 12.6% over the forecast period. This growth is due to consumers' growing focus on natural and pure labels. Expectant mothers seek prenatal vitamins with supplements, and synthetics are given priority for optimal nutrition.

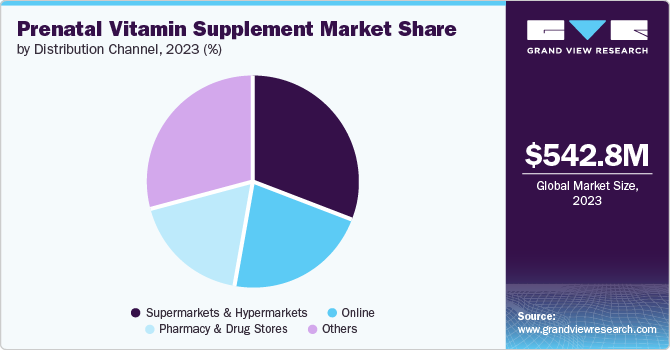

Distribution Channel Insights

The supermarkets & hypermarkets segment dominated the market in 2023. This is owing to easy availability of supplement in supermarkets as customer can preview the product directly before purchasing it. For instance, in April 2021, Natural Grocers by Vitamin Cottage, Inc. was expanding its brand of vitamins and supplements, offering over 100 high-quality choices at affordable prices. These are all third-party certified for good manufacturing practices.

The online segment is projected to grow at the fastest CAGR of 9.3% over the forecast period. The increasing trend of e-commerce and the increasing number of online retailers offering prenatal vitamin supplements are the major factors driving the growth of the online market. Online channels make it easier to buy and get products from home and allow consumers to compare prices. In addition, online channels often offer attractive discounts, special offers, and free home delivery, which is anticipated to drive market growth.

Regional Insights

North American prenatal vitamin supplements dominated the market with 51.6% in 2023. This position is due to the high concentration of health care providers recommending prenatal vitamins to pregnant women, promoting widespread awareness and adoption. In addition, North America has a well-developed and regulated supplement industry, increasing consumer confidence in the safety and quality of prenatal vitamin products.

U.S. Prenatal Vitamin Supplement Market Trends

The U.S. prenatal vitamin supplements market was identified as a lucrative region in 2023. Strong endorsements and guidelines from healthcare providers such as the CDC and ACOG bolster confidence in the efficacy and necessity of prenatal vitamins among expectant mothers, driving widespread adoption and market growth in the U.S. According to the American College of Obstetricians and Gynecologists (ACOG), during pregnancy, essential nutrients such as iron, folic acid, choline, calcium, omega-3 fatty acids, vitamin D, B vitamins, and vitamin C are crucial for fetal development and maternal health. A balanced diet rich in sources such as leafy greens, dairy, lean meats, fortified foods, and a prenatal vitamin containing folic acid ensures adequate intake to support both mother and baby's needs.

Europe Prenatal Vitamin Supplement Market Trends

Europe prenatal vitamin supplements market was identified as a lucrative region in 2023. This is attributable to increased maternal and fetal health awareness, leading to higher demand for prenatal vitamins. In addition, improved healthcare and nutritional deficiencies in women is anticipated to drive the market growth.

The high prevalence of dietary deficiencies among pregnant women in the UK increases the need for supplemental vitamins to ensure adequate maternal and fetal nutrition, driving the demand for prenatal vitamin supplements. The study published by the University of Southampton found that 90% of pregnant women in wealthy countries lack vital nutrients. This is due to modern diets and could worsen with the rise of plant-based eating: vitamin B, folic acid, and vitamin D deficiency harm fetal development.

Asia Pacific Vitamin Supplement Market Trends

Asia Pacific's prenatal vitamin supplements market is anticipated to witness significant growth owing to increasing awareness of prenatal health and increasing incidence of nutritional deficiencies among pregnant women in the region. Economic growth and improvements in health care provide greater access to prenatal medicine, while the growing middle class drives demand for higher subsidized health care. Furthermore, government policy and health campaigns promote the importance of prenatal nutrition, further increasing market expansion.

The China prenatal vitamin supplements market held a substantial market share in 2023. This is attributable to the recent implementation of the three-child policy, which has led to an increase in pregnancy rates and an increase in the use of antenatal health care. In August 2021, China's government approved a three-child policy to reverse a declining birth rate, allowing couples to have more children than previously permitted.

Key Prenatal Vitamin Supplement Company Insights

Some key companies in the global prenatal vitamin supplements market include Country Life Vitamins, Garden of Life, MegaFood, Biotics Research Corporation, Renew Life Formulas, LLC., Church & Dwight Co., Inc., Avion Pharmaceuticals, New Chapter., and Abbott. Organizations in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Country Life Vitamins manufactures and distributes natural health and wellness products, including vitamins, supplements, and personal care products, with a focus on sustainability and quality. Their product portfolio includes Country Life Vitamins, Biochem Sports, and Iron Tech, which cater to health and fitness needs.

-

Abbott specializes in developing and manufacturing scientific nutritional supplements for people of all ages. Their product portfolio includes popular brands such as Ensure, Similac, and Pediasure, aiming to provide essential nutrients for various products' health needs and lifestyles.

Key Prenatal Vitamin Supplement Companies:

The following are the leading companies in the prenatal vitamin supplement market. These companies collectively hold the largest market share and dictate industry trends.

- Country Life Vitamins

- Garden of Life

- MegaFood

- Biotics Research Corporation

- Renew Life Formulas, LLC.

- Church & Dwight Co., Inc.

- Avion Pharmaceuticals

- New Chapter.

- Abbott

Recent Developments

-

In June 2024, Abbott partnered with the National Association of Community Health Centers to increase access to healthy foods and promote positive health outcomes. This program aims to address malnutrition and its impact on chronic diseases by integrating nutrition services into community health facilities. The partnership was expected to provide resources, education, and support to improve the nutritional health of underserved populations.

-

In October 2023, Garden of Life launched a new line of Vitamin Code Gummies made with clean, traceable, non-GMO ingredients and whole foods. The gummies come in seven formulations, each designed to address specific nutritional needs, and are certified gluten-free, kosher, and lower in sugar.

-

In January 2023 Biotics Research Corporation achieved ISO accreditation, recognizing its commitment to quality and safety standards. This recognition increases the company’s credibility and assures customers that international best practices will be adhered to. It also sets the stage for biotics research for further development and confidence in the industry.

Prenatal Vitamin Supplement Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 586.2 million

Revenue forecast in 2030

USD 957.7 million

Growth rate

CAGR of 8.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

Country Life Vitamins; Garden of Life; MegaFood; Biotics Research Corporation; Renew Life Formulas, LLC.; Church & Dwight Co., Inc.; Avion Pharmaceuticals; New Chapter.; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prenatal Vitamin Supplement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prenatal vitamin supplement market report based on product, nature, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Powder

-

Gummy

-

Liquid

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.