- Home

- »

- Clothing, Footwear & Accessories

- »

-

Premium Sportswear Market Size And Share Report, 2030GVR Report cover

![Premium Sportswear Market Size, Share & Trends Report]()

Premium Sportswear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Top Wear, Bottom Wear), By Distribution Channel (Sporting Goods Retailers, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-467-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Premium Sportswear Market Summary

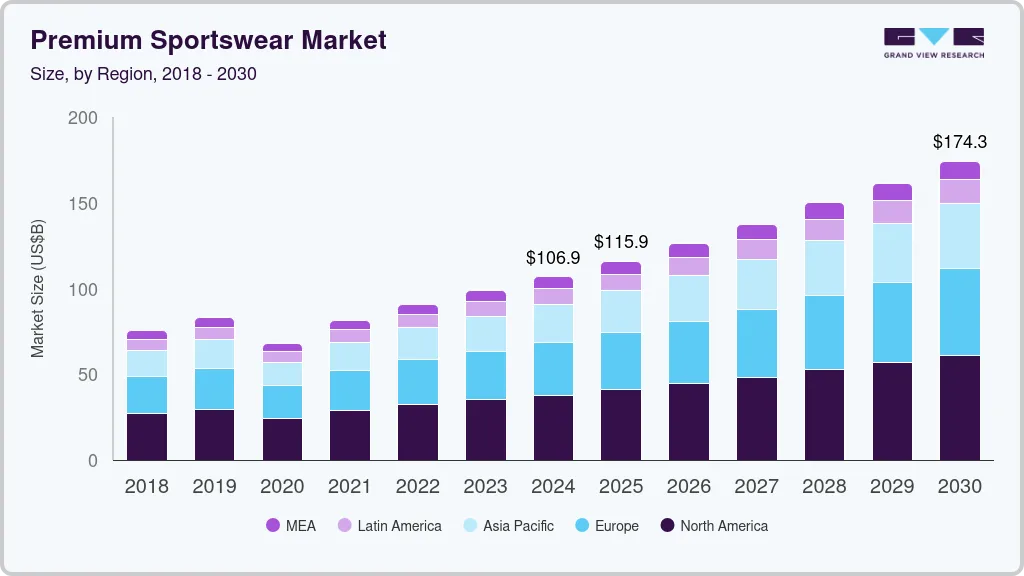

The global premium sportswear market size was estimated at USD 106.87 billion in 2024 and is anticipated to reach USD 174.32 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The market is driven by factors such as rising health consciousness, increasing participation in fitness activities, and the growing trend of athleisure, where high-end athletic apparel is worn in both workout and casual settings.

Key Market Trends & Insights

- North America premium sportswear market accounted for a revenue share of 35.4% in 2023.

- Asia Pacific premium sportswear market is expected to grow at a CAGR of 9.2% from 2024 to 2030.

- By product, the top wear segment accounted for a revenue share of 68.8% in 2023.

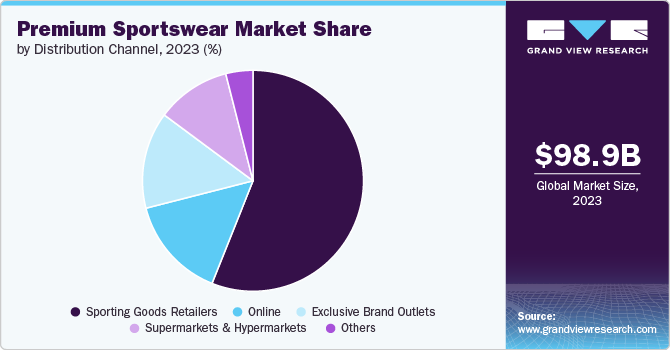

- By distribution channel, sales through sporting goods retailers accounted for a revenue share of 57.0% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 106.87 Billion

- 2030 Projected Market Size: USD 174.32 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2023

Advances in fabric technology, including moisture-wicking, odor control, and temperature regulation, significantly enhance the functionality and appeal of premium sportswear. In addition, the influence of social media and celebrity endorsements has heightened brand visibility and consumer demand for premium labels. The expansion of e-commerce platforms has made luxury sportswear more accessible. At the same time, the focus on sustainability and eco-friendly materials aligns with the values of environmentally conscious consumers, further boosting market growth.The market demand for premium sportswear is expanding rapidly, driven primarily by a growing awareness of health and fitness. As more people incorporate exercise into their daily routines, the need for high-performance, durable, and comfortable athletic wear has increased. Consumers are seeking sportswear that enhances their workout experience through advanced materials, such as moisture-wicking fabrics, and designs that provide both functionality and style. This shift towards a more active lifestyle has made premium sportswear brands, known for their quality and innovation, more attractive to health-conscious buyers.

Another key trend fueling the market’s growth is the rise of athleisure, a style that blends athletic wear with everyday fashion. This trend allows consumers to wear sportswear not just for exercise but in social, casual, and even professional settings. Premium brands like Lululemon and Adidas have capitalized on this trend by creating versatile apparel that meets both fitness and lifestyle needs. The seamless transition from the gym to everyday life has made sportswear a wardrobe staple for many, contributing to the market's continued expansion.

Sustainability is also playing a significant role in the rise of premium sportswear demand. Consumers are increasingly concerned about the environmental impact of their purchases, leading them to choose brands that prioritize eco-friendly materials and ethical production practices. Premium sportswear brands are responding by offering products made from recycled materials and committing to transparent, sustainable practices, attracting a more environmentally conscious customer base. This shift towards sustainability aligns with broader consumer values, helping premium sportswear brands differentiate themselves in a competitive market.

In addition, the influence of social media, athletes, and celebrities has amplified the demand for premium sportswear. High-profile endorsements and collaborations with famous athletes or fitness influencers help to create a sense of aspiration and exclusivity around these products. Wearing premium brands is not only about performance but also a symbol of lifestyle and status. This blend of functionality, style, and social influence is driving consumers to invest more in premium sportswear, making it a key growth sector within the broader apparel industry.

Product Insights

The top wear segment accounted for a revenue share of 68.8% in 2023. The rise of athleisure, where sportswear is worn not just for workouts but also in casual and social settings, has led to an increased demand for stylish and versatile top wear like premium hoodies, t-shirts, and sweatshirts. Consumers seek products that combine performance with fashion, making premium top wear a popular choice for daily wear. Premium sportswear brands are incorporating advanced fabric technologies, such as moisture-wicking, breathability, and temperature regulation, into their top wear. These innovations enhance comfort and performance, attracting consumers who value high-quality materials that improve their athletic and everyday experiences.

The bottom wear market is expected to grow at a CAGR of 9.1% from 2024 to 2030. As more people engage in activities like running, yoga, and gym workouts, there is a rising demand for high-performance bottom wear that offers durability and flexibility. Premium brands are able to meet these needs, leading to increased consumer interest in their products.The ongoing athleisure trend has made premium bottom wear, such as leggings, joggers, and performance shorts, popular for both athletic and casual wear. Consumers are seeking versatile pieces that can transition seamlessly from workouts to daily activities, driving the demand for stylish yet functional bottom wear.

Distribution Channel Insights

Sales through sporting goods retailers accounted for a revenue share of 57.0% in 2023. Sporting goods retailers allow consumers to physically experience the quality, fit and feel of premium sportswear before making a purchase. This hands-on shopping experience helps buyers make informed decisions, particularly when investing in high-end products that emphasize performance and comfort. In addition, many premium sportswear brands partner with sporting goods retailers to offer exclusive collections or limited-edition items. These collaborations drive foot traffic to stores, as consumers are drawn to the opportunity to purchase exclusive or hard-to-find premium products.

Sales through online channels are expected to grow with a CAGR of 9.4% from 2024 to 2030. Online platforms often offer a broader selection of premium sportswear, including exclusive products, sizes, and styles that may not be available in physical stores. This variety enhances the shopping experience, allowing consumers to find the exact products that fit their preferences.Online shopping allows consumers to browse and purchase premium sportswear from the comfort of their homes, making it highly convenient. With 24/7 access to products, consumers can easily explore a wide range of options without visiting physical stores, driving demand through e-commerce platforms.

Regional Insights

North America premium sportswear market accounted for a revenue share of 35.4% in 2023. An increasing number of people in North America are adopting active lifestyles, focusing on fitness, wellness, and overall health. This shift has led to a greater demand for high-performance premium sportswear that supports various athletic activities while offering comfort and durability.The athleisure movement, where sportswear is worn in both casual and fitness settings, has gained significant popularity in North America. Consumers are looking for versatile premium sportswear that seamlessly blends style with functionality, making it a staple for both workouts and everyday wear.

U.S. Premium Sportswear Market Trends

The premium sportswear market in the U.S. is growing. Premium sportswear brands in the U.S. are incorporating cutting-edge fabric technologies such as moisture-wicking, temperature regulation, and enhanced breathability. These innovations have made premium sportswear more appealing to consumers who value both performance and comfort during exercise and daily activities.

Asia Pacific Premium Sportswear Market Trends

Asia Pacific premium sportswear market is expected to grow at a CAGR of 9.2% from 2024 to 2030. The economic growth in the Asia Pacific region has led to an expanding middle class with increased disposable income. As consumers have more purchasing power, they are more likely to invest in high-quality, premium sportswear that offers superior materials, technology, and brand prestige.

Europe Premium Sportswear Market Trends

The Europe premium sportswear market is expected to grow at a CAGR of 8.7% from 2024 to 2030. Europeans are becoming more health-conscious, with rising participation in sports, fitness routines, and outdoor activities. This has led to increased demand for premium sportswear that provides both performance and comfort for an active lifestyle.European consumers are highly aware of environmental issues, and many are gravitating toward premium sportswear brands that prioritize sustainability. These brands often use eco-friendly materials and sustainable manufacturing practices, attracting environmentally conscious buyers.

Key Premium Sportswear Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the types used while strictly adhering to international regulatory standards.

Key Premium Sportswear Companies:

The following are the leading companies in the premium sportswear market. These companies collectively hold the largest market share and dictate industry trends.

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Lululemon Athletica Inc.

- Asics Corporation

- Columbia Sportswear Company

- New Balance Athletics, Inc.

- The North Face

- Reebok International Ltd.

Recent Developments

-

In November 2023, Luxury modest fashion brand Lanuuk launched its debut activewear collection, Lanuuk Athletic, aimed at providing premium sportswear that combines modest coverage with fashion and functionality. The collection features five signature styles, including a yoga tunic, a zip-up hooded jacket, leggings, joggers, and a hijab hooded tunic, all designed for ease of movement and crafted from functional, breathable materials.

Premium Sportswear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 115.92 billion

Revenue forecast in 2030

USD 174.32 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nike, Inc.; Adidas AG; Puma SE; Under Armour, Inc.; Lululemon Athletica Inc.; Asics Corporation; Columbia Sportswear Company; New Balance Athletics, Inc.; The North Face; Reebok International Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Sportswear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global premium sportswear market report based on the product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Wear

-

T-shirts & Tops

-

Hoodies & Sweatshirts

-

Jackets

-

Others

-

-

Bottom Wear

-

Pants & Leggings

-

Shorts & Skorts

-

-

Underwear/ Base Layers

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 -2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 -2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global premium sportswear market size was estimated at USD 98.85 billion in 2023 and is expected to reach USD 106.87 billion in 2024.

b. The global premium sportswear market is expected to grow at a compounded growth rate of 5.5% from 2024 to 2030 to reach USD 174.33 billion by 2030.

b. Bottomwear are expected to growth with a CAGR of 9.1% from 2024 to 2030. s more people engage in activities like running, yoga, and gym workouts, there is a rising demand for high-performance bottom wear that offers durability and flexibility. Premium brands are able to meet these needs, leading to increased consumer interest in their products.

b. Some key players operating in the premium sportswear market include Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., and others.

b. Key factors that are driving the market growth include rising participation in sports and increasing health consiousness among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.