- Home

- »

- Beauty & Personal Care

- »

-

Premium Hair Care Market Size & Share Report, 2030GVR Report cover

![Premium Hair Care Market Size, Share & Trends Report]()

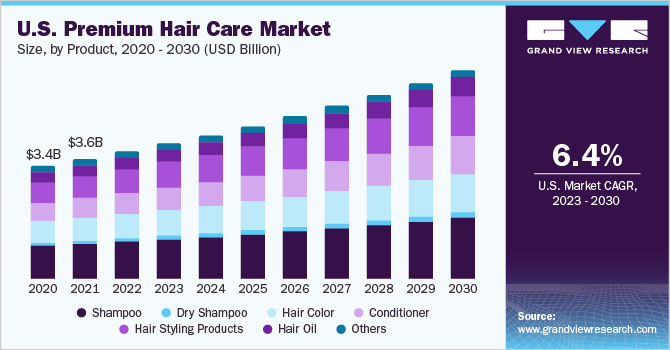

Premium Hair Care Market Size, Share & Trends Analysis Report By Product (Shampoo, Dry Shampoo), By Demography (Men, Women, Children), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-565-9

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Premium Hair Care Market Size & Trends

The global premium hair care market size was valued at USD 21.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Surge in the use of premium hair care products as complete hair solutions, increasing demand for chemical-free natural care products, growing disposable incomes, demand for anti-aging and anti-hair loss products, and technological advancements plus innovations in the beauty industry are the major factors boosting the market. In India, for instance, consumers in urban areas, mainly comprising younger people, had spent 3 times as much on hair care as those in rural areas, in 2020.

However, the COVID-19 outbreak had a significant impact on consumer behavior as well as manufacturing trends in the premium hair care industry. The early onslaught of the pandemic had an adverse impact on the market in worst-hit countries such as the U.S., India, Brazil, Russia, and the U.K. The first quarter sales (2020) of these products have been significantly low as a result of the widespread closures and lockdowns. Consumers became more conscious of their spending habits and avoided buying frivolously.

The growing e-commerce retail market is among the key factors fueling demand for premium hair care products. In the coming years, online selling techniques such as drop shipping and affiliate marketing are likely to gain momentum. Brands operating in this segment are focusing on launching unisex/gender-neutral products to target gender-fluid consumers, which is likely to contribute to an increase in product demand in the foreseeable future. Key brands are expected to focus on neutral packaging to target a varied set of consumers.

Robust product innovation, by new entrants, related to men’s premium hair care range is providing the necessary boost for such products. For instance, in January 2021, Priyanka Chopra Jonas, a Hollywood/Bollywood celebrity, launched her gender-neutral premium hair care product brand Anomaly, in partnership with beauty brand creator and incubator Maesa, which is available in Target stores from 1st February 2021.

This gender-neutral product range consists of shampoos, conditioners, a hair mask, and dry shampoo, all of which are cruelty-free, chemical-free, and packed in recyclable bottles made with post-consumer recycled materials.

In addition, there is a growing demand for chemical-free, organic, and natural ingredient-based products from a large section of environmentally aware shoppers. Thus, to meet the rising demand for such products, some of the key players in this market are adopting product innovation and R&D strategies to gain a substantial market share within this segment. For instance, in 2020, Henkel Beauty Care announced its plans to launch several product innovations in the upcoming years under its brand called N.A.E. (Naturale Antica Erboristeria), which is the company’s 100% organic personal care brand.

The popularity of social media influencers has been prompting companies to spend anywhere from USD 100.0 to thousands of dollars for a single product post on an influencer’s page. According to an Edelman survey published in December 2019, 63.0% of the 18 to 34-year demographic trust influencers’ opinions of brands more than advertising done by the brand itself.

Thus, initiatives adopted by the companies are likely to drive revenue growth. For instance, in January 2020, premium hair care brand Briogeo launched its first influencer collaboration with Kathleen Fuentes to promote its new hair care range B.Well, launched in 2019.

Product Insights

In terms of revenue, shampoo dominated the market with a share of above 29.0% in 2022. The rising demand for shampoos is attributed to the increasing prevalence of various hair-related problems such as dandruff, thinning, oily scalp, dryness, and itchiness. The growth of the premium shampoo market is supported by the changing lifestyles of consumers along with environmental challenges such as rising pollution which is harmful for the scalp's health.

Furthermore, consumers are becoming more conscious about their hygiene, and are therefore spending more to maintain a healthy lifestyle, which, in turn, is creating a huge demand for personal care products including shampoos.

Dry shampoo is expected to register a CAGR of 8.2% from 2022 to 2030. The demand for it is growing significantly due to the availability of herbal and organic variants. The inclusion of natural ingredients in dry shampoo such as kaolin clay and Fuller’s Earth reduces the risk of damage caused by the excessive use of chemical products. Another major factor that contributes to the rising demand for dry shampoos is the fast-paced and busy lifestyles of consumers. With increasing modernization, both men and women are opting for products that are convenient and quick.

Demography Insights

Women consumers dominated the 2022 markets with a share of above 82.0%. The rising number of working women is boosting the market. Work pressure, long working hours, poor work-life balance, and high levels of stress lead to various hair-related problems such as thinning, greying, etc. among women. This has created a significant demand for premium products among women, as they can maintain their desired appearance by using such products.

Additionally, increasing awareness among women regarding the benefits of using natural products over chemical-based products on their health has further increased demand for premium hair care products.

The men’s segment is estimated to expand at a CAGR of 7.3% in the forecast period. The market is primarily driven by the rising consciousness among male consumers about personal wellness and appearance. Moreover, due to the increased penetration of social media, there has been a significant rise in interest regarding personal care products, such as hair care, among men.

Manufacturers have been subsequently launching products and collaborating with brands and celebrities to promote premium products. These celebrity endorsements, promotions, and campaigns tend to create an influential impact on male consumers.

Distribution Channel Insights

The online segment accounted for the largest revenue share of more than 26.0% of the global market in 2022. Consumers prefer to purchase products through online channels due to the wide availability of brands and convenience. Furthermore, several online channels offer the products at a discounted price as compared to offline retail stores, which is likely to boost product sales through this channel. Value-added services offered by the e-retailers such as an easy refund policy, huge discounts, free shipping, availability of a wide variety of international brands, and cash on delivery are the key factors boosting the sales of premium hair care products through this channel.

Specialty stores are set to expand at a CAGR of 6.8% in the forecast period. Specialty stores focus on specific product categories and offer a wide range of products for that specific product category, thus, making it easier for the customers to purchase the products that they desire. Most specialty stores sell a considerable range in terms of products that they offer to provide quality service and expert assistance to customers. Consumers buy premium and luxury care products from specialty stores as they stock an array of premium products that are otherwise not available at local retail outlets.

Regional Insights

Asia Pacific dominated the market with a share of above 38.0% in 2022. Organic premium hair care products emerged as the most significant trend in 2020, with a sizable number of Asian consumers becoming conscious of the numerous benefits of sustainably-sourced luxury cosmetics. The growing middle-income population in the Asia Pacific is one of the prominent factors stimulating the demand for premium hair care products. Such consumers seek quality and sophisticated products.

European markets are forecasted to expand at a CAGR of 6.6%. According to a report by Cosmetics Europe, 71.0% of the consumers in the region consider personal care products such as hair care products as essential products in their daily lives. Such initiatives drive the market for premium natural hair care products in the region. Increasing instances of scalp-related problems such as dandruff and itchiness have led consumers in the European region to incline toward organic and natural premium hair care products. With the changing consumer preferences towards herbal and organic products, manufacturers are focusing on offering products containing natural ingredients.

Key Companies & Market Share Insights

The global premium hair care market is concentrated with internationally renowned market participants accounting for the majority of sales. Key players in the industry have been focusing towards mergers & acquisitions, strengthening online presence, new product launches, and sustainable ingredients to compete effectively.

-

In May 2021, Beiersdorf AG invested in a start-up for personalized skin care & hair care. The company launched its new personalized skin care brand Routinely, which focuses on a modular skin care ritual emphasizing the dynamic nature of the skin. The new investment is a further important step toward implementing the company’s C.A.R.E.+ strategy and the successful promotion of innovative business models

-

In April 2021, Kao Corporation launched its hair salon brand Oribe in Japan, through its subsidiary, Kao Salon Japan. Oribe is a hair care brand with a robust market presence among the top salons and departmental stores across Europe and the U.S. Through this launch, Kao aims to expand the brand portfolio of its salon business and enhance the customer base in the region

Some of the key players in the global premium hair care market include: -

-

Procter & Gamble Company

-

L’Oreal S.A.

-

Aveda Corp.

-

Johnson & Johnson

-

Unilever

-

The Estee Lauder Companies

-

Alcora Corp.

-

Beiersdorf Group (Nivea)

-

John Masters Organic

-

Kao Corp.

-

Ouai

-

Briogeo

-

Living Proof, Inc.

Premium Hair Care Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.65 billion

Revenue forecast in 2030

USD 35.49 billion

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, demography, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; Russia; China; India; Singapore; Malaysia; Indonesia; Brazil; Saudi Arabia

Key companies profiled

Procter and Gamble (P&G); Unilever; The Estée Lauder Companies Inc.; Aveda Corporation; Alcora Corporation; Kao Corporation; Ouai, John Masters Organics; Briogeo; Living Proof Inc.; L’Oreal S.A.; Johnson & Johnson Services; Inc.; Beiersdorf AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Hair Care Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global premium hair care market based on the product, demography, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Shampoo

-

Dry Shampoo

-

Hair Color

-

Conditioner

-

Hair Styling Products

-

Hair Serum

-

Mousse

-

Hair Spray

-

Others

-

-

Hair Oil

-

Others

-

-

Demography Outlook (Revenue, USD Million, 2017 - 2030)

-

Men

-

Women

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Departmental Stores

-

Specialty Stores

-

Pharmacy and Drug Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

France

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Singapore

-

Malaysia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global premium hair care market was estimated at USD 21.26 billion in 2022 and is expected to reach USD 22.65 billion in 2023.

b. The global premium hair care is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 35.49 billion by 2030.

b. Asia Pacific region dominated the premium hair care market with a share of about 38% in 2022. This is owing to rising demand for sustainably-sourced luxury products, and the growing disposable incomes of the middle-class group in the region.

b. Some key players operating in the premium hair care market include Procter and Gamble (P&G), Unilever, The Estée Lauder Companies Inc., Aveda Corporation, Alcora Corporation, Kao Corporation, Ouai, John Masters Organics, Briogeo, Living Proof Inc., L'Oréal S.A., Johnson & Johnson Services, Inc., Beiersdorf AG

b. Key factors that are driving the premium hair care market growth include the surge in the use of premium hair care products as complete hair solutions, increasing demand for chemical-free natural care products, growing disposable incomes, demand for anti-aging and anti-hair loss products, and technological advancements and innovations in the beauty industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."