- Home

- »

- Beauty & Personal Care

- »

-

Premium Cosmetics Market Size, Industry Report, 2030GVR Report cover

![Premium Cosmetics Market Size, Share & Trends Report]()

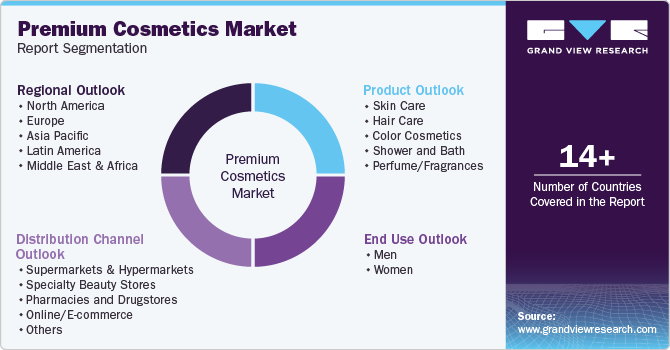

Premium Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Color Cosmetics), By End Use (Men, Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-869-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Premium Cosmetics Market Summary

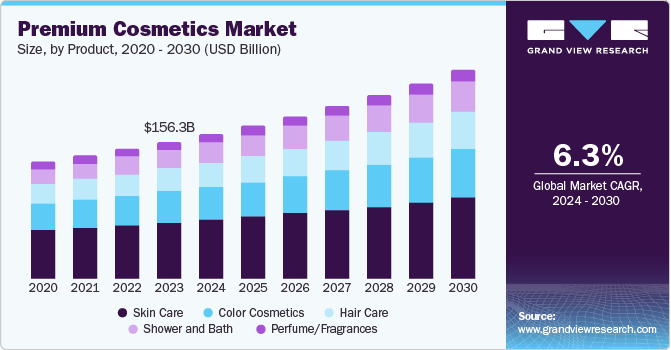

The global premium cosmetics market size was valued at USD 156.3 billion in 2023 and is projected to reach USD 238.0 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. TDemand for beauty and wellness products is increasing globally owing to increased brand recognition, influencer marketing by brands on social media platforms such as YouTube, Snapchat, and Instagram, and easy availability of global brands in megacities of developing countries.

Key Market Trends & Insights

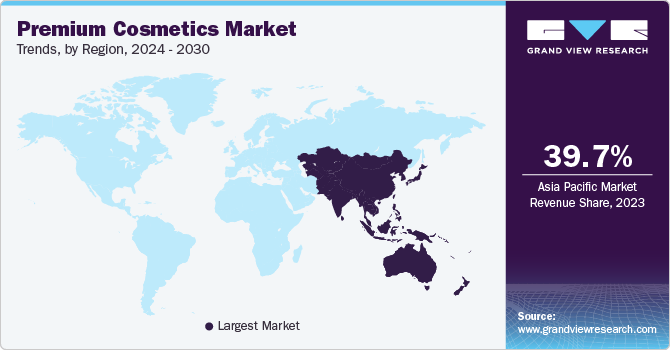

- Asia Pacific premium cosmetics market accounted for the highest revenue share of 39.7% in 2023.

- U.S. dominated the North America accounting for a largest revenue share in 2023.

- Based on product, the skin care segment dominated the market with a revenue share of 41.1% in 2023.

- Based on end-use, the women segment dominated the market with a revenue share of 79.4% in 2023.

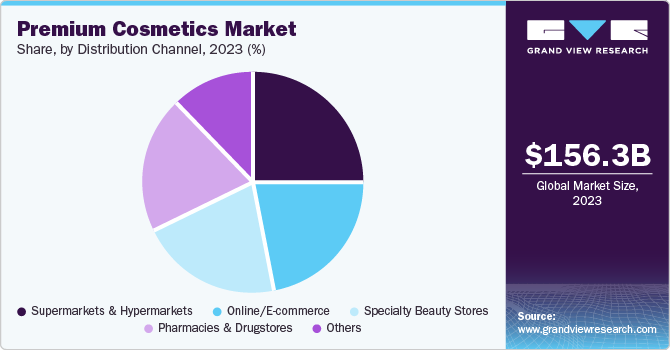

- Based on distribution channel, the supermarkets & hypermarkets segment dominated the market with a share of 35.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 156.3 Billion

- 2030 Projected Market Size: USD 238.0 Billion

- CAGR (2024-2030): 6.3%

- Asia Pacific: Largest market in 2023

Moreover, a widespread awareness regarding carcinogenic effects of synthetic and low-cost chemicals on skin and their long-term impact on body health has led to a surge in demand for plant-based, natural, and organic beauty products. Also, growing urbanization and financial independence among women has created a steady demand for premium cosmetic products.

Globalization and internet penetration in far-flung areas of the world have led to a virtually connected environment. This has led to cross-cultural fusion among regions. For instance, people follow and express their thoughts on international trends related to festivals, celebrations, movies, and web series on Twitter and other social media platforms. The rise of influencer marketing culture has significantly impacted the beauty industry. Leading brands are smartly exploiting this opportunity by approaching youth icons and collaborating with them for brand endorsements. Consumers are exposed to a constant stream of content featuring premium cosmetics by their favorite celebrities, driving brand awareness, desire, and purchase intent.

People are becoming increasingly aware regarding the importance of personal care and the impact of cosmetic ingredients on their bodies. Moreover, disposable income levels of consumers around the world have been rising steadily. This has allowed them to allocate more budget towards premium products that are perceived to offer greater value and an enriching experience. Additionally, consumer preferences are evolving beyond just functionality, as they are also seeking products that elevate their beauty routines. This is leading to a demand for high-quality and effective products that deliver tangible results. A combination of such factors is anticipated to contribute to steady product demand during the forecast period.

Product Insights

Skin care products dominated the market with a revenue share of 41.1% in 2023. The human skin is often exposed to the outside environment and comes in frequent contact with polluting components. Consequently, consumers are increasingly adopting a preventive approach to skincare, aiming to maintain a healthy, youthful skin. Premium skincare products cater to this trend by offering targeted solutions for various concerns, such as anti-aging, anti-acne, scars, hydration, and hyper-pigmentation. Additionally, skincare brands often invest heavily in research and development activities, formulating innovative products with natural ingredients and promoting them in a targeted manner, leading to strong segment growth.

Color cosmetics contributed substantially to the market revenue in 2023. This share can be attributed to the increasing demand for chemical-free, organic, and plant-based color cosmetics products to address conditions such as sensitive skin, infection, and irritation. The availability of waterproof and smudge-proof cosmetics, particularly designed for hot and humid climate conditions, is further expected to boost the demand for lipsticks, eyeshadows, foundations, mascaras, and blushes. The wide range of products and their inherent variety help create a dynamic market with frequent innovations in textures, finishes, and color palettes. Consumers seeking the latest trends and high-performance formulas are drawn to premium offerings.

End Use Insights

Women end-users dominated the premium cosmetics market with a revenue share of 79.4% in 2023. The cosmetics industry has primarily focused on women for a long time. Marketing campaigns and product development have historically positioned cosmetics as tools for feminine beauty enhancement. This has established a strong female consumer base for the entire cosmetics market. Beauty standards have evolved over the years and have become more diverse and inclusive. Manufacturers have acknowledged this evolution by offering a wider range of shades, formulations, and finishes, allowing for personalized expression and catering to a broader female demographic, ensuring constant segment growth.

Despite a clear domination of women consumers in this market, male consumers also present promising growth prospects during the forecast period. Major cosmetic brands have recognized the potential of developing products geared towards this demographic and are creating targeted marketing campaigns and product lines specifically designed for men's needs and preferences. For instance, premium cosmetics offer solutions for specific concerns such as beard care, anti-aging, and maintaining a healthy complexion, addressing the growing desire for having a presentable look. This tailored approach resonates with male consumers and fosters brand loyalty.

Distribution Channel Insights

Supermarkets & hypermarkets dominated the market with a revenue share of 35.7% in 2023. Premium cosmetics often emphasize luxury ingredients, textures, and application methods. Supermarkets allow customers to physically touch, test, and experience these features through a free sample trial before purchase, leading to higher confidence and satisfaction in their choices. Moreover, in-store personnel offer advice, personalized recommendations to choose from a wide variety of products, and makeup application assistance. Owing to their scale of operations, supermarkets offer competitive pricing compared to other retailers. This convergence of factors has led to segment domination.

The online/e-commerce segment is anticipated to register the highest growth rate during the forecast period. Increasing use of internet globally has led to awareness regarding premium brands among consumers from developing economies. With a rise in e-commerce platforms coupled with improved, efficient, and affordable logistics, premium brands have made a significant presence in previously untapped markets. Additionally, the online marketplace offers a wide range of products and brands for customers to choose from, allowing them to make informed decisions. This convenience of choices is expected to drive segment growth.

Regional Insights

Asia Pacific accounted for the highest revenue share of 39.7% in 2023. Developing economies in this region are experiencing a rise in the number of female working professionals in various corporate sectors. This has resulted in financial independence among this population, along with freedom of decision making in their personal sphere. Furthermore, rapid urbanization, advent of international brand stores in urban and metropolitan areas, and increased spending capacity have helped create a demographic that focuses highly on their appearance and personal care, driving the regional premium cosmetics industry.

India Premium Cosmetics Market Trends

Cross-cultural contacts and globalization have significantly changed the perspective of Indian consumers regarding premium cosmetics. With growing influence of social media and beauty influencers promoting premium brands, which are often positioned as offering superior formulations, advanced ingredients, and scientifically backed benefits, an increased demand is anticipated in the near future. Additionally, e-commerce platforms such as Nykaa, Foxy, Tira, and Purplle have improved the availability of products from international brands for the country’s youth. This extensive availability, coupled with rising financial independence among urban Indian women, is fueling the demand for premium cosmetic products.

North America Premium Cosmetics Market Trends

North America held the second-highest market share in 2023. Financial affluence of consumers and a well-developed retail infrastructure with a diverse mix of distribution channels has led to increased spending by regional consumers. Premium brands have a significant presence in established department stores, specialty beauty stores, supermarkets carrying premium lines, and e-commerce platforms. Furthermore, targeted advertising campaigns, celebrity endorsements, and social media influencer partnerships lead to enhanced brand recognition, awareness, and demand growth, accounting for a substantial regional share.

The U.S. has a well-established beauty culture with a strong focus on personal grooming and appearance. Hollywood stars, red carpet, and substantial celebrity following are related to this trend. For instance, Hollywood celebrities endorsing premium cosmetics create significant brand recognition and credibility, driving consumer desire. Makeup trends showcased by celebrities on red carpets and in movies are widely followed, which fuels demand for premium cosmetics that promise superior quality, innovation, and effectiveness. A robust offline and online distribution network further ensures on-time delivery of these products, maintaining a steady market growth.

Europe Premium Cosmetics Market Trends

Europe accounted for a notable market revenue share in 2023. Europe is the birthplace of leading premium cosmetic brands such as L'Oreal, Dior, and Chanel. These brands leverage their home market advantage to establish strong distribution channels and brand recognition within Europe. The region has a well-developed network of supermarkets, specialty beauty stores, and pharmacies catering specifically to premium cosmetic products. This established infrastructure facilitates efficient product distribution and accessibility for consumers. With a high disposable income, European consumers offer promising growth prospects for the regional industry.

The UK functions as a global hub for retail and fashion, owing to its diverse population converging from every global location. This attracts international premium cosmetic brands seeking access to a wider European and global audience. Additionally, the country has a vibrant fashion and beauty media landscape in cities such as London, which heavily influences consumer trends. This strong marketing and media presence provides a platform for premium cosmetic brands to reach their target audience effectively, driving sales from various established distribution channels.

Key Premium Cosmetics Company Insights

Some key companies involved in the premium cosmetics market include Coty Inc.; The Estée Lauder Companies (ELC); and L’Oréal Groupe.

-

L’Oréal is Paris-based multinational company having presence in over 150 countries, serving in multiple cosmetics segments, including skin care, hair care, color cosmetics, and perfumes. Prominent brands such as Garnier, Maybelline, and NYX Cosmetics are subsidiaries of the L’Oréal group, catering to diverse consumer needs. Historically, the company has gained significant recognition and expertise in the hair care business, such as hair color and styling.

-

Estée Lauder is a New York-based multinational company having a diverse range of products in makeup, skincare, hair care, and perfume segments. The company owns a varied portfolio of luxury and affordable brands. Clinique, La Mer, Origins, and Bobbi Brown are some of the well-known subsidiary brands under Estée Lauder. The company serves over 150 countries with affiliate offices in more than 50 regions.

Key Premium Cosmetics Companies:

The following are the leading companies in the premium cosmetics market. These companies collectively hold the largest market share and dictate industry trends.

- The Estée Lauder Companies (ELC)

- L’Oréal Groupe

- Coty Inc.

- LVMH

- Shiseido Co.,Ltd.

- CHANEL

- DIOR

- Kao Corporation

- Elizabeth Arden

- YSL Beauty

Recent Developments

-

In June 2024, The Estée Lauder Companies announced the acquisition of DECIEM Beauty Group Inc., a Canada-based beauty company. The acquisition is expected to enable the strategic expansion of the former’s skincare portfolio. DECIEM’s ‘The Ordinary’ flagship brand has been a notable name in the premium skin care space in countries such as Canada, the U.S., Germany, the UK, and France.

-

In February 2024, L’Oréal Groupe and Prada, a major Italian luxury accessories brand, announced their worldwide exclusive licensing agreement to create, develop, and distribute premium beauty products for Prada’s subsidiary brand Miu Miu. The companies are expected to launch a diverse range of premium fragrances under this collaboration.

Premium Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 165.1 billion

Revenue Forecast in 2030

USD 238.0 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, India, Brazil, South Africa

Key companies profiled

Coty Inc.; The Estée Lauder Companies (ELC); L’Oréal Groupe; LVMH; Shiseido Co.,Ltd.; CHANEL; DIOR; Kao Corporation; Elizabeth Arden; YSL Beauty

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Premium Cosmetics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global premium cosmetics market report based on product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Face Care

-

Body Care

-

-

Hair Care

-

Shampoo

-

Conditioner

-

Serums

-

Others

-

-

Color Cosmetics

-

Face Cosmetics

-

Lip Cosmetics

-

Eye Cosmetics

-

Nail Cosmetics

-

-

Shower and Bath

-

Perfume/Fragrances

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Beauty Stores

-

Pharmacies and Drugstores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.