Pregnancy Care Products Market Size, Share & Trends Analysis Report By Product (Stretch Mark Minimizer), By Application, By Stage of Pregnancy, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-464-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pregnancy Care Products Market Trends

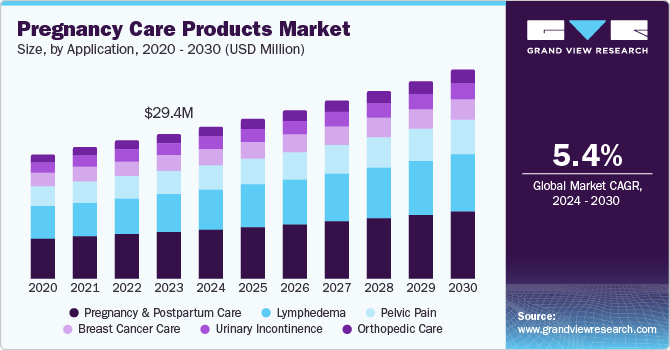

The global pregnancy care products market size was valued at USD 29.4 million in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The rising awareness and emphasis on maternal health and the growing inclination of consumer preference for organic and natural products are major factors in the market growth. In addition, the gradual shift in adopting and accepting commercially available organic products from traditional home remedies has played a significant role in boosting the market growth.

There has been a rise in the number of pregnancies and cesarean delivery rates in developed and developing countries, and this has an impact on the surge in demand for products designed to help in the care of expectant mothers. According to a report published by the Centers for Disease Control and Prevention in April 2024, the cesarean delivery rate rose to 32.4% in 2023 from 32.1% in 2022. Pregnancy care products help in meeting the health needs of these expectant mothers and their unborn children. Therefore, a rising delivery rate is expected to boost the market growth over the forecast period.

Various government schemes and initiatives have helped to improve patient care. For instance- the Government of India launches the Pradhan Mantri Matru Vandana Yojana and Pradhan Mantri Surakshit Matritva Abhiyan to provide assured, quality antenatal care free of cost universally to all pregnant women. Such initiatives lead to a greater demand for pregnancy care products to support women through their journeys.

The emotional and physical impact of miscarriage has heightened awareness among women regarding the importance of prenatal care. This also encourages using various pregnancy care products, such as supplements, skincare items, and other health-related products designed to enhance maternal well-being and potentially reduce the risk of future miscarriages. According to an article published in the National Center for Biotechnology Information (NCBI) in April 2021, an estimated 23 million miscarriages occur every year worldwide.

R&D efforts have improved product formulations catering to specific pregnancy-related concerns, such as stretch marks, skin sensitivity, and hormonal changes. This has enabled companies to expand their product lines significantly. This includes developing specialized items such as stretch mark minimizers, toning gels, and skincare products designed specifically for postpartum recovery. For instance, in August 2023, Lansinoh Laboratories launched the new Lansinoh Wearable Pump designed to empower all pumping mothers, giving them the freedom to pump confidently anywhere.

Social media has facilitated sharing personal experiences of the pregnancy journey, leading to increased visibility of pregnancy care products. Influencers and healthcare professionals often promote these products, encouraging more women to consider them as part of their pregnancy planning and care regimen. For instance, in March 2024, ReadyToBeMom.com and FOGSI introduced a multimedia pregnancy education platform with doctors podcast live streams on social media and Big FM to support pregnant women with vital pregnancy information.

Product Insights

The stretch marks minimizer segment accounted for a significant market share in 2023. This is attributed to increasing consumer awareness and the high incidence of stretch marks during pregnancy. For instance, according to an article published in the National Center for Biotechnology Information (NCBI) in August 2023, about 43-88% of women have stretch marks during pregnancy. This high incidence of stretch marks adds to the increased product demand, boosting the segment growth.

The breast cream segment is expected to grow significantly during the forecast period. It is attributed to the growing awareness of breast health during pregnancy and lactation. Breast creams help retain skin and hydrate, strengthen breasts, and elasticize as they contain omega-3 fatty acids and antioxidants. After delivery, its care is strongly advised to ensure proper feeding, or else it causes problems such as elasticity, flattening of beasts, and sagging. Therefore, the significance of breast cream is expected to drive its growth over the forecast period.

In addition, the risk of developing breast cancer can further add to the segment growth. For instance, in May 2023, according to an article published by the Breast Cancer Research Foundation, for one in 3,000 pregnant women, there’s a diagnosis of breast cancer. Pregnancy-safe moisturizers and creams can help alleviate symptoms, providing comfort and improving skin health. Prenatal vitamins and other nutritional supplements can support the overall health of a mother during cancer treatment.

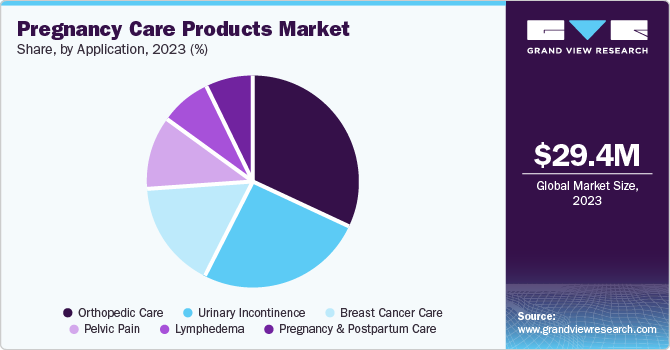

Application Insights

Orthopedic care accounted for the largest market revenue share of 32.2% in 2023 attributed to the growing awareness of maternal health and availability in healthcare settings. During pregnancy, physical discomforts such as back pain, pelvic pain, and leg cramps are common in women. Orthopedic care products, including maternity support belts, pillows, and compression stockings, are designed to alleviate these issues. These applications of orthopedic care products help drive their demand and lead to segment growth.

Urinary incontinence is expected to register the fastest CAGR of 5.9% during the forecast period attributed to factors such as hormonal changes in the body and increased pressure on the bladder as the uterus grows. According to an article published in the International Journal of Gynecology & Obstetrics in July 2023, about 35-67% and 15-45% of women were affected by urinary incontinence during pregnancy and after delivery, respectively. This prevalence drives demand for incontinence care products specifically designed for pregnant women. In addition, the diverse product offerings and focus on non-invasive solutions have further boosted the market growth.

Stage of Pregnancy Insights

The third trimester segment dominated the market and accounted for a significant market share in 2023. It can be attributed to the fact that the third trimester represents the period of greatest need for pregnancy care products that provide comfort, support, and health benefits for both mother and baby as the pregnancy reaches its final stages and the risk of stillbirths also increases. For instance, according to the UNICEF data published in January 2023, around 1.9 million stillbirths occurred in 2021 at 28 weeks of pregnancy or later. In addition, the growing awareness of maternal health and increased participation in exercise have led to the segment growth.

The postpartum segment is expected to grow with a significant CAGR during the forecast period. It is attributed to the rising awareness of postpartum health, supportive government initiatives, and rising participation of women in the workforce. There is growing awareness among new mothers about the importance of postpartum care products to aid recovery, promote breastfeeding, and address issues such as postpartum depression. For instance, in February 2024, according to an article published in the Journal of Neurosciences in Rural Practice, the prevalence of postpartum depression in India is 22%, with the southern region having the majority of cases. This is expected to drive demand for pregnancy care products over the forecast period.

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for a significant market share in 2023. It is attributed to the increased birth rates in hospital settings, trust and reliability, and specialized care. In addition, hospital pharmacies have healthcare professionals who can provide expert guidance on pregnancy care products, which is highly appreciated by expectant mothers seeking safe and effective products.

The online/ e-commerce segment is expected to grow significantly over the forecast period. It can be attributed to the convenience and accessibility offered by online channels, the availability of a wider product range, and rising digital literacy. In addition, the COVID-19 pandemic significantly accelerated the shift towards online shopping as many consumers opted for e-commerce to minimize exposure to the virus. This trend has persisted, with many women continuing to prefer online purchases of pregnancy care products due to their safety and convenience. For instance, Babylist, a media and e-commerce platform, currently has 12% of its registrants use the platform to buy breast pumps with insurance. The platform also provides families access to postpartum care by working with major insurance providers, including Aetna, Blue Cross Blue Shield, Cigna, and others. The presence of such platforms is further expected to drive market growth.

Regional Insights

North America pregnancy care products market dominated in 2023. It is attributed to the growing awareness among would-be parents, higher birth rate, rising demand for pregnancy care products, and increasing disposable income in the region. In addition, the improved healthcare sector and the funding/investment offered by governments in different countries have further contributed to the market growth.

U.S. Pregnancy Care Products Market Trends

The U.S. pregnancy care products market dominated the global market with a share of 24.5% in 2023 owing to improved healthcare facilities and expenditure, the increasing birth rate, and awareness regarding maternal health during the gestation period and after delivery, significantly impacting the market growth. In addition, various government initiatives and programs adopted by the U.S. government have created awareness among expecting mothers, which has helped grow the market rapidly in the U.S. For instance, in July 2024, according to an article published in the White House Blueprint, over 2000 facilities considered “Birthing Friendly” committed to improving maternity care quality. In addition, the National Maternal Mental Health Hotline was launched for behavioral health issues during pregnancy and childbirth, where they can receive immediate support, resources, and referrals.

Asia Pacific Pregnancy Care Products Market Trends

Asia Pacific pregnancy care products market is anticipated to witness significant growth over the forecast period. It is attributed to the high population and customer base witnessing a paradigm shift in customer buying behavior with increasing disposable income. In addition, the growing awareness regarding maternal health and improvements in healthcare facilities contribute to market growth. For instance- in February 2024, according to a report published in the State Council of the People’s Republic of China, China established over 18,000 medical consortia in 2023 to improve community healthcare infrastructure and accessibility. In addition, according to China’s NHC, 3,491 critical maternal and obstetric care centers have been established nationwide for the treatment of critical maternal and obstetric cases and newborns.

Europe Pregnancy Care Products Market Trends

Europe pregnancy care products market was identified as a lucrative region in 2023. It is attributed to the high demand for organic and natural products, rising R&D and innovation, and high population growth with young demographics. Government initiatives and programs have raised awareness among mothers about their health, with increasing concerns about their skincare and physical appearance after giving birth, motivating them to use pregnancy care products, thereby boosting the market growth. For instance, according to a report published by the European Institute of Women’s Health in October 2023, the Women’s Health Interest Group was launched in October 2023 at the European Parliament to provide maternal health and care access.

MEA Pregnancy Care Products Market Trends

The MEA pregnancy care products market is anticipated to witness significant growth. The rising demand for pregnancy products due to growing public awareness of maternal health is expected to increase market growth. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the growing demand for pregnancy care products, thereby increasing the market growth in this region.

Pregnancy Care Products Company Share & Insights

Some of the key companies in the pregnancy care products market include Mama Mio U.S. Inc., Clarins Group, Novena Maternity, E.T. Browne Drug Co., Inc. and others. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

Mama Mio U.S. Inc. offers effective solutions for moms and moms-to-be. Its products are packed with plant-based active ingredients and are designed to protect and soothe the skin from stretching during pregnancy. The brand offers a wide range of products, including Tummy Rub Butter and Oil to prevent stretch marks, Pregnancy Boob Tube for bust care, Lucky Legs Cooling Gel for leg comfort, among others.

-

Clarins Group offers a specialized range of pregnancy care products to support women during pregnancy and postpartum. Their offerings address common skin concerns associated with pregnancy, such as stretch marks, skin elasticity, and overall skin hydration. Clarins emphasizes using plant-based ingredients in its formulations, avoiding harsh chemicals and parabens.

Key Pregnancy Care Products Companies:

The following are the leading companies in the pregnancy care products market. These companies collectively hold the largest market share and dictate industry trends.

- Mama Mio U.S. Inc.

- Clarins Group

- Novena Maternity

- E.T. Browne Drug Co., Inc.

- Expanscience Laboratories, Inc.

- Noodle & Boo

- Abbott

- The Honest Company, Inc.

- Lansinoh Laboratories

- Mankind Pharma

Recent Developments

-

In September 2022, Mama Mio U.S. Inc. introduced Pink Tummy Rub Butter in partnership with CoppaFeel to create awareness regarding breast cancer. The product is designed to help increase skin elasticity and moisture and help protect against stretch marks.

Pregnancy Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.9 million |

|

Revenue forecast in 2030 |

USD 42.3 million |

|

Growth rate |

CAGR of 5.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, stage of pregnancy, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa, Kuwait |

|

Key companies profiled |

Mama Mio U.S. Inc., Clarins Group, Novena Maternity, E.T. Browne Drug Co., Inc., Expanscience Laboratories, Inc., Noodle & Boo, Abbott, The Honest Company, Inc., Lansinoh Laboratories, Mankind Pharma |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pregnancy Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pregnancy care products market report based on product, application, and stage of pregnancy, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Stretch Mark Minimizer

-

Breast Cream

-

Toning/Firming Lotion

-

Itching Prevention Cream

-

Nipple Protection Cream

-

Body Restructuring Gel

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Care

-

Urinary Incontinence

-

Breast Cancer Care

-

Pelvic Pain

-

Lymphedema

-

Pregnancy and Postpartum Care

-

-

Stage of Pregnancy Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-conception

-

First Trimester

-

Second Trimester

-

Third Trimester

-

Postpartum

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Independent Pharmacies

-

Hypermarkets/Supermarkets

-

Online/ E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."