- Home

- »

- Clinical Diagnostics

- »

-

Precision Oncology Market Size, Share, Growth Report, 2030GVR Report cover

![Precision Oncology Market Size, Share & Trends Report]()

Precision Oncology Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Diagnostics, Therapeutics), By Cancer Type (Breast Cancer, Cervical Cancer, Prostate Cancer, Lung Cancer), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-032-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Oncology Market Summary

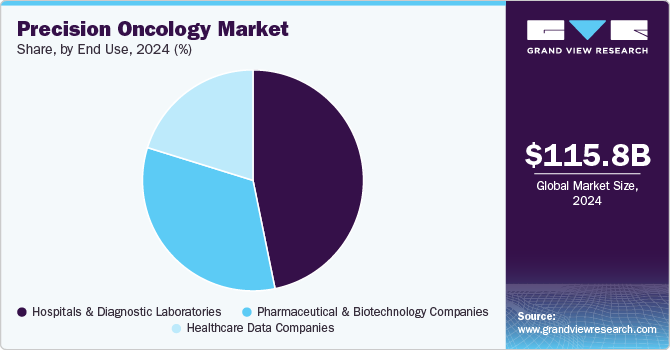

The global precision oncology market size was estimated at USD 115.80 billion in 2024 and is projected to reach USD 201.96 billion by 2030, growing at a CAGR of 8.05% from 2025 to 2030. The market is expected to show significant growth due to the advances in technology, rapid demand for diagnostics products providing effective clinical results, further minimizing side effects of therapeutics in cancer patients, and avoiding specific drug resistance.

Key Market Trends & Insights

- North America precision oncology market dominated with the largest revenue share of 44.0% in 2024.

- The U.S. precision oncology market is projected to grow at a significant CAGR during the forecast period.

- Based on product type, the therapeutics segment led the market with the largest revenue share of 71.3% in 2024.

- Based on cancer type, the breast cancer segment led the market with the largest revenue share of 41.7% in 2024.

- Based on end-use, the hospitals and diagnostic segment led the market with the largest revenue share of 46.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 115.80 Billion

- 2030 Projected Market Size: USD 201.96 Billion

- CAGR (2025-2030): 8.05%

- North America: Largest market in 2024

For instance, Ataraxis AI's innovative AI-native diagnostic tool, Ataraxis Breast, unveiled in October 2024, demonstrated a 30% higher accuracy rate compared to current standards in breast cancer care, which highlights the potential for AI to revolutionize patient diagnosis and treatment planning.

Traditional molecular diagnostics, while valuable, have limitations such as high costs, long development times, and lower accuracy, pushing the demand for next-generation solutions like Ataraxis's AI-powered tests. As the global cancer patient population continues to rise, innovations that can improve outcomes and enable individualized treatment plans will be crucial in advancing precision oncology, thereby driving market growth.

The increasing emphasis on early cancer detection and the development of innovative screening technologies is a key driving factor in the precision oncology industry. Several government organizations are taking initiatives to contribute to bringing new technologies in cancer detection. For instanc , according to the news published in February 2024, the National Institutes of Health launched the Cancer Screening Research Network to evaluate emerging technologies, including multi-cancer detection blood tests. These tests have the potential to screen for multiple types of cancer at once, facilitating earlier detection when cancers are more treatable. The NIH's Vanguard Study on MCDs, which will involve 24,000 participants, aims to assess the feasibility and effectiveness of these tests, potentially transforming how cancers are diagnosed and treated. As more technologies like MCDs are developed and validated, the precision oncology industry will see growth driven by the demand for more accurate, efficient, and less invasive screening methods.

The increasing approval of targeted therapies and combination treatments by regulatory bodies such as the FDA significantly drives market growth. For instance, in April 2024, the FDA approved several groundbreaking therapies and combination therapies for various cancers, including dostarlimab-gxly (Jemperli) for advanced endometrial cancer, trastuzumab deruxtecan-nxki (Enhertu) for HER2-positive solid tumors, and others. These approvals demonstrate the growing focus on personalized medicine that targets specific cancer subtypes and mutations. By enabling more effective and tailored treatments, these therapies address the unique genetic and molecular profiles of cancers, improving patient outcomes and fueling the demand for precision oncology solutions. In addition, the faster approval process for innovative treatments further accelerates market growth, as more options become available for clinicians to offer personalized, cutting-edge care.

Market Concentration & Characteristics

The degree of innovation has been significant, driven by advancements in genomic sequencing, artificial intelligence, and biomarker-based therapies. Technologies such as next-generation sequencing enable detailed tumor profiling, while AI accelerates drug discovery and treatment personalization. Breakthroughs such as CAR-T cell therapies and liquid biopsies are revolutionizing cancer care, offering minimally invasive and highly targeted treatment options.

The precision oncology industry is marked by a high level of collaboration and partnership activities, as stakeholders join forces to accelerate advancements in cancer care. Strategic alliances between pharmaceutical companies, biotech firms, and academic institutions are driving drug discovery and biomarker identification. Initiatives like LC-SCRUM-Asia and global efforts under the Cancer Moonshot program exemplify partnerships that streamline clinical trials and expand access to cutting-edge therapies. These collaborations are pivotal in addressing unmet needs and fostering innovation in personalized oncology.

Regulatory bodies often mandate robust clinical validation for new biomakers used in cancer diagnostics. Regulatory frameworks such as the FDA's Breakthrough Therapy Designation and EMA's Priority Medicines (PRIME) accelerate the approval of innovative treatments, fostering market growth. While this ensures reliability, it can also extend the time and cost of bringing innovative products to market.

Product expansions in the precision oncology industry are driven by the launch of innovative therapies and diagnostic tools tailored to specific cancer types and genetic mutations. Companies like Roche and Illumina are introducing advanced next-generation sequencing (NGS) platforms, while pharmaceutical firms are expanding their pipelines with targeted therapies like KRAS inhibitors and CAR-T cell treatments. These expansions address unmet clinical needs and enhance personalized cancer care.

Regional expansion in the precision oncology industry is a critical strategy for companies aiming to increase their market presence, tap into emerging opportunities, and address diverse healthcare needs globally. The focus on regional expansion is driven by factors such as varying disease prevalence, economic development, healthcare infrastructure, and regulatory environments.

Product Type Insights

Based on product type, the therapeutics segment led the market with the largest revenue share of 71.3% in 2024, due to the increasing development and approval of targeted treatments tailored to specific genetic mutations. For instance, in October 2024, the FDA approved Genentech, Inc. Itovebi (inavolisib) for advanced hormone receptor-positive, HER2-negative breast cancer with a PIK3CA mutation. Based on Phase III INAVO120 results, Itovebi significantly improved progression-free survival, addressing an unmet need for a common and challenging mutation in breast cancer. Such advancements play a crucial role in therapeutic innovation and help in transforming outcomes for patients with genetically driven cancers. Owing to such regulatory approvals for advanced therapeutics, the segment has dominated the market and is expected to grow significantly during the study period.

The diagnostics segment is anticipated to grow at the fastest CAGR of 8.6% over the forecast period, driven by advancements in AI-driven technologies that enable more accurate and personalized care. For instance, in September 2024, F. Hoffmann-La Roche Ltd expanded its digital pathology open environment, which is integrating over 20 AI algorithms from eight new collaborators, that showcases the transformative potential of AI in cancer diagnostics. These tools provide high-value insights that enhance pathology, allowing clinicians to identify specific biomarkers and tailor treatments to individual patients. Such innovations not only improve clinical outcomes but also create significant opportunities for growth in the diagnostics sector, solidifying its role as a cornerstone of precision medicine.

Cancer Type Insights

Based on cancer type, the breast cancer segment led the market with the largest revenue share of 41.7% in 2024, attributed to increasing awareness for breast cancer screening, diagnosis, and surgical and radiation techniques. Likewise, expanding research activities, early breast cancer detection and patient overall prognosis are likely to boost the development of novel methods, such as precision oncology, due to the growing adoption of targeted therapies that improve patient outcomes. For instan ce, Pfizer’s Phase 3 PATINA trial demonstrated that adding IBRANCE (palbociclib) to standard first-line maintenance therapy significantly improved progression-free survival in patients with HR+, and HER2+ metastatic breast cancer. This breakthrough highlights the importance of tailored treatment strategies for this prevalent cancer type, driving innovation and investment in the sector. Such advancements reinforce the segment's leadership in the precision oncology industry by improving survival rates for breast cancer patients.

The cervical cancer segment is anticipated to witness at the fastest CAGR of 8.7% over the forecast period, owing to growing research projects, funding, and product launches that have fueled the market growth in the cervical cancer segment. In addition, advancements in targeted therapies that offer improved survival outcomes for patients contribute to the segment’s growth. For instance, in April 2024, TIVDAK (tisotumab vedotin-tftv) received FDA approval which marked a significant milestone as the first antibody-drug conjugate to demonstrate an overall survival benefit in recurrent or metastatic cervical cancer. Results from the global Phase 3 study showed superior efficacy compared to chemotherapy, addressing a critical unmet need in this challenging cancer type. Such breakthroughs highlight the potential for innovative treatments to transform care, accelerating the market growth of this segment.

End-use Insights

Based on end-use, the hospitals and diagnostic segment led the market with the largest revenue share of 46.8% in 2024. In hospital and diagnostic, precision oncology products are garnering an increasing amount of interest worldwide as it emphases molecular profiling of tumors to identify alterations in the gene. Focusing on components such as precision planning, precise diagnosis, monitoring, and precise treatment along with expertise, the market has gained increasing importance in hospital and diagnostics laboratories.

The pharmaceutical & biotechnology companies segment is anticipated to witness at the fastest CAGR of 8.5% over the forecast period. In addition, pharmaceutical and biotechnology manufacturers focus on developing customized end-to-end solutions to meet the changing customer requirements. The segment companies are expected to increase large-scale projects that support drug development programs.

Regional Insights

North America precision oncology market dominated with the largest revenue share of 44.0% in 2024. The market dominance can be attributed to the increasing availability of advanced diagnostic tools that enable personalized treatment approaches. For instance, in August 2024, Illumina Inc. announced the FDA approval of its TruSight Oncology comprehensive test, representing a significant advancement, analyzing over 500 genes in solid tumors to identify actionable biomarkers. With its approval as a companion diagnostic for therapies like Bayer's VITRAKVI and Lilly's RETEVMO, the test enhances the precision of cancer care by matching patients with targeted treatments. Such innovations are propelling the growth of precision oncology in the region by improving diagnostic accuracy and expanding therapeutic options.

U.S. Precision Oncology Market Trends

The U.S. precision oncology market is projected to grow at a significant CAGR during the forecast period. Significant approvals for innovative treatment regimens for various cancers are one of the prime factors driving the market. For instance, AstraZeneca’s Imfinzi (durvalumab) received FDA approval in August 2024 for use with chemotherapy in treating resectable early-stage non-small cell lung cancer. Based on the AEGEAN Phase III trial, the Imfinzi-based regimen reduced the risk of recurrence, progression, or death by 32% compared to neoadjuvant chemotherapy alone. Such advancements demonstrate the growing adoption of precision therapies that enhance survival rates, driving the demand for personalized cancer treatments in the U.S., and thereby fostering market growth.

Europe Precision Oncology Market Trends

The precision oncology market in Europe is likely to emerge as a lucrative region due to the growing focus on innovative therapies for rare cancers through strategic collaborations and advancements in radioligand treatments. For instance, in September 2024, Sanofi announced a licensing agreement with RadioMedix and Orano Med highlighting the development of AlphaMedix (212Pb-DOTAMTATE), a targeted alpha therapy for somatostatin receptor-expressing neuroendocrine tumors. This next-generation radioligand medicine leverages lead-212 to deliver precise, targeted cancer treatment, addressing the unmet needs of patients with rare and difficult-to-treat cancers. Such initiatives are advancing precision medicine in Europe, driving growth through innovative solutions tailored to specific cancer subtypes.

The UK precision oncology market is projected to grow at a significant CAGR during the forecast period, due to the increasing emphasis on developing advanced antibody-drug conjugates that target specific cancer biomarkers. For instance, GSK's B7-H3-targeted ADC, which received breakthrough therapy designation from the US FDA in August 2024, for relapsed or refractory extensive-stage small-cell lung cancer, highlights the potential of such therapies. This innovation reflects the growing demand for precision treatments that address complex cancer cases, spurring investment and adoption in the UK market to meet evolving healthcare needs.

The precision oncology market in France is expected to grow at the fastest CAGR over the forecast period. The France market is growing due to the expanding adoption of advanced nuclear medicine diagnostics that enable more precise detection and monitoring of cancers. For instance, in May 2024, Curium introduced PYLCLARI (Piflufolastat [18F]), an innovative PET tracer that marked a significant milestone in prostate cancer care. This diagnostic tool helps identify PSMA-positive lesions in high-risk patients and localize recurrence in those with rising PSA levels. By improving diagnostic accuracy, PYLCLARI has enhanced treatment planning and patient outcomes, reinforcing the country’s leadership in precision oncology and driving growth in the adoption of cutting-edge radiopharmaceutical solutions.

The Germany precision oncology market is projected to expand at a significant CAGR during the forecast period. The country's strong emphasis on personalized medicine and its comprehensive healthcare infrastructure, which supports the adoption of innovative cancer treatments, is one of the key market drivers. Germany is a leader in implementing genomic profiling and molecular diagnostics, which are integral to precision oncology. In addition, Germany’s extensive network of academic institutions and research organizations, such as the German Cancer Research Center, plays a crucial role in advancing the development of precision oncology therapies, further driving the market growth.

Asia Pacific Precision Oncology Market Trends

The Asia Pacific precision oncology market is expected to experience at the fastest CAGR of 9.0% during the forecast period, driven by increasing focus on collaborative international efforts to enhance cancer care and research. For instance, the launch of the Quad Cancer Moonshot initiative by the United States, Australia, India, and Japan is set to strengthen the cancer care ecosystem in the Indo-Pacific. This initiative focuses on improving health infrastructure, expanding research collaborations, and enhancing support for cancer prevention, detection, and treatment. The emphasis on cervical cancer as a starting point, along with the broader commitment to address other cancer types, is expected to drive advancements in precision oncology, improve access to cutting-edge treatments, and foster the development of region-specific diagnostic and therapeutic solutions.

The India precision oncology market is projected to grow at the fastest CAGR throughout the forecast period. The development of accessible and affordable innovative therapies in the country is exemplified by the launch of India’s first home-grown CAR-T cell therapy for cancer. This breakthrough gene therapy, launched in April 2024, is a significant advancement in cancer treatment, offering a promising option for patients who previously lacked access to such therapies due to high costs. As CAR-T cell therapy becomes more affordable, it increases access to cutting-edge treatments, helping to address cancer in the Indian population. This initiative not only demonstrates the country's growing capabilities in biotechnology but also aligns with the broader movements, further driving the market growth in India.

The precision oncology market in Japan is anticipated to grow at a significant CAGR during the forecast period. Japan’s investment in research and development, particularly in biotechnology and diagnostics, supports continuous innovation and market growth.

Latin America Precision Oncology Market Trends

The precision oncology market in Latin Americais expected to experience at a significant CAGR throughout the forecast period. The increasing investment in healthcare infrastructure and the adoption of advanced diagnostic and therapeutic technologies are major market drivers in the region. Countries such as Brazil, and Argentina are expanding access to molecular diagnostics and targeted therapies to address the rising burden of cancer in the region. Initiatives such as public-private partnerships, regional collaborations, and government funding for cancer care are enhancing the availability of precision oncology solutions, driving market growth across Latin America.

The Brazil precision oncology market is anticipated to grow at a substantial CAGR over the forecast period. The Brazil market is growing as initiatives focus on expanding access to advanced cancer treatments. The Oncidium Foundation actively improved accessibility by implementing the RLT-Connect program, a global treatment donation initiative. By partnering with institutions like MND Campinas during the Belgian Economic Mission, the foundation ensured that underserved communities in Brazil could benefit from lifesaving radioligand therapy. This historic agreement demonstrated a strong commitment to equitable cancer care, driving the adoption of innovative precision oncology solutions in the country.

Middle East & Africa Precision Oncology Market Trends

The precision oncology market in the Middle East and Africais expected to grow at the fastest CAGR during the forecast period, due to several driving factors. Increasing availability of innovative cancer therapies through strategic collaborations contributes to the region’s growth. For instance, in November 2024, Pharmaceuticals entered into a collaboration with Pharmalink. With this partnership, Pharmalink received the commercial rights for sugemalimab, an advanced anti-cancer therapy, across key countries in the MENA region and South Africa. This agreement not only ensures the supply and commercialization of sugemalimab but also accelerates access to cutting-edge treatments in countries like Saudi Arabia, UAE, Egypt, and South Africa. Such collaborations are bolstering the precision oncology ecosystem by addressing unmet medical needs and improving cancer care outcomes across the region.

The Saudi Arabia precision oncology market is anticipated to experience at a lucrative CAGR during the forecast period. For instance, in January 2025, Boston Oncology Arabia and SPIMACO Memorandum of Understanding to produce advanced oral oncology treatments within the kingdom. This initiative enhances patient access to cutting-edge therapies, builds local expertise in precision medicine, and strengthens the country’s pharmaceutical infrastructure, driving market growth

Key Precision Oncology Company Insights

Key players are focusing on technological innovations, such as the development of new combination therapies, and advanced diagnostic tools, to enhance the accuracy, speed, and efficiency of diagnostic tests and treatment. Various organizations are actively involved in collaboration, innovation, and streamlining clinical trial processes. For instance, initiatives such as LC-SCRUM-CD, a partnership between the National Cancer Center, PREMIA, and Paradigm, showcase the focus on leveraging extensive genomic screening networks, comprising 150+ LC-SCRUM-Asia hospitals, to advance individualized cancer care. By simplifying workflows and reducing trial costs, these strategies enhance efficiency and accelerate patient enrollment in clinical trials. In addition, partnerships with global pharmaceutical sponsors aim to bring cutting-edge therapies to market.

Key Precision Oncology Companies:

The following are the leading companies in the precision oncology market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Invitae Corporation

- Qiagen N.V.

- Illumina, Inc.

- Laboratory Corporation Of America Holding

- Exact Sciences Corporation

- Rain Oncology Inc.

- Strata Oncology, Inc.

- Xilis, Inc.

- Variantyx, Inc.

- Bioserve

- Relay Therapeutics

- Acrivon Therapeutics

Recent Developments

-

In August 2024, The Biden-Harris Administration’s ARPA-H has launched the POSEIDON program to develop a first-of-its-kind, at-home synthetic Multi-Cancer-Early Detection (MCED) test for detecting 30+ solid tumors at stage I using breath and/or urine samples. This initiative is part of the Biden Cancer Moonshot’s goal to significantly impact the global market by enhancing early detection and broadening access to cancer screening.

-

In August 2024, ImCheck Therapeutics was awarded €20.18 million in non-dilutive funding through the “i-Démo” initiative of the France 2030 Plan, managed by Bpifrance. The funding will accelerate the development of ICT01, a γ9δ2 T cell-activating antibody in Phase I/IIa trials for cancer, and support the clinical advancement of ICT41 for infectious diseases.

-

In May 2024, Clasp Therapeutics launched with USD150 million in Series A financing, co-led by Catalio Capital Management, Third Rock Ventures, and Novo Holdings. The company’s platform develops next-generation T cell engagers tailored to oncogenic driver mutations for highly specific tumor targeting, enhancing treatment precision and reducing off-target effects, further advancing personalized cancer care.

Precision Oncology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 126.95 billion

Revenue forecast in 2030

USD 201.96 billion

Growth rate

CAGR of 8.05% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, cancer type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

Thermo Fisher Scientific Inc.; Invitae Corporation; Qiagen N.V.; Illumina, Inc.; Laboratory Corporation Of America Holding; Exact Sciences Corporation; Rain Oncology Inc.; Strata Oncology, Inc.; Xilis, Inc.; Variantyx, Inc.; Bioserve; Relay Therapeutics; Acrivon Therapeutics.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

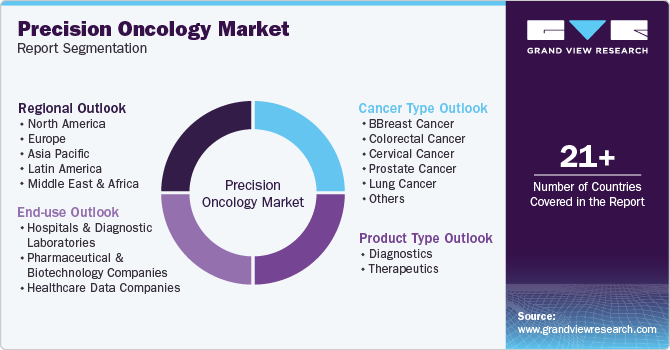

Global Precision Oncology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global precision oncology market report based on product type, cancer type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Therapeutics

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Prostate Cancer

-

Lung Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Healthcare Data Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global precision oncology market size was estimated at USD 115.80 billion in 2024 and is likely to reach USD 126.95 billion in 2025.

b. The global precision oncology market is anticipated to grow at a compound annual growth rate of 8.05% from 2025 to 2030 to reach USD 201.96 million by 2030.

b. North America dominated the market with a revenue share of around 44.0% in 2024 owing to the presence of key player in region and well developed biotechnology industry and burden of cancer cases in the region.

b. Key players operating in the precision oncology market include Thermo Fisher Scientific Inc., Invitae Corporation, Qiagen N.V., Illumina, Inc., Laboratory Corporation of America Holding, Exact Sciences Corporation, Rain Oncology Inc., Strata Oncology, Inc, Xilis, Inc., Variantyx, Inc., Bioserve, Relay Therapeutics and Acrivon Therapeutics among many others.

b. Key factors that are driving the market growth include prevalence of cancer across the globe, rising number of clinical trial studies, technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.