Precision Fermentation Market Size, Share & Trends Analysis Report By Microbe, (Yeast, Algae, Fungi, Bacteria), By Ingredients (Whey & Casein Protein, Egg White), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-371-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Precision Fermentation Market Size & Trends

The global precision fermentation market was estimated at USD 2.80 billion in 2023 and is projected to grow at a CAGR of 43.2% from 2024 to 2030. The consumers are increasing the demand for sustainable and eco-friendly products. This demand is a result of the rising awareness about the negative impact of traditional production methods on the environment, including deforestation, greenhouse gas emissions, and water pollution. In addition, the market is seeing a surge in demand for alternative protein sources due to the environmental concerns associated with traditional protein production methods.

Consumer preferences are shifting towards plant-based animal protein, leading to changes in eating patterns. This shift has been further accelerated by the shortage of beef and pork during the pandemic, leading to an increased demand for precision fermented-based products. The market has witnessed a significant increase in the sales of plant-based products, indicating a growing consumer preference for alternative protein sources.

Technological advancements and regulatory support have contributed to the market growth. Advancements in biotechnology, along with the growing environmental concern and rising government support, have further fueled the demand for precision fermentation. This method offers an opportunity to produce a wide range of sustainable, nutritious, and cost-effective alternative protein sources, further driving its demand. These factors collectively contribute to the growth and expansion of the market, positioning it as a key player in the production of sustainable and eco-friendly products, alternative protein sources, and specialized ingredients for various industries such as food, pharmaceuticals, and cosmetics.

Advancements in the food industry have emerged as a key trend of the product market. Major companies operating in the food and nutrition sector are focused on developing new advancements in their products to strengthen their position in the market. For instance, the introduction of animal-free ingredients in food products is a significant trend driving the market growth.

Scientists and researchers are continuously exploring new frontiers for fermentation-derived products, expanding beyond early adoption in food and specialty chemicals. This ongoing exploration is driving the development of new applications for product technology, contributing to its growth and expansion.

The market is fueled by technological advancements, such as CRISPR-Cas9, which enable precise modifications of microorganisms. These advancements are driving innovation and driving the ongoing research and development in fermentation technologies. Collaborations among industry stakeholders, research institutions, and academia hold the potential to drive innovation and expedite the commercialization of precision fermentation products. These collaborative efforts are contributing to the ongoing research and development in the product.

Microbe Insights

Based on microbe, the fungi segment led the market with the largest revenue share of 32.67% in 2023. The market is witnessing significant demand in the fungi microbe segment. Fungi are crucial in precision fermentation as they produce various ingredients and compounds. Fungi are extensively used to make enzymes, vitamins, and bioactive molecules through fermentation processes.

These ingredients find applications in multiple industries, including food and beverages, pharmaceuticals, and cosmetics. For example, market using fungi can produce specific strains of yeast optimized for beer production, resulting in a more efficient and controlled brewing process. The fungi microbe segment is expected to contribute to the market growth, due to its versatility and potential for producing valuable ingredients.

Extensive research and development activities in the field of industry have revolutionized the landscape of animal-free protein alternatives. Food producers have harnessed the power of microbes such as bacteria, yeast, and fungi to achieve this transformation. One of the key advantages of utilizing fungal metabolic engineering is their eukaryotic origin, allowing them to effectively tolerate and express heterologous eukaryotic proteins and enzymes, resulting in proper protein folding and post-translational modifications.

The product is also experiencing demand in the algae microbe segment. Algae offer unique advantages in precision fermentation, particularly in producing sustainable and plant-based ingredients. Algae-based products can make proteins, oils, and other valuable compounds. Algae-derived ingredients find applications in various industries, including food and beverages, cosmetics, and pharmaceuticals. For instance, algae-based product produces plant-based meat alternatives, providing consumers with a sustainable and nutritious protein source. The algae microbe segment is expected to contribute to the market growth, driven by the increasing demand for sustainable and vegan products.

Ingredients Insights

Based on ingredients, the collagen protein segment led the market with the largest revenue share of 32.39% in 2023 Collagen protein is a significant ingredient segment in the industry. Collagen is a structural protein found in the connective tissues of animals, and it plays a crucial role in maintaining the strength and elasticity of various tissues in the body. Precision fermentation allows for the production of collagen protein without the need for traditional animal sources. This is particularly important for consumers seeking alternative protein sources and those following specific dietary restrictions.

Collagen protein derived from product can be used in various applications, including food and beverages, cosmetics, and pharmaceuticals. For example, collagen protein is used in the formulation of skincare products to promote skin elasticity and reduce the appearance of wrinkles.

Whey and casein proteins are another essential ingredient in the market. These proteins are derived from milk and are highly sought-after protein sources due to their nutritional benefits and functional properties. The technology allows for the production of whey and casein proteins without using traditional animal sources. These proteins find applications in various food and beverage products, including protein powders, bars, and drinks. Precision fermentation enables the production of whey and casein proteins with improved sustainability and reduced environmental impact, aligning with the growing demand for sustainable and plant-based protein alternatives.

Egg white is a significant segment in the global market. Egg white proteins are widely used in the food and beverage industry due to their functional properties, such as emulsification and foaming. Precision fermentation allows for the production of egg white proteins without traditional egg sources. This is particularly important for consumers with dietary restrictions or ethical concerns.

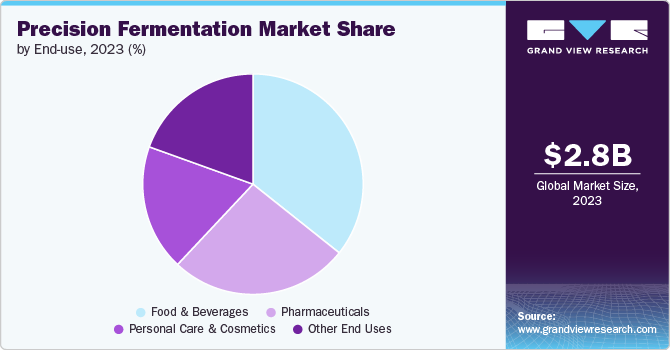

End-use Insights

Based on end use, the food & beverage segment led the market with the largest revenue share of 35.67% in 2023, owing to the fact that the market is experiencing significant demand in the food and beverage segment. Precision fermentation involves the production of ingredients through lab-grown microorganisms, offering a sustainable and innovative approach to food production. One key driver of demand in this segment is the growing popularity of plant-based proteins in the meat alternatives category. The global plant-based meat industry has witnessed remarkable growth, leading to an increased demand for precision-fermented meat alternative products such as burgers, fats, and proteins. Startups like Impossible Foods, Motif Food Works, and Melt & Marble have introduced precision-fermented meat alternatives, catering to the changing consumer preferences for sustainable and healthy food options.

The pharmaceutical segment is another significant segment driving the demand for precision fermentation. The industry offers the potential for producing complex therapeutic proteins, enzymes, and bioactive compounds, reducing dependency on traditional methods. It enables cost-effective and scalable production of biopharmaceuticals, fostering advancements in medical science. This technology can potentially revolutionize the fermentation-derived API (Active Pharmaceutical Ingredient) market, enhancing pharmaceutical production processes and yields. Despite regulatory hurdles, precision fermentation innovations hold the potential to drive substantial value and growth in the pharmaceutical industry.

In addition to the food and beverage and pharmaceutical segments, precision fermentation is also utilized in other segments such as cosmetics. The market's expansion can be attributed to the growing number of startups venturing into the industry, driven by heightened investor interest from companies like ADM and Cult Food. Precision fermentation involves lab-grown ingredients, demanding substantial investments in research and development to expedite progress. Overall, the demand for product in various end use segments is driven by factors such as the increasing demand for sustainable and healthy food and beverages, advancements in medical science, and the growth of the plant-based meat industry.

Regional Insight

North America dominated the precision fermentation market with the revenue share of 40.52% in 2023, due to the increasing consumer awareness and the growing demand for sustainable and eco-friendly products. This trend is fueled by the rising adoption of healthy food ingredients and the increasing embrace of veganism. Notably, according to The Hartman Group) around 40% of U.S. adults, over 90 million individuals, are projected to embrace products, with an estimated reach of 132 million consumers by 2027.

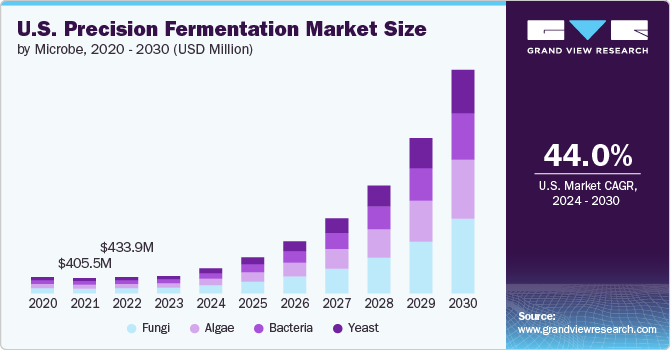

U.S. Precision Fermentation Market Trends

The precision fermentation market in U.S. is anticipated to grow at the fastest CAGR during the forecast period. The increasing consumer awareness and consumption of healthy food ingredients, along with the growing trend of veganism, are contributing to the market growth in North America. Approximately 40% of U.S. adults, totaling over 90 million individuals, are expressing readiness to adopt products.

Asia Pacific Precision Fermentation Market Trends

The precision fermentation market in Asia-Pacific has shown growing interest and investment in precision fermentation, driven by the need to address food security, population growth, and sustainability. Countries like Japan, China, and Singapore have been particularly active in research and development efforts related to precision fermentation.

Europe Precision Fermentation Market Trends

The precision fermentation market in Europe is anticipated to grow at the fastest CAGR during the forecast period Regulatory agencies in Europe have been actively engaged in reviewing and updating guidelines related to precision fermentation products. This regulatory involvement reflects the significance of Europe in the market, with countries like Germany, the Netherlands, and the UK leading in research and development.

Key Precision Fermentation Company Insights

Some of the key players operating in the market include Geltor, Perday Day Inc., The Every Co., Impossible Foods Inc., Motif Food Works Inc, Formo, Eden Brew, Mycorena, Change Foods,MycoTechnology.

-

Geltor is a biodesign company specializing in producing advanced designer proteins using precision fermentation and synthetic biology techniques. The company has gained recognition as a key player in the precision fermentation ingredients market, indicating its strong market presence and potential influence

-

Perfect Day Inc. is a food technology startup based in Berkeley, California. The company specializes in precision fermentation and creating dairy proteins, including casein and whey. Instead of extracting these proteins from cow's milk, Perfect Day uses fermentation in microbiota, specifically from fungi in bioreactors

Key Precision Fermentation Companies:

The following are the leading companies in the precision fermentation market. These companies collectively hold the largest market share and dictate industry trends.

- Geltor

- Perday Day Inc

- The Every Co.

- Impossible Foods Inc.

- Motif FoodWorks Inc.

- Formo

- Eden Brew

- Mycorena

- Change Foods

- MycoTechnology

Recent Developments

-

In May 2023, EVERY Company and Alpha Foods have entered into a Joint Development Agreement with the shared objective of bringing next-generation alt-meat products to the market. This collaboration aims to assertively leverage EVERY's trailblazing expertise in animal-free protein production and Alpha Foods' renowned chef-crafted plant-based foods to accelerate advancements in taste and texture for non-animal products

-

In March 2023, The partnership between The Hartman Group, Perfect Day, and Cargill has provided invaluable insights into consumer attitudes and preferences related to precision fermentation ingredients, thus strengthening Perfect Day's market position and establishing its leadership in the Precision Fermentation Alliance

Precision Fermentation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.01 billion |

|

Revenue forecast in 2030 |

USD 34.61 billion |

|

Growth rate |

CAGR of 43.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Microbe, ingredients, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia |

|

Key companies profiled |

Geltor; Perday Day Inc.; The Every Co.; Impossible Foods Inc.; Motif FoodWorks Inc; Formo; Eden Brew; Mycorena; Change Foods; MycoTechnology |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Precision Fermentation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision fermentation market report based on microbe, ingredient, end-use & region:

-

Microbe Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Yeast

-

Algae

-

Fungi

-

Bacteria

-

-

Ingredients Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Whey & Casein Protein

-

Egg White

-

Collagen Protein

-

Heme Protein

-

Enzymes

-

Others

-

-

End-use Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision fermentation market size was estimated at USD 2.80 billion in 2023 and is expected to reach USD 4.01 billion in 2024.

b. The global precision fermentation market is expected to grow at a compound annual growth rate of 43.2% from 2024 to 2030 to reach USD 34.61 billion by 2030.

b. North America dominated the precision fermentation market with a share of 40.5% in 2023. This is attributable to increasing consumer awareness and the growing demand for sustainable and eco-friendly products. This trend is fueled by the rising adoption of healthy food ingredients and the increasing embrace of veganism.

b. Some key players operating in the precision fermentation market include Geltor, Perday Day Inc., The Every Co., Impossible Foods Inc., Motif FoodWorks Inc, Formo, Eden Brew, Mycorena, Change Foods, MycoTechnology.

b. Key factors that are driving the market growth include the surge in demand for alternative protein sources due to the environmental concerns associated with traditional protein production methods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."