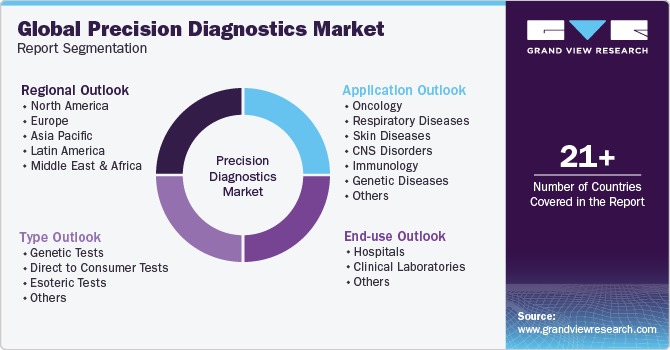

Precision Diagnostics Market Size, Share & Trends Analysis Report By Type (Genetic Tests, Direct to Consumer Tests, Esoteric Tests), By Application (Oncology, Respiratory Diseases, Immunology), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Precision Diagnostics Market Size & Trends

The global precision diagnostics market size was estimated at USD 15.60 billion in 2023 and is projected to grow at a CAGR of 18.4% from 2024 to 2030. The market growth is attributed to advancements in genomic and proteomic sciences, the rising prevalence of chronic diseases, and the need for early detection and personalized treatment plans. Technological innovations in diagnostic tools and platforms, including AI and machine learning algorithms, have enhanced the accuracy and efficiency of these tests. Furthermore, growing awareness and acceptance of precision diagnostic approaches among healthcare professionals and patients is expected to continue to boost the market growth.

The increasing aging population is likely to drive the market growth. According to the WHO, by the year 2050, the global population aged 60 years and above is projected to double, reaching 2.1 billion individuals. In addition, the number of people aged 80 years or older is expected to grow three times from 2020 to 2050, reaching a total of 426 million. As people age, there is a higher chance of developing various diseases and health conditions that require precise and early diagnosis for effective treatment. Precision diagnostics, which include advanced technologies and methods such as genetic testing, molecular diagnostics, and big data analytics, can offer personalized and accurate diagnostic information. This allows for the timely and targeted treatment of conditions, which is particularly important for the elderly population who may have multiple health issues. Therefore, the growing number of older adults globally represents a key factor in the expansion of the global market, as it responds to the increased demand for advanced diagnostic solutions to manage aging-related diseases more effectively.

Increasing government investment plays a significant role in driving the market growth. It supports research and development activities, which are crucial for the advancement of precision diagnostics technologies. These technologies require substantial funding to cover the costs associated with developing, testing, and validating new diagnostic methods and tools. Government funding can help bridge this financial gap, enabling more innovative solutions to come to market.

Government investment can enable the adoption of precision diagnostics in public health systems. By allocating funds for the procurement of advanced diagnostic equipment and training healthcare professionals in its use, governments can ensure that these technologies are more widely available, thus improving patient outcomes and the overall efficiency of healthcare services. For instance, in the India Union budget of 2023-24, the government has allocated USD 889.56 billion for health expenditure, an increase of 2.71% over the year 2022.

Market Concentration & Characteristics

The degree of innovation in the market is high, reflecting a dynamic and rapidly evolving sector that is at the forefront of transforming healthcare. This market is characterized by its pursuit of accuracy, efficiency, and personalization in diagnostic solutions, which are essential for the early detection and targeted treatment of diseases.

The level of collaboration and partnership activities in the global market is notably high and continues to be a driving force for innovation and expansion. The field of precision diagnostics is complex and rapidly evolving, necessitating a wide range of expertise, technologies, and resources. Collaborations and partnerships are essential for combining different strengths, such as clinical knowledge, technological platforms, research and development capabilities, and market access.

The impact of regulations in the market is significant. Strict regulatory standards require diagnostic tests to meet high levels of accuracy, reliability, and validity. While this ensures the development of superior-quality diagnostics, the strict approval process can also slow down the pace of innovation and increase development costs.

The market is experiencing transformative growth, driven by technological advancements, an increasing emphasis on personalized medicine, and the global demand for more accurate and efficient diagnostic solutions and continuously investing in research and development to introduce new diagnostic technologies and tests that can provide more precise results. This includes leveraging AI and machine learning algorithms to analyze data more effectively.

Expanding into new regions in the global market involves a strategic approach to adapt products and services to meet local regulatory requirements and healthcare needs. This strategy is particularly effective in targeting emerging economies where the demand for advanced healthcare solutions is rapidly growing.

Type Insights

Based on type, the genetic tests segment led the market with the largest revenue share of 54.6% in 2023. The dominance of genetic tests in the market can be attributed to technological advancements, a better understanding of genetic disorders, the rise of personalized medicine, an increase in chronic diseases and cancer, consumer interest, and a supportive regulatory environment. Furthermore, the sector has witnessed significant investments and collaborations between diagnostic companies, pharmaceutical companies, and academic institutions. These partnerships aim to develop new genetic tests and integrate them into clinical practice, further driving market growth. For instance, in January 2024, DNAnexus, Inc. and TMA Precision Health announced a collaboration to enhance diagnostic processes and treatment alternatives for rare diseases. This partnership is focused on developing more accurate and efficient diagnostic tools that can lead to better personalized treatment plans for individuals suffering from rare conditions.

The Direct to Consumer Tests (DTC)segment is anticipated to register at the fastest CAGR from 2024 to 2030. There's a growing awareness among consumers about the importance of early disease detection and personalized health information. DTC tests provide a convenient way for individuals to access health information directly without necessarily going through a healthcare provider. Advancements in genomic sequencing technologies and bioinformatics have made it easier and more cost-effective to offer these tests directly to consumers. This has led to an increase in the variety and accuracy of tests available, from genetic predisposition to certain conditions to personalized nutrition and fitness advice. Regulatory bodies in some regions have started providing clearer frameworks and guidelines for DTC genetic testing, which has helped companies navigate the approval process more efficiently and bring their products to market.

Application Insights

Based on application, the oncology segment led the market with the largest revenue share of 24.7%in 2023. This is primarily due to the increasing prevalence of cancer worldwide and the need for early detection and monitoring of this disease. According to the American Cancer Society, approximately 1.96 million new cases of cancer were diagnosed in 2023. This high prevalence demands more personalized and accurate diagnostic methods to identify specific cancer types and their genetic makeup, facilitating targeted treatment approaches. In addition, government investment in this segment is expected to boost the market in the forecast years. For instance, in the U.S., the National Cancer Institute (NCI) received USD 7.8 billion from the government and a USD 500 million increase from the Fiscal Year 2023 budget to support personalized medicine.

The genetic diseases application segment is expected to grow at the fastest CAGR during the forecast period. The rising incidence of genetic disorders worldwide is driving the demand for personalized diagnostic solutions. Conditions such as cystic fibrosis, sickle cell anemia, and various forms of cancer have genetic roots, necessitating advanced diagnostics for early detection and management. The advent of next-generation sequencing (NGS) and other high-throughput technologies has revolutionized genetic testing. These advancements have made it possible to analyze and interpret large volumes of genetic data quickly and cost-effectively, thereby accelerating the growth of precision diagnostics in identifying genetic diseases.

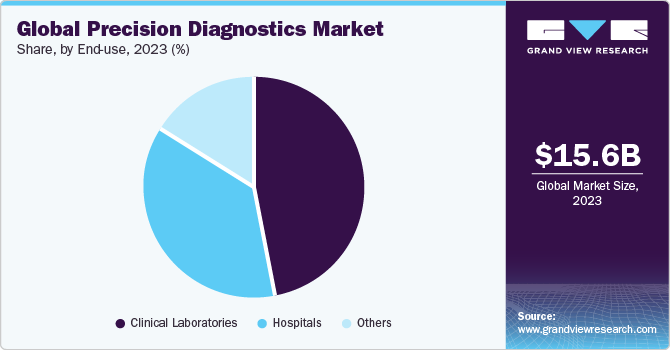

End-use Insights

Based on end-use, the clinical laboratories segment led the market with the largest revenue share of 47.3% in 2023.Clinical laboratories play a key role in the market, primarily due to their extensive use of advanced diagnostic technologies for accurate disease detection and monitoring. Precision diagnostics often requires the interpretation of complex data, such as genetic mutations or biomarker levels. Clinical laboratories have the expertise and personnel, such as pathologists and geneticists, to interpret these results accurately, making them a crucial end-use segment. Furthermore,clinical laboratories offer a wide range of diagnostic services, from routine blood tests to complex genetic testing. This flexibility attracts a broad patient base, further driving the demand for personalized diagnostics.

The hospital segment is anticipated to grow at a significant CAGR during the forecast period. Hospitals are adopting precision diagnostic technologies, driven by the need for more accurate and individualized patient care. This adoption is facilitated by advancements in diagnostic technologies, such as next-generation sequencing (NGS), PCR (polymerase chain reaction), and liquid biopsy, which are becoming more accessible and integrated into hospital settings. In addition, rising investment and collaborations by private players in the market are expected to support market growth. For instance, in January 2024, Qlucore Insights, a software development company for precision diagnostics, signed an agreement with Sahlgrenska University Hospital in Sweden. Through the agreement, the hospital will use the Qlucore Insights software to improve the diagnosis of acute lymphoblastic leukemia in children.

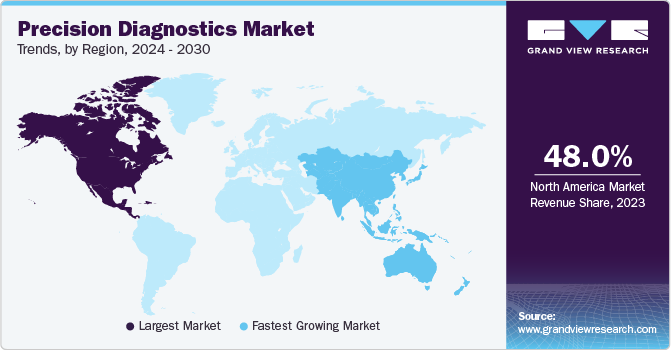

Regional Insights

North America dominated the precision diagnostics market with the largest revenue share of 48.01% in 2023, mainly the U.S., which is known for its advanced healthcare infrastructure and robust biotechnology research sectors. Continuous investments and developments in these areas have led to innovations in personalized diagnostics technologies, making them more efficient and reliable. Government initiatives in North America aimed at improving healthcare quality and accessibility, along with funding for research and development in the field of diagnostics, have significantly contributed to the market growth.

U.S. Precision Diagnostics Market Trends

The precision diagnostics market in the U.S. is expected to grow at the fastest CAGR over the forecast period, driven by advancements in genomic medicine, increased awareness of personalized healthcare, the integration of artificial intelligence (AI) in diagnostic processes, and rising demand for early and more accurate disease detection. Precision diagnostics, which includes genetic testing, molecular diagnostics, and companion diagnostics, among others, focus on identifying unique genetic and biomolecular characteristics to guide more tailored treatment strategies.

The U.S. government and private sectors have supported research and initiatives related to precision medicine and diagnostics. Programs such as the Precision Medicine Initiative (PMI) aim to revolutionize how diseases are treated and prevented by considering individual differences in people’s genes, environments, and lifestyles.

Europe Precision Diagnostics Market Trends

The precision diagnostics market in Europe was identified as a lucrative region in this industry. The Europe market is experiencing significant growth. This growth can be attributed to advancements in technologies, increasing healthcare expenditures, the rising prevalence of chronic diseases, and the growing emphasis on personalized medicine. The regulatory environment in Europe is also adapting to the advancements in precision diagnostics, with efforts to streamline approval processes for new diagnostic technologies. In addition, collaborations between diagnostic companies, research institutions, and healthcare providers are fostering innovation and accelerating the development of new diagnostic solutions.

The UK precision diagnostics market held a significant share in 2023. There is a growing emphasis on personalized healthcare in the UK. Treatments and diagnostics are tailored to individual genetic profiles, improving patient outcomes and treatment efficacy. The UK government and healthcare system are supportive of precision medicine initiatives. For instance, the NHS has launched the 100,000 Genomes Project and continues to invest in genomic medicine, creating a conducive environment for the growth of precision diagnostics.

The precision diagnostics market in France is expected to grow at a remarkable CAGR over the forecast period,driven by the increasing incidence of chronic diseases, such as cancer, cardiovascular diseases, and diabetes, which has heightened the demand for early and accurate diagnostic solutions. This need is critical in managing these conditions effectively, leading to a push for advancements in diagnostic technologies. France has an aging population. This demographic trend results in a higher prevalence of various diseases, necessitating the development and implementation of advanced diagnostic tools to cater to the growing healthcare needs of this segment of the population.

The Germany precision diagnostics market is anticipated to grow at a significant CAGR over the forecast period. The Germany market is characterized by a strong focus on innovation and quality, reflecting the country's leading position in healthcare and medical technology. With a robust healthcare system and a high level of spending on healthcare relative to GDP, Germany presents a productive ground for the growth and adoption of personalized diagnostics technologies. Regulatory frameworks in Germany are designed to ensure patient safety while promoting technological advancements. The Federal Institute for Drugs and Medical Devices (BfArM) and the Paul-Ehrlich-Institute (PEI) are key regulatory bodies that oversee the approval and market surveillance of diagnostic products. These agencies work to balance innovation with strict safety standards, ensuring that new diagnostic technologies entering the market are effective and reliable.

Asia Pacific Precision Diagnostics Market Trends

The precision diagnostics market in Asia Pacific is anticipated to grow at the fastest CAGR of 12.7% over the forecast period. The increasing prevalence of chronic diseases, such as cancer and diabetes, in this region drives the demand for advanced diagnostic methods that can provide personalized treatment options. The growing awareness and acceptance of precision diagnostics among healthcare professionals and patients contribute to this rapid growth. Improvements in healthcare infrastructure, mainly in emerging economies such as China and India, along with government initiatives aimed at incorporating advanced healthcare technologies, further bolster the market expansion. The rising investment in healthcare research and development, coupled with collaborations between public and private sectors in the field of precision medicine, are also significant contributors.

The China precision diagnostics market is expected to grow at a rapid CAGR over the forecast period. China has seen rapid advancements in healthcare infrastructure and technology. The government and private sector have invested robustly in healthcare innovation, particularly in precision medicine, which includes genomics and personalized healthcare solutions. This focus aligns with the global trend toward more personalized and precise medical interventions based on individual genetic and molecular profiles.

The precision diagnostics market in Japan has one of the highest proportions of elderly citizens in the world. This demographic trend increases the demand for healthcare services, including precision diagnostics, as older populations typically have higher incidences of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders. The Japanese government actively promotes healthcare innovation through funding, research programs, and regulatory reforms designed to facilitate the development and adoption of new medical technologies. Initiatives such as the Japan Health Sciences Foundation and the Japan Agency for Medical Research and Development (AMED) support research in precision medicine and diagnostics.

Middle East & Africa Precision Diagnostics Market Trends

The precision diagnostics market in Middle East & Africa is expected to grow at a exponential CAGR over the forecast period. Countries across the MEA are significantly investing in healthcare infrastructure and services. This includes the development of state-of-the-art medical facilities and hospitals, which are essential for implementing advanced diagnostic technologies. The MEA region is witnessing a surge in chronic diseases such as diabetes, cardiovascular diseases, and cancer. Precision diagnostics play a crucial role in the early detection and management of these conditions, making them important in regional healthcare.

The Saudi Arabia precision diagnostics market is expected to grow at the fastest CAGR over the forecast period. The Saudi Arabian government has been actively investing in healthcare infrastructure and digital health technologies as part of its Vision 2030 program. This includes initiatives aimed at enhancing the precision diagnostics sector, such as funding for research and development and the establishment of state-of-the-art medical facilities equipped with the latest diagnostic technologies. There has been an increase in the prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in Saudi Arabia. Precision diagnostics play a crucial role in the early detection and management of these conditions, driving demand for advanced diagnostic services.

The precision diagnostics market in Kuwait is anticipated to grow at a significant CAGR over the forecast period. Kuwait is witnessing a substantial adoption of digital health technologies. The use of artificial intelligence (AI) and machine learning for data analysis in healthcare is becoming more common. These technologies are improving the accuracy and efficiency of disease diagnosis and treatment plans, thus boosting the capabilities of precision diagnostics. There's a focus on ensuring that healthcare professionals in Kuwait are up-to-date with the latest diagnostic technologies and techniques. Education and training programs are critical for equipping the healthcare workforce with the necessary skills to utilize precision diagnostics tools effectively.

Key Precision Diagnostics Company Insights

The market players operating in the global market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Precision Diagnostics Companies:

The following are the leading companies in the precision diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Becton, Dickinson and Company

- Danaher Corporation

- QIAGEN N.V.

- Hologic Inc.

- Agilent Technologies Inc.

Recent Developments

-

In January 2024, Siemens Healthineers & the Indian Institute of Science launched a collaborative laboratory for AI in Precision Medicine. The lab's official name is the Siemens Healthineers-Computational Data Sciences Collaborative Laboratory for AI in Precision Medicine. The lab's main focus is on developing open-source AI tools to analyze neurological diseases. This collaboration is a significant development in AI research for India, specifically targeting neurovascular diseases

-

In May 2023, HALO Precision Diagnostics, Inc., announced a partnership with Agamon Health. The partnership focuses on improving the patient experience and the effectiveness of HALO Precision Diagnostics' treatments

-

In December 2022, the Lily Foundation launched the Precision Diagnostics project. The project aims to achieve this by re-analyzing existing patient data with the latest genetic techniques and expertise

Precision Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 18.29 billion |

|

Revenue forecast in 2030 |

USD 50.27 billion |

|

Growth rate |

CAGR of 18.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Thermo Fisher Scientific Inc.; bioMérieux SA; Becton, Dickinson and Company; Danaher Corporation; QIAGEN N.V.; Hologic Inc.; Agilent Technologies Inc. |

|

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Precision Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global precision diagnostics market based on type, application,end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Tests

-

Direct to Consumer Tests

-

Esoteric Tests

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Respiratory Diseases

-

Skin Diseases

-

CNS Disorders

-

Immunology

-

Genetic Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global precision diagnostics market size was estimated at USD 15.60 billion in 2023 and is expected to reach USD 18.29 billion in 2024.

b. The global precision diagnostics market is expected to grow at a compound annual growth rate of 18.4% from 2024 to 2030 to reach USD 50.27 billion by 2030.

b. North America dominated the precision diagnostics market with a share of 48.01% in 2023. This is attributable to the region's advanced healthcare infrastructure and robust biotechnology research. Furthermore, the rising number of investments and approvals within the U.S. is likely to fuel the regional growth

b. Some key players operating in the precision diagnostics market include Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Siemens Healthineers AG; Thermo Fisher Scientific Inc.; bioMérieux SA; Becton, Dickinson and Company; Danaher Corporation; QIAGEN N.V.; Hologic Inc.; and Agilent Technologies Inc.

b. Key factors that are driving the market growth include growing demand for personalized medicine along with supportive government initiatives and funding

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."