- Home

- »

- Advanced Interior Materials

- »

-

Precious Metal Market Size & Share, Industry Report, 2033GVR Report cover

![Precious Metal Market Size, Share & Trends Report]()

Precious Metal Market (2026 - 2033) Size, Share & Trends Analysis Report By Metal (Gold, PGM, Silver), By Application (Jewelry, Industrial, Investment), By Region (North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68038-853-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precious Metal Market Summary

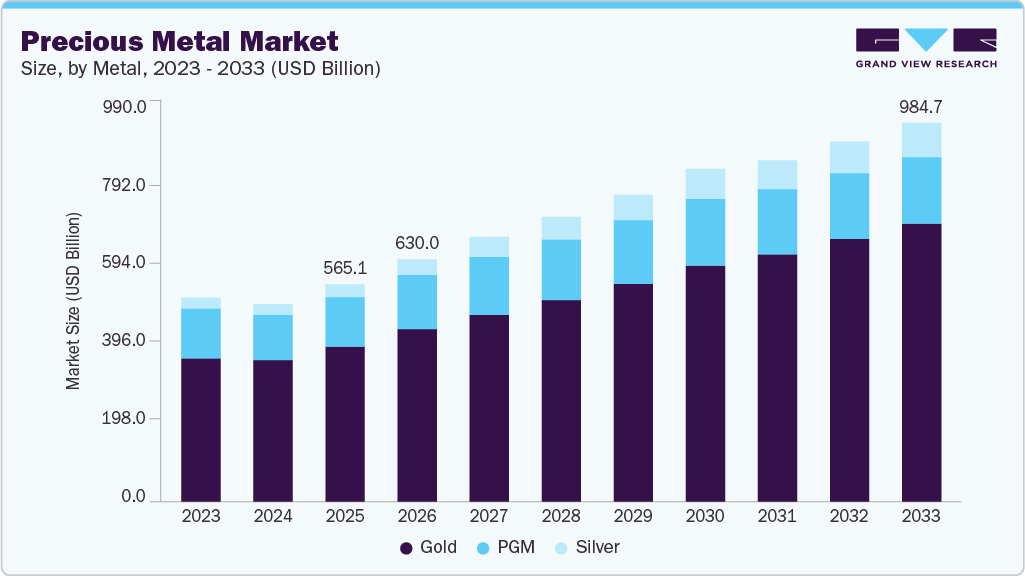

The global precious metal market size was estimated at USD 565.08 billion in 2025 and is projected to reach USD 984.77 billion by 2033, growing at a CAGR of 6.6% from 2026 to 2033. This growth is primarily driven by rising investor demand for safe-haven assets amid economic and geopolitical uncertainties, as well as the increasing use of industrial applications in electronics, automotive catalytic converters, and renewable energy technologies.

Key Market Trends & Insights

- Asia Pacific dominated the precious metal market with a revenue share of over 47.0% in 2025.

- The precious metal market in China is expected to grow at the significant CAGR over the forecast period.

- By metal, the gold segment dominated the market with a revenue share of over 71.0% in 2025.

- By application, the industrial segment is expected to grow at the fastest CAGR of 7.1% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 565.08 Billion

- 2033 Projected Market Size: USD 984.77 Billion

- CAGR (2026-2033): 6.6%

- Asia Pacific: Largest market in 2025

- North America: Fastest growing market

The precious metals market has increasingly aligned with sustainable practices, driven by environmental, social, and governance (ESG) considerations. Leading companies are focusing on reducing carbon emissions in mining and refining operations, implementing water and energy-efficient processes, and ensuring responsible sourcing of metals through certified supply chains. Recycling and urban mining of precious metals from electronic waste and industrial scrap have become significant contributors to supply, reducing dependence on primary mining while supporting circular economic principles. These initiatives not only mitigate environmental impact but also enhance corporate reputation and compliance with global regulatory standards.

Technological innovation is transforming the precious metals market, enhancing the efficiency of extraction, processing, and application. Advanced metallurgical techniques, automation, and digital mine management systems are improving yield, reducing operational costs, and optimizing resource utilization. In addition, the integration of precious metals in high-tech applications such as automotive catalytic converters, hydrogen fuel cells, electronics, and renewable energy systems is driving demand for high-purity materials. Cutting-edge refining, micronization, and nanotechnology processes are enabling companies to produce metals with precise particle size, composition, and performance characteristics, supporting both industrial growth and emerging technology sectors.

Drivers, Opportunities & Restraints

The market is primarily driven by strong investment and industrial demand. Rising geopolitical and economic uncertainties have prompted investors to seek safe-haven assets, such as gold and silver, driving their prices to record highs; in late December 2025, gold surged past USD 4,500 per ounce, and silver also reached unprecedented levels amid safe-haven flows and expectations of further interest rate cuts by the U.S. Federal Reserve. Supply constraints, particularly in platinum group metals, combined with increasing industrial use in catalytic converters and hydrogen technologies, further reinforce market growth. Favorable macroeconomic factors, such as a weaker U.S. dollar and expectations of interest rate cuts, have added momentum to investor interest in these metals. Growing awareness of precious metals as a hedge against inflation and currency fluctuations continues to attract institutional and retail investors worldwide.

The market presents significant growth opportunities due to the increasing adoption of technological and renewable energy applications. Silver’s role in solar panels, electronics, and electric vehicles, along with platinum’s use in emission control and hydrogen fuel cells, is expanding demand. Moreover, the high prices and supply limitations are encouraging recycling and secondary sourcing of precious metals, creating new business models and supporting a circular economic approach that benefits both manufacturers and investors. Emerging markets in Asia and Africa also provide potential for expanding production and industrial applications, further strengthening long-term market prospects. In November 2025, platinum futures surged by over 150% year‑to‑date, highlighting elevated investor interest and tightening supplies that support broader industrial and investment demand.

High precious metal prices can restrict downstream demand, affecting jewelry consumption and industrial use, as cost-sensitive sectors may reduce purchases. Furthermore, production expansion is limited by capital‑intensive mining operations and persistent supply chain challenges. In the longer term, the automotive shift toward electric vehicles could reduce demand for palladium in catalytic converters, posing additional constraints to the market. Regulatory pressures and environmental compliance requirements can also increase operational costs for miners and refiners, limiting the rapid scaling of production. Additionally, recycling supply forecasts for platinum in 2025 were revised downward due to challenges in recovering catalyst scrap, underscoring short-term supply constraints that may strain market balance and potentially lead to further cost increases.

Metal Insights

The gold segment dominated the market with a revenue share of over 71.0% in 2025, due to its long-standing role as a store of value, a safe-haven asset, and a key component of jewelry demand. The strong cultural significance in major consuming regions, such as India and China, along with sustained central bank purchases, continues to support gold’s dominance. In addition, heightened geopolitical tensions and macroeconomic uncertainty have reinforced investor preference for gold-backed assets, ensuring stable demand across investment and reserve management applications.

Silver is expected to register the fastest CAGR over the forecast period, driven by its expanding industrial applications alongside investment demand. The metal’s extensive use in solar photovoltaics, electronics, electric vehicles, and advanced electrical components is accelerating consumption, particularly amid global energy transition initiatives. Compared to gold, silver’s lower price point also attracts retail investors, further supporting volume growth and contributing to its faster rate of expansion.

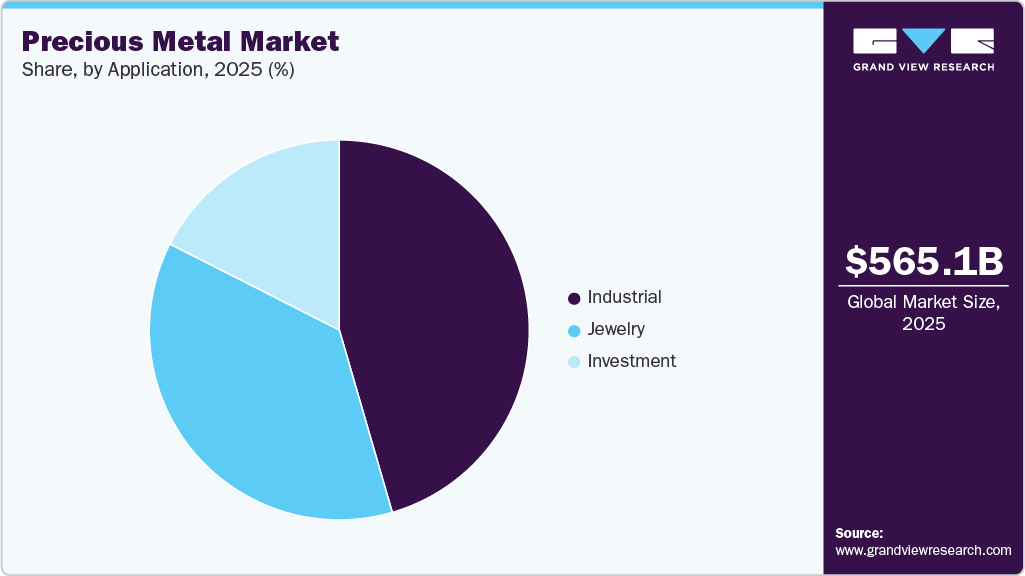

Application Insights

The industrial segment accounts for the largest share of the precious metals market and is expected to grow at the fastest CAGR of 7.1% over the forecast period. This dominance is attributed to the widespread use of precious metals in electronics, automotive catalytic converters, chemical processing, medical devices, and renewable energy technologies. Platinum group metals play a critical role in emission control systems, while silver’s conductivity properties make it indispensable in electrical and electronic applications.

The industrial segment’s strong growth outlook is further supported by rising adoption of electric vehicles, expansion of renewable energy infrastructure, and increasing demand for high-performance materials in advanced manufacturing. Technological advancements, coupled with stricter emission regulations and sustainability-driven innovation, are expected to sustain long-term demand for industrial precious metals, reinforcing both market share and growth momentum.

Jewelry and investment applications continue to support market growth, though they hold a smaller share compared to industrial usage. Jewelry demand is concentrated in countries with strong cultural and traditional preferences for gold, whereas investment demand is driven by economic uncertainty, hedging inflation, and central bank accumulation. Coins, bars, and ETFs remain popular investment vehicles for retail and institutional investors. Despite slower growth than industrial applications, these segments provide stability and liquidity to the overall precious metals market.

Regional Insights

The North America precious metal market is expected to grow at the fastest CAGR of 7.4% over the forecast period, driven by strong investment demand and a mature industrial base. The region benefits from high consumption of gold and silver in jewelry, electronics, and automotive applications, particularly in the U.S. and Canada. The adoption of technological innovations, such as electric vehicles and renewable energy infrastructure, is further supporting industrial demand for PGMs and silver. Favorable regulatory frameworks, advanced mining infrastructure, and investor confidence in safe-haven assets contribute to steady market growth in this region.

U.S. Precious Metal Market Trends

The U.S. represents the largest single-country market in North America, fueled by both investment and industrial applications. Gold remains the preferred choice for investors during periods of economic uncertainty, while silver and PGMs see extensive use in electronics, automotive catalytic converters, and healthcare devices. Rising adoption of green technologies and government incentives for renewable energy projects are increasing industrial demand for silver and platinum, driving growth in the U.S. precious metals market.

Asia Pacific Precious Metal Market Trends

Asia Pacific dominated the precious metal market with a revenue share of over 47.0% in 2025, driven by rapid industrialization, increasing disposable income, and cultural affinity for gold jewelry. Countries such as China and India dominate jewelry consumption, while industrial demand for silver, gold, and PGMs is rising due to electronics manufacturing, renewable energy projects, and automotive applications.

Growing investments in EVs, solar panels, and digital technologies, combined with supportive government policies, are fueling regional market expansion, making the Asia Pacific a key growth hub.

Europe Precious Metal Market Trends

Europe holds a substantial share of the global precious metals market, primarily driven by industrial applications in the automotive, electronics, and chemical processing sectors. Platinum group metals are particularly important in Europe due to strict emission norms, while gold continues to attract investment demand through coins, ETFs, and jewelry. The presence of major mining and refining companies, coupled with strong technological adoption and ESG-focused initiatives, is strengthening both the industrial and investment segments in the region.

Key Precious Metal Company Insights

Some of the key players operating in the market include Newmont Corporation, Barrick Gold Corporation, and Anglo-American Platinum Limited, among others.

-

Newmont Corporation, founded in 1921 and headquartered in the U.S., is the world’s largest gold mining company with a diversified portfolio of gold and silver assets across North America, South America, Australia, and Africa. The company focuses on large-scale, long-life mining operations supported by advanced extraction technologies and strong ESG frameworks. Newmont emphasizes operational efficiency, responsible mining practices, and disciplined capital allocation to sustain long-term production of precious metals.

-

Barrick Gold Corporation, established in 1983 and based in Canada, is a leading global gold producer with additional exposure to copper through integrated mining operations. The company operates Tier-1 assets across the Americas, Africa, and the Middle East, enabling stable output and cost optimization. Barrick prioritizes digital mine management, reserve expansion, and sustainability-driven operations to strengthen its competitive position in the precious metals market.

-

Anglo American Platinum Limited, incorporated in 1946 and headquartered in South Africa, is the world’s largest primary producer of platinum group metals. The company operates vertically integrated mining and processing facilities, producing platinum, palladium, rhodium, and associated metals for automotive, industrial, and jewelry applications. Anglo American Platinum focuses on operational resilience, supply reliability, and low-carbon initiatives to support long-term demand growth for PGMs.

Key Precious Metal Companies:

The following are the leading companies in the precious metal market. These companies collectively hold the largest Market share and dictate industry trends.

- Anglo American Platinum Limited

- Barrick Gold Corporation

- First Quantum Minerals Ltd.

- Fresnillo plc

- Glencore plc

- Impala Platinum Holdings Limited

- Newmont Corporation

- MMC Norilsk Nickel

- Pan American Silver Corp.

- Sibanye-Stillwater Limited

Recent Developments

-

In October 2025, Newmont Corporation announced third-quarter 2025 results reporting approximately 1.4 million attributable gold ounces produced and a record free cash flow of about USD 1.6 billion, along with improved cost and capital guidance for the full year. The company also continued to optimize its portfolio through divestitures, strengthening its balance sheet while advancing key Tier 1 asset operations and cost-saving initiatives to support long-term production growth.

-

In June 2025, Anglo American Platinum Limited’s business was demerged from Anglo American plc to form Valterra Platinum Limited, with approximately 51 percent of the PGM business separated and listed independently. This strategic demerger unlocked shareholder value and established Valterra as a standalone entity focused on platinum group metals production in the global market.

-

In May 2025, Barrick Mining Corporation (formerly Barrick Gold Corporation) completed a corporate rebranding reflecting its evolution into a diversified gold and copper producer and announced it is evaluating an initial public offering (IPO) of its North American gold assets to highlight their value. The contemplated IPO would include interests in Nevada Gold Mines and the Fourmile gold discovery, with Barrick retaining a controlling majority stake while unlocking shareholder value in the strong precious metals market.

Precious Metal Market Report Scope

Report Attribute

Details

Market definition

Apparent consumption of precious metals such as gold, silver, and PGMs refers to the total volume utilized across various sectors, including jewelry, investment products (bars and coins), and industrial applications such as electronics, automotive catalysts, and renewable energy technologies.

Market size value in 2026

USD 630.05 billion

Revenue forecast in 2033

USD 984.77 billion

Growth rate

CAGR of 6.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Metal, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Switzerland; China; India; Japan; South Korea; Vietnam; Brazil; Argentina; Saudi Arbia; UAE; Qatar

Key companies profiled

Anglo American Platinum Limited; Barrick Gold Corporation; First Quantum Minerals Ltd.; Fresnillo plc; Glencore plc; Impala Platinum Holdings Limited (Implats); Newmont Corporation; MMC Norilsk Nickel; Pan American Silver Corp.; Sibanye-Stillwater Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precious Metal Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global precious metal market report by Metal, application, and region.

-

Metal Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Gold

-

Silver

-

PGM

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Jewelry

-

Industrial

-

Investment

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global precious metal market size was estimated at USD 565.08 billion in 2025 and is expected to reach USD 630.05 billion in 2026.

b. The global precious metal market is expected to grow at a compound annual growth rate of 6.6% from 2026 to 2033 to reach USD 984.77 billion by 2033.

b. By product, the gold segment dominated the market, accounting for a revenue share of over 71.0% in 2025.

b. Some of the key vendors in the global precious metal market include Anglo American Platinum Limited, Barrick Gold Corporation, First Quantum Minerals Ltd., Fresnillo plc, Glencore plc, Impala Platinum Holdings Limited, Newmont Corporation, MMC Norilsk Nickel, Pan American Silver Corp., and Sibanye-Stillwater Limited, among others.

b. The key factor driving the growth of the precious metals market is strong investment and industrial demand, with investors seeking safe-haven assets like gold and silver amid economic and geopolitical uncertainties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.