- Home

- »

- Consumer F&B

- »

-

Pre-workout Gummies Market Size And Share Report, 2030GVR Report cover

![Pre-workout Gummies Market Size, Share & Trends Report]()

Pre-workout Gummies Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Gelatin, Plant-based Gelatin Substitute), By End-use (Male, Female), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pre-workout Gummies Market Size & Trends

The global pre-workout gummies market size was estimated at USD 1.59 billion in 2024 and is expected to grow at a CAGR of 9.0% from 2025 to 2030. Pre-workout gummies are easy to consume and carry, making them a popular choice for fitness enthusiasts who prefer on-the-go solutions. Increasing awareness about the importance of fitness and a healthy lifestyle is driving the demand for pre-workout supplements, including gummies. With the growing popularity of gyms, fitness clubs, and outdoor activities, there is a rising demand for pre-workout supplements to enhance performance and endurance.

Consumers are increasingly seeking natural, organic, and clean-label supplements. Manufacturers are responding by using natural flavors, colors, and sweeteners in their gummy formulations. Inclusion of functional ingredients like BCAAs (Branched-Chain Amino Acids), caffeine, creatine, vitamins, and minerals to enhance workout performance and recovery. The rise of e-commerce and direct-to-consumer sales channels allows manufacturers to reach a wider audience and offer subscription-based services for regular delivery.

The youth demographic, especially millennials and Generation Z, actively seeks fun, innovative ways to enhance their performance. The appeal of gummies as a supplement aligns well with their preferences for fun and flavorful products over traditional capsules and powders. With advancements in nutritional science, manufacturers are creating tailored formulations aimed at specific fitness goals, such as increased endurance, muscle gain, or fat loss. This trend toward customization provides opportunities for brands to develop niche products that cater to specific consumer segments.

The market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global pre-workout gummies industry. Moreover, strategic collaborations with fitness influencers, nutritionists, and gyms are becoming popular strategies to build brand credibility and reach targeted consumer bases. Collaborations can also extend to co-branding opportunities with reputable health and wellness brands.

Ingredient Insights

The gelatin segment accounted for a share of 68.34% of the global revenue in 2023. Gelatin acts as an excellent delivery system for active ingredients such as amino acids, caffeine, vitamins, and minerals. It can encapsulate these nutrients effectively, ensuring their stability and bioavailability. Gelatin is highly versatile and can be used to create a wide range of gummy textures, from soft and chewy to firm. This versatility allows manufacturers to innovate and cater to diverse consumer preferences. Many established brands in the supplement industry have already invested in gelatin-based formulations due to their proven success in other gummy supplement markets, such as vitamins, and general health supplements.

Plant-based gelatin substitute segment is expected to grow at a CAGR of 10.0% from 2024 to 2030. Increasing awareness and adoption of plant-based diets, driven by health, environmental, and ethical concerns, have significantly boosted the demand for plant-based products. Consumers are actively seeking alternatives to animal-derived ingredients, including gelatin.Plant-based substitutes are often perceived as healthier and more natural compared to animal-derived gelatin, aligning with consumer preferences for clean, transparent ingredient lists.

End-use Insights

The male segment accounted for a share of 61.20% of the global revenue in 2023. Men have shown higher participation rates in fitness and bodybuilding activities. This demographic often seeks performance-enhancing supplements to support their workout routines, driving demand for pre-workout products, including gummies. Pre-workout supplements are particularly popular among men focused on muscle building, strength training, and improving athletic performance. These supplements are designed to enhance energy, endurance, and overall workout effectiveness, which aligns with the goals of many male fitness enthusiasts. Brands focus on leveraging the dominance of the male segment by developing targeted marketing campaigns that emphasize the benefits of pre-workout gummies for strength training, endurance, and muscle building.

The female segment is expected to grow at a CAGR of 9.1% from 2024 to 2030. Women are becoming more health-conscious and aware of the benefits of pre-workout supplements. This includes the desire for enhanced energy, endurance, and performance during workouts, which pre-workout gummies can provide. The convenience of pre-workout gummies is particularly appealing to busy women who seek quick and easy-to-consume supplements. Gummies eliminate the need for mixing powders or carrying bulky containers, fitting seamlessly into active lifestyles.

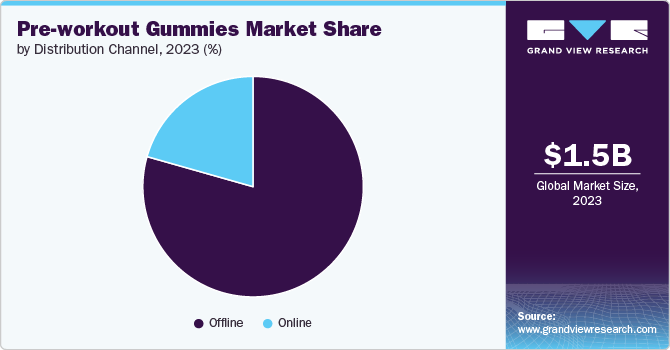

Distribution Channel Insights

The sales of pre-workout gummies through offline channels accounted for a revenue share of 79.40% in 2023. Companies producing pre-workout gummies have established partnerships with major retail chains such as supermarkets, hypermarkets, and convenience stores. These collaborations ensure that pre-workout gummies are widely available to a broad consumer base. Through these partnerships, pre-workout gummies brands can penetrate markets more effectively and establish a strong presence in both urban and rural areas. This widespread availability helps in maintaining a majority market share. Offline channels like supermarkets and convenience stores offer consumers the ease of picking up pre-workout gummies during their regular shopping trips. This convenience encourages repeat purchases.

The sales of pre-workout gummies through online channels are expected to grow at a CAGR of 11.6% from 2024 to 2030. E-commerce sites offer comprehensive product descriptions, ingredient lists, and customer reviews. This information helps consumers make informed decisions based on the experiences of other users, increasing their confidence in the purchase. Brands can leverage digital marketing tools to target specific demographics, increasing the effectiveness of advertising campaigns. Subscription-based models offer the convenience of regular deliveries, ensuring that consumers never run out of their favorite pre-workout gummies. These services often come with discounts and exclusive offers, encouraging long-term customer retention.

Regional Insights

North America pre-workout gummies market captured a revenue share of over 24.79% in the market. Growing consumer awareness and preferences for nutritional supplements and fortified food products have significantly boosted the consumption of pre-workout gummies in the region. Their essential role in supporting overall health, including metabolism and cardiovascular function, has made them popular among health-conscious consumers in North America. Additionally, the region's robust healthcare infrastructure and strong regulatory framework have facilitated market growth by ensuring product safety and efficacy standards. Manufacturers are also increasingly tailoring gummy supplements to target specific demographics or address particular health concerns.

U.S. Pre-workout Gummies Market Trends

The pre-workout gummies market in the U.S. is expected to grow at a CAGR of 8.3% from 2024 to 2030. The pre-workout gummies market in the U.S. is facing intense competition due to extensive product innovation in various categories, including cosmetics and vitamin-fortified foods. The increased consumption of energy gummies in the U.S. can be attributed to several factors and trends. These include a growing interest in health and wellness, the appeal of gummies as a more palatable and pleasant alternative to traditional supplement formats, and the convenience of pre-workout gummies, particularly for children or adults who may have difficulty swallowing pills. Additionally, the rising demand for natural and organic gummy supplements provides significant growth opportunities for pre-workout supplements in the U.S. gummy market.

Europe Pre-workout Gummies Market Trends

The pre-workout gummies market in Europe is expected to grow at a CAGR of 9.5% from 2024 to 2030. There is a growing awareness of health and fitness across Europe, leading to higher demand for pre-workout supplements, including gummies. Consumers are more focused on maintaining a healthy lifestyle, which includes regular exercise and proper nutrition. The convenience of gummies as a supplement format is appealing to many consumers. Gummies are easy to consume, portable, and often more palatable compared to traditional pills or powders, making them an attractive option for pre-workout nutrition. European consumers are increasingly seeking natural and organic products. This trend is driving the development and popularity of pre-workout gummies made with natural flavors, colors, and sweeteners, and free from artificial additives and preservatives.

Asia Pacific Pre-workout Gummies Market Trends

The pre-workout gummies market in Asia Pacific is expected to witness a CAGR of 9.0% from 2024 to 2030. The expanding middle-class population in countries like China, India, and Southeast Asian nations has more disposable income to spend on health and wellness products. Western fitness and dietary trends are gaining popularity in Asia Pacific. The adoption of these trends, combined with an increasing number of fitness centers and gyms, is boosting the demand for pre-workout supplements. Manufacturers are innovating by developing products that cater to local tastes and preferences. This includes creating gummies with flavors and ingredients that resonate with regional consumers, as well as addressing specific health concerns prevalent in the region.

Key Pre-workout Gummies Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are engaging in joint ventures, partnerships, mergers, agreements, and acquisitions to bolster their market position and extend their geographical reach. Leading manufacturers in the pre-workout gummies market leverage their extensive distribution networks and strong brand recognition to maintain a significant presence. They focus on quality, innovation, and catering to regional preferences, thereby solidifying their leadership in international markets that are embracing pre-workout gummies.

Key Pre-workout Gummies Companies:

The following are the leading companies in the pre-workout gummiest market. These companies collectively hold the largest market share and dictate industry trends.

- Genius Brand

- Vital Proteins LLC

- Cellucor

- MuscleTech

- Optimum Nutrition

- NutraBio

- Bare Performance Nutrition, LLC

- Alani Nu, LLC

- KAGED

- Redcon1, LLC

Recent Developments

-

In May 2023, Seattle Gummy Company (SGC) introduced a new line of gummies tailored for athletes who need rapid absorption of active ingredients before, during, and after their training or competitions. The PERFORMANCE GUMMIES line is designed to deliver critical nutrients quickly and effectively, providing athletes with the support they need at each stage of their activity. These innovative gummies help athletes prepare for their workouts, sustain their performance during exercise, and aid in a speedy recovery afterward.

-

In February 2023, Gummy supplement leader Olly entered the fitness market with two new products: Pre-Game Energize Gummy Rings and Post-Game Recovery Gummy Rings. The Pre-Game Energize Gummy Rings are crafted to prepare the body for a productive workout by enhancing energy levels and providing the stamina needed to sustain focus and performance.

Pre-workout Gummies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.74 billion

Revenue forecast in 2030

USD 2.67 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea;Australia & New Zealand; Brazil; South Africa

Key companies profiled

Genius Brand; Vital Proteins LLC; Cellucor; MuscleTech; Optimum Nutrition; NutraBio; Bare Performance Nutrition, LLC; Alani Nu, LLC; KAGED; and Redcon1, LLC

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Pre-workout Gummies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pre-workout gummies market report based on ingredient, end-use, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pre-workout gummies market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. The global pre-workout gummies market is expected to grow at a compounded growth rate of 8.9% from 2024 to 2030 to reach USD 2.67 billion by 2030.

b. The gelatin segment dominated the pre-workout gummies market with a share of 68.34% in 2023. Gelatin is highly versatile and can be used to create a wide range of gummy textures, from soft and chewy to firm. This versatility allows manufacturers to innovate and cater to diverse consumer preferences.

b. Some key players operating in the pre-workout gummies market include Genius Brand; Vital Proteins LLC; Cellucor; MuscleTech; Optimum Nutrition; NutraBio; and Bare Performance Nutrition, LLC

b. Key factors driving the market growth include increasing awareness about the importance of fitness and a healthy lifestyle. Consumers are increasingly seeking natural, organic, and clean-label supplements. Manufacturers are responding by using natural flavors, colors, and sweeteners in their gummy formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.