- Home

- »

- Advanced Interior Materials

- »

-

Pre-painted Aluminum Sheets Market, Industry Report, 2030GVR Report cover

![Pre-painted Aluminum Sheets Market Size, Share & Trends Report]()

Pre-painted Aluminum Sheets Market (2025 - 2030) Size, Share & Trends Analysis Report By Thickness (Under 2.5 mm, 2.5 mm - 3.0 mm), By Application (Aluminum Composite Panels, Signages & Boards, Vehicle Parts), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-065-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pre-painted Aluminum Sheets Market Trends

The global pre-painted aluminum sheets market size was valued at USD 5.6 billion in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2030, attributed to the escalating demand for pre-painted aluminum sheets in construction and architecture, coupled with the rising need for lightweight materials. Pre-painted aluminum sheets are increasingly favored for their durability, aesthetic appeal, and corrosion resistance.

Due to their beneficial features, the sheets are ideal for facades, roofing, and various other areas in interior design projects. The shift of the construction industry toward energy-efficient and sustainable materials is further anticipated to fuel demand for the pre-painted sheets. The lightweight nature of pre-painted aluminum sheets makes them easy to handle, transport, and install, fueling their adoption in modern architecture and infrastructure projects.

Furthermore, technological breakthroughs in coating techniques are expected to enhance the performance of pre-painted aluminum sheets, improving their durability, resistance to weathering, and color retention. These innovations make the sheets more versatile and appealing for a range of applications. In addition, the rising consumer preference for aesthetic appeal is propelling demand for pre-painted aluminum sheets in the construction, automotive, and interior design industries. The availability of various colors, finishes, and textures allows for greater design flexibility, further expanding the market as consumers seek visually attractive, high-performance materials for both functional and decorative purposes.

Thickness Insights

The 2.5 mm - 3.0 mm segment dominated the market with the largest revenue share of 79.1% in 2024, owing to the optimal balance of strength, flexibility, and cost-effectiveness of this category of sheets. Sheets of this thickness range are widely preferred in construction, roofing, and exterior cladding applications, where durability and aesthetic appeal are crucial. They offer enhanced formability while maintaining structural integrity, making them ideal for various architectural and industrial applications. The burgeoning demand for lightweight, corrosion-resistant materials and superior performance characteristics has strengthened the dominance of this segment in the pre-painted aluminum sheets industry.

The under 2.5 mm thickness segment is projected to grow at the fastest CAGR of 7.5% from 2025 to 2030, attributed to its surging demand in lightweight, high-performance applications. These thinner sheets offer excellent formability, corrosion resistance, and aesthetic appeal, making them ideal for automotive, construction, and electronics industries. The rising trend for energy-efficient and cost-effective materials in manufacturing is driving the adoption of thinner pre-painted aluminum sheets. Advancements in coating technologies and increasing consumer preference for durable yet lightweight materials are also expected to contribute to the segment's expansion.

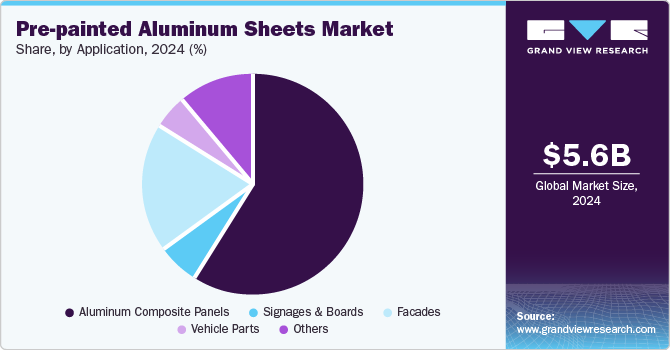

Application Insights

The aluminum composite panels (ACP) segment dominated the market with the largest revenue share of 59.2% due to their versatility, durability, and aesthetic appeal. ACPs are widely utilized in the construction and architectural industries for facades, cladding, signage, and interior applications, offering excellent resistance to weathering, corrosion, and UV rays. Their lightweight nature, superior insulation properties, and aesthetic finish options make them a preferred choice for modern building designs. The escalating demand for sustainable and visually appealing materials in construction has further propelled the growth of the ACP segment.

The facade segment is anticipated to be the fastest-growing segment, with a CAGR of 8.2% over the forecast period, driven by the demand for modern, durable, and aesthetically appealing building materials. As construction trends favor sustainable and energy-efficient solutions, pre-painted aluminum sheets are becoming popular for facades due to their lightweight, corrosion-resistant properties and versatile finishes. Increasing urban development and the need for high-performance materials in architectural designs are fueling this demand. In addition, the focus on eco-friendly construction practices and long-lasting building materials is further expected to boost the growth of the façade segment in the pre-painted aluminum sheets industry.

Regional Insights

North America pre-painted aluminum sheets market is anticipated to grow at the fastest CAGR of 6.1% during the forecast period, propelled by rapid urban & infrastructure development, and escalating demand for sustainable building materials. The focus of North America on energy-efficient, eco-friendly solutions in the construction and automotive sectors is propelling the adoption of pre-painted aluminum sheets. Moreover, technological breakthroughs in coating and painting processes, along with stringent environmental regulations, are further favoring market growth. The well-established industries across the region and increasing preference for lightweight, durable materials position North America for notable expansion in the coming years.

U.S. Pre-painted Aluminum Sheets Market Trends

The U.S. pre-painted aluminum sheets market held a considerable share in the North America in 2024, owing to the thriving construction industry and surging demand for sustainable materials. Pre-painted aluminum sheets are increasingly used in commercial and residential buildings for facades, roofing, and signage, owing to their durability, aesthetic appeal, and energy efficiency. With a focus on green building practices, eco-friendly solutions, and significant infrastructure development, the U.S. is well-positioned to lead the market, offering growth opportunities for pre-painted aluminum sheet manufacturers in the coming years.

Pre-painted aluminum sheets market in Canada is expected to record significant growth over the forecast period, owing toits expanding construction and infrastructure sectors. With a rise in demand for sustainable, energy-efficient materials, pre-painted aluminum sheets are gaining popularity in commercial and residential applications, particularly for interior liner panels, doors and trim and decorative purposes. The emphasis on green building certifications and eco-conscious construction practices of Canada supports the adoption of these materials. As urbanization continues and government initiatives prioritize sustainability, Canada pre-painted aluminum sheets market is expected to have ample growth opportunities.

Europe Pre-Painted Aluminum Sheets Market Trends

Europe pre-painted aluminum sheets market is projected to register a notable CAGR during the forecast period, attributed to the robust construction and automotive sectors in the region, which prioritize sustainable, durable, and visually appealing materials. The focus on energy-efficient building practices and green construction initiatives of the region has led to increased demand for pre-painted aluminum sheets in architectural applications such as facades, cladding, and roofing. Besides, the rising adoption of lightweight materials in automotive manufacturing and other industries is also accelerating market growth in this region. Advanced technological capabilities in coating processes and European stringent environmental regulations further contribute to market growth.

Germany pre-painted aluminum sheets market is expected to accumulate remarkable gains by 2030, owing toits strong industrial base and demand for sustainable, high-performance building materials. With a growing emphasis on eco-friendly construction and energy-efficient solutions, pre-painted aluminum sheets are increasingly favored in architectural designs for facades and roofing. The leadership of Germany in green building certifications and advanced manufacturing techniques further accelerates the adoption of these sheets. As urbanization and infrastructure projects expand, the pre-painted aluminum sheets industry in Germany is set to witness growth.

The UK is anticipated to establish a considerable foothold by 2030, fueled bysurging demand for sustainable and visually appealing building materials. With booming urban and infrastructure development, the construction sector is rapidly adopting pre-painted aluminum sheets for facades, cladding, and roofing applications. The emphasis of the UK on energy-efficient, durable, and low-maintenance materials aligns with the benefits of pre-painted aluminum. Consumer demand for aesthetic finishes and design flexibility is also driving its adoption in various sectors, including automotive, architecture, and signage, further fueling market growth.

Asia Pacific Pre-Painted Aluminum Sheets Market Trends

Asia Pacific pre-painted aluminum sheets market held the largest share of 51.8% in 2024, owing tofast-paced urbanization, rise in construction activities, and surging demand for lightweight and durable materials. The booming infrastructure projects, particularly in countries such as China, India, and Japan, are driving the demand for lightweight, durable, and aesthetically appealing materials, such as pre-painted aluminum sheets, in building facades, roofing, and cladding across the region. Furthermore, the automotive and transportation sectors in Asia Pacific are adopting aluminum sheets for their strength and aesthetic appeal. Government initiatives promoting sustainable building practices and energy-efficient materials have further favored the market growth in the region. The availability of cost-effective manufacturing and competitive pricing has further enhanced the prominence of Asia Pacific in the global market.

China pre-painted aluminum sheets industry registered a substantial revenue share in 2024 due torapid urbanization and the booming construction sector. With increasing demand for modern architecture, high-quality pre-painted aluminum sheets are sought for partitioning walls, decorative elements, and interior ceilings. The focus of China on infrastructure development and green building initiatives further fuels the need for durable, lightweight, and aesthetically pleasing materials. In addition, robust manufacturing capabilities, competitive pricing, and surging awareness of sustainable construction practices position China to lead the market in the years ahead.

Pre-painted aluminum sheets in India is projected to witness growth over the forecast period,driven byfast-paced urban and infrastructure development and burgeoning demand for modern building materials. With the expanding construction industry of the country, there is an increasing need for durable, lightweight, and aesthetically versatile materials such as pre-painted aluminum sheets. Moreover, government initiatives such as “Housing for All” and smart city projects are accelerating the demand for innovative building solutions. The growing emphasis on sustainability and energy-efficient construction is further supporting the adoption of pre-painted aluminum sheets in India.

Key Pre-painted Aluminum Sheets Company Insights

Some of the key companies in the pre-painted aluminum sheets industry include Alucosuper New Materials Co., Ltd.; Cascadia Metals; ITALCOAT S.r.l.; Arconic; Novelis; Ertegan BV; Henan Stek Color Aluminium Co. Ltd; Richard Austin Alloys.

-

Richard Austin Alloys provides high-quality aluminum products, specializing in aluminum alloys, sheets, plates, and coils for various industries, including construction and automotive.

-

Cascadia Metals offers a wide range of high-quality metal products, including aluminum, steel, and stainless steel, along with customized processing services. It serves industries with reliable supply chain solutions and expertise.

Key Pre-painted Aluminum Sheets Companies:

The following are the leading companies in the pre-painted aluminum sheets market. These companies collectively hold the largest market share and dictate industry trends.

- Alucosuper New Materials Co., Ltd.

- Cascadia Metals

- ITALCOAT S.r.l.

- Arconic

- Novelis

- Ertegan BV

- Henan Stek Color Aluminum Co., Ltd

- Richard Austin Alloys

Recent Developments

-

In November 2024, ALUCOBOND introduced ALUCODUAL, a new engineered solid sheet designed for architectural applications. This innovative product enhances the portfolio of advanced cladding solutions, combining superior design and performance for modern architectural needs.

-

In November 2024, Meviy introduced anodized aluminum sheets in clear and black finishes to its sheet-metal service lineup. These pre-finished sheets are perfect for 3D CAD design projects, offering enhanced versatility and precision.

-

In November 2022, AZZ Inc. announced its plans to construct a new aluminum coil coating facility in Washington, Missouri. This expansion aims to boost production capacity and cater to the increasing demand for environmentally-friendly aluminum coil products.

Pre-painted Aluminum Sheets Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.0 billion

Revenue forecast in 2030

USD 8.9 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in kilotons, USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Thickness, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Türkiye; China; India; Japan; South Korea; Brazil

Key companies profiled

Alucosuper New Materials Co., Ltd., Cascadia Metals; Ertegan BV; ITALCOAT S.r.l.; Novelis; Arconic; Henan Stek Color Aluminum Co., Ltd; and Richard Austin Alloys.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pre-Painted Aluminum Sheets Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global pre-painted aluminum sheets market report based on thickness, application, and region:

-

Thickness Outlook (Revenue, Kilotons; USD Million, 2018 - 2030)

-

Under 2.5 mm

-

2.5 mm - 3.0 mm

-

Others

-

-

Application Outlook (Revenue, Kilotons; USD Million, 2018 - 2030)

-

Aluminum Composite Panels

-

Signages & Boards

-

Facades

-

Vehicle Parts

-

Others

-

-

Regional Outlook (Revenue, Kilotons;USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Türkiye

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.