- Home

- »

- Consumer F&B

- »

-

Pre-packaged Sandwiches Market Size & Share Report 2030GVR Report cover

![Pre-packaged Sandwiches Market Size, Share & Trends Report]()

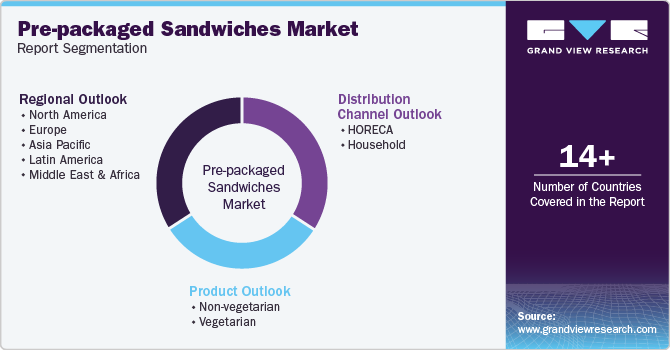

Pre-packaged Sandwiches Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Non-vegetarian, Vegetarian), By Distribution Channel (HORECA, Household), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-471-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pre-packaged Sandwiches Market Trends

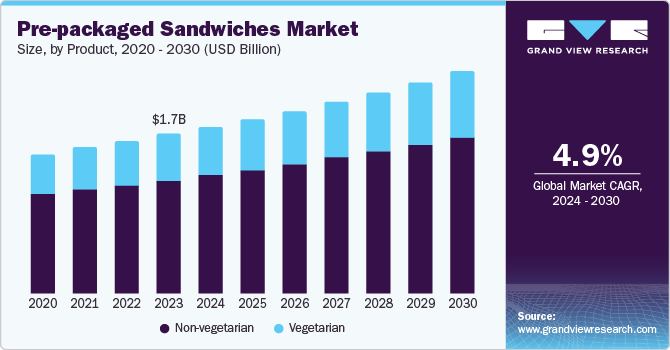

The global pre-packaged sandwiches market size was valued at USD 1.74 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Growing demand for convenience food among the working class is expected to remain a driving factor for the market worldwide. Furthermore, over the past few years, the availability of a wide range of products for different dietary preferences and tastes has been fueling the demand for convenience products, including pre-packaged sandwiches.

The increasing focus on health and wellness is another factor influencing the market. Consumers are increasingly seeking food choices that are both convenient and healthy. Consequently, manufacturers are prioritizing the creation of pre-packaged sandwiches containing nutritious components like whole grains, lean proteins, and fresh vegetables. Moreover, the increasing popularity of dietary restrictions such as gluten-free, vegetarian, and vegan diets has led to the development of specialized pre-packaged sandwiches to meet the demands of these particular consumers. The market's consumer base has grown due to the wide selection of options that cater to diverse dietary needs.

The growth of retail outlets and the rising presence of convenience stores and supermarkets have driven the market growth. The widespread availability of pre-packaged sandwiches at various retail outlets has made them accessible to consumers. Furthermore, the increasing demand for online food delivery services has also helped expand the market by providing convenient and effective access to different pre-packaged sandwich choices.

Product Insights

The non-vegetarian segment dominated the market and accounted for a revenue share of 71.1% in 2023. Traditionally, sandwiches have been associated with non-vegetarian fillings, such as chicken, tuna, and ham, which have established a strong consumer base for the pre-packaged sandwich market. Moreover, the versatility of non-vegetarian proteins allows for a wider range of flavor combinations and product differentiation, thereby enhancing market appeal. Additionally, the perception of non-vegetarian sandwiches as providing a more substantial and satisfying meal option has contributed to their popularity among consumers wanting a convenient and fulfilling eating experience.

The vegetarian segment is expected to register the fastest CAGR during the forecast period. The rapid growth is attributed to the rising trend of plant-based diets and the increasing number of consumers adopting vegetarian or flexitarian lifestyles. The growing recognition of the health benefits associated with plant-based consumption, such as low risk of chronic diseases and enhanced overall health and well-being, fuels the desire for vegetarian sandwich options. Furthermore, the increasing occurrence of food allergies and intolerances is driving the use of vegetarian options as safer and more inclusive selections. Moreover, the growing access to new plant-based ingredients and technologies has allowed manufacturers to develop a broader range of flavorful vegetarian sandwiches, helping grow this market segment.

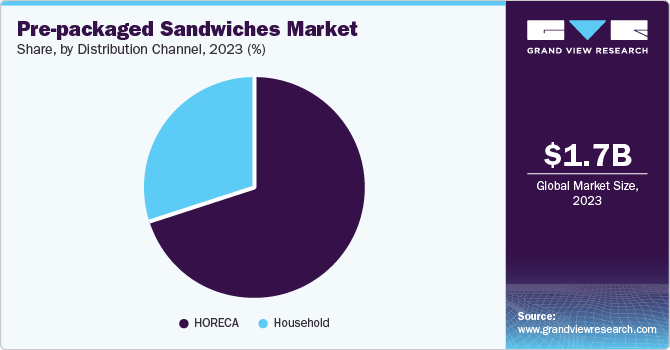

Distribution Channel Insights

The HORECA channel accounted for the largest revenue share in 2023. The fast-paced nature of the HORECA industry is an excellent match for the convenience and time-saving benefits of pre-packaged sandwiches. These businesses serve diverse consumers with varying food preferences and time constraints, making pre-packaged sandwiches an ideal option. Offering a variety of sandwich choices, including different flavors, fillings, and types of bread, enhances customer satisfaction and boosts sales. Furthermore, the increasing trend of food service outsourcing and the growing demand for grab-and-go options have contributed to the sector's dominance.

The household distribution channel is expected to register the fastest CAGR during the forecast period. The growth is primarily attributed to the rising popularity of quick and easily consumable meal options within households. The evolving consumer lifestyle, characterized by hectic schedules and less time for cooking, has increased the need for pre-packaged sandwiches as a convenient and time-efficient option. Furthermore, the increase in dual-income households and the higher occurrence of single-person households have also played a part in the growth of this segment. Additionally, the increased availability of pre-packaged sandwiches in different retail outlets such as grocery stores, supermarkets, convenience stores, and online platforms, has enhanced accessibility and fueled consumer adoption.

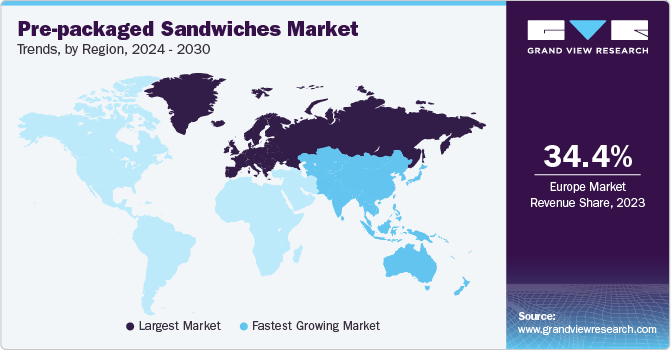

Regional Insights

Europe pre-packaged sandwiches market dominated the market revenue share with 34.4% in 2023. The region has a well-established food service sector, with many convenience stores, supermarkets, and fast-food restaurants, making it easy to get and eat pre-packaged sandwiches. A strong consumer base with busy schedules who prefer convenient meal options has driven the market's growth. Furthermore, the variety of food options in the region, along with a focus on innovations and creating new products, has resulted in a diverse range of sandwiches that appeal to different tastes and dietary needs, further increasing the potential for market growth.

UK Pre-packaged Sandwiches Market Trends

The UK dominated the European pre-packaged sandwiches market in 2023. A fast-paced lifestyle, a large workforce, and a culture of on-the-go consumption have created a robust demand for convenient, ready-to-eat food options. Moreover, the UK boasts a mature retail environment, with a strong presence of convenience stores and supermarkets, facilitating the widespread availability of pre-packaged sandwiches. Additionally, a strong focus on innovation and product development within the food industry has contributed to the market growth in the UK.

North America Pre-packaged Sandwiches Market Trends

North America pre-packaged sandwiches market was identified as a lucrative region in 2023. The widespread availability of pre-packaged sandwiches in the market is reinforced by the strong presence of established food service chains and retail outlets, along with a well-developed regional distribution network. Additionally, the rise in disposable income of consumers and their preference for high-quality and handmade sandwiches have contributed to market growth.

The U.S. pre-packaged sandwiches market is expected to grow rapidly in the coming years. The growing prevalence of dual-income families and households with only one individual has driven the demand for pre-packaged sandwiches as a convenient meal option. Moreover, the increased focus on health and wellness has stimulated the innovation of healthier sandwich options, expanding the consumer demographic in the market.

Asia Pacific Pre-packaged Sandwiches Market Trends

Asia Pacific pre-packaged sandwiches market is anticipated to witness the fastest CAGR over the forecast period. The region's growth is attributed to rapid urbanization, which leads to increasingly hectic lifestyles and a surge in demand for convenient and ready-to-consume food options. Moreover, rising disposable incomes and changing dietary preferences fuel the consumption of pre-packaged sandwiches. The growing number of young professionals and students prioritizing time efficiency are key consumers driving market growth. Additionally, the expanding retail infrastructure and the increasing penetration of convenience stores and supermarkets are improving the accessibility of pre-packaged sandwiches, contributing to market growth.

China's pre-packaged sandwiches market held a substantial market share in 2023. The demand for convenient and time-saving meal options has increased due to the country's rapid urbanization and rising workforce. Furthermore, the growing financial resources of the middle class in China have allowed people to try various food options, such as ready-made sandwiches. Furthermore, the increasing impact of Western culture and the embracing of fast-paced lifestyles have also played a role in the growing acceptance of pre-packaged food options, further fueling market growth.

Key Pre-packaged Sandwiches Company Insights

Some of the key companies in the pre-packaged sandwiches market include Greencore Group plc, Marks & Spencer Group plc, Tyson Foods, Inc., Norac Food, Raynor Foods Limited, Landshire, Inc., and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives such as new product launches, innovations, and acquisitions.

-

Greencore Group plc is one of the key players in the pre-packaged food industry, with a significant presence in the pre-packaged sandwiches market. The company operates across multiple geographies and produces diverse food products, including sandwiches, salads, and sushi. Renowned for its emphasis on innovation and consumer trends, Greencore Group caters to retail and food service channels.

-

Tyson Foods, Inc. is a manufacturer of pre-packaged sandwiches. As one of the key manufacturers, it offers a wide range of chicken sandwiches that cater to consumer demand for high-quality, convenient food options. Their pre-packaged sandwiches come individually wrapped for serving ease, added safety, and greater peace of mind. With its strong brand presence and focus on product innovation, Tyson Foods is well-positioned to capitalize on the growing demand for pre-packaged sandwiches, expected to reach USD 18.2 billion by 2025.

Key Pre-Packaged Sandwiches Companies:

The following are the leading companies in the pre-packaged sandwiches market. These companies collectively hold the largest market share and dictate industry trends.

- Greencore Group plc

- Marks & Spencer Group plc

- Tyson Foods, Inc.

- Norac Food

- Raynor Foods Limited

- Landshire, Inc.

- The Brunch Box

- URBAN EAT

- AROUND NOON

- Grand Strand Sandwich Company Inc.

Recent Developments

-

In May 2023, Tyson Foods, Inc. announced the completion of its acquisition of Williams Sausage Company, Inc. of Union City, Tenn. This strategic move aligns with Tyson Foods' goal of expanding its production capacity and range of products to ensure the uninterrupted functioning of business activities.

Pre-packaged Sandwiches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.83 billion

Revenue forecast in 2030

USD 2.44 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, Brazil, and South Africa

Key companies profiled

Greencore Group plc; Marks & Spencer Group plc; Tyson Foods, Inc.; Norac Food; Raynor Foods Limited; Landshire, Inc.; The Brunch Box; URBAN EAT; AROUND NOON; Grand Strand Sandwich Company Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pre-packaged Sandwiches Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pre-packaged sandwiches market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-vegetarian

-

Vegetarian

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

HORECA

-

Household

-

Supermarkets & Hypermarkets

-

Specialty Store

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.