Power Transmission And Distribution Market Size, Share & Trends Analysis Report By Asset (Transmission Line, Distribution Line), By End Use (Electric Utility, Industrial, Renewables), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-466-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

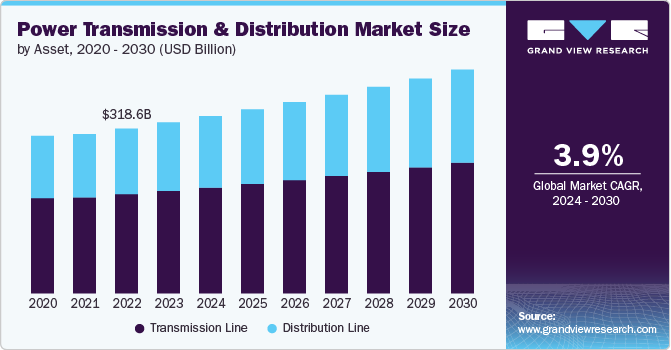

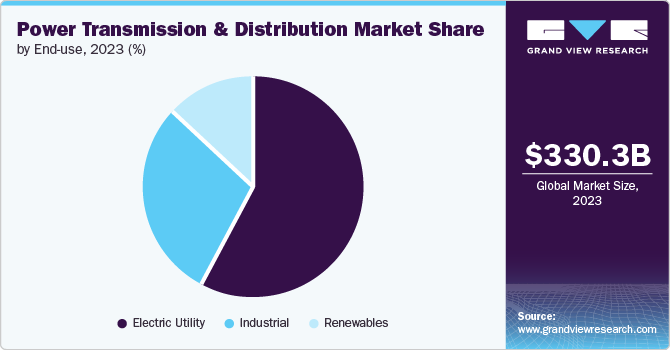

The global power transmission and distribution market size was valued at USD 330,287.71 million in 2023 and expected to expand at a CAGR of 3.9% from 2024 to 2030. The market is experiencing significant growth, driven primarily by the increasing demand for electricity, particularly in emerging economies. Rapid industrialization, urbanization, and population growth are key factors boosting the need for expanded and upgraded transmission and distribution (T&D) infrastructure. The shift towards renewable energy sources, such as wind and solar, is also driving investments in smart grids and advanced T&D systems to efficiently integrate and manage renewable energy into the grid.

Technological advancements in digitalization, automation, and the implementation of smart grids are transforming the traditional T&D landscape. These innovations allow for better real-time monitoring, control, and optimization of the power flow, resulting in enhanced grid reliability and reduced energy losses. The adoption of advanced T&D technologies, such as high-voltage direct current (HVDC) and flexible AC transmission systems (FACTS), is further enabling the efficient long-distance transmission of electricity, addressing the need for improved grid connectivity and stability.

Government initiatives and regulatory frameworks promoting grid modernization and electrification are propelling the market forward. Countries worldwide are making significant investments to upgrade aging infrastructure, reduce carbon emissions, and enhance energy efficiency. Additionally, the ongoing electrification of remote and rural areas, particularly in developing regions, is creating opportunities for T&D market players. The global focus on sustainability and clean energy transition is expected to continue fueling growth in the power transmission and distribution sector in the coming years.

Drivers, Opportunities & Restraints

The global power transmission and distribution (T&D) market is driven by several key factors, with increasing electricity demand being at the forefront. Rapid urbanization, industrialization, and the growing electrification of transportation and other sectors are significantly boosting the need for advanced T&D infrastructure. Additionally, the global shift towards renewable energy is acting as a catalyst for investments in smart grids and energy storage solutions, which are essential for integrating intermittent energy sources like wind and solar into the grid. The push for clean energy is further supported by government policies and financial incentives aimed at reducing carbon footprints and enhancing grid resilience, which collectively fuel growth in the T&D sector.

Despite these drivers, the market faces notable restraints. High capital costs associated with upgrading aging infrastructure and deploying advanced T&D technologies present financial challenges, particularly in developing economies. Additionally, regulatory hurdles, lengthy approval processes, and concerns over land acquisition for the installation of new transmission lines create bottlenecks that slow down infrastructure expansion. Moreover, intermittent renewable energy generation and grid integration complexities pose technical challenges, requiring robust and often costly solutions to ensure grid stability and reliability.

Opportunities in the T&D market are abundant, particularly in the development of smart grids, energy storage systems, and the deployment of digital technologies for grid management. The growing focus on rural electrification in developing countries offers significant potential for market expansion, as governments and international organizations work to extend power access to remote areas. Similarly, investments in HVDC and flexible AC transmission systems present opportunities to enhance long-distance power transmission and reduce energy losses, addressing global energy efficiency goals. These advancements are expected to open new avenues for innovation and growth in the T&D market, particularly as the demand for reliable and sustainable energy solutions continues to rise.

Asset Insights

Based on asset type, transmission line held the market with the largest revenue share of 59.93% in 2023. This leading position is driven by the crucial role that transmission lines play in transporting electricity over long distances, from power generation sites to distribution networks and end consumers. The rising global demand for electricity, particularly in rapidly industrializing and urbanizing regions, has amplified the need for efficient and expansive transmission networks. Moreover, the transition to renewable energy sources, such as solar and wind, necessitates robust transmission infrastructure to connect often remote renewable energy farms to national grids and urban centers. Investments in high-voltage transmission lines, especially High Voltage Direct Current (HVDC) systems, are becoming increasingly common as countries aim to reduce energy losses and improve grid stability over long-distance power transmission.

The growing adoption of advanced transmission technologies, such as smart grids and flexible AC transmission systems (FACTS), is further boosting the prominence of transmission lines in the market. These technologies enable more efficient power flow management, reduce transmission losses, and increase grid reliability, all of which are critical in meeting the rising global energy demand. Additionally, many countries are undertaking large-scale grid modernization projects to replace aging infrastructure, which is another factor contributing to the increasing share of transmission lines. With governments and energy companies prioritizing the expansion and upgrading of transmission networks to accommodate the growing electricity demand and the integration of renewable energy, transmission lines are expected to maintain their dominant position in the power transmission and distribution market in the coming years.

End-use Insights

Based on end use, Electric utility held the market with the largest revenue share of 57.73% in 2023. This substantial share is largely driven by the essential role electric utilities play in generating, transmitting, and distributing electricity to end users across various industries and households. As the backbone of national and regional power systems, electric utilities are responsible for managing and maintaining vast grids, making them the primary consumers of transmission and distribution infrastructure. The rising global demand for electricity, coupled with an increased focus on renewable energy integration, has led electric utilities to invest heavily in upgrading aging infrastructure, enhancing grid resilience, and deploying advanced technologies such as smart grids. These investments are necessary to accommodate fluctuating energy loads and manage the complexities of integrating renewable energy sources, which are often intermittent in nature.

Moreover, regulatory pressures and government incentives aimed at achieving energy efficiency and reducing carbon emissions have further propelled growth in the electric utility sector. Governments worldwide are pushing utilities to modernize grids and adopt cleaner energy practices, which includes the expansion of transmission and distribution networks to connect renewable energy projects, as well as the development of energy storage solutions to manage grid reliability. As electric utilities strive to meet both regulatory requirements and the increasing consumer demand for reliable power, their dominance in the transmission and distribution market is set to continue. The sector's focus on modernization, particularly through the deployment of advanced technologies such as automated grid management and real-time monitoring systems, will ensure that electric utilities remain central players in the power transmission and distribution landscape.

Regional Insights

In North America, the power transmission and distribution market is witnessing significant modernization, driven by the need to replace aging infrastructure and accommodate the growing adoption of renewable energy. With a strong focus on improving grid reliability and resilience, particularly in response to extreme weather events, investments are being channeled into upgrading transmission lines and integrating smart grid technologies. The transition to cleaner energy sources, along with federal support for grid modernization, is expected to fuel continued growth in the market.

U.S. Power Transmission and Distribution Market Trends

The U.S. is at the forefront of North America's power transmission and distribution market, driven by government initiatives to modernize the grid and reduce carbon emissions. Large-scale investments in high-voltage transmission lines and the development of microgrids are addressing the need for enhanced reliability and efficiency. The push for renewable energy integration, along with the Biden administration's focus on infrastructure improvements, is propelling the sector forward, while the increasing prevalence of electric vehicles (EVs) is creating new challenges and opportunities for grid expansion.

Europe Power Transmission And Distribution Market Trends

In Europe, the power transmission and distribution market is strongly influenced by the European Union’s commitment to reducing carbon emissions and achieving energy security. Investments in cross-border interconnectors and smart grids are key trends as countries seek to improve grid integration and accommodate the growing share of renewable energy. The European Green Deal and various national policies promoting energy efficiency and renewable adoption are expected to sustain market growth across the region.

Germany power transmission and distribution market is leading Europe's energy transition, or "Energiewende," which is driving demand for advanced transmission and distribution systems to handle the increasing penetration of renewable energy sources like wind and solar. The country is investing in both local grid improvements and long-distance transmission lines, especially high-voltage direct current (HVDC) systems, to ensure efficient power transfer between regions. Germany’s focus on phasing out nuclear and coal power is accelerating grid upgrades to ensure stability and efficiency.

Power transmission and distribution market in UK is being shaped by its ambitious net-zero targets and the ongoing shift toward renewable energy. Significant investments are being made in offshore wind farm connections and the development of smart grids to better manage energy flows. Additionally, grid modernization efforts are underway to meet the rising demand for electricity from electric vehicles and heating systems, with a focus on reducing carbon emissions and improving energy efficiency.

Asia Pacific Power Transmission And Distribution Market Trends

Asia Pacific continues to dominate the global power transmission and distribution market, driven by rapid urbanization, industrialization, and population growth. Countries like China and India are making large-scale investments in grid expansion and modernization to meet increasing electricity demand and integrate renewable energy. The development of smart grids and energy storage solutions is also gaining traction, as the region seeks to enhance grid stability and reduce energy losses.

Asia Pacific dominated the global power transmission and distribution market and accounted for largest revenue share of over 40.04% in 2023. This dominance was fueled by rapid industrialization, urbanization, and the growing energy needs of countries like China, India, and Japan. Significant investments in grid expansion and modernization, particularly to support the integration of renewable energy sources, have been key drivers of the region’s growth. The focus on improving energy access in rural areas and upgrading aging infrastructure further contributed to Asia Pacific's strong market position.

Government policies promoting electrification and energy efficiency across the region have also boosted the power transmission and distribution sector. As nations push toward clean energy transitions and invest in advanced technologies such as smart grids, Asia Pacific's role in the global market is expected to remain robust, driven by rising energy demand and continued economic expansion.

China Power Transmission And Distribution Market leads the Asia Pacific market, with massive investments in power transmission and distribution infrastructure to support its growing energy needs and renewable energy ambitions. The country is heavily focused on the deployment of ultra-high voltage (UHV) transmission lines to efficiently transmit power across vast distances, connecting renewable energy sources in remote areas to urban centers. China’s push for grid modernization, including the integration of smart technologies, is expected to remain a key growth driver.

Power transmission and distribution market in Japan is evolving in response to the country’s shift toward renewable energy and its commitment to reducing greenhouse gas emissions. Investments in grid modernization, including the integration of smart grids and energy storage systems, are increasing. The country is also focusing on improving grid resilience following natural disasters, particularly in the wake of the 2011 Fukushima disaster, which highlighted vulnerabilities in Japan's energy infrastructure.

In Central and South America, the power transmission and distribution market is expanding as countries work to improve energy access and integrate renewable energy sources. Brazil, the region’s largest market, is making significant investments in transmission lines to connect hydroelectric and wind energy projects to the grid. Grid expansion and electrification efforts in rural and underserved areas are also key trends, as governments aim to ensure reliable energy access across the region.

Middle East & Africa Power Transmission And Distribution Market Trends

The power transmission and distribution market in the Middle East and Africa is growing due to rising energy demand, driven by population growth and industrialization. In the Middle East, countries like Saudi Arabia and the UAE are investing in grid expansion to support economic diversification and renewable energy projects, particularly solar power. In Africa, efforts to improve energy access and modernize outdated infrastructure are key drivers, with several international organizations providing financial support for electrification and grid development projects. The region's focus on renewable energy integration, along with efforts to improve energy reliability, is expected to sustain market growth.

Key Power Transmission And Distribution Company Insights

The global power transmission and distribution market features a highly competitive landscape with prominent players such as General Electric, Siemens, ABB, and Crompton Greaves leading the industry. These companies are heavily investing in research and development to innovate and enhance their product portfolios, aiming to meet the growing global demand for efficient and reliable power transmission solutions. With the increasing focus on renewable energy integration, grid modernization, and reducing energy losses, these key players are advancing technologies such as high-voltage transmission lines, smart grids, and flexible AC transmission systems (FACTS), ensuring they remain at the forefront of market developments.

Regional dynamics in the power transmission and distribution market highlight North America and Europe as significant players, driven by ongoing grid upgrades, the need for energy efficiency, and strong governmental support for renewable energy projects. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by rapid urbanization, industrialization, and ambitious renewable energy targets in countries like China and India. In response to these evolving demands, companies are also pursuing strategic partnerships and acquisitions, while focusing on innovations to strengthen their market positions. The competitive landscape is expected to remain dynamic as these key players continue to address the shifting needs of customers and adapt to the global energy transition.

Key Power Transmission And Distribution Companies:

The following are the leading companies in the power transmission and distribution market. These companies collectively hold the largest market share and dictate industry trends.

- Duke Energy Corporation

- National Grid plc

- Enel SpA

- E.ON SE

- NextEra Energy, Inc.

- Dominion Energy, Inc.

- Tokyo Electric Power Company Holdings

- American Electric Power Company, Inc.

- Power Grid Corporation of India

- State Grid Corporation of China

Recent Developments

-

In June 2024, L&T's Power Transmission & Distribution business has secured an order valued between Rs 1000 crore and Rs 2500 crore to construct a solar panel and battery energy storage plant. This project aligns with the growing focus on renewable energy and energy storage solutions in India, as it aims to enhance energy reliability and support the integration of solar power into the grid.

-

In February 2024, GE Vernova’s Grid Solutions has secured multi-million dollar orders from the Power Grid Corporation of India (PGCIL) to supply 765 kV Shunt Reactors for various transmission system projects across the country. These projects are part of PGCIL's initiatives to integrate renewable energy into India's national grid and improve electricity transmission, particularly in regions like Rajasthan and Karnataka.

Power Transmission And Distribution Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 342,640.47 million |

|

Revenue forecast in 2030 |

USD 432,232.23 million |

|

Growth rate |

CAGR of 3.9% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Asset, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Duke Energy Corporation; National Grid plc; Enel SpA; E.ON SE; NextEra Energy, Inc.; Dominion Energy, Inc.; Tokyo Electric Power Company Holdings; American Electric Power Company, Inc.; Power Grid Corporation of India; State Grid Corporation of China |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Power Transmission And Distribution Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global power transmission and distribution market report on the basis of asset, end use and region:

-

Asset Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmission Line

-

Distribution Line

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Utility

-

Industrial

-

Renewables

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global power transmission and distribution market size was estimated at USD 330.29 billion in 2023 and is expected to reach USD 342.64 billion in 2024.

b. The global power transmission and distribution market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 432.23 billion by 2030.

b. Based on asset type, transmission lines were the dominant segment in 2023, with a revenue share of about 59.93%. This is attributable to their critical role in efficiently transporting electricity over long distances. Increasing demand for reliable power supply and the need to integrate renewable energy sources have driven significant investments in transmission infrastructure.

b. .Some of the key players operating in this industry include Duke Energy Corporation, National Grid plc, Enel SpA, E.ON SE, NextEra Energy, Inc., Dominion Energy, Inc., Tokyo Electric Power Company Holdings, American Electric Power Company, Inc., Power Grid Corporation of India, State Grid Corporation of China.

b. The power transmission and distribution market is driven by rising electricity demand from urbanization and industrial growth, coupled with the urgent need to integrate renewable energy sources into existing grids. Additionally, government initiatives aimed at modernizing infrastructure and enhancing energy efficiency further propel market expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."