- Home

- »

- Distribution & Utilities

- »

-

Power Transformer Market Size, Share, Industry Report 2033GVR Report cover

![Power Transformer Market Size, Share & Trends Report]()

Power Transformer Market (2025 - 2033) Size, Share & Trends Analysis Report By Core (Closed, Shell, Berry), By Insulation (Gas, Oil), By Phase (Single, Three), By Rating, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-136-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Transformer Market Summary

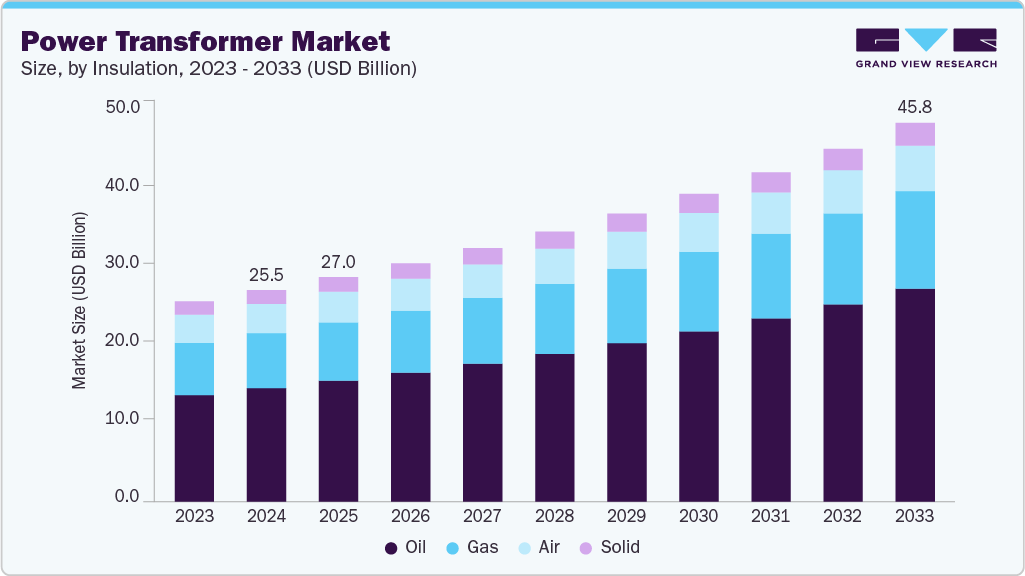

The global power transformer market size was estimated at USD 25.47 billion in 2024 and is projected to reach USD 45.82 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. Increasing electricity demand in emerging and developed countries, with rising investment in infrastructure, is expected to be the key driving force for the market’s growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific power transformer market held the largest share of 40.78% of the global market in 2024.

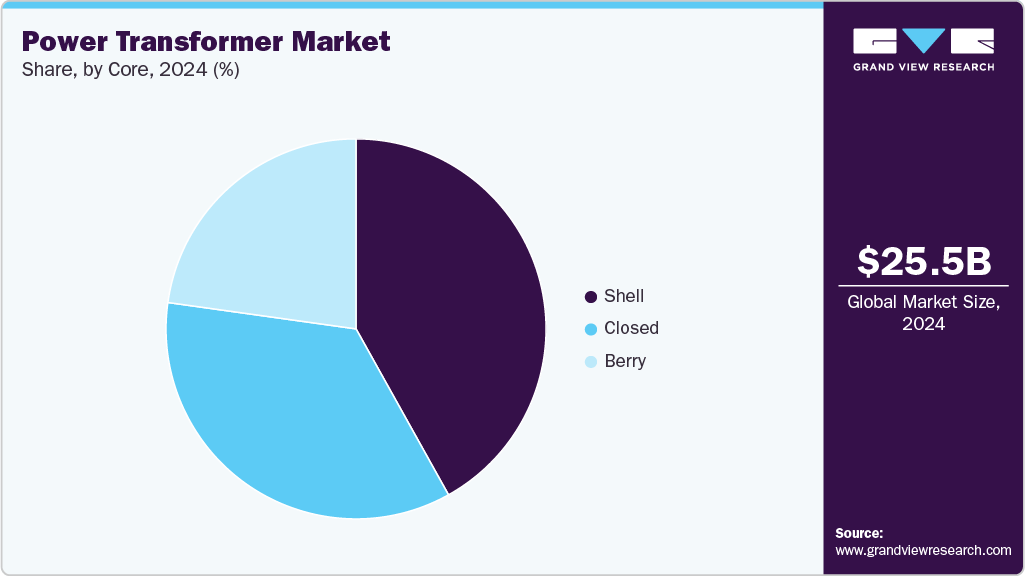

- By core, the shell segment held the highest market share of 41.9% in 2024.

- Based on insulation, the oil segment held the highest market share in 2024.

- By phase, the three-phase segment held the highest market share in 2024.

- By rating, the 100 MVA to 500 MVA segment held the highest market share in 2024.

- By application, the industrial segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.47 Billion

- 2033 Projected Market Size: USD 45.82 Billion

- CAGR (2025-2033): 6.8%

- Asia Pacific: Largest market in 2024

High demand and supportive initiatives for smart grid development have resulted in the need for smart meters, which are expected to positively impact power transformer industry growth over the next five years. In addition, a number of government initiatives for installing technologically advanced power transformers and modernizing the existing power grids for improving energy efficiency and minimizing losses are projected to positively impact demand for the power transformer industry. The power transformer industry will be driven by rising transmission network research and the fast use of non-traditional and renewable energy sources for generating electricity in remote places during the assessment period. Smart grids can be accessed and monitored remotely, and they can rapidly adjust to changes in electricity demand. In addition, they guarantee effective cooling and power delivery, which lowers carbon emissions. During the projection period, the development of green transformers, high voltage transmission technologies, and strict government regulations aimed at lowering greenhouse gas emissions will support the expansion of the worldwide power transformer industry.

Due to the environmental safety precautions and cutting-edge features supplied by eco-friendly products, traditional transformers are expected to be replaced. These are incompatible with the current environmental and technological criteria. Moreover, developed nations are incorporating wind and other renewable sources into cross-border electricity trading, which is increasing the pressure on aging networks.

In addition, due to the current aging infrastructure, challenges like short circuits occur frequently, creating profitable growth potential for players in the power transformer industry. A super grid and smart grid are being developed since low-carbon emissions are becoming a bigger concern. In addition, it is predicted that increasing PCB replacement programs, burgeoning green initiatives, and service expansions in resource-based industries would all present significant prospects for the power transformer industry.

The primary materials used in the production of power transformers are steel, aluminium, and copper. The sale of power transformers will be restricted in middle- and low-income nations due to an increase in the overall price of these raw materials. Power transformers are more expensive than traditional power distribution systems due to fluctuations in the raw material supply and disruptions in the supply channels and distribution brought on by pandemics.

Over the forecast period, the lack of quality steel, installation processes, lengthy manufacturing for power transformers, and the significant capital expenditures necessary to build the supporting infrastructure for reliable and stable transformer operation will negatively impact the power transformer industry’s expansion. Leading industry competitors are attempting to lower the cost of producing transformers. Using more effective monitoring methods and alternative materials is one of their primary cost-cutting strategies.

Drivers, Opportunities & Restraints

The power transformer industry is primarily driven by the rising global demand for electricity, fueled by rapid industrialization, urbanization, and increasing infrastructure investments across developing and developed nations. Aging power grid infrastructure in North America and Europe also prompts upgrades and replacements, creating steady demand for new and more efficient power transformers. In addition, integrating renewable energy sources such as solar and wind into the grid has intensified the need for advanced power transformers that can handle fluctuating loads and bidirectional power flows, further supporting market expansion.

The power transformer industry opportunities are expanding with the global push toward energy transition and grid modernization. Government-backed electrification programs, particularly in Asia Pacific and Africa, pave the way for large-scale installations. Technological advancements, including developing eco-friendly transformers with reduced noise and minimal oil usage, offer promising potential for utilities focused on sustainability. Digitalization trends, including remote monitoring and predictive maintenance capabilities, are also opening new doors for innovation and enhanced operational efficiency in smart grids.

Despite the growth, the market faces restraints such as the high initial investment and long lead times associated with transformer manufacturing and installation. Complex regulatory approvals and standards across different regions can delay projects and increase compliance costs. Raw material price volatility, especially for copper and silicon steel, and supply chain disruptions pose additional challenges. Moreover, managing transformer efficiency, losses, and safety in extreme environmental conditions requires advanced engineering solutions and robust R&D investments.

Insulation Insights

Based on insulation, the segment is divided into sub-segments such as gas, oil, solid, air, and other insulation types. The oil insulation accounted for the largest market share of 59.0% in 2024 and is expected to foresee a positive CAGR of 7.3% from 2025 to 2033. Oil as an insulation medium is often used in different industries, owing to its ability to maintain stability in high temperatures. Its electrical insulation qualities, such as its dielectric ability, reduce any incoming damage from high voltage. These advantages position oil insulators as the preferred choice among manufacturers.

Furthermore, oil also prevents other components, such as copper coils, from damage, such as burning oil, as an insulator is used in fluorescent lamp ballasts, high-voltage capacitors, oil-filled transformers, high-voltage switches, and circuit breakers. Generally, the transformers use mineral oil (mostly naphthenic), silicone, and bio-based oils for insulations. However, as environmental concerns are becoming more prevalent among transformer manufacturers worldwide, they are shifting toward more eco-friendly alternatives such as ester oil for developing transformers.

For instance, in April 2024, Baoding Tianwei Baobian Electric Co. Ltd. announced advancements in its natural ester oil-based transformer technology, reaffirming its focus on sustainable high-voltage solutions. The company highlighted the continued deployment of its 110kV transformer using natural ester insulating oil, which maintains a high ignition point above 300°C and achieves a 98% natural degradation rate-key for reducing environmental risk in grid applications.

Phase Insights

Based on phase type the segment is divided into two types, namely single and three-phase. Based on the estimations, the three-phase segment established a dominant market share of 66.1% in 2024 and is expected to register the fastest market growth of 6.8% by 2033. Three-phase transformers are generally used in precision machine tools, the manufacturing industry, the mining industry, the petrochemical industry, automation equipment, and the telecommunication industry, among others, for generating power and distribution.

Three-phase transformers are the best choice for industrial equipment since they are more affordable, lighter, and smaller at greater power ratings. In three-phase applications, numerous single-phase toroid or ferro-resonant devices may also be advantageous. Three-phase transformers are also appropriate for low voltage distribution with high fluctuation and low voltage owing to their high level of isolation, strong common-mode interference suppression, and customizable design by end-users’ parameters. Hence, three-phase transformers have a wide range of applications. Its advantages and widespread usage across different industries are poised to grow over the forecast period.

Rating Insights

Based on rating, the market is fragmented into 100 MVA to 500 MVA, 501 MVA to 800 MVA, and 801 MVA to 1200 MVA. Among the three types, 100 MVA to 500 MVA rating transformers held the largest market share of 59.9% in 2024 and are expected to register the fastest CAGR of 7.5 % from 2025 to 2033. The 100 MVA to 500 MVA transformers find applicability in the amplitude of the field, such as industrial usage to powering a vehicle motor. The growing demand for electricity owing to industrialization and urbanization worldwide is proliferating the demand for transformers within the range of 100 MVA to 500 MVA. Technological and design refinement to implement are further adding to the growing usage of these transformers.

Application Insights

Based on application, the market is further branched into residential & commercial, utilities, and industrial applications. Throughout the estimation period, the industrial sub-segment registered the largest market share of 50% in 2024. The sub-segment is further anticipated to reflect the fastest growth rate of 7.1 % within the forecast period. Power transformers in industrial sectors ensure safe, risk-free, and accurate usage of electricity in industries use. The growth in the industrial usage of transformers is associated with the advent of smart transformers, providing a competitive edge to the market players. In addition, heavy investment worldwide towards energy generation, industrialization, and urbanization is pushing market players to dedicate resources towards research and development for developing eco-friendly transformers.

Core Insights

Based on core type, the market is divided into closed, shell, and berry cores. Among the three types, shell core held a majority market share of 41.9 % in 2024, while registering the fastest growth rate of 7.3 % within the forecast period. These are commonly used for low-voltage and high-output applications.

The shell core is also frequently utilized in both electronic circuits and low-voltage power circuits. Since these transformers feature a square or rectangular cross-sectional core, which is less expensive, they are also utilized to optimize the cost of a circuit. In addition, shell core offers various advantages such as an efficient cooling system, design flexibility, high seismic withstanding ability, efficient control of leakage magnetic flux, and high short circuit strength.

Regional Insights

The North American power transformer industry is witnessing steady growth, driven by rising investments in grid modernization, renewable energy integration, and the replacement of aging infrastructure. Utilities across the U.S. and Canada are actively upgrading transmission networks to support higher efficiency and reliability, while the expansion of solar and wind projects is boosting the need for high-capacity transformers capable of managing variable loads. Adopting smart grid technologies and digital substations further accelerates demand for intelligent transformer systems with real-time monitoring and diagnostic capabilities. In addition, ongoing electrification across industrial sectors and electric vehicle charging infrastructure rollout continue to strengthen the regional market outlook.

U.S. Power Transformer Market Trends

The power transformer industry in the U.S. is driven by the push for energy infrastructure upgrades, the expansion of renewable energy projects, and the transition to smart grid technologies. Key trends include integrating digital monitoring systems and eco-friendly insulation materials like ester oils to improve grid reliability and environmental performance. Increased activity in offshore wind, utility-scale solar, and battery storage installations is accelerating the need for high-capacity, high-voltage transformers. The presence of established manufacturers and a strong regulatory focus on grid resiliency and energy efficiency reinforce the market’s growth across utility, industrial, and commercial sectors.

Asia Pacific Power Transformer Market Trends

Asia Pacific power transformer market held the largest share of 40.78% of the global market in 2024. The Asia Pacific industry is expanding rapidly, supported by strong economic growth, a rising population, and an increasing demand for uninterrupted and efficient power supply. Rapid industrialization and urbanization across countries such as China, India, and Indonesia are driving extensive upgrades in power infrastructure. China is heavily investing in the expansion and modernization of its transmission and distribution networks to meet surging electricity needs across urban and industrial regions. The region’s focus on integrating renewable energy sources and reducing transmission losses also encourages the adoption of advanced, energy-efficient transformer technologies.

Europe Power Transformer Market Trends

The European power transformer industry is witnessing stable growth, driven by the region’s transition to renewable energy, cross-border power integration, and modernization of aging grid infrastructure. Countries such as Germany, France, and the UK are actively upgrading their transmission networks to support the increasing share of wind and solar energy and enhance grid reliability and efficiency. The push toward decarbonization and electrification of transport and industry is prompting greater demand for high-performance transformers across utility and industrial segments. Ongoing collaborations between energy firms, technology providers, and regulatory bodies foster innovation in smart transformer systems, digital substations, and environmentally friendly insulation materials.

Latin America Power Transformer Market Trends

Latin America’s power transformer industry is gaining traction, particularly in Brazil, Mexico, and Argentina, as governments and utilities prioritize energy infrastructure upgrades and grid expansion. The increasing integration of renewable energy sources like solar and wind drives the need for efficient high-voltage transformers capable of supporting variable power flows. Efforts to reduce transmission losses, improve electrification rates in rural areas, and enhance grid reliability further stimulate demand. While the market remains in a developmental stage, ongoing investments in industrial growth, urban expansion, and regional interconnection projects create new opportunities for transformer manufacturers and service providers.

Middle East & Africa Power Transformer Market Trends

The Middle East and Africa power transformer industry is progressing steadily, driven by large-scale infrastructure development, energy diversification, and growing electricity demand across urban and remote regions. Gulf nations like Saudi Arabia and the UAE invest heavily in upgrading power transmission systems to support industrial expansion, smart city initiatives, and renewable energy integration. At the same time, African countries are working to expand electrification and strengthen grid reliability, particularly in underserved areas. Ongoing utility reforms, cross-border interconnection projects, and solar and wind deployments reinforce the need for efficient and durable transformer technologies across both regions.

Key Power Transformer Company Insights

Some of the key players operating in the global market for power transformers include Siemens AG, Crompton Greaves Ltd, ABB Ltd, Alstom SA, Toshiba Corp, and GE Co.

-

In February 2024, General Electric (GE) launched its new eco-friendly power transformers utilizing advanced natural ester insulating fluids. These transformers offer enhanced thermal stability and safety features, supporting sustainable grid upgrades and reducing environmental impact across the utility and industrial sectors.

-

In January 2024, Siemens Energy expanded its portfolio with high-capacity smart power transformers for integrating renewable energy and digital grid management. These transformers incorporate real-time monitoring and predictive maintenance capabilities, addressing the increasing demand for reliable and efficient power distribution in evolving energy networks.

Key Power Transformer Companies:

The following are the leading companies in the power transformer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Alstom SA

- Bharat Heavy Electricals Limited

- Crompton Greaves Ltd.

- GE Co.

- Hyosung Power & Industrial Systems Performance Group

- Hyundai Heavy Industries Co. Ltd.

- Mitsubishi Electric Corporation

- Siemens Energy

- Toshiba Corp.

Power Transformer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.02 billion

Revenue forecast in 2033

USD 45.82 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Core, insulation, phase, rating, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil

Key companies profiled

ABB Ltd.; Alstom SA; Bharat Heavy Electricals Limited; Crompton Greaves Ltd.; GE Co.; Hyosung Power & Industrial Systems Performance Group; Hyundai Heavy Industries Co. Ltd.; Mitsubishi Electric Corporation, Siemens Energy; Toshiba Corp.Top of Form

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Transformer Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power transformer market report based on core, insulation, phase, rating, application, and region:

-

Core Outlook (Revenue, USD Billion, 2021 - 2033)

-

Closed

-

Shell

-

Berry

-

-

Insulation Outlook (Revenue, USD Billion, 2021 - 2033)

-

Gas

-

Oil

-

Solid

-

Air

-

-

Phase Outlook (Revenue, USD Billion, 2021 - 2033)

-

Single

-

Three

-

-

Rating Outlook (Revenue, USD Billion, 2021 - 2033)

-

100 MVA to 500 MVA

-

501 MVA to 800 MVA

-

801 MVA to 1200 MVA

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential & Commercial

-

Utilities

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global power transformer market size was estimated at USD 25.47 billion in 2024 and is expected to reach USD 27.02 billion in 2025.

b. The global power transformer market is expected to grow at a compound annual growth rate of 6.8 % from 2025 to 2033 to reach USD 45.82 billion by 2030.

b. Asia Pacific dominated the power transformer market with a share of 40.78 % in 2024. This is attributable to rapid industrialization and increased need for uninterrupted and reliable power supply in the wake of the rising population in the region.

b. Some of the key vendors in the global power transformer market include Siemens AG, Crompton Greaves Ltd, ABB Ltd, Alstom SA, Toshiba Corp, and GE Co.

b. The key factors driving the growth of the global power transformer market include the increasing demand for reliable and efficient power transmission, the rapid expansion of renewable energy integration, and the modernization of aging grid infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.