Power System Simulator Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Analysis (Load Flow, Short Circuit, Harmonic, Transient), By End-use (Power, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Power System Simulator Market Trends

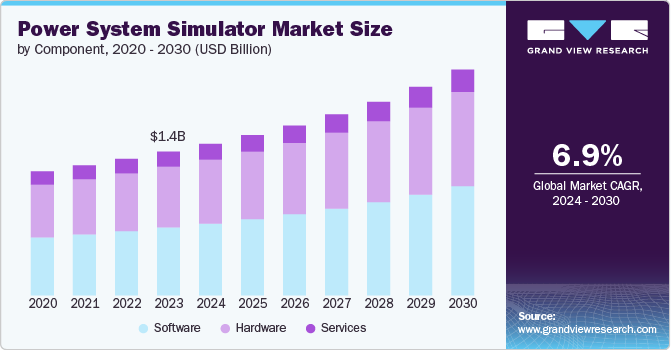

The global power system simulator market size was estimated at USD 1.36 billion in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. Factors such as the growing investments in upgrading aging power infrastructure and the increasing demand for reliable power supply are driving the global power system simulator industry growth. Power system simulation is the process of using software tools to model, analyze, and simulate the behavior of electrical power systems. This includes the generation, transmission, distribution, and consumption of electrical energy.

Power system analyses are crucial for the design of electrical power systems. Calculations and simulations are conducted to ensure that the electrical system and its components are accurately specified to function as intended, endure anticipated stresses, and safeguard against failures. Power system simulation offers benefits such as improved efficiency, enhanced reliability, cost savings, and aid in better decision-making. Simulation helps in identifying potential issues and weaknesses in the power system, allowing for proactive measures to enhance reliability and prevent outages.

Many countries are investing in upgrading their aging power infrastructure, and power system simulators are essential for designing and implementing these upgrades effectively. The International Energy Agency (IEA) estimates that global investment in power grids must increase to USD 820 billion annually by 2030, up from USD 260 billion in 2020, to support renewable energy projects necessary for limiting global warming to 1.5°C above pre-industrial levels.

Advancements in simulation technologies, particularly the incorporation of Artificial Intelligence (AI) and Machine Learning (ML), are significantly boosting the accuracy and efficiency of power system simulators. Additionally, stringent regulatory requirements and standards for power quality, reliability, and efficiency are driving utilities and power companies to embrace these advanced simulation technologies. For example, in North America, the North American Electric Reliability Corporation (NERC) establishes standards to ensure the reliability and safety of the bulk power system.

The implementation of smart grid technologies enhances the complexity, efficiency, and reliability of power systems, creating a strong demand for advanced power system simulators to manage and optimize these sophisticated networks. This drives the growth of the global power system simulator market as utilities and power companies seek to leverage these tools for better planning, operation, and compliance.

Component Insights

In terms of component, the market is classified into hardware, services, and software. The software segment dominated the target market in 2023 and accounted for more than 47.0% share of global revenue. The segment’s growth is attributed to the growing need to optimize resources. Simulation software helps in optimizing the use of existing infrastructure and resources, reducing operational costs and enhancing efficiency. Moreover, advanced software enables predictive maintenance by simulating various scenarios and identifying potential issues before they lead to failures, thereby reducing downtime and maintenance costs. The incorporation of AI and ML into power system simulation software enhances predictive capabilities, accuracy, and efficiency, making these tools more powerful and appealing to users, presenting significant growth opportunities for the segment.

The hardware segment is projected to grow at a significant CAGR of 6.7% from 2024 to 2030. The need for advanced hardware for real-time simulation requirements drives the segment’s growth. Hardware components such as high-performance processors, memory, and specialized Graphical Processing Units (GPUs) are essential for running complex simulations with high accuracy and speed. Some applications in power system simulation require real-time processing capabilities, necessitating specialized hardware components that can handle large volumes of data and computations quickly. For instance, OPAL-RT TECHNOLOGIES, Inc., a Canada-based company, offers an OP4610XG real-time simulator. The simulator incorporates the latest AMD Ryzen processing cores, enabling the simulation of complex power systems.

Analysis Insights

In terms of analysis, the market is classified into load flow, short circuit, harmonic, transient, others. The load flow segment dominated the market in 2023 and accounted for more than 38.0% share of global revenue. The segment’s growth is attributed to the need to ensure grid stability and reliability. Load flow analysis is essential for planning and designing power grids, ensuring optimal placement and sizing of generation, transmission, and distribution assets to maintain grid stability and reliability. Load flow analysis data includes voltage drop calculations and power flow analysis and losses. ETAP (Operation Technology, Inc.), a U.S.-based company, is one of the companies offering Load Flow Analysis Software. The ETAP Load Flow Analysis Software provides comprehensive power flow analysis and simulation capabilities for calculating currents, branch power factors, bus voltages, and power flows across the entire electrical system.

The harmonic segment is projected to grow at the fastest CAGR of 7.5% from 2024 to 2030. The growing use of non-linear devices is a significant driver of the growth of the harmonic analysis segment in the global power system simulator market. Non-linear devices, such as Variable Frequency Drives (VFDs), LED lighting, and electronic devices, generate harmonic currents and voltages that can distort the waveform of the electrical supply. Harmonic distortions can degrade power quality, affecting sensitive equipment and causing operational issues. Industries and utilities need accurate harmonic analysis to identify potential issues and implement mitigation strategies.

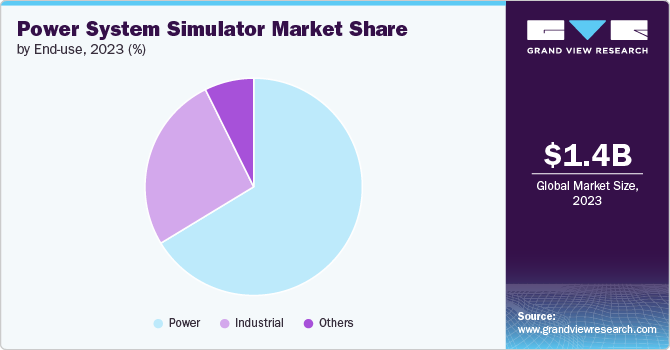

End-use Insights

In terms of end use, the market is classified into power, industrial, and others. The power segment dominated the market in 2023 and accounted for more than 66.0% share of global revenue. The power segment’s growth is driven by increasing energy demand globally and the growing integration of renewable energy. As global energy consumption rises, there is a growing need to ensure the stability, reliability, and efficiency of power generation, transmission, and distribution systems. Power system simulators help in optimizing these systems to meet increasing energy demands effectively. Moreover, many countries are investing in grid modernization projects to enhance grid resilience, accommodate new technologies, and improve energy efficiency. Power system simulators play a crucial role in planning, testing, and optimizing these modernization efforts.

The industrial segment is projected to grow at the fastest CAGR of 7.5% from 2024 to 2030. The need to minimize risks is driving the growth of the industrial segment. Industrial facilities often rely on uninterrupted power supply for critical operations. Power system simulators are used for training operators in handling various operational scenarios and emergencies, thus ensuring continuity of operations and minimizing downtime. Moreover, industrial power systems are becoming more complex due to the integration of renewable energy sources, microgrids, energy storage systems, and advanced grid technologies. Power system simulators help in modeling and analyzing these complex systems to ensure reliability, stability, and optimal operation.

Regional Insights

North America dominated the global power system simulator market and accounted for a revenue share of over 34.0% in 2023. The market’s growth in the region is attributed to the significant smart grid investments in the region. Significant investments are being made in developing smart grid technologies that incorporate advanced sensors, communication networks, and automation systems. Power system simulators are critical for designing and testing these smart grid components before large-scale implementation.

U.S. Power System Simulator Market Trends

The power system simulator market in the U.S. is expected to grow at a CAGR of 6.2% from 2024 to 2030. The U.S. is investing heavily in modernizing its aging power grid infrastructure. This includes the deployment of smart grid technologies, advanced grid management systems, and renewable energy integration. Power system simulators are critical for designing, testing, and implementing these advanced technologies. In November 2022, the U.S. government announced a USD 13 billion investment to modernize and expand the U.S. power grid through programs such as the Transmission Facilitation Program and the Grid Resilience Innovative Partnership, funded by the Bipartisan Infrastructure Law. This investment aims to enhance grid reliability, integrate renewable energy, and support the goal of 100% clean electricity by 2035.

Asia Pacific Power System Simulator Market Trends

The power system simulator market in Asia Pacific is expected to grow at the fastest CAGR of 7.6% from 2024 to 2030. The rising energy demand in the region is contributing to the market’s growth. The region's growing population and economic activities drive higher energy demand. Power system simulators assist in planning and managing this increased load on the power grid, ensuring that supply meets demand efficiently. Moreover, governments in the region are investing heavily in modernizing power infrastructure and promoting smart grid technologies. These initiatives include significant funding and policy support for the adoption of advanced simulation tools to enhance grid reliability and performance.

Europe Power System Simulator Market Trends

The power system simulator market in Europe is expected to grow at a significant CAGR of 7.0% from 2024 to 2030. Europe invests significantly in the Research and Development (R&D) in the energy sector, leading to innovations in power system simulation technologies. Collaboration between governments, academic institutions, and private companies fosters the development and adoption of advanced simulation tools. In January 2024, the European Commission allocated USD 188 million to fund 13 research and innovation projects aimed at enhancing the European Union's energy independence. These projects align with the objectives of REPowerEU, promoting secure, affordable, and sustainable energy for Europe while gradually eliminating the import of Russian fossil fuels.

Key Power System Simulator Company Insights

Some of the key companies operating in the market include The MathWorks, Inc., Siemens, ABB, and Fuji Electric Co., Ltd., among others.

- Siemens is a global conglomerate headquartered in Germany, known for its wide-ranging activities in the industry, energy, and healthcare sectors. It offers a range of power system simulator solutions designed to address various needs in power system analysis and simulation. The company operates in over 190 countries and regions worldwide, with a significant presence in both developed and emerging markets.

OPAL-RT TECHNOLOGIES, Inc. and RTDS Technologies Inc are some of the emerging companies in the target market.

- OPAL-RT TECHNOLOGIES, Inc. specializes in real-time simulation and hardware-in-the-loop testing solutions for various industries, including automotive, aerospace, and power systems. Their advanced simulation platforms enable engineers to validate and optimize complex systems in a virtual environment before physical implementation, ensuring reliability and efficiency. The company is recognized globally for its innovation in real-time simulation technology, supporting organizations worldwide in accelerating their development processes.

Key Power System Simulator Companies:

The following are the leading companies in the power system simulator market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- ABB

- Eaton

- The MathWorks, Inc.

- RTDS Technologies Inc

- Fuji Electric Co., Ltd.

- General Electric Company

- ETAP (Operation Technology, Inc.)

- OPAL-RT TECHNOLOGIES, Inc.

- PSI Neplan AG

Recent Developments

-

In June 2024, OPAL-RT TECHNOLOGIES, Inc. announced the acquisition of 4D-Virtualiz, a France-based company. This acquisition enhances OPAL-RT TECHNOLOGIES, Inc.'s capabilities in real-time simulation and hardware-in-the-loop testing solutions for power systems and other industries. It strengthens OPAL-RT TECHNOLOGIES, Inc.'s position in providing advanced simulation technologies to its global customer base, supporting its innovation and development efforts.

-

In May 2022, ETAP (Operation Technology, Inc.) and Schneider Electric jointly integrated EcoStruxure Power Operation with ETAP (Operation Technology, Inc.)'s Power System Monitoring & Simulation (PSMS) and Operator Training Simulator (eOTS). This integration enables real-time connection and digital twin modeling, enhancing predictive analysis and power system training for engineers and operators. By leveraging this technology, operators can simulate and analyze power system behavior, validate new procedures, and mitigate risks without disrupting actual operations, thereby improving operational efficiency and reducing financial losses associated with unplanned shutdowns.

Power System Simulator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.43 billion |

|

Revenue forecast in 2030 |

USD 2.13 billion |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, analysis, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Siemens; ABB; Eaton; The MathWorks, Inc.; RTDS Technologies Inc; Fuji Electric Co., Ltd.; General Electric Company; ETAP (Operation Technology, Inc.); OPAL-RT TECHNOLOGIES, Inc.; PSI Neplan AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Power System Simulator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global power system simulator market report based on component, analysis, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Analysis Outlook (Revenue, USD Million, 2017 - 2030)

-

Load Flow

-

Short Circuit

-

Harmonic

-

Transient

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Power

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power system simulator market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.43 billion in 2024.

b. The global power system simulator market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 2.13 billion by 2030.

b. North America dominated the power system simulator market with a share of over 34.0% in 2023. This is attributable to the developed technological infrastructure and the presence of numerous market players.

b. Some key players operating in the power system simulator market include Siemens, ABB, Eaton, The MathWorks, Inc., RTDS Technologies Inc, Fuji Electric Co., Ltd., General Electric Company, ETAP (Operation Technology, Inc.), OPAL-RT TECHNOLOGIES, Inc., and PSI Neplan AG.

b. Key factors driving market growth include growing investments in upgrading aging power infrastructure and the growing need for reliable power supply.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."