- Home

- »

- Automotive & Transportation

- »

-

Power Sports Market Size, Share And Growth Report, 2030GVR Report cover

![Power Sports Market Size, Share & Trends Report]()

Power Sports Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (SXS, Heavyweight Motorcycle, ATV, Off Road Motorcycle), By Fuel Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-479-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Sports Market Summary

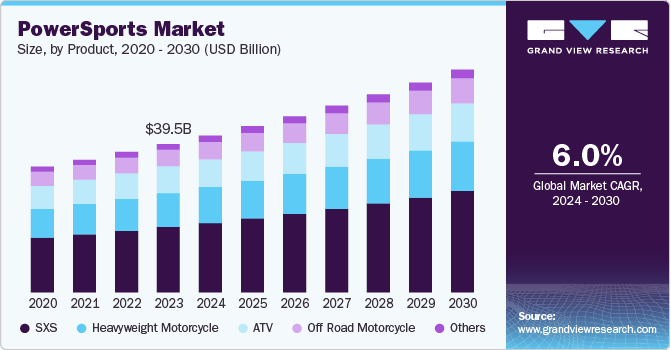

The global power sports market size was estimated at USD 39.50 billion in 2023 and is projected to reach USD 59.28 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. One of the primary growth drivers for this market is the increasing consumer disposable income, which enables more individuals to invest in recreational activities and high-performance vehicles.

Key Market Trends & Insights

- North America dominated the power sports market with a share of over 51.9% in 2023.

- The U.S. power sports market was estimated to be USD 14 billion in 2023.

- By product, side-by-side vehicles, commonly referred to as SxS or SSVs segment accounted for 45% of the market in 2023.

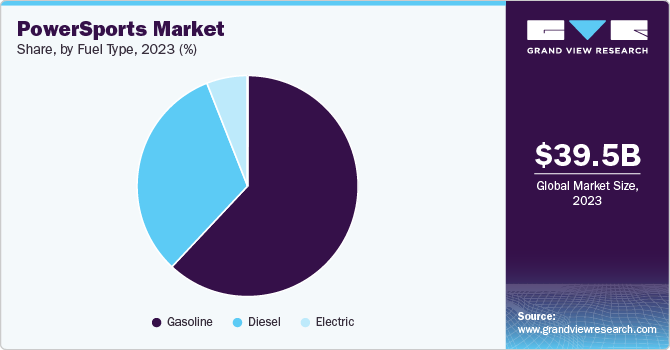

- By fuel type, gasoline powered vehicles segment accounted for 60% of market revenue in 2023.

- Based on end use, the consumer/residential segment led the market a share of 59.5% in 2024.

Market Size & Forecast

- 2023 Market Size: USD 39.50 Billion

- 2030 Projected Market Size: USD 59.28 Billion

- CAGR (2024-2030): 6.0%

- North America: Largest market in 2023

As people seek thrilling experiences, the popularity of outdoor recreational activities has surged, leading to a higher demand for power sports vehicles such as all-terrain vehicles (ATVs), personal watercraft, and motorcycles. Technological advancements also play a crucial role in propelling the market forward. Innovations in vehicle design and propulsion systems, particularly the rise of electric-powered options, are attracting environmentally conscious consumers who prefer sustainable alternatives to traditional gasoline engines. These technologies not only address environmental concerns but also appeal to eco-conscious consumers seeking sustainable recreational options. Manufacturers are investing in electric models to reduce fossil fuel dependence, which is expected to drive further growth in this segment. This shift not only meets the growing demand for eco-friendly products but also enhances performance capabilities, making electric vehicles increasingly appealing.

Moreover, the growing infrastructure for outdoor leisure activities, including the development of theme parks and recreational trails, supports the expansion of the power sports market. Investments from both public and private sectors in recreational facilities are creating more opportunities for consumers to engage in adventure sports. Additionally, changing consumer preferences are evident as younger buyers gravitate towards motorcycles due to their affordability, low maintenance costs, and convenience. This demographic shift is expected to sustain the demand for motorcycles, which is projected to hold the largest share of the power sports market during the forecast period.

Enhanced safety technologies are becoming standard in power sports vehicles. Innovations such as advanced braking systems, traction control, and stability control provide additional safety for users, making these vehicles more appealing to a broader demographic concerned about safety. Continuous investments in R&D are driving the introduction of innovative products that meet evolving consumer demands. Companies are focused on enhancing engine performance, fuel efficiency, and overall vehicle durability through technological advancements. In addition, advanced suspension technologies contribute significantly to ride comfort and vehicle handling. These innovations improve the overall performance of power sports vehicles, making them more capable in challenging terrains, which is crucial for off-road applications.

Overall, the combination of rising disposable incomes, technological advancements, enhanced recreational infrastructure, and evolving consumer preferences is driving robust growth in the global power sports market, with projections indicating a significant increase in market size over the coming years.

One of the primary barriers is the high cost of power sports vehicles, which often come with hefty price tags, especially those equipped with advanced features and technologies. This financial barrier limits accessibility for many potential buyers, as the initial purchase price can be prohibitive. Additionally, ongoing costs such as maintenance, repairs, and insurance further increase the total cost of ownership, making these vehicles more of a luxury than a necessity for the average consumer.

Safety remains a critical concern in the power sports sector. The high speeds and challenging terrains associated with these vehicles can lead to accidents and injuries, prompting manufacturers to invest heavily in safety features and training programs. Compliance with stringent safety regulations can also increase production costs and complicate market entry for new players. Access to suitable terrain and infrastructure for power sports activities can be limited, particularly in urban areas where recreational spaces are scarce. The need for collaboration among government agencies, private landowners, and community partners to develop trails and access points can pose challenges to market growth.

Product Insights

Side-by-side vehicles, commonly referred to as SxS or SSVs were the largest powersports vehicles and accounted for nearly 45% of the market in 2023. SxS are versatile off-road vehicles designed to accommodate at least two passengers seated next to each other. They are characterized by their enclosed roll cage structure and are equipped with a steering wheel and foot controls. These vehicles typically have four wheels and can also be known as utility task vehicles (UTVs), recreational off-highway vehicles (ROVs), or multipurpose off-highway utility vehicles (MOHUV).

The growth of this segment can be attributed to several key factors. Firstly, the increasing popularity of outdoor recreational activities plays a significant role, as more consumers seek thrilling experiences in diverse terrains. This trend is particularly strong among younger demographics who are eager to engage in adventure tourism and off-road excursions, leading to a heightened demand for versatile vehicles like SxS units that can accommodate multiple passengers and provide enhanced comfort during excursions.

Technological advancements also contribute significantly to this growth. Modern SxS vehicles are equipped with features such as improved rollover protection, advanced suspension systems, and multiple seating arrangements, making them suitable for various applications, including recreational use in forestry and agriculture. These innovations not only enhance safety but also expand the utility of SxS vehicles, appealing to both recreational users and those in professional sectors.

Moreover, government initiatives aimed at promoting outdoor activities and developing recreational infrastructure further stimulate market growth. Increased investment in ATV parks and trails encourages participation in power sports, making SxS vehicles more accessible to a broader audience. Additionally, the rise of rental services allows potential buyers to experience these vehicles firsthand before making a purchase, thereby increasing consumer interest.

The growing trend of customization among consumers has led to a demand for SxS vehicles that can be tailored with various accessories and modifications. This desire for personalization enhances the appeal of SxS units, driving sales as consumers seek to create unique vehicles that reflect their individual tastes and needs. Collectively, these factors position side-by-side vehicles as a dynamic and rapidly growing segment within the power sports market.

The heavyweight motorcycle segment in the power sports market is experiencing robust growth driven by several key factors. The segment is expected to grow at a CAGR of 5.5% from 2024 to 2030. One significant driver is the increased interest in adventure and leisure activities, particularly among younger consumers seeking thrilling experiences. Heavyweight motorcycles, known for their power and comfort, are particularly appealing for long-distance touring and off-road adventures, aligning perfectly with the rising trend of motorcycle tourism.

Moreover, the growing culture of motorsports and organized racing events significantly contribute to market demand. Major manufacturers like Harley-Davidson, Ducati, and KTM actively promote their heavyweight motorcycles through racing events and exhibitions, fostering community engagement and increasing visibility. This competitive environment encourages consumers to invest in high-performance bikes that offer both excitement and prestige.

Additionally, the rising disposable incomes in various regions enable more consumers to purchase heavyweight motorcycles, which are often seen as luxury items. As economic conditions improve, more individuals are willing to invest in recreational vehicles that offer unique experiences.

Fuel Type Insights

Gasoline powered vehicles were the most widely used in powersports and accounted for over 60% of market revenue in 2023. One of the primary drivers is the high performance and reliability associated with gasoline engines. These vehicles, including motorcycles, ATVs, and personal watercraft, are known for their power and speed, providing exhilarating experiences that attract enthusiasts seeking adventure and excitement. The performance capabilities of gasoline engines often surpass those of electric counterparts, making them a preferred choice for off-road and racing applications where power and agility are paramount.

Another significant factor is the well-established infrastructure supporting gasoline vehicles. With a widespread network of fuel stations and maintenance services, consumers find it convenient to refuel and service their vehicles during adventures. This accessibility contributes to the continued popularity of gasoline-powered options, especially in remote areas where charging stations for electric vehicles may be limited.

Affordability also plays a crucial role in driving demand for gasoline-powered vehicles. Generally, these vehicles have a lower initial purchase price compared to electric models, making them more accessible to a broader range of consumers. Additionally, maintenance and repair costs for gasoline engines are often lower, further enhancing their attractiveness to budget-conscious buyers.

Electric vehicles in power sports are expected to gain share over the forecast period to reach a market revenue of USD 5 billion in 2023. The increasing demand for eco-friendly recreational options. As awareness of environmental issues rises, consumers are increasingly seeking sustainable alternatives to traditional gasoline-powered vehicles. Electric power sports vehicles, including electric motorcycles, ATVs, and personal watercraft, offer zero-emission operation, appealing to eco-conscious riders who want to minimize their carbon footprint while enjoying outdoor activities.

Technological advancements also play a crucial role in propelling the electric power sports market. Innovations in battery technology have significantly improved the range and performance of electric vehicles, making them more practical for recreational use. Enhanced motor designs and powertrain engineering contribute to superior acceleration and torque, providing thrilling experiences that rival those of their gasoline counterparts. These advancements not only attract traditional power sports enthusiasts but also broaden the market to include new consumers who prioritize performance alongside sustainability.

Moreover, the growing infrastructure for electric vehicles, such as charging stations and support services, enhances the convenience of owning electric power sports vehicles. As more manufacturers invest in developing robust charging networks, the practicality of using electric models increases, further driving consumer adoption.

Additionally, government incentives and regulations aimed at promoting electric vehicle adoption bolster market growth. Many regions offer subsidies, tax breaks, and grants for purchasing electric vehicles, making them more financially attractive. Regulatory support also encourages manufacturers to innovate and expand their electric offerings.

Regional Insights

North America power sports market size exceeded USD 20 billion in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030. The power sports market in North America is experiencing robust growth, primarily driven by a well-established outdoor recreation culture and high disposable incomes among consumers. The region's diverse geography, which includes mountains, forests, and coastlines, provides ideal conditions for various powersports activities such as ATV riding, snowmobiling, and personal watercraft usage. This cultural affinity for outdoor adventures is further bolstered by an increasing interest in health and well-being, leading to a rise in outdoor activities and recreational pursuits.

U.S. Power Sports Market Trends

The U.S. power sports market was estimated to be USD 14 billion in 2023 and is expected to grow at a CAGR of 6% from 2024 to 2030. Technological advancements play a crucial role in shaping the market. Leading manufacturers such as Polaris Industries and Harley-Davidson are based in the U.S., driving innovation through the development of electric and hybrid models, advanced suspension systems, and smart connectivity features. These innovations cater to a more environmentally conscious consumer base while enhancing performance and user experience.

Government initiatives that promote outdoor recreation through infrastructure development—such as trail maintenance and safety programs—also contribute to market growth. Furthermore, the rising popularity of adventure tourism among younger demographics is increasing engagement in off-road activities. As a result, the U.S. powersports market is expected to continue expanding, reflecting both a robust consumer base and ongoing advancements in vehicle technology.

Asia Pacific Power Sports Market Trends

The powersports market in Asia Pacific is expected to grow at a CAGR of 8% over the forecast period. Rising disposable incomes and a burgeoning middle class across countries like China, India, and Japan are enhancing consumer purchasing power, leading to increased demand for recreational vehicles such as motorcycles, ATVs, and personal watercraft. In 2023, the region's disposable income reached approximately USD 20.77 trillion, marking a notable increase from previous years. This economic uplift is coupled with a growing interest in leisure activities, particularly among younger generations seeking adventure and outdoor experiences.

Government initiatives promoting eco-friendly transportation further stimulate market growth by encouraging the adoption of electric and hybrid powersport vehicles. Countries in the region are implementing stricter emission norms and offering incentives for electric vehicle purchases, which aligns with the global shift towards sustainability. Additionally, the rise of adventure tourism and extreme sports is fostering a culture of outdoor recreation, contributing to the popularity of powersports.

Despite challenges such as high vehicle costs and limited servicing infrastructure, the market is expected to thrive due to technological advancements and increased consumer awareness regarding recreational activities. Major manufacturers are investing in product innovations and expanding their offerings to meet the evolving demands of consumers. Overall, the combination of economic growth, government support, and technological progress positions the Asia Pacific powersports market for robust expansion in the coming years.

Key Power Sports Company Insights

The competitive landscape of the power sports market is characterized by a mix of established global players and emerging companies, each vying for market share in a rapidly growing industry. Major companies such as Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, and Suzuki Motor Corporation dominate the market. These firms leverage extensive product portfolios and technological advancements to maintain their competitive edge. For instance, Polaris has been at the forefront of innovation with its diverse range of vehicles including ATVs and snowmobiles, while Harley-Davidson continues to capture the motorcycle segment with its iconic brand.

The market is witnessing a trend toward consolidation, with strategic mergers and acquisitions aimed at enhancing product offerings and expanding distribution networks. A notable example is RumbleOn Inc.'s acquisition of RideNow, which aims to integrate technology with an extensive retail footprint. Additionally, companies are increasingly focusing on electric and hybrid vehicles to cater to growing consumer demand for eco-friendly options.

Key Power Sports Companies:

The following are the leading companies in the power sports market. These companies collectively hold the largest market share and dictate industry trends.

- Yamaha Motor Co., Ltd.

- Arctic Cat Inc.

- BRP

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Polaris Inc.

- Textron Inc.

- Harley Davidson

- CF Moto

- KTM

- KYMCO

- Taiga Motors

- Argo

- Alpina

- Suzuki Motor Corporation

Power Sports Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.79 billion

Revenue forecast in 2030

USD 59.28 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fuel type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Yamaha Motor Co., Ltd.; Arctic Cat Inc.; BRP; Honda Motor Co., Ltd.; Kawasaki Heavy Industries, Ltd.; Polaris Inc.; Textron Inc.; Harley Davidson; CF Moto; KTM; KYMCO; Taiga Motors; Argo; Alpina; Suzuki Motor Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Power Sports Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global power sports market report based on product, fuel type, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

SXS

-

Heavyweight Motorcycle

-

ATV

-

Off Road Motorcycle

-

Others

-

-

Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gasoline

-

Diesel

-

Electric

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power sports market size was estimated at USD 39.50 billion in 2024 and is expected to reach USD 41.79 billion in 2024.

b. The global power sports market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 59.28 billion by 2030.

b. North America dominated the power sports market with a share of over 51.9% in 2023. This is attributable to a well-established outdoor recreation culture and high disposable incomes among consumers in the region.

b. Some key players operating in the power sports market include Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, and Suzuki Motor Corporation.

b. Key factors that are driving the power sports market growth include a significant increase in consumer disposable income and the rising popularity of outdoor recreational activities worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.