- Home

- »

- Distribution & Utilities

- »

-

Power Rental Market Size, Share And Trends Report, 2030GVR Report cover

![Power Rental Market Size, Share & Trends Report]()

Power Rental Market (2024 - 2030) Size, Share & Trends Analysis Report By Fuel Type (Diesel, Natural Gas), By Equipment (Generator, Transformers, Load Banks), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Rental Market Summary

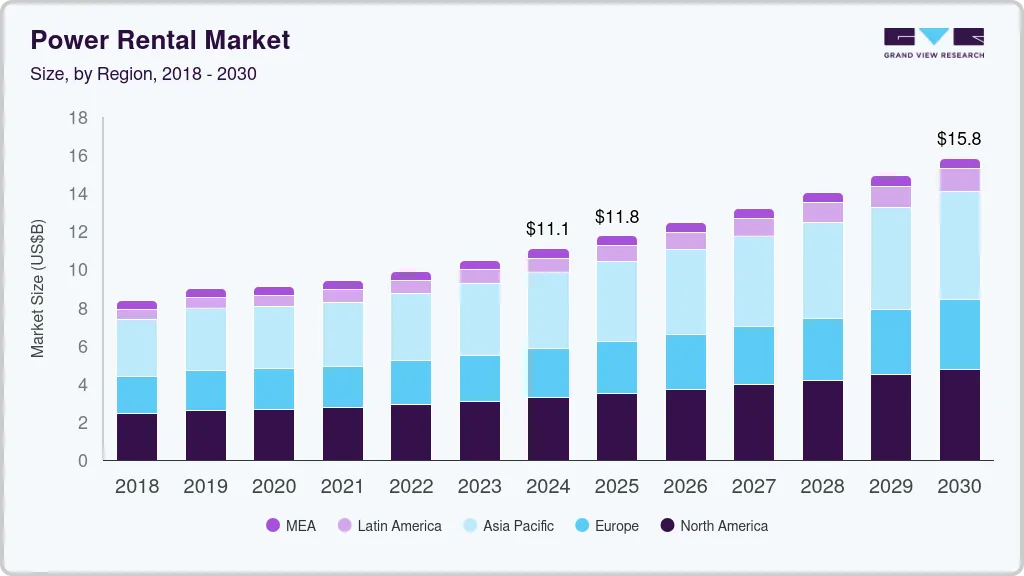

The global power rental market size was estimated at USD 10.48 billion in 2023 and is projected to reach USD 15.85 billion by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market growth is driven by several key factors, making it an essential component in various industries.

Key Market Trends & Insights

- Asia Pacific dominated the global power rental market and accounted for largest revenue share of over 35.78% in 2023.

- The China's power rental market is the largest in Asia Pacific, driven by technological advancements which play a significant role in shaping the market.

- By fuel type, the diesel segment held the largest revenue share of 59.62% in 2023.

- By equipment, the generators segment held the largest revenue share of 69.42% in 2023.

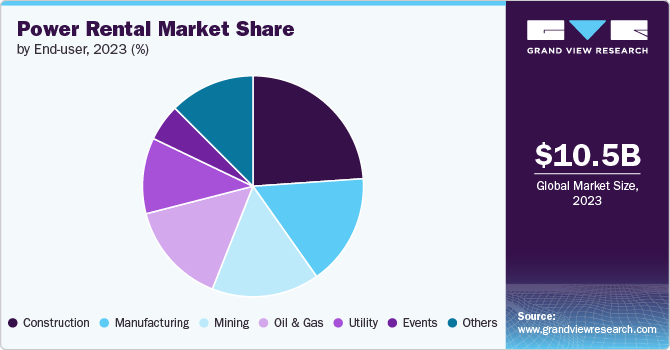

- By end user, the construction segment held the largest revenue share of 23.91% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 10.48 Billion

- 2030 Projected Market Size: USD 15.85 Billion

- CAGR (2024-2030): 6.1%

- Asia Pacific: Largest market in 2023

Many industries, particularly in developing regions, face frequent power outages or lack of reliable grid infrastructure. Power rental solutions offer a flexible and quick alternative to ensure continuous operations in sectors like construction, manufacturing, and oil & gas. With increasing reliance on these industries, the demand for temporary power solutions continues to grow.

Another significant driver is the expansion of construction and infrastructure projects worldwide. Rapid urbanization, particularly in emerging economies, is pushing governments and private entities to invest heavily in infrastructure development. From building highways to setting up temporary workstations, construction sites often require temporary power solutions, especially in remote or grid-limited areas. The ability to rent power equipment tailored to the project's needs, without the long-term commitment of ownership, is attractive to businesses in this space.

Drivers, Opportunities & Restraints

One of the most significant is the demand for uninterrupted power supply across various industries. With frequent power outages in many developing regions, industrial sectors such as manufacturing, oil & gas, and construction need reliable and flexible temporary power solutions to maintain continuous operations. Additionally, increased infrastructure development in emerging economies is fueling demand, as construction projects often require temporary power sources in remote areas or places where the electrical grid is underdeveloped or unreliable.

Another key driver is the growing need for cost-effective energy solutions in industries where purchasing power equipment may not be financially viable. Renting power generation equipment allows companies to meet temporary energy needs without the long-term investment in owning and maintaining expensive machinery. The adoption of energy-efficient technologies like gas-powered and hybrid generators also boosts the market, driven by regulatory pressures to reduce emissions and the need for more sustainable business practices.

There is significant growth potential in the shift toward cleaner and more sustainable power rental solutions. With increasing awareness of climate change and stricter emissions regulations, the demand for low-emission and renewable energy-powered rental generators is on the rise. Companies providing hybrid systems that combine renewable energy sources with traditional fuels are poised to capture a growing share of the market. Additionally, technological advancements in remote monitoring and energy management present opportunities for enhanced service offerings, as businesses look for smarter ways to track, optimize, and maintain power rental equipment.

One of the main restraints for the power rental market is fluctuating fuel prices. Most power rental solutions, particularly diesel generators, rely heavily on fuel. Significant price volatility in oil markets can impact the operational costs for power rental companies, making it difficult to maintain profit margins or offer competitive pricing. In addition, fuel dependency can also deter businesses from renting traditional diesel-powered generators, as fuel costs may outweigh the benefits of a rental solution, pushing them toward alternative energy sources.

Fuel Type Insights

The diesel segment held the largest revenue share of 59.62% in 2023. The diesel fuel segment continues to dominate the power rental market due to several key drivers. Diesel generators are widely preferred for their high efficiency, reliability, and ability to generate large amounts of power with relatively low operational costs. In industries such as construction, mining, and oil & gas, where operations are often in remote locations or areas with limited grid access, diesel generators offer a dependable solution for temporary and emergency power needs. Additionally, the global availability of diesel fuel and the ease of transportation make it a practical choice for various industries, particularly in developing regions where grid infrastructure is unreliable.

The natural gas segment is gaining traction due to several drivers. One of the key factors is the increasing regulatory pressure to reduce carbon emissions and adopt cleaner energy sources. Compared to diesel and other fossil fuels, natural gas is a cleaner-burning fuel, producing significantly lower emissions of carbon dioxide, sulfur oxides, and particulate matter. This makes it an attractive option for companies seeking to meet environmental standards and demonstrate their commitment to sustainability. Additionally, the global abundance of natural gas and advancements in extraction techniques, such as hydraulic fracturing, have improved the availability and affordability of natural gas, making it a more cost-effective fuel for power generation.

Equipment Insights

The generators segment held the largest revenue share of 69.42% in 2023. One of the key drivers for generator rentals is the increasing demand for continuous and reliable power in sectors such as construction, oil & gas, mining, and manufacturing. These industries often operate in remote or grid-constrained areas where access to consistent power supply is limited, making generators essential for temporary power needs. Additionally, the growing occurrence of natural disasters and grid failures in certain regions has further bolstered demand for rental generators as backup power solutions to prevent operational disruptions and financial losses.

The transformer rental segment is experiencing increased demand for smart transformers that allow real-time monitoring and optimization of energy use. As companies seek more efficient and reliable power solutions, they are gravitating towards advanced technologies that offer features like predictive maintenance, remote control, and automated fault detection. Another trend is the shift toward sustainable and eco-friendly transformers, which are designed to minimize energy losses and reduce the environmental impact of power generation and distribution. This trend aligns with the global push for greener energy solutions, with businesses looking to comply with stricter regulations on emissions and energy efficiency.

End User Insights

The construction segment held the largest revenue share of 23.91% in 2023. Construction projects, especially large-scale infrastructure developments like roads, bridges, and buildings, often occur in remote areas where grid power is either unavailable or unreliable. In such cases, rental power equipment ensures that operations run smoothly without delays caused by power shortages. Additionally, the cyclical nature of construction projects, where power needs fluctuate based on the project phase, makes renting more cost-effective than investing in permanent power infrastructure.

The events sector is a significant end user segment, driven by the need for reliable and temporary power solutions for various functions, including concerts, festivals, sports events, exhibitions, and corporate gatherings. These events often take place in outdoor or temporary venues where access to a stable power grid is limited or non-existent. As these events grow in size and complexity, the demand for uninterrupted power supply becomes critical to support lighting, sound systems, catering services, and security systems. The ability to rent customized power solutions, such as generators tailored to specific energy requirements, makes it more efficient and cost-effective for event organizers to ensure smooth operations.

Regional Insights

The power rental market in North America is experiencing steady growth, driven by several key trends and drivers. One of the primary factors is the region’s aging power infrastructure and the increasing frequency of power outages, particularly in the United States. This has prompted industries like construction, oil & gas, mining, and event management to rely more on rental power solutions for both emergency and planned maintenance needs.

U.S. Power Rental Market Trends

The power rental market in the U.S. is experiencing significant growth, driven by a variety of factors and evolving trends. One of the most prominent drivers is the need for temporary power solutions in industries such as construction, oil & gas, and manufacturing. The U.S. economy is undergoing substantial infrastructure development, with numerous large-scale construction projects and refurbishments requiring a reliable, temporary power supply. These projects often occur in remote locations or urban areas where grid connections may not be feasible, making power rentals an attractive and flexible solution.

Europe Power Rental Market Trends

The power rental market in Europe is characterized by combination of industrial, infrastructural, and regulatory factors. One of the key trends in the European market is the increased focus on sustainability. The European Union's stringent environmental regulations and commitments to reduce carbon emissions have spurred demand for cleaner and more efficient power rental solutions. As a result, rental companies are investing in hybrid systems that integrate renewable energy sources, such as solar and wind, with traditional generators to meet regulatory requirements and address environmental concerns.

The Germany power rental market holds a significant position in the European region, driven by Germany's strong industrial sector, which demands reliable and flexible power solutions. Key industries such as manufacturing, construction, and automotive often require temporary power sources to support operations, particularly during peak loads or when facing outages. The country’s robust infrastructure projects and industrial activities create a consistent need for power rental solutions.

The power rental market in UK has been evolving rapidly, driven by a combination of industry demands and broader economic factors. One of the primary drivers is the ongoing growth in infrastructure projects and construction activities. With the UK government investing heavily in infrastructure development, including projects like HS2 and various renewable energy initiatives, there is a strong need for reliable temporary power solutions. These projects often require substantial and flexible power sources, especially in remote or undeveloped areas where the grid infrastructure may be insufficient.

Asia Pacific Power Rental Market Trends

Asia Pacific dominated the global power rental market and accounted for largest revenue share of over 35.78% in 2023. The regional market is experiencing robust growth, driven by rapid urbanization, industrial expansion, and increasing infrastructure projects across emerging economies like India, China, and Southeast Asia. One of the key trends in the region is the rising demand for temporary power solutions in construction and infrastructure sectors, as governments invest heavily in developing roads, bridges, and rail networks. Another trend is the growing need for reliable power supply in remote and off-grid areas, especially in industries like mining and oil & gas, which rely on temporary power to ensure uninterrupted operations.

The China's power rental market is the largest in Asia Pacific, driven by technological advancements which play a significant role in shaping the market. Innovations in generator technology, including improved fuel efficiency and advanced monitoring systems, are enhancing the appeal of power rental services. Rental companies are investing in state-of-the-art equipment that offers better performance, lower emissions, and greater reliability. The integration of digital technologies allows for real-time monitoring and management of power systems, which helps in optimizing fuel consumption and minimizing operational costs.

A major trend in the Japan power rental market is the shift toward cleaner energy solutions. Driven by Japan's commitment to reducing carbon emissions and adhering to stringent environmental regulations, there is a growing demand for renewable and low-emission power rental options. This trend is leading to increased adoption of gas-powered and hybrid generators that combine renewable energy sources with traditional fuels. The Japanese government’s focus on sustainability and green technology is pushing rental companies to invest in and offer more eco-friendly solutions.

Central & South America Power Rental Market Trends

The power rental market in Central and South America is poised for growth, driven by several key factors. Infrastructure development is a major driver, as many countries in the region are investing heavily in large-scale projects, including roads, bridges, and urban development. These construction activities often require temporary power solutions, particularly in remote or less-developed areas where the local grid infrastructure is insufficient. The need for reliable, on-site power to support these projects is fueling demand for rental services across the region.

Middle East & Africa Power Rental Market Trends

The power rental market in the Middle East and Africa is experiencing significant growth, driven by rapid urbanization, industrialization, and infrastructure development. Countries in the Middle East, particularly the Gulf Cooperation Council (GCC) states, are investing heavily in mega-projects, including construction, real estate, and industrial developments. Similarly, in Africa, emerging economies are focusing on infrastructure to support urbanization and industrialization. These projects often require temporary power solutions, leading to increased demand for power rental services.

Key Power Rental Company Insights

The Power Rental market is characterized by a competitive landscape featuring key players such as Caterpillar Inc., Cummins Inc., Aggreko, Atlas Copco, Kohler-SDMO, among others. These companies are focusing on research and development to enhance product offerings and meet the growing demand for power backup solutions. Regional dynamics show significant market shares in North America and Europe, with Asia-Pacific expected to exhibit the fastest growth due to rapid urbanization and infrastructure integration. Companies are also pursuing strategic partnerships and innovations to strengthen their market positions and address customer needs effectively.

Key Power Rental Companies:

The following are the leading companies in the power rental market. These companies collectively hold the largest market share and dictate industry trends.

- Aggreko

- APR Energy

- Atlas Copco

- Caterpillar Inc.

- Cummins Inc.

- FG Wilson

- Global Power Supply

- Jassim Transport & Stevedoring Co. K.S.C.C.

- Kohler-SDMO

- Modern Hiring Service

- Newburn Power Rental Ltd

- NIDS GROUP

- ProPower Rental

- Pump Power Rental

- Shenton Group

- Sudhir Power Ltd.

- United Rentals

Recent Developments

-

In March 2024, United Rentals, Inc. acquired Yak Access, LLC, Yak Mat, LLC and New South Access & Environmental Solutions, LLC for an amount of USD 1.1 billion.

-

In December 2022, United Rentals completed the acquisition of assets from Ahern Rentals, a strategic business combination involving the eighth-largest equipment rental company in North America. This acquisition, which spans 30 states, primarily serves the construction and industrial sectors. The strategic objectives of this move are to boost capacity in key regions, enhance the availability of high-demand equipment, and create opportunities for cross-selling within a larger customer base.

Power Rental Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.09 billion

Revenue forecast in 2030

USD 15.85 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Fuel type, equipment, end user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Caterpillar Inc.; Cummins Inc.; Aggreko; Atlas Copco; Kohler-SDMO; Shenton Group; NIDS GROUP; Jassim Transport & Stevedoring Co. K.S.C.C.; Pump Power Rental; United Rentals; Sudhir Power Ltd.; Modern Hiring Service; Newburn Power Rental Ltd.; Global Power Supply; FG Wilson; ProPower Rental; APR Energy

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented power rental market report on the basis of fuel type, equipment, end user, and region:

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Natural Gas

-

Other Fuel Type

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Generators

-

Transformers

-

Load Banks

-

Other Equipment

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Mining

-

Construction

-

Manufacturing

-

Utility

-

Events

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global power rental market size was estimated at USD 10.48 billion in 2023 and is expected to reach USD 11.10 billion in 2024.

b. The global power rental market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 15.85 billion by 2030.

b. By end-user, the construction segment dominated the market with a revenue share of over 23.91% in 2023. Construction projects, especially large-scale infrastructure developments like roads, bridges, and buildings, often occur in remote areas where grid power is either unavailable or unreliable. In such cases, rental power equipment ensures that operations run smoothly without delays caused by power shortages.

b. Some of the key vendors of the global power rental market are Caterpillar Inc., Cummins Inc., Aggreko, Atlas Copco, among others.

b. The key factor driving the growth of the global power rental market is the demand for uninterrupted power supply across various industries. With frequent power outages in many developing regions, industrial sectors such as manufacturing, oil & gas, and construction need reliable and flexible temporary power solutions to maintain continuous operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.