- Home

- »

- Electronic Devices

- »

-

Power Quality Equipment Market Size & Share Report, 2030GVR Report cover

![Power Quality Equipment Market Size, Share & Trends Report]()

Power Quality Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment, By Phase (Single Phase, Three Phase), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Quality Equipment Market Summary

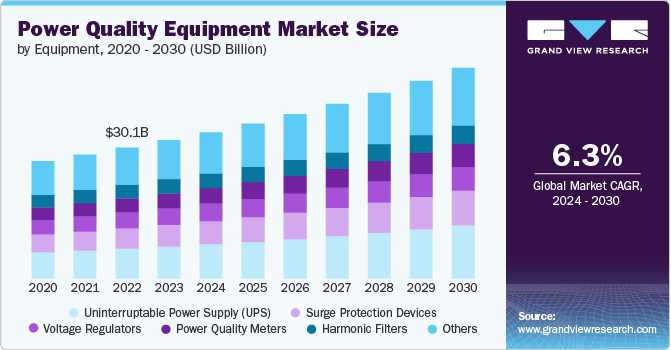

The global power quality equipment market size was estimated at USD 31.82 billion in 2023 and is projected to reach USD 48.46 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The market growth is driven by the increasing demand for reliable and uninterrupted power supply across various industries.

Key Market Trends & Insights

- Asia Pacific power quality equipment market dominated with a revenue share of 36.4% in 2023.

- North America power quality equipment market is expected to register significant growth during the forecast period.

- By equipment, uninterruptible power supply (UPS) segment accounted for the largest share of 23.16% in 2023.

- By phase, three‑phase equipment segment held the largest revenue share in 2023.

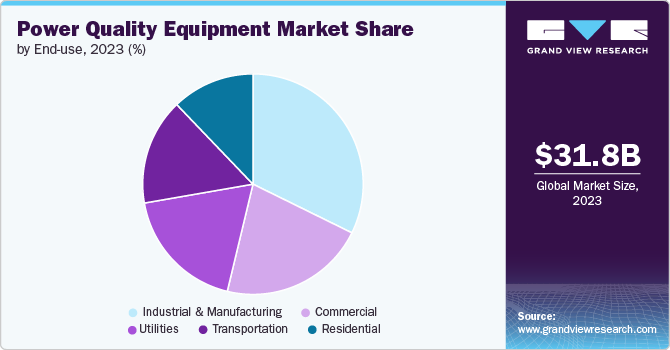

- By end use, industrial & manufacturing segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 31.82 Billion

- 2030 Projected Market Size: USD 48.46 Billion

- CAGR (2024–2030): 6.3%

- Asia Pacific: Largest market in 2023

The rising incidence of power outages and voltage fluctuations, particularly in developing regions, underscores the need for effective power quality solutions. Additionally, the growing adoption of sensitive electronic devices and equipment, which require high power quality standards to function optimally, is propelling market growth.

The power quality equipment market is witnessing significant advancements in technology, which are enhancing the efficiency and functionality of these systems. One notable trend is the integration of Internet of Things (IoT) technology, which enables real-time monitoring and control of power quality. This allows for proactive maintenance and quick response to power disturbances, thereby minimizing downtime and operational costs. IoT-enabled power quality equipment can also provide valuable data analytics, helping organizations optimize their energy usage and improve overall power management.

Another key technological trend is the development of smart grids, which are designed to enhance the reliability and efficiency of electricity distribution. Smart grids incorporate advanced power quality equipment that can dynamically respond to changes in power demand and supply. These systems can identify and isolate faults, reroute power, and balance loads to ensure a stable and high-quality power supply. The integration of renewable energy sources into smart grids also necessitates advanced power quality solutions to manage the variable nature of these energy sources and ensure consistent power delivery.

The market presents numerous opportunities for growth, particularly in emerging economies where industrialization and urbanization are rapidly increasing. The expansion of data centers, telecommunications infrastructure, and renewable energy projects in these regions is driving the demand for reliable power quality solutions. Additionally, advancements in technology and increasing awareness about the importance of power quality are creating new avenues for market expansion. Companies that can offer innovative and cost-effective solutions tailored to the specific needs of these growing markets are well-positioned to capitalize on these opportunities.

However, the high initial investment costs and maintenance expenses can deter small and medium-sized enterprises from adopting these solutions thereby, posing as challenges for market growth. Additionally, the complexity of integrating advanced power quality equipment with existing infrastructure can pose technical challenges. There is also a need for skilled personnel to manage and maintain these systems, which can be a constraint in regions with limited technical expertise. Moreover, the rapid pace of technological advancements means that companies must continuously innovate to stay competitive, which can be a significant challenge in terms of research and development costs.

Equipment Insights

Based on the equipment, the market is segmented into power quality meters, surge protection devices, harmonic filters, voltage regulators, uninterruptible power supply (UPS), and others. The UPS segment held the largest market share of 23.16% in 2023, owing to its widespread use in guaranteeing continuous power supply. The segment growth is further propelled by the growing demand for UPS in data centers, hospitals, and other critical infrastructure requiring uninterrupted power supply.

The surge protection devices segment is expected to grow rapidly during the forecast period. Surge protection devices are essential for protecting electrical systems from voltage spikes. The segment is expected to grow due to the rising need to safeguard electronic gadgets in homes and workplaces. In addition, rising awareness about the protection of sensitive electronic equipment and increasing instances of voltage surges due to lightning and power outages is expected to fuel the segment growth.

Phase Insights

Based on phase, the market is segmented into single phase and three phase. The three phase segment held the largest market share in 2023. Three phase power quality equipment is predominantly used in large commercial and industrial applications due to their higher power capacity and efficiency. Growing industrialization is anticipated to propel the demand for three phase power quality equipment as it provides greater power stability for large-scale operations.

The single phase segment is anticipated to grow substantially throughout the projection period. The growth can be attributed to the growing demand for power quality equipment for residential and light commercial use. Another factor fueling the segment growth is ease of installation of single phase equipment and lower cost compared to three-phase systems.

End Use Insights

Based on end use, the market is segmented into residential, commercial, industrial & manufacturing, utilities, and transportation. The industrial & manufacturing segment dominated the market in 2023 and is predicted to grow significantly during the forecast period. The growth of the segment can be attributed to rapid industrialization, increasing automation, and stringent power quality standards. As industries adopt advanced automation and IoT technologies, the demand for reliable and efficient power quality solutions is escalating to prevent costly downtime and equipment damage. Significant investments in industrial infrastructure, coupled with the need for uninterrupted and stable power supply in manufacturing processes, are further propelling this segment's expansion.

The commercial segment is expected to grow significantly during the forecast period driven by the demand for reliable power in offices, data centers, and retail establishments. As businesses increasingly rely on digital infrastructure and automation, the need for uninterrupted and high-quality power supply has become paramount to ensure smooth operations and safeguard sensitive electronic equipment. Additionally, the growing trend of smart buildings and energy-efficient commercial spaces is bolstering investments in power quality equipment, positioning the commercial segment as a critical driver of market growth.

Regional Insights

The Asia Pacific power quality equipment market dominated the global market in 2023 and accounted for a 36.4% share of the market. The regional market is witnessing rapid industrialization and urbanization, driving the demand for power quality equipment. Countries such as China and India are investing heavily in infrastructure development and smart grid technologies. The rising investment is expected to enhance the deployment of power quality equipment to ensure a reliable power supply and improve grid resilience. Additionally, the increasing use of sensitive electronic devices in industrial and commercial applications is boosting the demand for power quality solutions in the region.

North America Power Quality Equipment Market Trends

The power quality equipment market in North America is driven by the increasing demand for reliable power in data centers and the IT sector. The region is witnessing significant investments in smart grid technologies, which are expected to enhance the demand for advanced power quality equipment to ensure efficient power distribution and minimize disruptions.

The U.S. power quality equipment market is experiencing robust growth, primarily due to the rising number of industrial and commercial establishments. The increasing penetration of renewable energy sources, such as solar and wind, is also contributing to the demand for power quality solutions.

Europe Power Quality Equipment Market Trends

The power quality equipment market in Europe growth is driven by the increasing integration of renewable energy sources across the region. Countries such as Germany, Spain, and Denmark are leading the charge in increasing their renewable energy capacity. In 2023, renewable energy sources accounted for 46% of Germany's total electricity consumption. The intermittent nature of renewable energy sources such as wind and solar necessitates advanced power quality solutions to manage grid stability, voltage regulation, and frequency control, ensuring a reliable and consistent power supply.

Key Power Quality Equipment Company Insights

Key players are focusing on several strategic initiatives, including new product development, partnerships & collaborations, and geographic expansion to gain a competitive advantage over their rivals. In January 2023, Schneider Electric S.E., a global leader in energy management and automation's digital transformation, launched the Easy UPS 3-Phase Modular. This durable UPS is engineered to safeguard critical loads. Available in capacities ranging from 50 to 250 kW with an N+1 scalable configuration, the EcoStruxure architecture is supported by the Easy UPS 3-Phase Modular, enabling remote monitoring services.

Key Power Quality Equipment Companies:

The following are the leading companies in the power quality equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton Corporation

- ABB Ltd.

- Siemens

- General Electric Company

- Honeywell International, Inc.

- Leviton Manufacturing Co., Inc.

- Emerson Electric Co.

- Schneider Electric S.E.

- Legrand

- Piller Power Systems.

Power Quality Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.67 billion

Revenue forecast in 2030

USD 48.46 million

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Equipment, phase, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Eaton Corporation; ABB Ltd.; Siemens; General Electric Company; Honeywell International, Inc.; Leviton Manufacturing Co., Inc.; Emerson Electric Co.; Schneider Electric S.E.; Legrand; Piller Power Systems

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Quality Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the power quality equipment market report based on equipment, phase, end use, and region:

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Quality Meters

-

Surge Protection Devices

-

Harmonic Filters

-

Voltage Regulators

-

Uninterruptable Power Supply (UPS)

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Phase

-

Three Phase

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial & Manufacturing

-

Utilities

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power quality equipment market size was estimated at USD 31.82 billion in 2023 and is expected to reach USD 33.67 billion in 2024.

b. The global power quality equipment market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 48.46 billion by 2030.

b. Asia Pacific dominated the power quality equipment market with a share of 36.4% in 2023. The regional market is witnessing rapid industrialization and urbanization, driving the demand for power quality equipment.

b. Some key players operating in the power quality equipment market include Eaton Corporation, ABB Ltd., Siemens, General Electric Company, Honeywell International, Inc., Leviton Manufacturing Co., Inc., Emerson Electric Co., Schneider Electric S.E., Legrand, Piller Power Systems.

b. Key factors that are driving the market growth include increasing demand for reliable and uninterrupted power supply across various industries and the growing adoption of sensitive electronic devices and equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.