Power Management IC Market Size, Share & Trends Analysis Report By Product (Linear Regulators, Switching Regulators, Battery Management ICs, Power Supply ICs), By Industry Vertical (Consumer Electronics, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-438-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Power Management IC Market Size & Trends

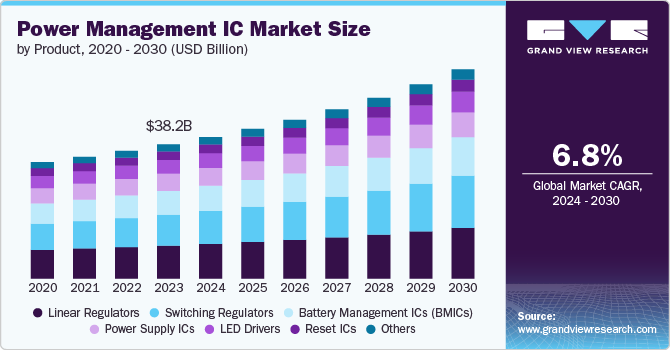

The global power management IC market was estimated at USD 38.22 billion in 2023 and is expected to grow at a CAGR of 6.8% from 2024 to 2030. Power management integrated circuits (PMICs) are essential components in electronic devices that efficiently manage and control the flow of electrical power. They play a crucial role in optimizing battery life, improving device performance, and ensuring safe operation. PMICs are used in a wide range of applications, including smartphones, laptops, tablets, wearable devices, automotive electronics, industrial equipment, and consumer appliances.

The power management integrated circuit market is experiencing rapid growth due to several key trends. The demand for smaller, more portable electronic devices has driven the development of PMICs with reduced form factors and increased integration. As electronic systems become more complex, PMICs are required to handle diverse power requirements and provide advanced features such as fast charging and battery management. The growing focus on energy efficiency has led to the development of PMICs with higher efficiency and lower power consumption. In addition, the proliferation of IoT devices and the rapid growth of the EV market have created significant demand for PMICs to power various components and manage complex power requirements.

The power management IC market is subject to various regulations, including energy efficiency, safety, and electromagnetic compatibility (EMC). Manufacturers must ensure their products comply with these regulations to obtain market access. The Energy Star program sets energy efficiency standards for electronic products, including those using PMICs. Safety standards are essential to prevent electrical hazards, and organizations like UL and TÜV provide safety certifications. To minimize electromagnetic interference and ensure compatibility, PMICs must adhere to EMC standards governed by international standards like IEC 61000.

The power management IC market is driven by several factors. Technological advancements in semiconductor technology are enabling the development of PMICs with higher performance, lower power consumption, and smaller form factors. The increasing penetration of smartphones, tablets, laptops, and other electronic devices is driving the demand for PMICs. The trend towards electric vehicles and the increasing complexity of automotive electronics are creating new opportunities for PMICs to manage the power requirements of these systems. In addition, the shift towards renewable energy sources, such as solar and wind power, is driving the demand for PMICs to manage energy storage and distribution.

The power management IC market is witnessing significant growth opportunities driven by various trends. The Internet of Things (IoT) is expanding rapidly, creating a demand for PMICs to power a wide range of connected devices. Wearable technology, such as smartwatches and fitness trackers, is gaining popularity, requiring PMICs with small form factors and low power consumption. The transition to electric vehicles is driving the demand for high-performance PMICs to manage battery systems and other components. In addition, the increasing adoption of wireless charging technology is creating opportunities for PMICs with integrated wireless charging capabilities.

Product Insights

The linear regulators segment dominated the market in 2023 and accounted for more than 25% share of global revenue. These regulators are widely used in low-power applications where efficiency is not the primary concern, such as in consumer electronics, sensors, and small signal processing circuits. Their dominance in the market is largely attributed to their ease of integration into various devices and their ability to provide a stable output voltage with minimal external components. Linear regulators also exhibit low electromagnetic interference (EMI), which is crucial in sensitive analog circuits and communication devices. This makes them a preferred choice in applications where noise can affect performance, such as in medical devices and precision measurement equipment. Furthermore, the increasing demand for compact and energy-efficient devices in the consumer electronics sector continues to drive the market for linear regulators.

The switching regulators segment is projected to expand with the fastest growth rate during the forecast period 2024 to 2030. Unlike linear regulators, switching regulators can maintain high efficiency across a wide load range, making them ideal for battery-powered devices, high-power applications, and energy-sensitive systems such as those found in automotive, industrial, and communication sectors.

The growing emphasis on energy efficiency and the increasing adoption of renewable energy systems have further accelerated the demand for switching regulators. These regulators are capable of stepping up (boost), stepping down (buck), or inverting voltage levels, offering greater flexibility in power management solutions. As more devices, from smartphones to electric vehicles, require efficient power conversion with minimal heat generation, the market for switching regulators is expanding rapidly. Technological advancements in semiconductor manufacturing have also contributed to this growth, enabling more compact and efficient designs that can be integrated into increasingly smaller devices.

Industry Vertical Insights

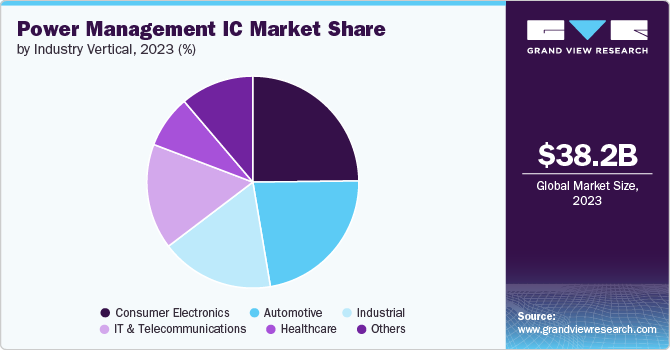

The consumer electronics segment dominated the market in 2023, due to the proliferation of portable electronic devices such as smartphones, tablets, wearables, and laptops. The continuous demand for longer battery life, faster charging times, and compact form factors in these devices has led to significant advancements in PMIC technology. Manufacturers are increasingly integrating sophisticated power management solutions to optimize energy usage, reduce heat generation, and enhance overall device performance. The widespread adoption of smart devices and the Internet of Things (IoT) has further fueled the demand for efficient PMICs in consumer electronics. Moreover, the shift towards more powerful, feature-rich devices with high processing capabilities and advanced displays requires more complex power management solutions, reinforcing the dominance of this sector in the market. In addition, the trend towards wireless charging and the development of new power delivery standards, such as USB-C and fast charging protocols, have created new opportunities for PMICs tailored for these applications.

The automotive segment is projected to grow at the fastest growth rate during the forecast period 2024 to 2030, driven by the increasing electrification of vehicles, the rise of electric vehicles (EVs), and the integration of advanced driver-assistance systems (ADAS). The shift towards EVs and hybrid vehicles has created a substantial demand for efficient power management solutions to optimize battery usage, manage power distribution, and ensure reliable operation of various electronic components under varying conditions. In addition, the adoption of ADAS, infotainment systems, and in-vehicle networking requires sophisticated PMICs that can handle the high-power demands and provide stable operation across a wide temperature range. As vehicles become more connected and autonomous, the complexity of onboard electronic systems increases, driving the need for more advanced power management solutions that can support these functions while ensuring energy efficiency and safety. The growing emphasis on reducing carbon emissions and improving fuel efficiency is also contributing to the accelerated adoption of PMICs in the automotive sector.

Regional Insights

The power management IC market in North Americais expected to grow at a significant CAGR from 2024 to 2030, driven by the region's technological leadership, advanced industrial base, and strong focus on energy efficiency. The U.S. and Canada, being key players in the global technology landscape, have a high demand for power management solutions across various industries, including consumer electronics, automotive, and industrial automation. The rapid adoption of electric vehicles, coupled with increasing investments in renewable energy projects, particularly in solar and wind energy, has further accelerated the demand for PMICs. In addition, the proliferation of IoT devices, smart homes, and advanced communication networks in North America requires efficient power management to ensure reliable and sustainable operation. The region's focus on reducing carbon emissions and enhancing energy efficiency continues to drive the market's growth, making North America a significant player in the global PMIC market.

U.S. Power Management IC Market Trends

The power management IC market in the U.S. is expected to grow at the fastest CAGR from 2024 to 2030. The country’s robust consumer electronics market, driven by high demand for smartphones, laptops, and other portable devices, requires advanced power management solutions to enhance battery life and performance. In addition, the U.S. is at the forefront of electric vehicle adoption and renewable energy deployment, particularly in solar and wind power, which has led to increased demand for PMICs. The country's emphasis on sustainability, coupled with government incentives for green technologies, has further accelerated the market's growth. Moreover, the rapid expansion of the IoT ecosystem and smart infrastructure projects in the U.S. necessitates efficient power management, contributing to the sustained growth of the PMIC market in the country.

Asia Pacific Power Management IC Market Trends

The Asia Pacific region dominated the power management IC market in 2023 and accounted for a 43.9% share of the global revenue. The region is expected to witness the fastest growth rate over the forecast period 2024 to 2030, driven by the region's rapid industrialization, technological advancements, and burgeoning consumer electronics sector. Countries such as China, Japan, South Korea, and India are major hubs for electronics manufacturing, which significantly boosts the demand for PMICs. The increasing adoption of smartphones, tablets, and other portable devices in these countries, coupled with the growing popularity of electric vehicles (EVs), has accelerated the need for advanced power management solutions. Moreover, the region's strong focus on renewable energy and energy-efficient technologies is further propelling the market's growth. The availability of skilled labor, advanced manufacturing facilities, and supportive government policies in several Asia Pacific countries are also contributing to the region's dominance.

The power management IC market in India is expected to grow at a significant CAGR from 2024 to 2030, driven by rapid urbanization, an expanding middle class, and a surge in the consumption of consumer electronics. The government's push towards digitization, coupled with initiatives such as "Make in India," has encouraged both domestic and international companies to set up manufacturing units in the country. The growing penetration of smartphones, tablets, and other IoT devices has significantly increased the demand for efficient power management solutions. In addition, India's emphasis on renewable energy and electric mobility, reflected in ambitious targets for solar power and electric vehicles, is creating new opportunities for the PMIC market. The burgeoning automotive sector, with a shift towards electric and hybrid vehicles, also contributes to the rising demand for advanced power management solutions.

Europe Power Management IC Market Trends

The power management IC market in Europe is expected to witness steady growth from 2024 to 2030. The European Union's stringent regulations on energy consumption and carbon emissions have led to increased demand for energy-efficient power management solutions in industries such as automotive, industrial automation, and renewable energy. The region's leadership in automotive innovation, particularly in electric and hybrid vehicles, has driven the need for sophisticated PMICs that can manage complex power requirements. Moreover, the growing investment in smart grids and renewable energy sources, such as wind and solar power, further boosts the market's growth. Europe’s commitment to sustainability and its ongoing transition to a low-carbon economy continue to drive the adoption of advanced power management technologies, contributing to the region's significant growth in the global PMIC market.

The power management IC market in France is expected to grow at a significant CAGR from 2024 to 2030. France is leading the way in terms of growth within the European Power Management IC market, propelled by the country's robust automotive sector and its strong emphasis on renewable energy. France’s automotive industry, which is increasingly focusing on electric and hybrid vehicles, demands advanced power management solutions to optimize battery performance and energy efficiency. In addition, France’s aggressive goals for reducing carbon emissions and expanding its renewable energy capacity have spurred investments in technologies that require efficient power management, such as solar and wind energy systems. The French government’s support for innovation and technological advancement, particularly in the energy and transportation sectors, has also contributed to the growing demand for PMICs.

Key Power Management IC Company Insights

The competitive landscape of the power management IC market is characterized by intense competition among several key players, ranging from established semiconductor giants to innovative startups. Major companies like Texas Instruments, Analog Devices, Infineon Technologies, and ON Semiconductor dominate the market, leveraging their extensive product portfolios, strong research and development capabilities, and global distribution networks. These companies continually innovate to introduce more efficient, compact, and cost-effective PMICs to meet the evolving demands of various industries, including consumer electronics, automotive, and industrial sectors.

The market is also seeing increasing competition from emerging players who focus on niche applications or advanced technologies such as GaN (Gallium Nitride) and SiC (Silicon Carbide) power devices. These materials offer superior performance in high-frequency and high-voltage applications, giving these new entrants a competitive edge in specific segments of the market. In addition, strategic partnerships, mergers, and acquisitions are common as companies aim to expand their market share, enhance their technological capabilities, and enter new markets. The growing demand for energy-efficient and compact devices, coupled with the rapid adoption of electric vehicles and renewable energy systems, continues to drive innovation in the PMIC market. This dynamic and competitive environment pushes companies to continuously innovate, adapt, and optimize their product offerings to maintain and grow their market position.

-

In July 2024, Renesas Electronics partnered with AMD to launch a space-qualified power management solution for AMD's Versal AI Edge Adaptive SOC. The design integrates vital space-grade components to boost power management performance. Designed for affordable AI Edge applications, it includes comprehensive qualification, a PMBus interface, and telemetry readouts, ensuring seamless integration into satellite payload systems.

-

In May 2024, Yageo Corporation is set to acquire a significant stake in uPI Semiconductor Corp for USD 162.35 million (NT$5.31 billion). This acquisition is intended to strengthen Yageo's position in the AI and HPC applications market. Once the deal is finalized, Yageo will own a 20.23 percent share in uPI.

-

In March 2024, Infinix Mobile launched its first power management chip, the Cheetah X1. This chip will be used in the Infinix NOTE 40 series smartphones and supports All-Round FastCharge 2.0 technology. The Cheetah X1 integrates three powerful modules to adapt to eight different charging scenarios and includes features like high-precision power monitoring and security measures.

Key Power Management IC Companies:

The following are the leading companies in the power management IC market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.,

- Diodes Incorporated

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Semiconductor Components Industries, LLC (onsemi)

- Semtech Corporation

- Texas Instruments Incorporated

Power Management IC Market Report Scope

|

Attribute |

Details |

|

Market size value in 2024 |

USD 40.29 billion |

|

Revenue forecast in 2030 |

USD 59.63 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Actual data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

|

Key companies profiled |

Analog Devices, Inc.; Diodes Incorporated; Infineon Technologies AG; Microchip Technology Inc.; NXP Semiconductors; Renesas Electronics Corporation; ROHM Co., Ltd.; Semiconductor Components Industries, LLC (onsemi); Semtech Corporation; Texas Instruments Incorporated |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Power Management IC Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the power management IC market based on product, industry vertical, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Linear Regulators

-

Switching Regulators

-

Battery Management ICs (BMICs)

-

Power Supply ICs

-

LED Drivers

-

Reset ICs

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Electronics

-

Smartphones and Tablets

-

Laptops

-

Televisions

-

Wearables

-

Others

-

-

Automotive

-

Engine Management

-

Infotainment Systems

-

Others

-

-

Industrial

-

Factory Automation

-

Energy Management Systems

-

Others

-

-

IT & Telecommunications

-

Servers

-

Data Centers

-

Networking Equipment

-

Others

-

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power management IC market size was estimated at USD 38.22 billion in 2023 and is expected to reach USD 40.29 billion in 2024.

b. The global power management IC market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030, reaching USD 59.63 billion by 2030.

b. The Asia Pacific region dominated the power management IC market in 2023 and accounted for a 43.9% share of the global revenue. The region is expected to witness the fastest growth rate over the forecast period 2024 to 2030, driven by the region's rapid industrialization, technological advancements, and burgeoning consumer electronics sector. The region's strong focus on renewable energy and energy-efficient technologies is further propelling the market's growth.

b. Some key players operating in the power management IC market include Analog Devices, Inc., Diodes Incorporated, Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors, Renesas Electronics Corporation, ROHM Co., Ltd., Semiconductor Components Industries, LLC (onsemi), Semtech Corporation, and Texas Instruments Incorporated.

b. The power management IC market is experiencing rapid growth due to several key trends. The demand for smaller, more portable electronic devices has driven the development of PMICs with reduced form factors and increased integration. As electronic systems become more complex, PMICs are required to handle diverse power requirements and provide advanced features like fast charging and battery management. The growing focus on energy efficiency has led to the development of PMICs with higher efficiency and lower power consumption.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."