- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Powder Coating Pretreatment Market Size, Share Report 2030GVR Report cover

![Powder Coating Pretreatment Market Size, Share & Trends Report]()

Powder Coating Pretreatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Phosphate, Chromate, Chromate Free, Blast Clean), By Application (Automotive & Transportation, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Powder Coating Pretreatment Market Trends

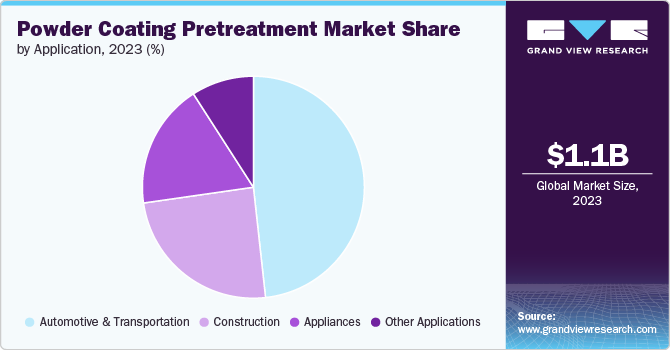

The global powder coating pretreatment market size was valued at USD 1.14 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. This growth is attributed to the increasing demand from the various application sectors such as automotive industry, aerospace industry, furniture, appliances, and architectural applications.

Powder coating is a finishing process used to apply a dry, powder-based paint to various materials, often metals. The powder, consisting of finely ground particles of pigment and resin, is electrostatically charged and sprayed onto the surface to be coated. The object is then cured under heat, allowing the powder to melt and form a uniform, durable, high-quality finish. This technique provides a stronger, more corrosion-resistant coating than traditional liquid paint and is environmentally friendly due to the absence of volatile organic compounds (VOCs).

Drivers, Opportunities & Restraints

The shift from liquid to powder coatings marks a significant advancement in surface finishing technologies. Unlike liquid paints, powder coatings consist of finely ground particles of pigment and resin that are electrically charged and sprayed onto the surface. This method provides a uniform, durable, and high-quality finish and offers superior corrosion resistance. Additionally, powder coatings are an environmentally friendly alternative, as they do not contain volatile organic compounds (VOCs), which are prevalent in liquid paints. The curing process under heat allows the powder to melt and form a robust coating, making this technique increasingly preferred for its efficiency and eco-friendly profile.

Growing concerns about the toxic effects of chromate-based coatings are driven by the environmental and health hazards they present. Chromate, a key ingredient in traditional pretreatment coatings, is recognized for its corrosion resistance properties. However, its use poses serious environmental risks due to its carcinogenic nature and high toxicity. The release of chromate into the environment during application and disposal endangers water sources, soil, and air quality, prompting a shift towards safer alternatives in coatings technology. This has increased interest in developing and adopting non-toxic, environmentally friendly pretreatment methods that ensure safety without compromising performance.

Stricter environmental regulations, particularly in North America and Europe, are pushing manufacturers to adopt safer, chromate-free pretreatment technologies. This shift aligns with the increasing emphasis on sustainability and green building practices, providing opportunities for companies that offer eco-friendly powder coating pretreatment solutions

Product Insights

“Chromate emerged as the fastest growing product with a CAGR of 5.9%”

Phosphate segment dominated the market and accounted for a revenue share of 32.3% in 2023. The shift from hazardous chromate-based coatings has spotlighted the phosphate segment within powder coating pretreatment processes. Phosphate coatings, encompassing iron, zinc, and manganese phosphates, offer a safer alternative for surface preparation. These coatings enhance paint adhesion and corrosion resistance, aligning with environmental and health safety standards. Their application is pivotal in industries seeking to combine performance with sustainability, marking a significant move towards reducing toxic exposure and environmental impact.

Chromate is known for its effectiveness in promoting paint adhesion and corrosion resistance; chromate coatings have fallen out of favor due to their toxic properties. This has paved the way for phosphate-based coatings, including iron, zinc, and manganese phosphates, to emerge as safer alternatives. These phosphate coatings meet environmental and health safety standards and maintain the desired qualities in surface preparation for paint adhesion and corrosion resistance. The shift towards more environmentally friendly and health-conscious manufacturing practices in the powder coating industry has led to limited use of chromate-based coatings for pretreatment.

Application Insights

“Construction emerged as the fastest growing application with a CAGR of 5.9%”

Automotive & Transportation dominated the market with a market and accounted for a revenue share of 48.3% in 2023. There has been a significant shift in the automotive and transportation sectors towards adopting environmentally friendly and health-conscious manufacturing practices, especially in powder coating pretreatment processes. This shift has notably reduced the usage of chromate-based coatings, traditionally favored for their ability to enhance paint adhesion and offer superior corrosion resistance but criticized for their toxicity. The industry now leans towards phosphate-based coatings, such as iron, zinc, and manganese phosphates, which are safer and still meet rigorous environmental and health safety standards.

The construction industry has a growing focus on embracing sustainable and health-conscious approaches, especially in powder coating pretreatment processes. This evolution mirrors broader industry trends, shifting away from chromate-based coatings, which, while effective in enhancing paint adhesion and corrosion resistance, have raised significant environmental and health concerns due to their toxicity. The preference has shifted towards phosphate-based coatings, including iron, zinc, and manganese phosphates. These alternatives are safer and comply with stringent environmental and health safety standards without compromising the critical aspects of surface preparation required for effective paint adhesion and robust corrosion resistance. This transition marks a notable step forward in the construction industry's commitment to sustainable manufacturing practices.

Regional Insights

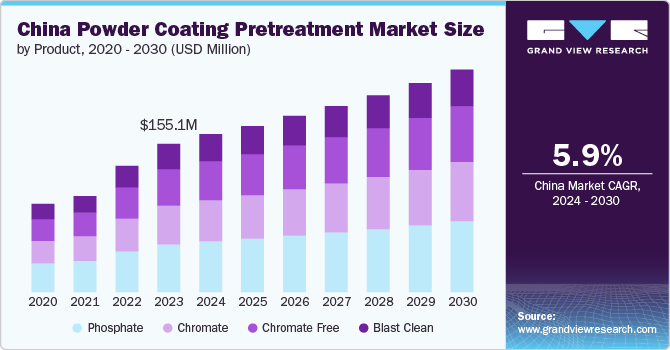

“China emerged as the fastest growing region in Asia Pacific with a CAGR of 5.9% in 2030”

Asia Pacific Powder Coating Pretreatment Market Trends

Asia Pacific powder coating pretreatment market dominated and accounted for a 39.7% share in 2023. The increasing demand for product markets from the automotive industry in developing countries such as China and India are expected to propel the demand for powder coating pretreatment in this region.

The powder coating pretreatment market of China dominated the market and accounted for a market share of 34.2% in 2023. This growth is attributed to increasing demand for the automotive industry in the country. China is one of the largest manufacturers of automotive products leading to a rise in demand for the product market in the region.

North America Powder Coating Pretreatment Market Trends

North America powder coating pretreatment market is expected to grow due to the growing appliance segment in the region. This growth will lead to a rise in demand for the product which is used to protect the appliance from corrosion and safeguard it from various environmental issues.

Europe Powder Coating Pretreatment Market Trends

The powder coating pretreatment market of Europe plays a significant role with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for electronics in the region leading to increased demand for product market.

Key Powder Coating Pretreatment Company Insights

Some of the key players operating in the market include

-

PPG Industries, Inc. manufactures and supplies paints, coatings, chemicals, and specialty materials. The company operates its business in two segments, namely Performance Coatings and Industrial Coatings. PPG Industries, Inc. offers its products to various end-use industries such as aerospace, automotive, marine, construction, packaging, petrochemicals, and consumer goods. Its products are also used in industrial manufacturing applications. The company markets its products under several brand names, including PPG, Glidden, Comex, Olympic, Dulux (in Canada), Sikkens, and PPG Pittsburgh Paints. The company has about 156 manufacturing facilities spread across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, along with research and development headquarters located in Allison Park, Pennsylvania in the U.S. It has architectural coating facilities located in the U.S., Canada, Australia, and China.

-

DuBois Chemicals, Inc. is a company specializing in the development and manufacturing of chemical solutions for various industries, including automotive, food and beverage, water treatment, and more. Their product offerings encompass a wide range of pretreatment and paint line solutions designed to enhance the performance and durability of coatings.

3M and Huntsman Advanced Materials are some of the emerging market participants in the market.

-

Sanchem, Inc. is a specialized manufacturer focused on rust prevention and corrosion control solutions. the company is involved in developing innovative coatings and treatments that address corrosion issues across various industries. The company also provides powder coating pretreatment solutions, which are essential for preparing metal surfaces before the application of powder coatings. The pretreatment process typically includes cleaning and applying a chemical treatment to enhance surface properties, ensuring optimal adhesion of the powder coating.

-

NABU-Oberflächentechnik GmbH is a specialized company in surface technology and chemical treatments for metals. The company has become a pioneer in chrome-free pretreatment processes, emphasizing environmentally friendly solutions. The company offers powder coating pretreatment solutions that are crucial for preparing metal surfaces before the application of powder coatings. Their pretreatment processes typically involve cleaning and applying chemical treatments that improve the adhesion of powder coatings, thereby enhancing the durability and corrosion resistance of the finished products.

Key Powder Coating Pretreatment Companies:

The following are the leading companies in the powder coating pretreatment market. These companies collectively hold the largest market share and dictate industry trends.

- DuBois Chemicals

- PPG Industries, Inc

- Jost International

- Sanchem, Inc.

- Bunty LLC

- NABU- Oberflächentechnik GmbH

- Hillebrand Coating

- Technofirma S.p.A.

- Euroimpianti Srl

- FOSHAN HAIHUA SURFACE TREATMENT TECHNOLOGY CO., LTD.

- Keyi Industrial (Shanghai) Co., Ltd.

- SEW SURFACE COATING PVT. LTD.

Recent Developments

-

In November 2023, Henkel, a surface treatment provider, expanded its manufacturing capacity in Spain by introducing solvent- and chromium-free metal pretreatment technologies for coating facilities to its European range.

-

In June 2024, Jotun announced the launch of a new cx-rated anticorrosive powder coating. This innovative product utilizes proven technology to protect critical equipment operating in challenging environments. It is the industry's first anticorrosive powder coating solution specifically engineered to safeguard steel used in the most extreme conditions.

Powder Coating Pretreatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.21 billion

Revenue forecast in 2030

USD 1.67 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

DuBois Chemicals; PPG Industries, Inc; Jost International; Sanchem, Inc.; Bunty LLC; NABU-Oberflächentechnik GmbH; Hillebrand Coating; Metalesa; Tecnofirma S.p.A.; Euroimpianti Srl; FOSHAN HAIHUA SURFACE TREATMENT TECHNOLOGY CO., LTD.; Keyi Industrial (Shanghai) Co.,Ltd; and SEW SURFACE COATING PVT. LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Coating Pretreatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powder coating pretreatment market report product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Phosphate

-

Chromate

-

Chromate Free

-

Blast Clean

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Appliances

-

Construction

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global powder coating pretreatment market size was valued at USD 1.14 billion in 2023 and is expected to reach USD 1.21 billion n in 2024.

b. The global powder coating pretreatment market size was valued at USD 1.67 billion in 2030 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% in terms of revenue from 2024 to 2030.

b. Phosphate segment dominated the market and accounted for a revenue share of 32.3% in 2023.The shift from hazardous chromate-based coatings has spotlighted the phosphate segment within powder coating pretreatment processes. Phosphate coatings, encompassing iron, zinc, and manganese phosphates, offer a safer alternative for surface preparation.

b. Some prominent players in the global powder coating pretreatment market include DuBois Chemicals; PPG Industries, Inc; Jost International; Sanchem, Inc.; Bunty LLC; NABU-Oberflächentechnik GmbH; Hillebrand Coating; Metalesa; Tecnofirma S.p.A.; Euroimpianti Srl; FOSHAN HAIHUA SURFACE TREATMENT TECHNOLOGY CO., LTD.; Keyi Industrial (Shanghai) Co.,Ltd; and SEW SURFACE COATING PVT. LTD.

b. The powder coating pretreatment market is driven by the environmentally friendly nature of powder coatings as compared to liquid coatings, thereby leading to increasing demand from transportation and architectural sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.