- Home

- »

- Plastics, Polymers & Resins

- »

-

Pour Point Depressant Market Size And Share Report, 2030GVR Report cover

![Pour Point Depressant Market Size, Share & Trends Report]()

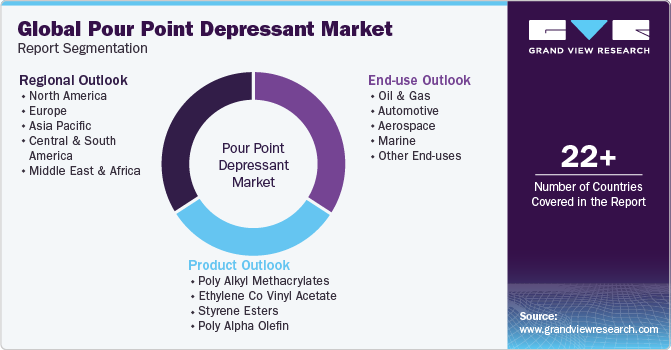

Pour Point Depressant Market Size, Share & Trends Analysis Report By Product (Poly Alkyl Methacrylates, Ethylene Co Vinyl Acetate, Styrene Esters, Poly Alpha Olefin), By End-use (Oil & Gas, Automotive, Aerospace), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-166-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Pour Point Depressant Market Size & Trends

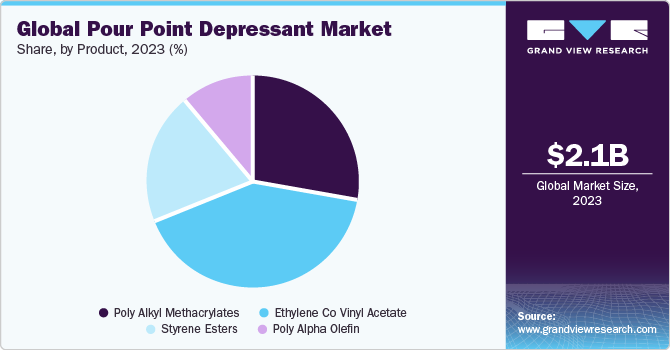

The global pour point depressant market size was estimated at USD 2.12 billion in 2023, and is expected to increase at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. This is attributed to increasing industrialization around the globe, rising awareness about vehicle maintenance, increasing scope of aerospace industry and wide-scale adoption of pour point depressants in the making of lubricants for the oil & gas industry. Pour point depressants are chemical compounds added to various hydrocarbon-based fluids to modify their flow characteristics at low temperatures. Their primary function is to reduce the pour point temperature of a fluid, which is especially important in regions with cold climates. They can be manufactured in different chemical structures such as polymers, copolymers, and organic compounds with polar functional groups, dependent upon the application and characteristics of base fluid.

Oil and gas industry is a prominent end-use market for pour point depressants on a global scale. They play an important role in optimizing the flow properties of crude oil and petroleum products, especially in tundra and other cold regions of the world. The hydrocarbons have an inherent characteristic to freeze and solidify at lower temperatures and it raises the need for additives. The difficulty in maintaining the flow of petroleum products such as petrol, diesel, and aviation fuel causes operational disruptions, reduced product quality and increased maintenance cost. Hence the growth of oil & gas industry is a major driver for pour oil depressants market.

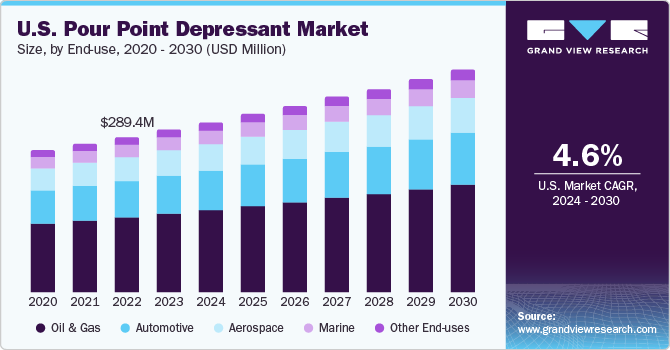

The substantial rise in the sales of vehicles all over the globe is also a major driver for the pour point depressant industry. The rapid increase in population as well as rising trend of urbanization has played a huge part in the growth of automobiles industry. According to the International Organization of Motor Vehicle Manufacturers, in 2022, the total number of cars sold touched the number of 61.6 million, an increase of 6% over the sales in 2021, this in turn accelerates the need for lubricant additives and pour point depressants.

Rapid industrialization has also significantly driven the demand for pour point depressants (PPDs) in end-user industries across the globe. Pour point depressants serve as crucial agents in mitigating the adverse effects of low temperatures on these industrial processes. Industries such as aviation, marine, and energy production rely on PPDs to ensure the smooth operation of their machinery and transportation networks, even in extreme cold weather conditions.

End-use Insights

Oil & gas segment accounted for the largest revenue share of around 45.70% in 2023. The oil & gas industry has experienced significant growth in recent years due to increasing demand for energy in developing countries. Fast-paced industrialization, rise in the number of automobiles and rapid urbanization have been major factors leading to the expansion of oil & gas extraction activities. According to the International Energy Agency, the demand for oil products is set to increase by 6% between 2022 and 2028 to reach 105.7 million barrels per day in the year 2028. This is bound to increase the consumption of pour point depressants applied in the industry.

Aerospace industry is another significant end-user of pour point depressants as they play a crucial role in addressing the challenges faced by aircraft in low-temperature environments such as high-altitude flight and space exploration. Pour point depressants maintain the functionality and fluidity in aircraft components, preventing the risk of oil gelling and excess viscosity in cold conditions.

Marine industry, including maritime transport, offshore activities and shipping is a significant end-user of pour point depressants. They are primarily used as engine lubricants for ships and other vessels. The hydraulic systems used on offshore platforms and ships rely on efficient lubrication in hydraulic systems to work in harsh environments, which necessitates the usage of additives in their machine operations.

Product Insights

The ethylene co vinyl acetate segment accounted for the largest revenue share in 2023. This is attributed to their widespread utilization in biomedical engineering and drug delivery applications. The growth in the drug delivery industry in recent years is due to advancements in technology and increased research and development. Additionally, the increasing prevalence of chronic diseases and the aging population have aided the growth of the drug delivery industry.

Styrene esters are derived after styrene is made to go through an esterification process. They provide flexibility and adhesion along with working as pour point depressants in the automotive and aerospace industries. The increasing demand in the automotive industry due to the adoption of electric vehicles has led to the growth in the consumption of styrene esters in the construction of engines and other parts in automotive.

Poly alkyl methacrylates are widely used in the automotive and healthcare industries due to their characteristic properties such as excellent thermal stability and resistance to a wide range of chemicals. The growing trend of using bio-based and environmentally friendly alternatives has also acted as a major driver for the consumption of the product in the polymer industry.

Regional Insights

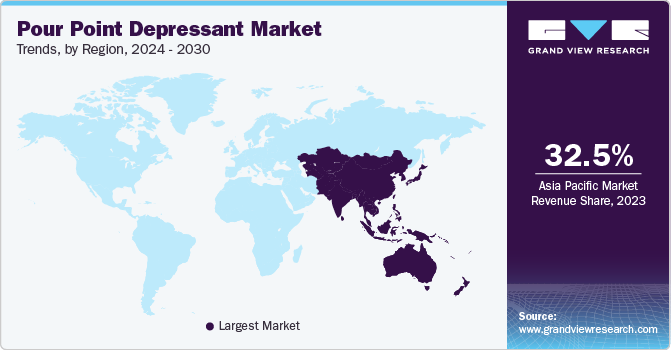

Asia Pacific region accounted for the largest revenue share of around 32.50% in 2023. This is attributed to rapid industrialization in the region driving up the demand for lubricants. The region is home to developing economies such as China, India, and Bangladesh with growing automotive sectors that act as major consumers for pour point depressants in the operation of engines. The liberal trade policies enacted by economic blocs such as the Association of Southeast Asian Nations (ASEAN) and individual countries such as China have contributed to the wide-scale industrial development in the region.

North America holds a significant position in the market due to its well-developed oil & gas and aerospace industry. The U.S. has the world’s largest aerospace industry and stood at a total value of USD 391 billion in 2021, according to the Aerospace Industries Association (AIA). It acts as a major consumer of pour point depressants for both civilian uses in airliners as well as in military aircraft. The other major end-user of pour point depressants in North America is the oil & gas industry, especially in the regions of Northern Canada and Alaska which experience extremely cold temperatures for the majority part of the year.

Europe contains a large-scale automobile industry which consumes pour point depressants in large quantity in the manufacturing of engines. The region contains major automobile manufacturing corporations such as Mercedez-Benz, Volkswagen, Renault SA and others which use lubricants to increase the performance of their product offerings. European authorities levy stringent regulations such as Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) to ensure safety and environmental impact within prescribed limits.

Key Companies & Market Share Insights

The development of environmentally sustainable and cost-effective products would offer major growth opportunities for key market players. In addition, the firms are focusing on producing biodegradable pour point depressants. The global market is currently dominated by key industry leaders such as CLARIANT, The Lubrizol Corporation, Ecolab, Infineum International Limited, Evonik Industries, and Afton Chemical. Major manufacturers operate in the market with diverse strategy initiatives such as expansion, product launches, mergers & acquisitions, and certifications for their products.

Key Pour Point Depressant Companies:

- CLARIANT

- Afton Chemical

- The Lubrizol Corporation

- Evonik Industries

- Infineum International Limited

- Ecolab

- Shengyang Greatwall Lubricant Oil Co.,Ltd.

- Puyang Jiahua Chemical Co., Ltd.

- Sanyo Chemical Industries, Ltd.

- Innospec

Pour Point Depressant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.21 billion

Revenue forecast in 2030

USD 2.98 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

CLARIANT; Afton Chemical; The Lubrizol Corporation; Evonik Industries; Infineum International Limited; Ecolab; Shengyang Greatwall Lubricant Oil Co.,Ltd.; Puyang Jiahua Chemical Co., Ltd.; Sanyo Chemical Industries, Ltd.; Innospec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pour Point Depressant Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pour point depressant market report based on product, end-use, and region:

-

Products Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Poly Alkyl Methacrylates

-

Ethylene Co Vinyl Acetate

-

Styrene Esters

-

Poly Alpha Olefin

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Automotive

-

Aerospace

-

Marine

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pour point depressants market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.21 billion in 2024.

b. The global pour point depressants market is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to reach USD 2.98 billion by 2030.

b. Asia Pacific dominated the global pour point depressants market with a share of 32.50% in 2023. This is attributed to rapid industrialization in the region driving up the demand for lubricants.

b. The global pour point depressant market is currently dominated by key industry leaders such as CLARIANT, The Lubrizol Corporation, Ecolab, Infineum International Limited, Evonik Industries, and Afton Chemical.

b. Rapid industrialization has significantly driven the demand for pour point depressants (PPDs) in end-user industries across the globe. Pour point depressants serve as crucial agents in mitigating the adverse effects of low temperatures on these industrial processes. Industries such as aviation, marine, and energy production rely on PPDs to ensure the smooth operation of their machinery and transportation networks, even in extreme cold weather conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."