- Home

- »

- Animal Health

- »

-

Poultry Diagnostics Market Size And Share Report, 2030GVR Report cover

![Poultry Diagnostics Market Size, Share & Trends Report]()

Poultry Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Test (ELISA, PCR), By Disease, By Testing Category, By Product (Consumables, Reagents & Kits), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-559-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Poultry Diagnostics Market Size & Trends

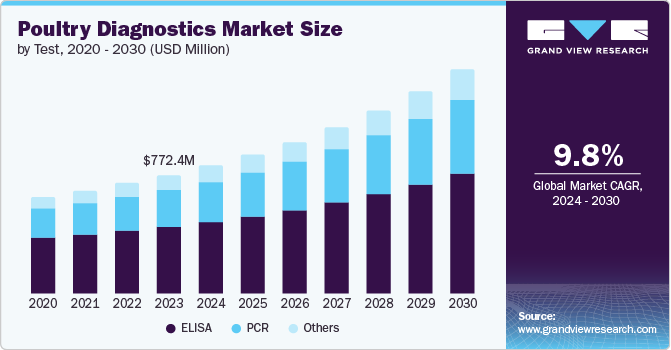

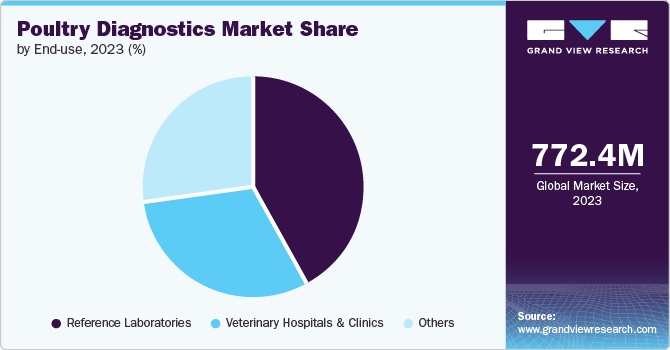

The global poultry diagnostics market size was valued at USD 772.4 million in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The market growth is driven by the increasing prevalence of poultry diseases, such as avian influenza and Newcastle disease, which has heightened the need for effective diagnostic solutions. Additionally, the rising demand for poultry-derived food products, including eggs and meat, is pushing farmers to ensure the health and productivity of their flocks.

Technological advancements in diagnostic tools, such as enzyme-linked immunosorbent assay (ELISA) and polymerase chain reaction (PCR) tests, have improved the accuracy and efficiency of disease detection. Furthermore, stringent food safety regulations and growing awareness about the economic impact of poultry disease outbreaks are encouraging the adoption of diagnostic services. Government and non-government initiatives aimed at promoting animal health and food security also play a significant role in driving market growth.

Advancements in diagnostic systems and methods have significantly transformed the poultry diagnostics market. Point-of-care tests, also known as decentralized tests, are becoming more affordable and practical for diagnosing poultry, especially in areas with limited laboratory services. These technological advancements and innovative test methods are driving substantial market growth.

Moreover, government authorities worldwide are raising awareness about the importance of accurate poultry disease diagnosis to enhance poultry health. Governments and various associations are promoting the use of diagnostic techniques through programs, schemes, disease surveillance, and policies aimed at early diagnosis and effective management of poultry diseases. These initiatives are increasing the demand for diagnostic products, thereby contributing to market growth.

Test Insights

The ELISA test segment dominated the market, accounting for a share of 56.4% in 2023. This growth is attributed to the extensive use of ELISA tests for detecting diseases in poultry. Additionally, many companies worldwide offer a diverse portfolio of ELISA test products, increasing the likelihood of their adoption and further boosting the segment’s growth. These factors are significantly driving the segment expansion.

The PCR segment is anticipated to grow at a CAGR of 10.6% from 2024 to 2030. The driving forces behind this growth include the widespread use and benefits of these tests, such as disease surveillance in global poultry trade, support for biosecurity measures to prevent disease outbreaks, compliance with regulatory requirements to ensure food safety and animal health, and substantial investment in R&D. These investments are improving the accuracy of disease detection, increasing product demand, and propelling the growth of this segment.

Disease Insights

The avian influenza disease segment accounted for the largest market revenue share of 23.4% in 2023. This growth is driven by serious health issues such as reduced egg production, respiratory illness, substantial infections, and a rising number of cases affecting the health of food-producing birds and impacting poultry production. These challenges increase the demand for enhanced treatment with better results, significantly growing this segment.

The chicken anemia disease segment is expected to grow with a CAGR of 11.3% from 2024 to 2030. Key factors driving this growth include the increasing prevalence of diseases, the demand for more specific diagnostic solutions, technological advancements, governmental actions, market strategies of key players, and global trends. These factors are raising the demand for products in this segment and significantly contributing to its growth.

Testing Category Insights

The clinical chemistry testing category segment accounted for a revenue share of 29.4% in 2023. This growth is attributed to the increasing demand for safe poultry products, enhanced disease detection through clinical chemistry enabling timely intervention, and increased accuracy due to technological advancements. Additionally, clinical chemistry assists in focusing on preventive healthcare for better animal health and performance. Rising competition in the market also drives the demand for superior clinical chemistry diagnostic services to gain a competitive advantage.

The parasitology testing category segment is anticipated to grow at a CAGR of 10.7% from 2024 to 2030. This growth is driven by the high incidence of parasitic diseases, their impact on poultry health and productivity, the need for compliance with existing regulations, innovations in diagnostic methods, and a shift towards preventive measures.

Product Insights

The consumables, reagents & kits product segment dominated the market, accounting for a share of 52.6% in 2023. The driving forces behind this growth include the increasing incidence of diseases among poultry populations, an emphasis on disease prevention measures for better health and performance of the animals, technological advancements in diagnostics to ensure accuracy and efficiency, regulatory compliance requirements, and the growing demand for point-of-care testing solutions.

The equipment & instruments product segment is expected to grow at a CAGR of 9.3% from 2024 to 2030. Factors contributing to this growth include technological enhancements in this segment, rising incidences of various poultry diseases, mandatory regulatory standards, growing awareness of preventive healthcare, and increased competition in the market to develop innovative products.

End-Use Insights

The reference laboratories dominated the market in 2023. This growth is fueled by the high level of accuracy in diagnostic services provided by reference laboratories in poultry health management. The specialized expertise and technicians in this segment ensure better treatment outcomes and results for consumers. Additionally, the vital role of reference laboratories in disease surveillance and monitoring significantly contributes to the market expansion.

The veterinary hospitals and clinics end-use segment is anticipated to grow at a CAGR of 9.5% from 2024 to 2030. The driving forces behind this growth include the adoption of advanced technologies and innovations, such as state-of-the-art diagnostic services for poultry farmers, substantial investment in R&D by veterinary hospitals and clinics, and adherence to stringent government regulations.

Regional Insights

North America dominated the poultry diagnostics market in 2023 owing to the high demand for products due to rising avian disease outbreaks in the region, which has led to significant investment opportunities and market expansion.

The U.S. poultry diagnostics market led the North American market with a share of 75.5% in 2023. This dominance is due to the increasing cases of infectious pathogens in the poultry industry, a surge in demand for point-of-care diagnostics, and government initiatives to enhance the poultry sector.

Mexico poultry diagnostics market is expected to grow the fastest rate in North America, with a CAGR of 11.3% from 2024 to 2030 pertaining to the rising and continuous demand for poultry-derived products, an increase in incidences of zoonotic diseases, government regulations, awareness of diagnostic technologies, and market trends at both international and national levels.

Europe Poultry Diagnostics Market Trends

Europe was identified as a lucrative region for the poultry diagnostics market in 2023 attributed to the expanding poultry industry, which increases the demand for diagnostics, growing awareness of animal safety and well-being, and the rising incidence of zoonotic diseases that require enhanced surveillance, monitoring, and diagnosis. These factors significantly drive the demand for diagnostic products and expand the market.

The UK poultry diagnostics market is expected to grow rapidly in the coming years due to increasing awareness of animal health, rising cases of avian diseases, and technological advancements in the poultry diagnostics industry. These factors are driving the demand for diagnostic products, leading to significant market growth in the country.

Asia Pacific Poultry Diagnostics Market Trends

TheAsia Pacific poultry diagnostics marketis expected to witness the fastest growth at a CAGR of 11.86% from 2024 to 2030. This growth is driven by the increasing incidence of chicken anemia, infectious bursal disease, fowl pox, and other poultry diseases, which is boosting the demand for diagnostic products. In addition, government initiatives aimed at raising awareness of animal welfare are significantly contributing to market expansion in the region.

China poultry diagnostics market held a substantial market share in 2023 owing to strategic efforts by market players, increased investment in the local industry, and technological advancements. These factors have significantly propelled market growth in the country.

Key Poultry Diagnostics Company Insights

Some of the key companies in the poultry diagnostics market include Zoetis Services LLC, IDEXX Laboratories, Inc., Embark Veterinary, Inc., and many more companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Poultry Diagnostics Companies:

The following are the leading companies in the poultry diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories, Inc.

- Zoetis Services LLC

- Antech Diagnostics, Inc.

- Embark Veterinary, Inc.

- Agrolabo S.p.A.

- Thermo Fisher Scientific Inc.

- Innovative Diagnostics SAS

- FUJIFILM Corporation

Recent Developments

-

In January 2024, Alveo Technologies, Inc. announced its collaboration with industry experts and poultry sector leaders to introduce an efficient, precise, in-situ multiplex panel designed to detect all relevant strains of avian influenza. The initial focus will be Group A, H5, H7, and H9. Alveo has formed partnerships with Pharmsure International Ltd., Royal GD, and x-OvO to aid in the co-development and distribution of the tests.

-

In March 2024, Harch Tech Group, a company based in the Netherlands that specializes in poultry diagnostics, acquired NYtor. The acquisition aimed to improve the health of their male chicks by utilizing advanced PCR technology tests.

Poultry Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 833.9 million

Revenue forecast in 2030

USD 1.46 billion

Growth Rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, disease, test category, product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, South Africa

Key companies profiled

IDEXX Laboratories, Inc.; Zoetis Services LLC; Antech Diagnostics, Inc.; Embark Veterinary, Inc; Agrolabo S.p.A.; Esaote SPA; Thermo Fisher Scientific Inc.; Virbac.; Innovative Diagnostics SAS; FUJIFILM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poultry Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global poultry diagnostics market report based on test, disease, test category, product, end use, and region

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA

-

PCR

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Avian Salmonellosis

-

Avian Influenza

-

Newcastle Disease

-

Avian Mycoplasmosis

-

Infectious Bronchitis

-

Infectious Bursal Disease

-

Avian Pasteurellosis

-

Avian Encephalomyelitis

-

Avian Reovirus

-

Chicken Anemia

-

Other Diseases

-

-

Test Category Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry

-

Hematology

-

Microbiology

-

Parasitology

-

Others

-

Immunology & Serology

-

Imaging

-

Cytopathology

-

Histopathology

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables, Reagents & Kits

-

Equipment & Instruments

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary hospitals & clinics

-

Reference laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.