- Home

- »

- Plastics, Polymers & Resins

- »

-

Pouches Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Pouches Market Size, Share & Trends Report]()

Pouches Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Paper, Bioplastics), By Product (Flat, Stand-up), By End-use, By Treatment Type, By Closure Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-786-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pouches Market Summary

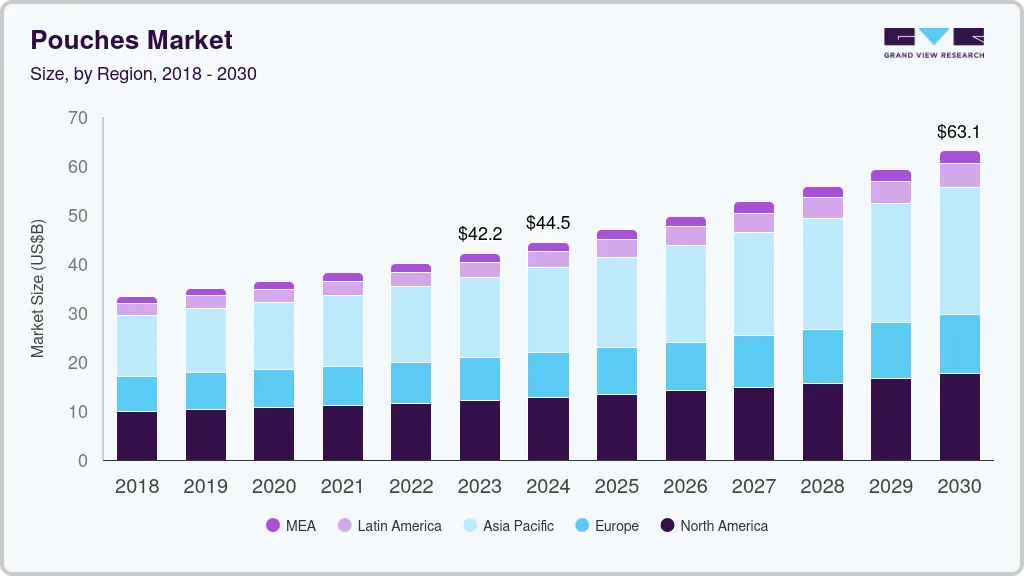

The global pouches market size was estimated at USD 42,192.1 million in 2023 and is projected to reach USD 63,136.2 million by 2030, growing at a CAGR of 5.9% from 2024 to 2030. Rising demand for packaged foods & beverages coupled with the cost-effectiveness and convenience of use provided by pouches compared to rigid packaging drive the demand for pouches.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Germany is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, plastics accounted for a revenue of USD 27,075.1 million in 2023.

- Bioplastics is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 42,192.1 Million

- 2030 Projected Market Size: USD 63,136.2 Million

- CAGR (2024-2030): 5.9%

- Asia Pacific: Largest market in 2023

The demand for packaged food has been significantly growing owing to innovations in food processing techniques and changing lifestyles, which is expected to boost the market demand over the forecast period.

In the transportation sector, occupying space also significantly influences logistics costs. Since pouches occupy less space in vehicles due to their compactness, they help reduce product transportation costs.

End-use companies are increasingly preferring sustainable packaging solutions owing to the growing awareness of sustainability among consumers and rising regulatory pressure. Pouches utilize less material, water, and energy while manufacturing and occupy lower space in landfills after disposal, which improves their sustainability profile. This factor also forces end-use companies to opt for the pouch packaging format, fueling market growth.

There is a growing use of biodegradable materials like polylactic acid (PLA) and other compostable films, which reduce environmental impact in the flexible packaging area. Incorporating post-consumer recycled (PCR) content into flexible pouches helps reduce the use of virgin plastics and supports a circular economy. In addition, manufacturers are increasingly using mono-materials that can be easily recycled.

Drivers, Opportunities & Restraints

Convenience meals have seen a rise in the rate of consumption over the years in both developed countries and emerging economies. The major reason for this shift is the changing lifestyle of working individuals with hectic schedules opting for ready-to-eat meals. In addition, the demand for convenience foods is propelled by the additive-free and minimally processed products offered in pouches with long shelf life. Ready meals are part of a convenience format that is deep-rooted in many countries and can be observed in important aspects, such as the lack of fully functional kitchens in apartment buildings in Canada and the U.S. Pouches are increasingly being preferred for packaging ready meals and packaged food products as they provide desired shelf life, eliminate the need for preservatives or cold chain, and can be customized as per the requirements of end-users.

The shift from canned packaging of food products to pouch packaging is another factor driving the market growth. Packaged foods that were only available in metal cans are becoming highly accessible to consumers across various regions due to retort and stand-up pouches. Since the pouches do not require freezing or refrigeration by consumers, retailers, and packers, the distribution of food products has become more feasible.

Plastic is a non-biodegradable and unsustainable material and can adversely impact human and animal life. In addition, the recycling rate of plastic waste products is low compared to the consumption rate, which ultimately pollutes land, ocean, and drinking water. According to the UN (United Nations), 300 million tons of plastic waste is generated every year globally, which is nearly equivalent to the weight of the global human population. To curb this humongous amount of plastic waste, many regulatory bodies and governments worldwide have imposed restrictions on the generation of primary plastic waste over the years, which can restrain market growth.

Plastic resins, such as polypropylene (PP), polyethylene (PE), Polyvinyl chloride (PVC), and polystyrene (PS), are mainly used to produce pouches. These plastic resins are derived from crude oil. Therefore, the continuous fluctuation in crude oil prices leads to uncertainty around the availability of raw materials at lower or economical prices.

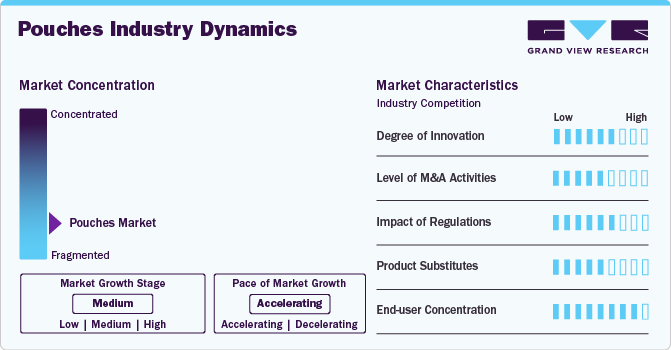

Market Concentration & Characteristics

Prominent manufacturers operating in the market include Amcor Plc, Sealed Air, Mondi, Cheer Pack North America, Smurfit Kappa, Constantia Flexibles, and Huhtamaki.

The industry is highly fragmented by the presence of domestic and global players. Companies mainly focus on M&As, strategic collaborations, and new product launches to strengthen their market position. For instance, in June 2023, an acquisition binding agreement was signed between Italy-based Pouch Partners s.r.l. and CCL Industries. This acquisition aimed at utilizing Pouch Partners s.r.l.'s technology to develop enhanced films for pouch manufacturing.

Also, in February 2024, North American flexible packaging manufacturer Brook + Whittle LTD acquired pouch manufacturer PouchIt, which specializes in lay-flat pouches, stand-up pouches, and roll stock films. This acquisition will help Brook + Whittle LTD's presence in the Southeastern part of the U.S.

Material Insights

The plastic material segment dominated the market and accounted for a revenue share of over 64.0% in 2023. Polyethylene terephthalate (PET), PE, and PP are some commonly used plastic resins for manufacturing plastic pouches. The high durability, impact resistance, and cost-effectiveness of plastic materials compared to other materials make them a favorable choice for pouch manufacturing. Moreover, strong resistance to moisture, dust, oxygen, and UV light, which help pouches keep packed products fresh for a longer duration, drive their demand in pouch production.

The bioplastic material segment is anticipated to witness the highest CAGR of 7.4% from 2024 to 2030. Bioplastics, derived from renewable resources like corn starch, sugarcane, and cellulose, offer a reduced carbon footprint compared to conventional plastics. Bioplastic exhibits properties similar to crude oil-based plastic material and is completely degradable. Innovative biopolymers such as PHAs (polyhydroxyalkanoates) and PLA (polylactic acid) are the major growth drivers of biodegradable plastic materials. Based on their chemical composition, they possess various physical and mechanical properties required for various applications, such as healthcare, homecare, and food packaging.

Treatment Type Insights

Based on treatment type, the market has been further divided into standard, aseptic, retort, and hot fill. The standard treatment type segment accounted for the dominant revenue share of over 58.0% in 2023. Standard treatment pouches are used across the personal care & cosmetics and food & beverage industries owing to their low cost and high durability.

The aseptic treatment type segment is expected to witness the highest CAGR of 6.8% from 2024 to 2030. Aseptic treatment ensures that the packaged product is safe from bacteria while eliminating the need for refrigeration during transportation. This is driving end-use companies to opt for aseptic treatment type-based packaging. In the aseptic treatment process, foods & beverages, such as non-carbonated beverages, soups, milk, and pharmaceuticals, are sterilized separately from the packaging. These products are then further packed in these pouches under sterile conditions.

Product Insights

Based on product, the market is segmented into flat and stand-up pouches. Among these, the flat-type segment accounted for the largest share of over 64.0% in 2023. Products, such as dry fruits, fabric care, medical equipment, detergents, confectionery, and snacks are predominantly packed in flat pouches due to their low cost and convenience of storage.

The stand-up pouch segment is expected to witness the highest CAGR of 7.2% from 2024 to 2030. Food products packed in stand-up pouches, such as baby food, yogurt, soup, dressing, and salad, can be consumed away from home. This portability, coupled with easy-to-open closures incorporated in product format, drives segment growth.

Closure Type Insights

Based on closure type, the market is further categorized into tear notch, zipper, and spout. The zipper segment dominated the market in 2023 and accounted for a revenue share of over 40.0%. Zipper protects edible products from excess moisture helping retain their freshness for a longer duration even when used more than once. Zipper pouches are becoming a popular choice in emerging economies where consumers are shifting toward packaged foods for daily consumption since it allows them time to consume food products based on their convenience.

The spout closure pouches segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. Spout closures make it easy to pour and dispense liquids, semi-liquids, and granular products with precision, reducing spillage and waste. The re-sealable nature of spout pouches allows consumers to use the product multiple times, maintaining freshness and reducing waste. Spout pouches are widely used in the packaging of juices, sauces, baby food & dairy products, and more, providing a user-friendly alternative to traditional bottles and cartons.

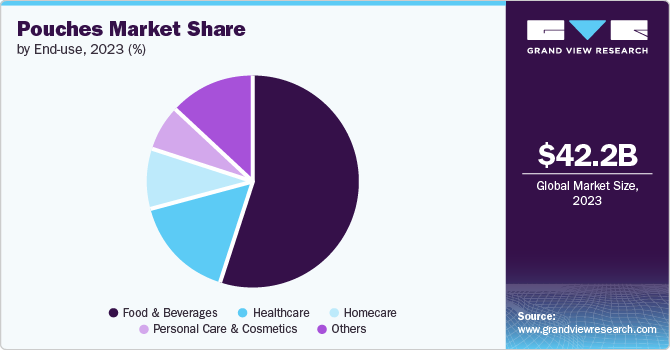

End-use Insights

Based on end use, the market is further segmented into food & beverages, healthcare, personal care & cosmetics, homecare, and others. Among these, the food & beverages segment accounted for the largest revenue share of over 55.0% in 2023. Increasing product usage for the packaging of alcoholic beverages due to their low weight, sustainability, and non-fragile nature is contributing to the segment's growth. Furthermore, standup pouches are increasingly utilized for the packaging of baby food products. The global baby food market has been witnessing considerable growth on account of the growing population of working women, which, in turn, is expected to drive the demand in the food and beverage end use segment over the forecast period.

The healthcare segment is expected to grow at the fastest CAGR of 6.9% over the forecast period. There is a growing demand for flexible packaging for medications, supplements, and vitamins, which require secure, tamper-evident, and protective packaging. Small medical devices and diagnostic kits are increasingly being packaged in pouches due to their convenience and protective qualities, which further contribute to pouches demand in healthcare.

Regional Insights

The North America pouches market is expected to observe steady growth over the forecast period. The fast-paced lifestyle of North American consumers has increased the demand for convenient packaging solutions. Pouches are lightweight, easy to carry, and ideal for on-the-go consumption. Moreover, the beverage industry, including products like juices, smoothies, energy drinks, and alcohol, is increasingly adopting pouches for their convenience and innovative packaging designs. These factors contribute to the regional market growth.

U.S. Pouches Market Trends

The pouches market in the U.S. held a significant share of over 83.0% in 2023. According to the American Pet Products Association (APPA), U.S. pet industry expenditure is seen to be growing and was valued at USD 147.0 million in 2023. The growing pet industry expenditures indicate a strong demand for pouches, which are used to pack pet food and other pet-related products.

The Mexico pouches market is expected to grow at a CAGR of 6.4% over the forecast period. Mexican consumers are highly price-sensitive, forcing manufacturers to develop cost-effective alternatives. Generally, flexible packaging is used to cut down the packaging costs. Thus, consumers in Mexico are comfortable with pouch packaging for many foods such as pork, beef, tuna, and refried beans, which is contributing to the growth of the pouches market in the country.

Asia Pacific Pouches Market Trends

The pouches market in Asia Pacific accounted for the largest revenue share of over 38.0% in 2023. Increasing demand for the packaging format due to its low cost and high aesthetic appeal on retail shelves coupled with the rising penetration of organized retail in the region augment the market growth. Furthermore, the growing spending power of consumers, especially in countries, such as Vietnam, India, and China, is boosting demand for packaged food products, which, in turn, is expected to propel market growth. Moreover, the rising consumption of packaged beverages and high preference for small-sized packs, due to their low cost and convenience of use, are expected to fuel demand for pouches.

The China pouches market dominated the Asia Pacific regional market and accounted for a share of over 41.0% in 2023. The country emerged as a manufacturing hub in the global supply chain with an extensive presence of end-use companies. The presence of a large population pool with substantial disposable income makes China one of the fastest-growing packaged food markets. Factors, such as busy lifestyles and rising disposable incomes, contribute to the increasing demand for convenience and packaged food products, which, in turn, supports the growth of the pouches market.

The pouches market in India is seeing an upward trend in the consumption of packaged foods due to increasing middle-class population with high disposable incomes. With many players, such as Tata, Unilever, and Nestlé, introducing novel ready-to-eat (RTE) meals, consumers are presented with a variety of options. Moreover, expanding physical and online retail networks across the country are expected to boost the growth of end use industry, thereby, benefitting the pouches sector growth in India over the forecast period.

Europe Pouches Market Trends

The Europe pouches market growth is driven by stringent rules introduced by the European Commission to curb packaging waste. The European Union plans to reduce plastic waste by 2030, mainly by banning single-use plastic packaging and emphasizing the use of recyclable packaging. Therefore, to align with this goal, end-use companies, and pouch manufacturers are expected to focus more on producing pouches made from mono-materials.

The pouches market in Germany accounted for the largest share of over 24.0% in 2023. The German food & beverage industry ranks among the top four sectors in the country. Bakery products & confectionery, baked goods, and meat & dairy are some of the food products that are produced and packaged in the country on a large scale. Germany has some of the major food manufacturing companies, such as Cargill, Nestlé, Mondelēz Deutschland, Arla, Südzucker, and Dr. Oetker Group. Moreover, the steadily expanding packaged food industry in the country, owing to increased traction around healthy and nutritional food products, is further anticipated to expand the size of the German pouch market in the coming years.

The Spain pouches market is expected to register a CAGR of 5.6% over the forecast period. The National Association for Meat Industries has recommended the use of several packaging types for meat packaging. Wherein pouches are recommended for the packaging of cured meat and cold-cut products. In addition, stand-up pouches are garnering significant traction in the Spanish packaged meat sector as they improve user experience. Moreover, the rising trend of lightweight or minimalist packaging is expected to favor the growth of the domestic market.

Central & South America Pouches Market Trends

The pouches market in Central & South America is projected to grow at a significant rate over forecast period. Pouches witness significant growth due to many processed food manufacturers, distributors, and retailers exploring ways to expand their businesses in the region to access the fast-growing market and skyrocketing retail sales in the country. However, escalating currency exchange rates, increasing production cost of packaging, and low disposable income due to economic slowdown are expected to hinder market growth.

Middle East & Africa Pouches Market Trends

The pouches market in Middle East & Africa is experiencing rapid expansion on account of the growing population and application industries. According to the estimates of the United Nations, Africa is expected to witness the highest population growth by 2050. Furthermore, increasing government initiatives by the Middle Eastern countries to promote other industries, except for crude oil, are expected to act as a stimulant for the packaging industry over the forecast period, thus contributing to market growth.

The South Africa pouches market growth can be attributed to the rapid industrialization in the country. Moreover, presence of key manufacturers, including Kangopak, Cispak, Swiss Pac South, and Kolysen Packaging Integration Co., Ltd., is expected to favor market growth in the country.

Key Pouches Company Insights

Some key companies operating in the pouches market include Amcor Plc, Sealed Air, Mondi, Cheer Pack North America, Smurfit Kappa, Huhtamaki, Guala Pack S.p.a., ProAmpac, Goglio SpA, Coveris, and Constantia Flexibles.

-

Amcor Plc was established in 1860 and is headquartered in Zürich, Switzerland. It provides packaging solutions worldwide with a primary focus on Western Europe, North America, Australia, and New Zealand. The company operates through two business segments, namely, flexible packaging and rigid packaging. Some of the key offerings of the company under these segments include rigid containers, flexible packaging pouches, closures, and specialty cartons

-

Sealed Air manufactures food, consumer care, and other packaging solutions. The company was established in 1960 and is headquartered in North Carolina, U.S. The company operates through its two business segments, namely, food and protective. The food segment largely serves perishable food processors, predominantly in fresh red meat, smoked & processed meats; poultry; and dairy (solids and liquids) markets worldwide

Key Pouches Companies:

The following are the leading companies in the pouches market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor Plc

- Mondi

- Sealed Air

- CONSTANTIA

- Coveris

- Goglio SpA

- ProAmpac

- Südpack

- GUALAPACK S.P.A

- Huhtamaki Group

- Smurfit Kappa

Recent Developments

-

In March 2024, Südpack introduced a certified recyclable film, designed for its in-house production of food pouches. This film is suitable for pasteurization and hot filling. The film will be used for producing stand-up pouches with spouts

-

In February 2024, Amcor Plc collaborated with Stonyfield Organic to manufacture a polyethylene-based spouted pouch for YoBaby refrigerated yogurt packaging. The new pouch eliminates metalized or foil-based film layers from its composition, while still providing superior heat resistance to allow for spout insertion

Pouches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 44.49 billion

Revenue forecast in 2030

USD 63.14 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, treatment type, product, end use, closure type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; South Korea, Brazil; South Africa

Key companies profiled

Amcor Plc; Sealed Air; Mondi; Cheer Pack North America; Smurfit Kappa; Huhtamaki; Guala Pack S.p.a.; Südpack, ProAmpac; Goglio SpA; Coveris; Constantia Flexibles

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pouches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pouches market report based on material, treatment type, product, end use, closure type, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Paper

-

Bioplastics

-

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard

-

Aseptic

-

Retort

-

Hot-Fill

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flat Pouch

-

Stand-up Pouch

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Healthcare

-

Personal Care & Cosmetics

-

Homecare

-

Others

-

-

Closure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tear Notch

-

Zipper

-

Spout

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pouches market size was estimated at USD 42.19 billion in 2023 and is expected to reach USD 44.49 billion in 2024.

b. The global pouches market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 63.14 billion by 2030.

b. Asia Pacific accounted for the largest share in 2023 owing to factors including increasing demand for the packaging format due to its low cost and high aesthetic appeal on retail shelves.

b. The pouches market includes key players such as Amcor plc, Mondi, Sealed Air, Constantia Flexibles, Coveris, Goglio SpA, ProAmpac, Gualapack S.P.A., Huhtamaki Group, and Smurfit Kappa.

b. The key factors that are driving the pouches market include rising demand for low-cost, convenient, shelf appealing, and lightweight packaging by end-use industries, including food & beverages, healthcare, personal care & cosmetics, and home care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.