- Home

- »

- Organic Chemicals

- »

-

Potting Compounds Market Size And Share Report, 2030GVR Report cover

![Potting Compounds Market Size, Share & Trends Report]()

Potting Compounds Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Epoxy Resin, Polyurethane, Silicone Resin, Polyester System), By Technology, By End Use (Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-367-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potting Compounds Market Size & Trends

“2030 Potting Compounds Market value to reach USD 41,551.34 million”

The global potting compounds market size was estimated at USD 33,275.20 million in 2023 and is projected to grow at a CAGR of 3.2% in terms of revenue from 2024 to 2030. This growth is attributed to the increasing demand from the consumer electronics industry and the growing trend of miniaturizing electronic devices.

Potting compounds are liquid resins applied to circuit boards to protect electronic components from moisture, heat, vibration, impact, and other environmental factors. These compounds, which include epoxy, polyurethane, and silicone, adhere well to electronic products. They help to prevent short circuits, provide increased chemical protection in complex assemblies, and offer mechanical shock and vibration resistance in harsh environmental conditions. Additionally, they provide high-temperature resistance and prevent cracking or yellowing of electronic devices due to ultraviolet (UV) radiation. Potting compounds are widely used worldwide in the automotive, electronics, aerospace, and power industries.

Drivers, Opportunities & Restraints

The consumer electronics sector has boomed due to technological advancements, economic reforms, and increased disposable income. Demand for potting compounds is rising alongside high-tech appliance sales. Encapsulants provide protection for integrated circuits and printed circuit boards. Miniaturization is a recent trend driven by the demand for smaller electronic devices. The product market serves as encasing materials for corrosion, electrical, and thermal resistance. Encapsulants offer minimal curing time in integrated circuits (IC) and printed circuit boards (PCB) by providing the best protection. Due to the demand for portable and smaller-sized electronic devices, miniaturization is one of the most recent trends in the consumer electronics sector.

In the product market, improperly selecting resin is a significant market restraint. Not all potting materials are suited for every application; some require specific surface preparations or primers for optimal bonding. Certain potting compounds, particularly those that are cured at higher temperatures (125-150 ºC), can potentially damage sensitive electronic components. This necessitates careful selection to ensure high protection and reliability of the encapsulated parts, which, if overlooked, can hinder market growth due to increased failure rates and concerns over component safety and longevity.

Adopting two-component polyurethane potting compounds has significantly increased over time due to their exceptional properties and versatility. These compounds offer excellent mechanical strength, superior adhesion, and flexibility, making them highly suitable for protecting various electronic components and assemblies. Their ability to provide durable insulation and resistance to moisture, chemicals, and extreme temperatures has made them a preferred choice for many industries seeking to enhance the reliability and longevity of their products. Moreover, these polyurethane systems' adjustable pot life and cure times allow for greater process flexibility, catering to both rapid production cycles and applications requiring precise workmanship.

Product Insights

“Epoxy resin emerged as the fastest growing product with a CAGR of 3.6%”

Epoxy segment dominated the market and accounted for a revenue share of 32.7% in 2023. Epoxy resin is a crucial component in potting compounds, serving as a robust adhesive and insulating material. This thermosetting polymer cures when mixed with a hardener, forming a durable, chemically resistant bond. It's widely used in electronics for encapsulating components, protecting them from moisture, dust, and mechanical shock. The versatility of epoxy resin and its excellent electrical properties make it ideal for potting applications, ensuring the longevity and reliability of electronic devices.

Polyurethane resin is another key material used in potting compounds, and it is appreciated for its flexibility and durability. This resin type offers excellent impact resistance and is more elastic than epoxy resin, making it suitable for applications where flexibility is crucial. It also performs well in extreme temperatures and provides excellent resistance to water, chemicals, and wear, ensuring the protection and longevity of encapsulated electronics. Its ability to form solid yet flexible bonds make polyurethane resin a preferred choice for dynamic environments.

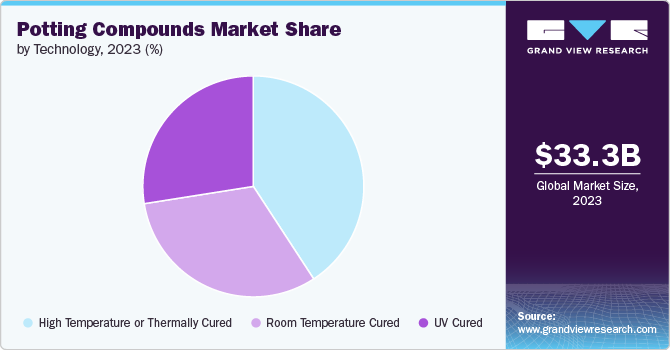

Technology Insights

“Room Temperature Cured emerged as the fastest growing technology with a CAGR of 3.5%”

High Temperature or Thermally Cured dominated the market with a market and accounted for a revenue share of 40.8% in 2023. High-temperature or Thermally Cured involves applying heat to initiate and accelerate the curing process. This technique is particularly suitable for materials like epoxy or silicone, which can benefit from elevated temperatures to achieve full curing. Through this process, the potting compound hardens and reaches its optimal physical properties faster than at room temperature, enhancing its durability and effectiveness in protecting electronic components. This method is ideal for applications requiring rapid curing and where the materials can withstand the heat without degradation.

Room-temperature cure involves allowing the materials to harden without applying external heat. This slower process benefits components that may be sensitive to heat or when the application does not permit elevated temperatures. Compounds like certain epoxies and silicones can cure effectively at ambient temperatures, making this method suitable for various applications. This technique ensures a gentle curing process, preserving the integrity of sensitive electronic components while still providing adequate protection and insulation.

End Use Insights

“Energy & power emerged as the fastest growing end use with a CAGR of 3.6%”

Transportation dominated the market with a market and accounted for a revenue share of 40.37% in 2023. The cessation of potting compound usage in Transportation primarily relates to the shift towards alternatives that offer better performance, sustainability, or cost-effectiveness. Potting compounds, traditionally used for protecting electronic assemblies against harsh environmental conditions, are being reconsidered due to advancements in material science. Alternatives like silicone, epoxy, and urethane resins are favored for their enhanced durability, ease of use, and environmental friendliness. The push for lighter and more energy-efficient transportation solutions also drives the exploration of new materials that fulfill these criteria without compromising protection and longevity.

Energy & Power sector, the product market plays a critical role in protecting and insulating various components. These compounds, often epoxies or silicones that cure at room temperature, are meticulously applied to electrical and electronic parts. Doing so safeguards these sensitive components from environmental stressors, moisture, and thermal shock, ensuring reliable performance under various conditions. This makes potting compounds indispensable in enhancing the durability and longevity of devices within renewable energy systems, power generators, and distribution units, ensuring they operate efficiently and safely over time.

Regional Insights

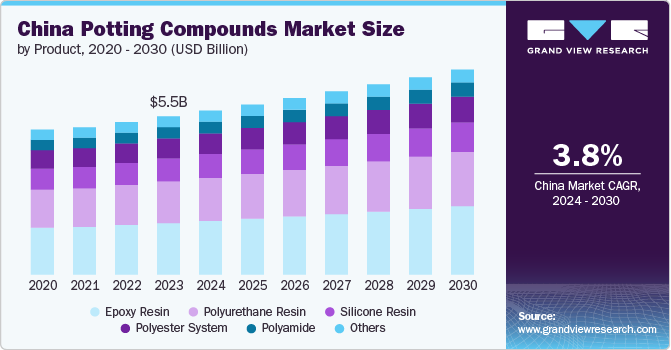

“China emerged as the fastest growing region in Asia Pacific with a CAGR of 3.8% in 2030”

Asia Pacific dominated the market and accounted for a 40.5% share in 2023. The increasing demand for product markets from the electronics industry in developing countries such as China and India are expected to propel the demand for potting compounds in this region.

China dominated the market and accounted for a market share of 40.9% in 2023. This growth is attributed to increasing demand for the electronics industry in the country. China is one of the largest manufacturers of electronic products, leading to an increase in demand for the product market in the region.

North America Potting Compounds Market Trends

The North American market is expected to grow due to the growing energy and power segment in the region. This growth will lead to a rise in demand for the product which is used to protect the electronic system used in the energy and power sectors, safeguarding it from various environmental issues.

Europe Potting Compounds Market Trends

Europe plays a significant role in the potting compounds market, with countries such as Germany, the UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for electronics in the region leading to increased demand for the product market.

Key Potting Compounds Company Insights

Some of the key players operating in the global potting compounds market include

-

Henke AG & Co. KGaA is a multinational company that operates in various industries including adhesives, sealants, surface treatments, and other industrial chemicals. The company is known for its well-known brands such as Loctite, Bonderite, Teroson, Technomelt, Aquence, and Schwarzkopf. The company holds leading positions in both industrial and consumer businesses, offering a diverse portfolio that includes hair care products, laundry detergents, fabric softeners, adhesives, sealants and functional coatings.

-

Dow, Inc. specializes in material science. The company’s product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. It offers a wide range of products and solutions in packaging, infrastructure, mobility, and consumer care segments. Dow’s products are used in various sectors such as homes and personal care, durable goods, adhesives and sealants, coatings and food & specialty packaging.

3M and Huntsman advanced materials are some of the emerging market participants in the global potting compounds market.

-

3M is a company that distributes and manufactures a wide range of industrial products and solutions. Its portfolio includes advanced materials, home care, display materials and systems, stationery and office, home improvement, roofing granules, personal safety, and other products. In addition, 3M offers various solutions in oral care, medical, food safety, consumer health care, and health information systems. The company serves customers worldwide in the automotive, healthcare, electronics, energy, safety, and consumer industries.

-

Huntsman Advanced Materials is a global manufacturer specializing in organic chemical products. The company's main activities involve producing and distributing various chemicals and formulations, including maleic anhydride, amines, epoxy-based polymer formulations, MDI, textile chemicals, and dyes. These products find applications in multiple industries, such as adhesives, aerospace, personal care and hygiene, automotive, construction, consumer products, digital inks, electronics, power generation, medical, packaging, coatings, synthetic fiber, and textile chemicals. Huntsman has a global presence and reaches its diverse customers through a global network of administrative, research and development, and manufacturing units.

Key Potting Compounds Companies:

The following are the leading companies in the potting compounds market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- 3M

- Dow

- MG Chemicals

- Huntsman Advanced Materials

- Hitachi Chemical Co. Ltd

- ELANTAS Beck GmbH

- H.B. Fuller Company

- Dymax Corporation

- CHT UK Manchester Ltd.

- EPIC Products

- ACC Silicones Ltd.

Recent Developments

-

In May 2023, Henkel AG announced the launch of three new products, two new one-component potting sealants: the polyacrylate-based Loctite AA 5832 and silicone-based Loctite SI 305. The third product is the two-component Loctite PE 8086 AB, which combines physical protection with thermal management. These sealants are designed for seamless integration into manufacturing and are highly compatible with the materials used in the automotive industry.

-

In May 2021, Dymax and HZO formed a strategic alliance to meet the increasing demand for protective coating in the market. This partnership will address the specific product needs driven by trends in IoT adoption, edge computing, ruggedization, electronic miniaturization, and lightweight devices. It will also help manufacturers reconsider how they produce and protect their offerings. With an estimated 100 billion electronic devices set to be connected worldwide and numerous stand-alone electrical products, these technologies will be deployed in some of the most challenging environments and mission-critical situations. This includes applications ranging from autonomous cars and satellites to health wearables and smart meters.

Potting Compounds Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34,322.03 million

Revenue forecast in 2030

USD 41,551.34 million

Growth rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Henkel AG & Co. KGaA; 3M; Dow; MG Chemicals; Huntsman Advanced Materials; Hitachi Chemical Co. Ltd.; ELANTAS Beck GmbH; H.B. Fuller Company; Dymax Corporation; Dymax Corporation; ACC Silicones Ltd.; Epic Resins; CHT UK Manchester Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potting Compounds Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global potting compounds market report based on resin, technology, end-use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy Resin

-

Polyurethane Resin

-

Silicone Resin

-

Polyester System

-

Polyamide

-

Other Products

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Room Temperature

-

High Temperature or Thermally Cured

-

UV Cured

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electronics

-

Electrical

-

Other Applications (if any)

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Energy & Power

-

Solar Power

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potting compounds market size was estimated at USD 33,275.20 million in 2023 and is expected to reach USD 34,322.03 million in 2024.

b. The global potting compounds market is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 41,551.34 million by 2030.

b. Asia Pacific dominated the potting compounds market with a share of 40.52%. The increasing demand for product markets from the electronics industry in developing countries such as China and India is expected to propel the demand for potting compounds in this region

b. Some key players operating in the potting compounds market include Henkel AG & Co. KGaA; 3M; Dow; MG Chemicals; Huntsman Advanced Materials; Hitachi Chemical Co. Ltd.; ELANTAS Beck GmbH; H.B. Fuller Company; Dymax Corporation; Dymax Corporation; ACC Silicones Ltd.; Epic Resins; and CHT UK Manchester Ltd.

b. Key factors that are driving the market growth include the increasing demand from the consumer electronics industry and the growing trend of miniaturizing electronic devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.