- Home

- »

- Food Safety & Processing

- »

-

Potato Starch Market Size, Share & Growth Report, 2030GVR Report cover

![Potato Starch Market Size, Share & Trends Report]()

Potato Starch Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Modified, Native), By Nature (Conventional, Organic), By End-use Industry (Food & Beverage, Paper), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-226-8

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potato Starch Market Summary

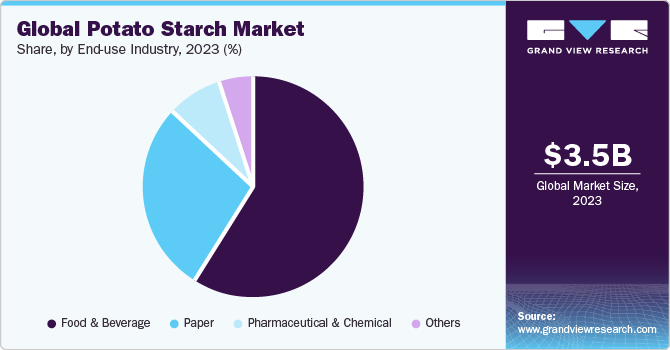

The global potato starch market size was estimated at USD 3.49 billion in 2023 and is projected to reach USD 4.79 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The market is experiencing significant growth driven by several key factors contributing to rising product demand across various industries.

Key Market Trends & Insights

- North America accounted for the largest revenue share of over 42.6% in 2023.

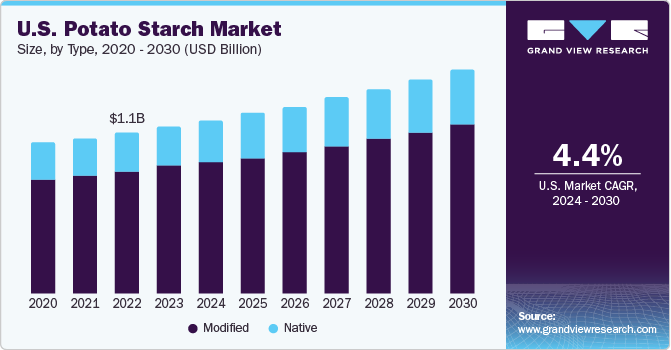

- U.S. potato starch market is expected to grow at a CAGR of 4.4% from 2024 to 2030,.

- By end use, in 2023, the food and beverage end-use industry segment accounted for the largest revenue share of 59.4%.

- By type, the modified potato starch segment accounted for a share of 72.3% in 2023 and is projected to continue its dominance during the forecast period.

- By nature, the conventional potato starch segment held a market share of 87.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.49 Billion

- 2030 Projected Market Size: USD 4.79 Billion

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

One major driver is the increasing consumer awareness and preference for clean-label and natural products. Potato starch, derived from potatoes through a natural extraction process, aligns with this trend as a minimally processed ingredient, appealing to those seeking healthier and more transparent food options. Moreover, a rise in gluten-free dietary preferences has significantly boosted product demand. As consumers increasingly opt for gluten-free alternatives due to health considerations or dietary restrictions, potato starch emerges as a versatile and effective substitute in a wide range of gluten-free products, including baked goods, snacks, and various processed foods.

The functional properties of the product also contribute to its growth. With excellent thickening, binding, and stabilizing qualities, potato starch enhances the texture and quality of various food products, making it a popular choice among food manufacturers. Its ability to improve viscosity and moisture retention positions it as a valuable ingredient in the formulation of sauces, soups, and other processed foods. Furthermore, diversifying potato starch applications beyond the food industry plays a pivotal role in market expansion. The product finds use in non-food sectors, such as textiles, pharmaceuticals, and paper manufacturing, contributing to its versatility and widening market scope.

Market Concentration & Characteristics

Innovation is a driving force within the potato starch market, with ongoing efforts to enhance production processes, improve product functionalities, and explore new applications. Technological advancements in extraction methods, such as developing modified potato starch with specialized properties, showcase the industry's commitment to innovation.

The market has experienced noteworthy M&A activities, reflecting the industry's pursuit of strategic partnerships and market consolidation. Mergers and acquisitions are often driven by a desire to achieve economies of scale, expand market reach, or access complementary technologies.

Stringent quality standards and compliance with health & safety regulations are crucial for market participants. In addition, evolving environmental regulations may impact sourcing practices, waste management, and processing methods. As consumers and industries prioritize sustainability, regulatory frameworks addressing eco-friendly practices and responsible sourcing will likely impact the market, driving companies to adapt and comply with changing standards.

End-use Industry Insights

In 2023, the food and beverage end-use industry segment accounted for the largest revenue share of 59.4%. Within the food industry, potato starch finds application in a diverse range of products, including baked goods, soups, sauces, and snacks, contributing to the desired texture, consistency, and stability. Moreover, its neutral taste profile and ability to enhance the mouthfeel of food products further bolster its popularity among food manufacturers seeking to improve the overall sensory experience of their offerings.

The pharmaceutical & chemical end-use industry segment is expected to grow at a CAGR of 4.5% from 2024 to 2030. The pharmaceutical sector is increasingly recognizing the value of potato starch as a versatile and biocompatible excipient in drug formulations. Its binding and disintegration properties make it a valuable ingredient in pharmaceutical tablet manufacturing, contributing to the overall quality and effectiveness of medicinal products. In addition, its biodegradability and eco-friendly nature align with the growing emphasis on sustainable practices within the chemical manufacturing sector.

Type Insights

The modified potato starch segment accounted for a share of 72.3% in 2023 and is projected to continue its dominance during the forecast period. The inherent characteristics of modified potato starch, such as improved stability, texture enhancement, and better thickening properties, have fueled its widespread adoption across diverse manufacturing processes. Furthermore, increasing demand for clean-label and natural ingredients has propelled the popularity of modified potato starch, as it is derived from a widely accepted and recognizable source.

The native type segment is expected to witness a CAGR of 5.1% from 2024 to 2030. The geographical distribution of potato cultivation and processing facilities, particularly in regions with well-established potato industries, is expected to contribute significantly to the market's growth. In addition, the relatively lower production costs associated with conventional farming practices may contribute to the sustained demand for conventional potato starch, especially in markets where cost-effectiveness is a critical factor.

Nature Insights

The conventional potato starch segment held a market share of 87.8% in 2023. The geographical distribution of potato cultivation and processing facilities, particularly in regions with well-established potato industries, is expected to contribute significantly to the market's growth during the forecast period. In addition, the relatively lower production costs associated with conventional farming practices may contribute to the sustained demand for conventional potato starch, especially in markets where cost-effectiveness is a critical factor.

The organic potato starch segment is expected to witness a CAGR of 5.5% from 2024 to 2030. The agriculture industry's emphasis on sustainable and eco-friendly practices has further propelled the adoption of organic potato starch. Farmers adopting organic farming methods contribute to the production of potatoes without synthetic chemicals, enhancing the appeal of the starch derived from these crops. As a result, organic potato starch has gained credibility not only for its health benefits but also for its positive environmental impact.

Regional Insights

North America accounted for the largest revenue share of over 42.6% in 2023. This strong market presence underscores the region's robust demand for potato starch and its widespread application across various industries. The region boasts a well-established potato industry with the U.S. and Canada providing a consistent and abundant supply of raw materials for potato starch production. In addition, the awareness of and preference for clean-label and natural ingredients among consumers in the region have fueled product adoption among food & beverage manufacturers seeking to meet these evolving preferences.

U.S. Potato Starch Market Trends

The U.S. potato starch market is expected to grow at a CAGR of 4.4% from 2024 to 2030, owing to the growing trend of clean labels and natural ingredients in food products, which has boosted product demand as it is a natural ingredient.

Asia Pacific Potato Starch Market Trends

The potato starch market in the Asia Pacific is expected to grow at a CAGR of 6.0% from 2024 to 2030. The potato starch market in Asia Pacific is expected to grow significantly over the forecast years. The market growth is mainly driven by the evolving dietary preferences and increasing population in the region. As consumer lifestyles change and become more Westernized, the demand for processed and convenience foods, where potato starch finds extensive use, is on the rise. In addition, the growing middle-class population with increased disposable income levels further fuels the demand for food products, propelling the utilization of potato starch in various culinary applications.

Key Potato Starch Company Insights

The potato starch market is characterized by competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Key players continuously engage in research and development activities to enhance the functional properties of potato starch, catering to the diverse needs of industries, such as food & beverages, pharmaceuticals, and chemicals. This focus on innovation allows market leaders to differentiate their products, gain a competitive edge, and respond effectively to changing demands.

Key Potato Starch Companies:

The following are the leading companies in the potato starch market. These companies collectively hold the largest market share and dictate industry trends.

- Emsland Group

- Cargill Inc.

- Ingredion Incorporated

- Novidon B.V.

- Ettlinger Corporation

- ADM

- Royal Ingredients Group B.V.

- PEPEES Group

- KMC

- Roquette Frères

Recent Developments

-

In June 2023, Brenntag Specialties forged a strategic partnership with the renowned potato starch manufacturer, Royal Avebe, marking a significant development in supply collaborations within the nutrition sector. The collaboration aimed to capitalize on the strengths of both entities, combining Brenntag Specialties' distribution expertise with Royal Avebe's excellence in potato starch production

-

In October 2022, AKV Langholt AmbA completed the acquisition of Cargill's 50% stake in their shared joint venture, Cargill-AKV I/S. Originating in 1987, this joint venture initially focused on the production and sale of cationic potato starches to the worldwide paper industry

Potato Starch Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.63 billion

Revenue forecast in 2030

USD 4.79 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, nature, end-use industry, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa

Key companies profiled

Emsland Group; Cargill Inc.; Ingredion Inc.; Novidon B.V.; Ettlinger Corp.; ADM; Royal Ingredients Group B.V.; PEPEES Group; KMC; Roquette Frères

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potato Starch Market Report Segmentation

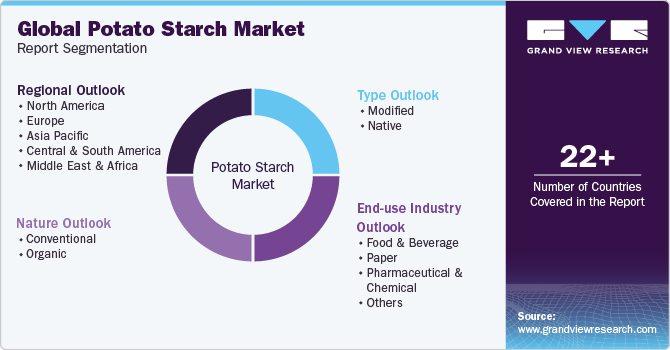

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global potato starch market report on the basis of type, nature, end-use industry, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modified

-

Native

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Paper

-

Pharmaceutical & Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potato starch products market size was estimated at USD 3.49 billion in 2023 and is expected to reach USD 3.63 billion in 2024.

b. The global potato starch products market is expected to grow at a compounded growth rate of 4.7% from 2024 to 2030 to reach USD 4.79 billion by 2030.

b. In 2023, North America captured a revenue share of over 42.6% in the potato starch market. This strong market presence underscores the region's robust demand for potato starch and its widespread application across various industries.

b. Some key players operating in the market include Emsland Group, Cargill Inc., Ingredion Incorporated, Novidon B.V., Ettlinger Corporation, ADM, Royal Ingredients Group B.V., PEPEES Group, KMC, and Roquette Frères

b. The potato starch market is experiencing significant growth driven by several key factors contributing to its expanding demand across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.