- Home

- »

- Consumer F&B

- »

-

Potato Protein Market Size, Share & Growth Report, 2030GVR Report cover

![Potato Protein Market Size, Share & Trends Report]()

Potato Protein Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Potato Protein Isolate, Potato Protein Concentrates), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-387-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potato Protein Market Summary

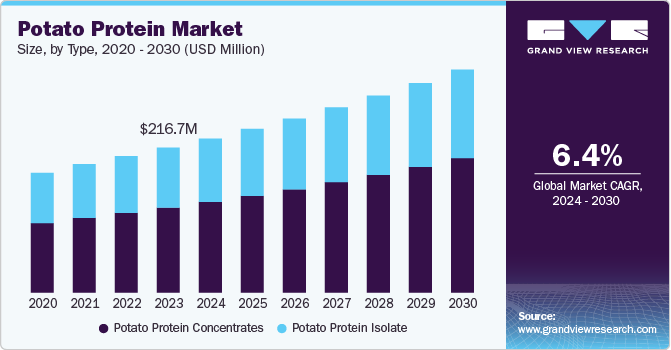

The global potato protein market size was estimated at USD 216.7 million in 2023 and is projected to reach USD 333.4 million by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The market is an emerging segment within the broader plant-based protein industry, characterized by its increasing demand due to the rise of veganism, plant-based diets, and sustainable food consumption.

Key Market Trends & Insights

- The North America potato protein market accounted for a revenue share of over 36% in 2023.

- The potato protein market in the U.S. is expected to grow at a CAGR of 5.5% from 2024 to 2030.

- Based on type, the potato protein concentrates accounted for a revenue share of over 61% in 2023.

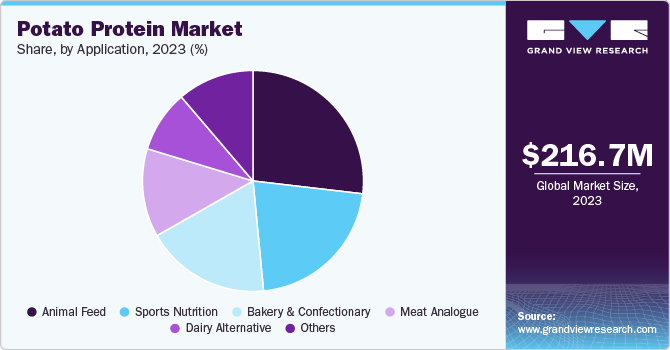

- Based on application, the potato protein in animal feed accounted for a revenue share of over 28% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 216.7 Million

- 2030 Projected Market Size: USD 333.4 Million

- CAGR (2024-2030): 6.4%

- North America: Largest market in 2023

Potato protein is derived from the byproducts of potato starch production and offers a rich, complete amino acid profile, making it an attractive alternative to animal-based proteins and other plant-based options like soy or pea protein.

Potato protein is valued for its high digestibility and rich amino acid content, making it suitable for various dietary applications. The growing interest in allergen-free and non-GMO protein sources is driving the adoption of potato protein in the food industry. Recent product launches, such as Solanic's potato protein isolates, highlight the potential of this ingredient in enhancing the texture and nutritional value of plant-based foods.

Sweet potato protein is emerging as a nutritious alternative, known for its high vitamin and mineral content. It is being explored in functional foods, sports nutrition, and dietary supplements. The increasing demand for nutrient-dense, plant-based ingredients is propelling the use of sweet potato protein. Companies like NutriFusion are developing sweet potato protein powders that cater to health-conscious consumers seeking whole food-based protein sources.

Developments in potato protein extraction and processing have improved its solubility and taste, addressing previous challenges that limited its use. These enhancements have broadened its application range, allowing manufacturers to incorporate potato protein into a variety of products, from protein shakes to snack bars. The environmental sustainability of potatoes, which require less water and pesticides compared to other crops, also contributes to the growing interest in potato protein as an eco-friendly protein source. This trend reflects the increasing consumer preference for sustainable and nutritious food products. For instance, in November 2021, Avebe introduced Solanic 100, a high-purity potato protein isolate designed for use in high-protein beverages and sports nutrition products.

Type Insights

Potato protein concentrates accounted for a revenue share of over 61% in 2023. There is a rising consumer preference for clean-label products that are non-GMO and gluten-free. Potato protein concentrates meet these criteria, making them appealing to health-conscious consumers looking for safe and nutritious options. They contain low levels of cholesterol and lactose while being rich in proteins, making them ideal for functional foods such as cereals, yogurt, and meat substitutes. Their unique nutritional profile is expected to drive demand significantly.

The potato protein isolate market is expected to grow at a CAGR of 5.6% from 2024 to 2030. It is gaining popularity due to its excellent amino acid profile, making it a suitable alternative for individuals seeking high-quality plant-based proteins. It is particularly favored for its digestibility and allergen-free nature, appealing to health-conscious consumers and those with dietary restrictions such as gluten intolerance. Advances in extraction technologies are improving the efficiency and quality of potato protein isolates. New methods are being developed that enhance yield and purity while reducing sensitivity to pH and temperature changes, making potato protein isolates more versatile for various applications.

Application Insights

Application of potato protein in animal feed accounted for a revenue share of over 28% in 2023. Potato protein, known for its high protein content, is widely utilized in animal feed, particularly as a sustainable alternative to other protein sources like soybean meal and fishmeal. It's rich in essential amino acids that promote growth and health in various animal species, including pigs, poultry, and aquaculture. Its low anti-nutritional properties make it an efficient replacement for other proteins, improving feed efficiency, texture, and palatability. The increasing demand for sustainable, health-enhancing proteins for animals drives its market growth.

Application of potato protein in meat analogue is expected to grow at a CAGR of 8.0% from 2024 to 2030. Potato protein's excellent emulsifying properties and amino acid profile make it an ideal ingredient for creating authentic textures and enhancing nutritional value. The sports nutrition segment leverages potato protein's digestibility and complete amino acid profile, although competition from established proteins like whey and soy remains strong. A shift toward plant-based diets in this region is evident, as reported by Vegconomist, a magazine focused on vegan business trends. According to their survey, 63% of Indian consumers are inclined to substitute meat with plant-based options, including proteins derived from potatoes and soy.

Regional Insights

North America potato protein market accounted for a revenue share of over 36% in 2023. The growth is driven by a mature plant-based food sector and strong consumer awareness. A 2022 survey conducted by CFANS Insights, affiliated with the University of Minnesota's College of Food, Agricultural, and Natural Resource Sciences, revealed that 80% of adults in the U.S. currently favor protein sources like pork, beef, poultry, and fish. However, 31% of respondents expressed their intention to consume more plant-based protein over the next five years, highlighting its growing trend.

In the same survey, Gen Xers stood out with the highest current preference for plant protein at 26%, surpassing the 20% preference in other consumer segments. Meanwhile, 44% of Gen Z expressed their willingness to pay a premium for plant-based protein options. This data suggests evolving consumer preferences and a shift towards incorporating more plant-based protein sources into diets, especially among younger generations.

U.S. Potato Protein Market Trends

The potato protein market in the U.S. is expected to grow at a CAGR of 5.5% from 2024 to 2030. There is an increasing demand for plant-based protein sources as more consumers seek alternatives to animal-derived proteins. Potato protein is also gaining popularity due to its allergen-free and non-GMO properties, making it suitable for various dietary restrictions.

In November 2023, a farmers' cooperative, Royal Avebe, known for its potato-based ingredients, launched PerfectaSOL, the next generation of potato protein products. PerfectaSOL offers favorable texture and the ability to create new plant-based consumer products. Examples of these products include potato cookies and veggie doughnuts.

Moreover, the growing awareness of the environmental impact of animal agriculture is leading to a shift towards plant-based proteins, further boosting the demand for potato protein. Furthermore, using potato protein in sports nutrition and functional food products contributes to its market growth.

Asia Pacific Potato Protein Market Trends

The potato protein market in Asia Pacific is expected to grow at a CAGR of 7.6% from 2024 to 2030. The alternate protein market in the Asia Pacific region is also significantly influenced by a combination of robust private investment and increased public funding, which together create a conducive environment for innovation and expansion. Private investors are increasingly recognizing the potential of alternative proteins, leading to substantial capital inflows into startups focused on plant-based, cultured, and insect proteins. This trend is further supported by venture capital firms and corporate investments that seek to capitalize on the growing market share of alternative proteins as traditional meat consumption faces scrutiny over environmental impacts.

Concurrently, governments across the region are ramping up public funding initiatives aimed at supporting research and development in food technology, promoting sustainability, and enhancing food security. According to the 2023 APAC State of the Industry Report, public funding for alternative proteins in Asia Pacific saw a remarkable increase of 207% year-over-year from 2021 to 2022, rising from USD 31 million to USD 94 million. Private funding also experienced a growth of 45% during the same timeframe, rising from USD 383 million to USD 556 million.

Europe Potato Protein Market Trends

The Europe potato protein market is expected to grow at a CAGR of 5.8% from 2024 to 2030. Investment in the potato protein sector has surged in recent years in Europe due to heightened consumer awareness regarding health, environmental sustainability, and animal welfare. Venture capitalists and large food corporations are increasingly funding startups focused on developing plant-based or cultured meat products. This influx of capital not only supports the scaling of production facilities but also facilitates marketing efforts aimed at educating consumers about the benefits of alternative proteins. As investors recognize the potential for high returns in this growing market segment, they continue to drive financial resources toward innovative companies that can meet the rising demand for alternative protein.

Key Potato Protein Company Insights

The global potato protein market is characterized by regional and emerging players. Recognizing the increasing demand for alternative protein and healthier food products, manufacturers are developing potato proteins that cater to health-conscious consumers. Furthermore, to appeal to a broader audience, manufacturers are expanding their product lines. In addition, Manufacturers are exploring opportunities to introduce potato protein to regions where they have traditionally not been a staple, such as Asia and Latin America.

Key Potato Protein Companies:

The following are the leading companies in the potato protein market. These companies collectively hold the largest market share and dictate industry trends.

- Agrana Beteiligungs-AG

- Omega Protein Corporation

- Avebe

- Tereos Group

- Roquette Freres

- Meelunie B.V.

- Kemin Industries, Inc.

- AKV Langholt AmbA

- Sudstarke GmbH

- Pepees S.A.

Recent Developments

-

In December 2023, Avebe, a Netherlands-based supplier of potato-based ingredients, announced the launch of a new generation of potato products called PerfectaSOL. This offering can be used in alt dairy, confectionery, and other food products. Properties of the novel product include a neutral white color, smoothness, emulsification, and smoothness.

-

In July 2023, Brenntag, a distribution company, announced its deal with Avebe that enables Brenntag to distribute Avebe's products, such as potato starch and protein ingredients, in Turkey.

Potato Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 230.2 million

Revenue forecast in 2030

USD 333.4 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Agrana Beteiligungs-AG; Omega Protein Corporation; Avebe; Tereos Group; Roquette Freres; Meelunie B.V.; Kemin Industries, Inc.; AKV Langholt AmbA; Sudstarke GmbH; Pepees S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Potato Protein Market Report Segmentation

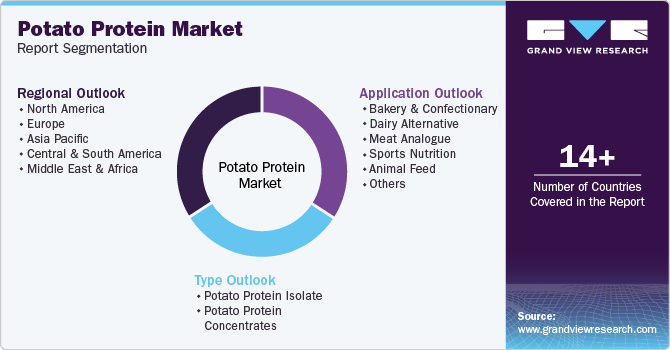

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global potato protein market report based on product, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Potato Protein Isolate

-

Potato Protein Concentrates

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Confectionary

-

Dairy Alternative

-

Meat Analogue

-

Sports Nutrition

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potato protein market size was estimated at USD 216.7 million in 2023 and is expected to reach USD 230.2 million in 2024.

b. The global potato protein market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 333.4 million by 2030.

b. North America dominated the potato protein market with a share of 52.3% in 2023. This is attributable to rising healthcare awareness coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the potato protein market include Avebe, Bioriginal Food and Science Corp., Roquette Freres, Agrana Beteiliguns AG, Peppes Group, Emsland Group, KMC Ingredients, AKV Langholt, PPZ Niechlow, and Sudstarke.

b. Key factors that are driving the market growth include increasing popularity of potato protein due to its high nutritional value and benefits, such as improved digestive health, strength, and controlled blood sugar.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.