- Home

- »

- Consumer F&B

- »

-

Potato Processing Market Size, Share, Industry Report, 2030GVR Report cover

![Potato Processing Market Size, Share & Trends Report]()

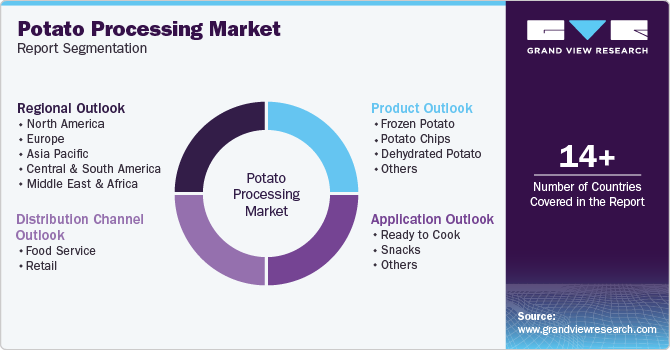

Potato Processing Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Frozen Potato, Potato chips, Dehydrated Potato), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-492-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Potato Processing Market Summary

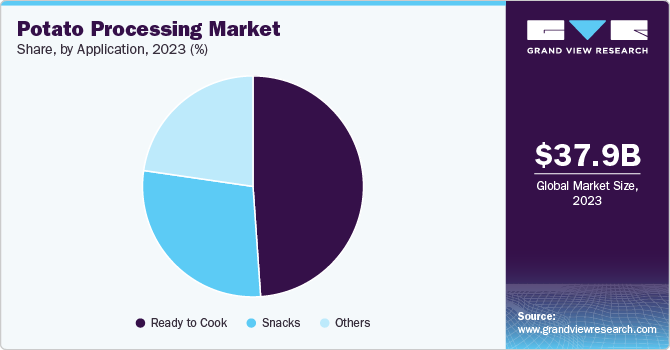

The global potato processing market size was estimated at USD 37.85 billion in 2023 and is projected to reach USD 56.5 billion by 2030, growing at a CAGR of 5.9% from 2024 to 2030. A significant driver of the potato processing market is the increasing demand for convenient food products that require minimal preparation time.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- The Asia Pacific region is expected to register the fastest CAGR from 2024 to 2030.

- By product, frozen potatoes dominated the market with over 40% of the revenue share in 2023.

- By distribution channel, the retail industry segment is anticipated to witness the fastest CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 37.85 Billion

- 2030 Projected Market Size: USD 56.5 Billion

- CAGR (2024-2030): 5.9%

- North America: Largest market in 2023

With urbanization and busy lifestyles becoming more prevalent, consumers gravitate towards ready-to-eat and easy-to-cook options. Additionally, a growing trend towards healthier eating habits leads to a rise in demand for organic and low-calorie processed potato products. This shift in consumer preferences has prompted manufacturers to innovate their product offerings, incorporating healthier ingredients and diverse flavors to attract a broader audience.

The expansion of quick-service restaurants has driven the processed potato market. Fast-food chains like McDonald's and KFC heavily feature potato-based items such as French fries and hash browns on their menus, making these products staples in many diets globally. The convenience and affordability of these items have led to increased consumption, further boosting the demand for processed potatoes. As QSRs grow worldwide, they create a sustained demand for processed potato products, reinforcing their market presence.

Technological innovations in potato processing have also contributed significantly to market growth. Adopting automation and digitalization within processing facilities has enhanced efficiency and product quality. These advancements allow manufacturers to reduce production costs while increasing output, making processed potato products more accessible to consumers. Furthermore, improved preservation techniques have extended the shelf life of these products, catering to the rising global food trade and enhancing distribution capabilities across various markets.

The global potato processing market is seeing varied growth across different regions, with Asia-Pacific leading due to its high production capacity and increasing consumption rates. Countries like China and India are major producers and significant consumers of processed potatoes, driven by cultural preferences for snacking and convenience foods. The combination of favorable agricultural conditions and rising disposable incomes in these regions supports sustained growth in the processed potato sector. As international markets continue to evolve, opportunities for Indian exporters are expanding, particularly as they adapt to meet global quality standards and consumer demands.

Health issues linked to the consumption of processed potato products. Concerns regarding high acrylamide content, a chemical formed during the cooking of starchy foods at high temperatures-have led to increased scrutiny from health authorities and consumers alike. As consumers become more health-conscious, a growing demand for cleaner labels and healthier options exists. This shift requires processors to reformulate products and invest in new processing technologies, further straining their resources. The market faces intense competition from alternative snack foods made from ingredients like corn and rice. These substitutes are increasingly popular among consumers seeking variety or healthier options. The rise of plant-based diets has also influenced consumer preferences, prompting processors to innovate or diversify their product lines to retain market share. This competitive pressure can limit pricing power for potato processors and necessitate continuous adaptation to changing consumer trends.

Product Insights

Frozen potatoes were the largest category in the processed potato market, accounting for over 40% of the market share in 2023. One of the primary drivers is the expansion of the food service industry, particularly quick-service restaurants (QSRs). As consumer lifestyles become increasingly fast-paced, there is a growing demand for convenient food options that require minimal preparation. QSRs rely heavily on frozen potato products like French fries and hash browns to meet customer expectations for quick service and consistent quality. The globalization of diets further supports this trend. Western eating habits are being adopted in developing countries, leading to higher consumption of processed potato products in various culinary applications.

Another important factor contributing to the processed frozen potato market's growth is consumers' rising health consciousness. There is an increasing demand for healthier alternatives to traditional fried snacks, prompting manufacturers to innovate by offering baked or air-fried potato options. Additionally, the convenience of frozen potatoes allows consumers to enjoy these healthier choices without compromising on taste or convenience. Developing new flavors and varieties along with effective marketing strategies have also enhanced product visibility and consumer engagement, further driving sales in this segment. As a result, the processed frozen potato market is poised for robust growth in the coming years and is projected to reach substantial market valuations driven by these trends.

Potato chips and wafers were the second most important category in the processed potato market, with a market revenue of over USD 10 billion in 2023. One of the primary drivers is the increasing consumer preference for convenient snack options that fit into busy lifestyles. As people seek quick and easily accessible food choices, where potato chips, and wafers have become popular among others due to their ready-to-eat nature and wide availability across retail outlets. Additionally, the influence of social media and changing dietary habits has led to a surge in snacking culture, particularly among younger demographics. E-commerce has made it easier for consumers to purchase various potato chip products online, enhancing their accessibility. Innovative packaging solutions and marketing strategies have also contributed to the appeal of these snacks, making them more attractive to consumers.

The dehydrated potato market is experiencing significant growth driven by the increasing demand for convenience foods and ready-to-eat meals among busy consumers. As lifestyles become more fast-paced, the appeal of dehydrated potatoes, which offer a quick and easy preparation method, has surged. These products are versatile and shelf-stable and retain essential nutrients without preservatives, making them an attractive option for health-conscious consumers. Additionally, advancements in food processing technology have improved the quality, flavor, and texture of dehydrated potato products, further enhancing their marketability. This trend is bolstered by rising urbanization and disposable incomes, which allow consumers to invest in convenient meal solutions that fit their dynamic lifestyles.

Application Insights

Ready-to-cook products were the largest application for processed potatoes and accounted for a market revenue of USD 15.64 billion in 2023. Urbanization and changing consumer lifestyles have increased preferences for convenience foods, requiring minimal preparation time. This trend is particularly evident among busy professionals and families looking for quick meal solutions. The rise of the food service industry, including fast-food chains and restaurants, further amplifies this demand, as these establishments heavily rely on processed potato products like frozen fries and pre-cut potatoes for their menus. Additionally, the COVID-19 pandemic has shifted consumer behavior towards pantry staples with longer shelf lives, making frozen and ready-to-cook potato products more appealing as they provide both convenience and reliability during uncertain times.

Technological advancements in potato processing are also crucial in meeting the growing demand for ready-to-cook products. Innovations in processing techniques, such as automation and improved freezing methods, enhance product quality and efficiency while reducing waste. Manufacturers are increasingly focusing on developing healthier options to cater to health-conscious consumers, leading to a rise in low-fat, gluten-free, and organic processed potato products. Furthermore, adopting sustainable practices in packaging and production processes is gaining traction as consumers become more environmentally aware. These trends not only support market growth but also align with evolving consumer preferences for transparency and sustainability in food sourcing.

As consumers seek quick and easy meal solutions, processed potato snacks such as chips, fries, and baked products have gained popularity due to their accessibility and variety. The growth of fast-food chains and quick-service restaurants further fuels this demand, as these establishments frequently incorporate potato snacks into their menus. Additionally, introducing innovative flavors and healthier alternatives, such as baked or air-fried options, caters to health-conscious consumers who are increasingly aware of nutritional content while desiring indulgent snack experiences. Technological advancements in processing methods also play a crucial role in the growth of the processed potato snacks market. Innovations in production techniques have improved efficiency and product quality while reducing costs, making these snacks more accessible to a broader audience. Moreover, the expansion of e-commerce has facilitated the distribution of processed potato snacks, allowing consumers to purchase their favorite products online easily. The increasing disposable income in emerging economies has further enhanced consumer spending on snack foods, contributing to market growth. However, health concerns regarding high-fat and high-calorie content in traditional fried snacks pose challenges for the industry, prompting manufacturers to focus on developing healthier alternatives to meet changing consumer demands.

Distribution Channel Insights

The food service industry was the largest distribution channel for processed potatoes and accounted for a market revenue of USD 23.60 billion in 2023. The growth is attributed to the increasing demand for convenience foods, as busy lifestyles lead consumers to seek quick and easy meal solutions. This trend is particularly evident in quick-service restaurants (QSRs) and fast-food chains, which rely heavily on processed potato products such as frozen fries and potato snacks to meet customer preferences for ready-to-eat options. Expanding food delivery services further amplifies this demand as more consumers opt for takeout meals that often include potato-based items. Additionally, urbanization and rising disposable incomes contribute to changing eating habits, with a growing number of consumers willing to spend on convenient dining options, thereby boosting the potato processing market within the food service distribution channel.

The retail industry for processed potatoes is expected to grow at a CAGR of 5.5% from 2024 to 2030. A critical driver is the evolving food culture and dietary preferences among consumers, particularly among younger demographics who favor snack foods and quick meals. The popularity of fast-food chains and the increasing snacking trend have led to higher consumption of processed potato snacks, such as chips and other flavored varieties. Furthermore, the growing awareness of health and wellness has prompted manufacturers to innovate healthier options, including low-fat and gluten-free products catering to health-conscious consumers. As a result, retailers are expanding their offerings to include a broader range of processed potato products that meet these diverse consumer demands, contributing to the overall growth of the potato processing market in the retail sector.

Regional Insights

The North America potato processing market was USD 10.41 billion in 2023 and is expected to grow at a CAGR of 5.5% over the forecast period. Technological advancements in potato processing also play a crucial role in this market's expansion in the region. Innovations in processing techniques have improved product quality and efficiency while reducing costs, making it easier for manufacturers to meet rising consumer demands. The availability of a diverse range of processed potato products, including healthier options like baked and air-fried varieties, caters to health-conscious consumers looking for better snack alternatives.

U.S. Potato Processing Market Trends

The U.S. processed potato market is expected to reach USD 12 billion by 2030. A significant driver is the ongoing innovation in product offerings and processing technologies within the industry. Companies are increasingly focusing on developing healthier and more diverse processed potato options, including baked and air-fried varieties that cater to health-conscious consumers. This shift addresses growing concerns about nutrition and aligns with trends toward vegetarian and vegan diets, which are becoming more prevalent in the U.S. market.

Asia Pacific Potato Processing Market Trends

The Asia Pacific processed potato market is expected to grow at a CAGR of 6.8% from 2024 to 2030. The growth of the processed potato market in Asia is primarily driven by rising demand for convenience foods and urbanization. As urban populations expand and lifestyles become increasingly fast-paced, consumers are gravitating towards ready-to-eat and easy-to-prepare food options. This trend is particularly strong in countries like China and India, where a burgeoning middle class is adopting Western dietary habits, leading to a significant increase in the consumption of processed potato products such as frozen fries, chips, and other snack foods.

Key Potato Processing Company Insights

Key participants include Lamb Weston Holdings, Inc., McCain Foods Limited, and The Kraft Heinz Company, which dominate the North American market due to their extensive product offerings and strong distribution networks. These companies are known for their frozen potato products, including French fries and other snacks, which are staples in both retail and foodservice sectors. Other notable players include J.R. Simplot Company, Farm Frites International B.V., and Aviko B.V., all of which have established significant market presence through strategic partnerships and product diversification aimed at meeting changing consumer preferences for convenience foods.

Key Potato Processing Companies:

The following are the leading companies in the potato processing market. These companies collectively hold the largest market share and dictate industry trends.

- Lamb Weston Holdings, Inc.

- McCain Foods Limited

- The Kraft Heinz Company

- J.R. Simplot Company

- Idahoan Foods, LLC

- Agristo NV

- Farm Frites International B.V.

- Aviko B.V.

- AGRANA Beteiligungs-AG

- Burts Potato Chips Ltd.

- Intersnack Group GmbH & Co. KG

- J.R. Short Milling Company

- The Little Potato Company Ltd.

- HyFun Foods

- Cavendish Farms

Potato Processing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.08 billion

Revenue forecast in 2030

USD 56.54 billion

Growth rate (Revenue)

CAGR of 5.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Lamb Weston Holdings, Inc.; McCain Foods Limited; The Kraft Heinz Company; J.R. Simplot Company; Idahoan Foods, LLC; Agristo NV; Farm Frites International B.V.; Aviko B.V.; AGRANA Beteiligungs-AG; Burts Potato Chips Ltd.; Intersnack Group GmbH & Co. KG; J.R. Short Milling Company; The Little Potato Company Ltd.; HyFun Foods; Cavendish Farms

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potato Processing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global potato processing market report based on product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Frozen Potato

-

Potato Chips

-

Dehydrated Potato

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ready to Cook

-

Snacks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food Service

-

Retail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the potato processing market include Lamb Weston Holdings, Inc.; McCain Foods Limited; The Kraft Heinz Company; J.R. Simplot Company; Idahoan Foods, LLC; Agristo NV; Farm Frites International B.V.; Aviko B.V.; AGRANA Beteiligungs-AG; Burts Potato Chips Ltd.; Intersnack Group GmbH & Co. KG; J.R. Short Milling Company; The Little Potato Company Ltd.; HyFun Foods; Cavendish Farms

b. A significant driver of the potato processing market is the increasing demand for convenient food products that require minimal preparation time. With urbanization and busy lifestyles becoming more prevalent, consumers gravitate towards ready-to-eat and easy-to-cook options. Additionally, a growing trend towards healthier eating habits leads to a rise in demand for organic and low-calorie processed potato products. This shift in consumer preferences has prompted manufacturers to innovate their product offerings, incorporating healthier ingredients and diverse flavors to attract a broader audience.

b. The global potato processing market size was estimated at USD 37.85 billion in 2023 and is expected to reach USD 40.08 billion in 2024.

b. The global potato processing market is projected to grow at a CAGR of 5.9% from 2024 to 2030 to reach USD 56.54 billion by 2030.

b. Frozen potatoes were the largest category in the processed potato market, accounting for over 40% of the market share in 2023. One of the primary drivers is the expansion of the food service industry, particularly quick-service restaurants (QSRs). As consumer lifestyles become increasingly fast-paced, there is a growing demand for convenient food options that require minimal preparation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.