- Home

- »

- Agrochemicals & Fertilizers

- »

-

Potassium Soap Insecticides Market Size Report, 2030GVR Report cover

![Potassium Soap Insecticides Market Size, Share & Trends Report]()

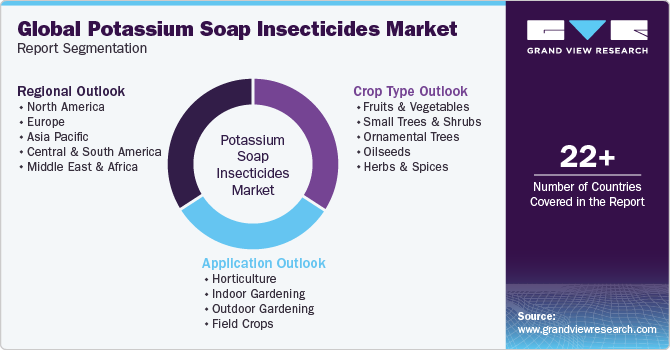

Potassium Soap Insecticides Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Horticulture, Indoor Gardening, Outdoor Gardening), By Crop Type (Fruits & Vegetables, Ornamental Trees, Oilseeds), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-323-9

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potassium Soap Insecticides Market Trends

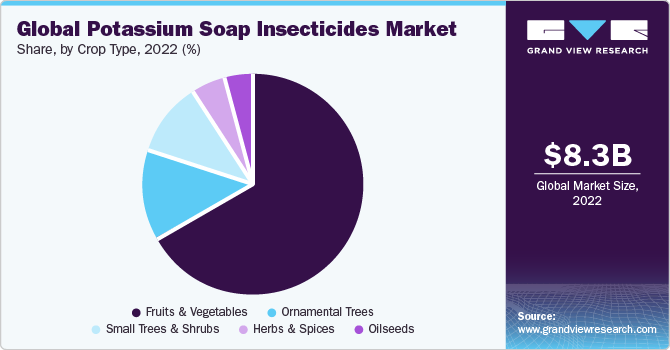

The global potassium soap insecticides market size was estimated at USD 8.3 million in 2022 and is projected to grow at a CAGR of 8.8% from 2023 to 2030. This growth is attributed to the continuous growth in the global population, contributing to the increased focus on sustainable agricultural practices to reduce the use of synthetic chemicals. Potassium soap insecticides are considered a more environmentally friendly alternative to chemical insecticides, as they are derived from natural sources and have lower environmental impact.

Expanding agriculture and horticulture sectors often involve the cultivation of a wide range of crops, including fruits, vegetables, nuts, and ornamental plants. Different crops attract different pests, and the use of a single pesticide may not suit them all. Potassium soap insecticides offer versatility, as they can be used on various crops without harming the plants. For instance, SPAA SRL Potassium Insecticidal Soap helps protect the plants when mixed with insecticides, the recommended dose for potassium insecticidal soap is 300 grams per hectoliter (100 liters) of water. For citrus fruits, fruits, and vegetables, the recommended dose is 800 grams per hectoliter, while aromatic, flower, and ornamental crops should be treated with 600 grams per hectoliter. For winter treatments, a higher dose of 1000-1200 grams per hectoliter is advised.

Moreover, potassium soap insecticides are effective against a range of soft-bodied pests, such as aphids, whiteflies, spider mites, and mealybugs. They work by disrupting the cell membranes and cuticles of these pests, leading to desiccation and eventual death. Unlike many chemical pesticides, these insecticides leave minimal chemical residue on crops, making them a preferred choice for organic and sustainable farming. This reduces the potential harm to beneficial insects and minimizes risks to human health.

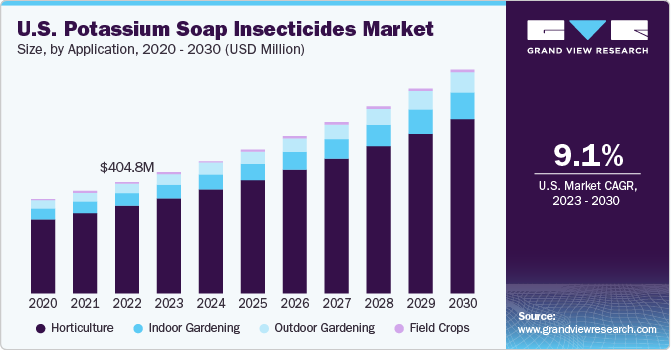

The U.S. was the largest consumer of the product in North America with a revenue share of 50.7% in 2022. The growth of the product market during the forecast period can be attributed to the growing organic farming trends in the country. As more farmers transition to organic practices, they are seeking environmentally friendly pest control alternatives to replace synthetic pesticides, aligning with organic certification requirements. This growing trend of organic agriculture, supported by government initiatives and incentives, has created a greater demand for potassium soap insecticides in the U.S.

According to the 2023 Organic Industry Survey, in 2022, organic food sales in the U.S. surged past the USD 60 billion mark, marking a historic milestone and underscoring the robust growth of the organic industry. The overall organic sector, encompassing both organic food and non-food products, reached an all-time high of USD 67.6 billion in sales. This significant increase reflects the enduring consumer demand for organic goods driven by health and sustainability concerns and showcases the sector's ongoing strength and resilience in the market.

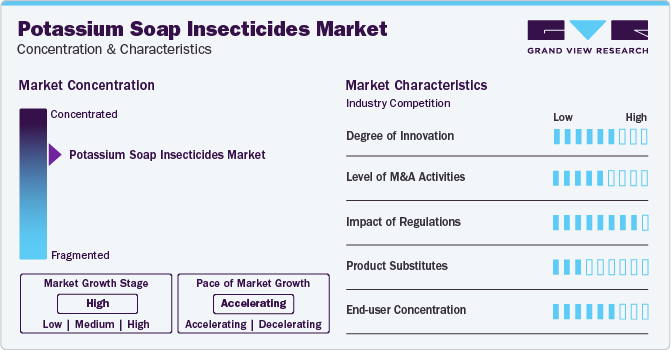

Market Concentration & Characteristics

The global potassium soap insecticides market is consolidated with the presence of few manufacturers.

Potassium soap insecticides are distributed/supplied through various sales channels/sales medium. Direct sales, third-party distribution, online sales medium are some of the commonly used sales channels used in the global market. Many manufacturers of potassium soap insecticides have their own websites and online stores where they directly sell their products to consumers and businesses. Direct sales allow manufacturers to retain higher profit margins and have more control over pricing and marketing.

Some of the key product distributors operating in the global market are BES-TEX Supply LLC; Hummert International; OHP, Inc.; Safer, Inc.; ECOWORM; BONIDE Products LLC; and Gardener’s Supply Company. Companies like ECOWORM; BONIDE Products LLC; and OHP, Inc. are forward integrated as they manufacture as well as supply their products.

Application Insights

The horticulture application segment dominated the market with a revenue share of 79.1% in 2022. This is attributed to the fact that potassium soap insecticide can be used to effectively control aphid population. Aphids are common pests in horticulture that can damage a wide range of plants. It is important to thoroughly spray the affected plants, covering both sides of the leaves where aphids often hide.

For instance, ladybirdplantcare.co.uk’s horticultural soap is an excellent choice for application before introducing biological controls, particularly when awaiting the dissipation of residues from prior chemical sprays. Soft Soap Concentrate effectively diminishes common pests populations such as aphids, red spider mites, whiteflies, mealybugs, thrips, and scale insects. Soft soap operates by blocking the respiratory openings on the insects' bodies, adhering to their wings and mobile body parts. Importantly, it is not a poisonous substance, which makes it safe for use on edible crops.

Indoor gardening is another segment anticipated to witness growth over the forecast period. Potassium soap insecticides are considered organic and safe for use around people, pets, and food crops. It is composed of vegetable oils, water, and potassium hydroxide, and it is pH-neutral. It is an excellent organic insecticide that can control various diseases in the garden without contaminating or causing health problems thus, is used in organic farming since it has low toxicity and very high effectiveness. Rising preference for organic pesticides among indoor gardeners is expected to bode well for the segment’s growth.

Crop Type Insights

The fruits and vegetables segment dominated the market with a revenue share of 66.7% in 2022. This is attributed to the fact that potassium soap insecticides are considered one of the safest options for pest control. They break down more rapidly and have low toxicity to humans and animals, making them a preferred choice for organic gardening and for those who are concerned about the potential health risks associated with synthetic pesticides. For instance, according to research conducted by Kansas State University, insecticidal soaps are categorized as bio-rational or reduced-risk insecticides. They are specifically employed in certain scenarios due to their ability to leave minimal residues, exhibit lower toxicity towards humans, and rapidly degrade in the environment.

It is essential for the fruit and vegetable producers to meet the pesticide residue standards of the export markets. The use of potassium soap insecticides can facilitate market access to regions with stringent pesticide residue regulations. For instance, the European Union registered and allowed fatty acid potassium salts, the active ingredient in the product, at a 2% concentration as an insecticide. This allows the fruit and vegetable producers in the EU to use the product to control pests and meet the pesticide residue standards.

The small trees & shrubs segment is anticipated to witness growth over the forecast period. Potassium soap insecticides exhibit exceptional effectiveness in addressing a broad spectrum of soft-bodied pests frequently found infesting small trees and shrubs. These pests encompass aphids, mealybugs, spider mites, scale insects, and whiteflies. The mechanism of action of insecticidal soaps involves the disruption of pests' cell membranes, leading to their dehydration and eventual demise.

The anticipated high level of efficacy in managing these pests is poised to stimulate the adoption of the product, given the considerable harm these insects can inflict on small trees and shrubs. One of the key advantages of the product is its minimal impact on beneficial insects such as ladybugs, parasitoid wasps, and pollinators like bees. This safety profile is critical for the ecological balance in gardens and landscapes, as it allows helpful insects to thrive while targeting harmful pests.

Regional Insights

The North America potassium soap insecticides market is expected to witness growth during the forecast period. Organic farming is a growing trend in North America, and potassium soap insecticide is a common ingredient in organic pest control products. This is driving the demand for potassium soap insecticide as more farmers transition toward organic farming practices.

U.S. Potassium Soap Insecticides Market Trends

The increasing government support for organic farming in the U.S. has had a positive impact on the potassium soap insecticides market in the country. As more farmers transition to organic practices, they are seeking environmentally friendly pest control alternatives to replace synthetic pesticides, aligning with organic certification requirements. This growing trend toward organic agriculture, supported by government initiatives and incentives, has created a greater demand for potassium soap insecticides.

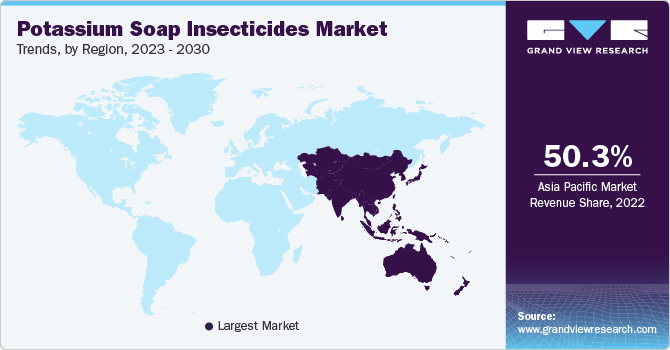

Asia Pacific Potassium Soap Insecticides Market Trends

Asia Pacific dominated the market with a revenue share of 50.3% in 2022. Rising awareness among farmers concerning the efficient use of land, the growing population, and increasing demand for agricultural products are anticipated to contribute to the market growth in the region. Countries like India, China, Indonesia, Philippines. and Malaysia are some of the leading countries in organic farming as well as horticulture in Asia Pacific.

The China potassium soap insecticides market is expected to grow during the forecast period. This growth is attributed due to growing population and changing dietary patterns which have resulted in an increased demand for agricultural products. This expansion has driven the need for effective pest management solutions such as potassium soap insecticides.

Europe Potassium Soap Insecticides Market Trends

European consumers have become more conscious of the food they consume, leading to an increased demand for pesticide-free and organic products. This consumer preference drove the adoption of potassium soap insecticides among European farmers.

The Germany potassium soap insecticides market is anticipated to grow over the forecast period. Germany’s initiatives to promote organic farming, including the allocation of research and innovation funding as outlined in Horizon Europe and the organic action plan, are contributing to the growth of the potassium soap insecticides market. Organic farming practices prioritize environmentally friendly pest control methods, making potassium soap insecticides an attractive option.

Central & South America Potassium Soap Insecticides Market Trends

The increasing adoption of organic farming practices in Central and South America has driven the demand for environmentally friendly and organic pest control solutions. Potassium soap insecticides are considered a safer and more sustainable alternative to chemical pesticides.

The Brazil potassium soap insecticides market is expected to witness growth from 2023 to 2030. Governments in the region have been promoting sustainable agricultural practices and providing support for organic farming, which includes the use of biopesticides such as potassium soap. For instance, Brazil stands out as a robust regulatory leader in Central and South America, with initiatives such as the national inventory of chemical substances and the Industrial Chemicals Regulation.

Middle East & Africa Potassium Soap Insecticides Market Trends

There has been a global shift toward more sustainable and eco-friendly agricultural practices. Potassium soap insecticides are considered safer for the environment compared to chemical pesticides. This trend toward sustainability has driven the adoption of potassium soap insecticides in the region.

The South Africa potassium soap insecticides market is expected to grow over the forecast period.The demand for organic produce is increasing globally, and this trend is reflected in the Middle East & Africa as well. Potassium soap insecticides are widely accepted in organic farming practices as they are compliant with organic certification standards leading to a rise in demand in the region.

Key Potassium Soap Insecticides Company Insights

Some of the key players operating in the market include Kao Corporation, OHP, Inc., among others.

-

Kao Corporation is one of the largest consumer goods companies in Asia, with operations in over 100 countries. Over the years, it has expanded its product range to include a wide variety of personal care, household cleaning, and fabric care products. The company also has a growing business in health and beauty care products, as well as specialty chemicals. Kao Corporation is known for its innovative products and its commitment to quality. The company has a strong research & development team that is constantly developing new products and technologies. Kao Corporation is also a leader in sustainability and is committed to reducing its environmental impact.

-

AMVAC Chemical Corporation acquired OHP, Inc. in 2017 and let it continue to operate as an entity. AMVAC is a manufacturer of chemical, biological, and bio-rational products, specializing in the development and marketing of solutions for agricultural, commercial, and consumer applications. The company engages in the synthesis and formulation of chemicals, as well as the fermentation and extraction of microbial products designed for use in crops, turf, and ornamental plants, and for the protection of human and animal health. These diverse product offerings encompass insecticides, fungicides, herbicides, soil health enhancers, plant nutrition solutions, molluscicides, growth regulators, and soil fumigants; all available in various forms including liquid, powder, and granular.

Bonide Products LLC, Certis USA L.L.C., and Ecoworm Limited are some of the emerging market participants.

-

BONIDE Products LLC manufactures and markets a wide variety of lawn and garden products including insecticides, fungicides, herbicides, fertilizers, and soil amendments. The company has a nationwide distribution network and sells its products through a variety of channels, including garden centers, home improvement stores, and online retailers.

-

Ecoworm Limited specializes in the production of organic concentrated fertilizers, leveraging advanced technology to extract naturally pure liquid humic substances from vermicompost. Their Soil Extract Liquid Fertilizers are designed to boost seed germination, stimulate plant and root growth, enhance crop yields, and improve overall plant nutrition. Ecoworm's products are not only proven to be safe but are also entirely natural, carrying certification from Organic Farmers & Growers and compliance with all EU standards and regulations. This ensures their suitability for use in organic farming, thus aligning with nature's intended agricultural practices.

Key Potassium Soap Insecticides Companies:

The following are the leading companies in the potassium soap insecticides market. These companies collectively hold the largest market share and dictate industry trends.

- BONIDE Products LLC

- Corax Bioner Co.

- Certis USA L.L.C.

- Ecoworm Limited

- Kao Corporation

- OHP, Inc. (AMVAC Chemical Corporation)

- PROMISOL S.A.

- SPAA SRL

- W. Neudorff GmbH

- Vellsam Materias Bioactivas S.L.

- Victorian Chemical Company Pty Ltd.

Recent Development

-

In 2022, Safer Brand launched a new insecticidal soap called Safer Soap Insect Killer made from natural ingredients; it is safe for use on a variety of plants. Similarly, manufacturing companies are also engaged in manufacturing bioinsecticides.

-

In 2021, Bayer CropScience has acquired AgraQuest, a leading developer of bioinsecticides. The acquisition was part of Bayer's strategy to expand its portfolio of sustainable crop protection products.

Potassium Soap Insecticides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.06 million

Revenue forecast in 2030

USD 16.4 million

Growth rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, crop type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; South Africa

Key companies profiled

BONIDE Products LLC; Corax Bioner Co.; Certis USA L.L.C.; Ecoworm Limited; Kao Corporation; OHP, Inc. (AMVAC Chemical Corporation); PROMISOL S.A.; SPAA SRL; W. Neudorff GmbH; Vellsam Materias Bioactivas S.L.; Victorian Chemical Company Pty Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potassium Soap Insecticides Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global potassium soap insecticides market report based on application, crop type, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Horticulture

-

Indoor Gardening

-

Outdoor Gardening

-

Field Crops

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fruits and Vegetables

-

Small Trees & Shrubs

-

Ornamental Trees

-

Oilseeds

-

Herbs & Spices

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global global potassium soap insecticides market size was estimated at USD 8.3 million in 2022 and is expected to reach USD 9.06 million in 2023.

b. The global potassium soap insecticides market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 16.4 million by 2030.

b. Asia Pacific dominated the global potassium soap insecticides market with a revenue share of 50.3% in 2022. This is attributable to the fact that Asia Pacific is home to some of the world's largest agricultural economies including China and India thus, driving the need for effective pest management solutions such as potassium soap insecticides.

b. Some key players operating in the global potassium soap insecticides market include BONIDE Products LLC, Corax Bioner Co., Certis USA L.L.C., Ecoworm Limited, Kao Corporation, OHP, Inc. (AMVAC Chemical Corporation), PROMISOL S.A., SPAA SRL, W. Neudorff GmbH, Vellsam Materias Bioactivas S.L., Victorian Chemical Company Pty Ltd.

b. The growth of the global potassium soap insecticides market is attributed to the fact that as the global population continues to grow, there is an increased focus on sustainable agricultural practices that reduce the use of synthetic chemicals. Potassium soap insecticides are considered a more environmentally friendly alternative to chemical insecticides, as they are derived from natural sources and have lower environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.