- Home

- »

- Agrochemicals & Fertilizers

- »

-

Potash Market Size, Share & Trends, Industry Report, 2032GVR Report cover

![Potash Market Size, Share & Trends Report]()

Potash Market (2025 - 2032) Size, Share & Trends Analysis Report By Product (Potassium Sulphate, Potassium Nitrate), By End Use (FCC Catalyst, Other End Uses), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68040-101-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2032

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Potash Market Summary

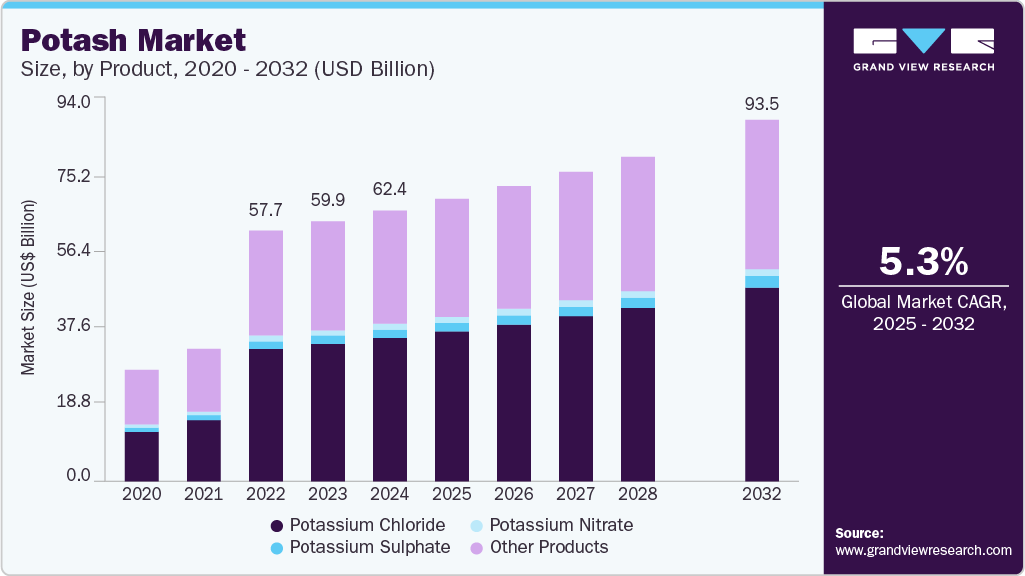

The global potash market size was estimated at USD 62,374.0 million in 2024 and is expected to reach USD 93,501.2 million in 2032, growing at a CAGR of 5.3% from 2025 to 2032. The increasing population directly impacts the demand for food and agricultural products, which, in turn, influences the market.

Key Market Trends & Insights

- The Asia Pacific region dominated the market with a revenue share of more than 38.4% in 2024.

- The China potash market is expected to grow significantly over the forecast period.

- By product, the potassium chloride product segment dominated the market with a revenue share of 53.0% in 2024.

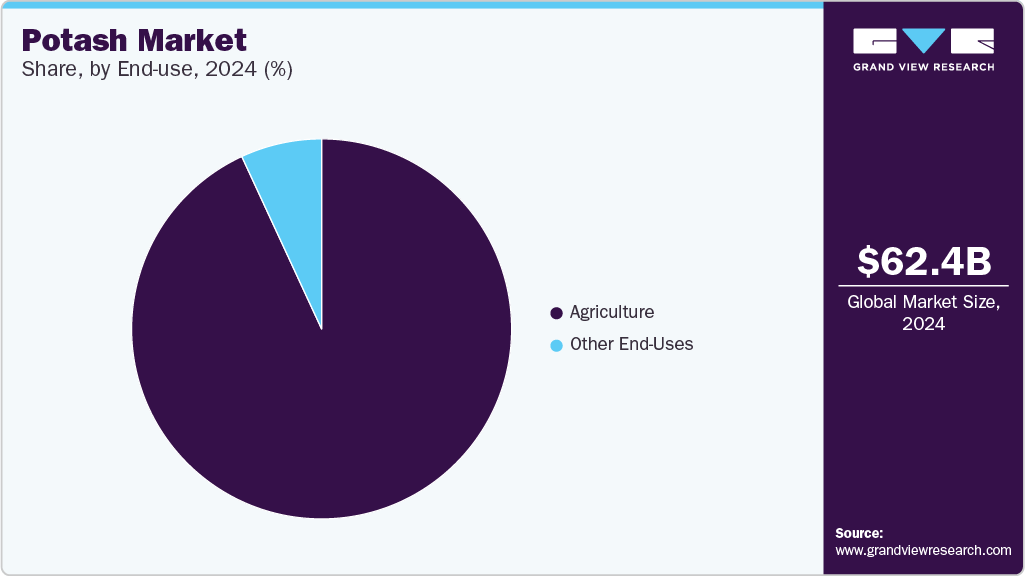

- By end-use, the agriculture end use segment dominated the market with a revenue share of 93.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 62,374.0 Million

- 2032 Projected Market Size: USD 93,501.2 Million

- CAGR (2025-2032): 5.3%

- Asia Pacific: Largest market in 2024

As the world's population grows, the demand for food also increases. Farmers increase their agricultural productivity and enhance crop yields to meet this demand. Potash is essential for providing the necessary nutrients that crops need to thrive.It enhances root development, nutrient absorption, and overall plant growth. The U.S. has a thriving agricultural sector, with various crops cultivated across its vast farmlands. Potash is a critical nutrient required for optimal crop growth and productivity. As a result, the demand for the U.S. remains consistently high due to the need to support the agricultural industry's output and meet the growing demand for food and farming products. The market in the U.S. exhibits a strong and consistent demand driven by the agricultural sector's needs, major crop cultivation, soil fertility maintenance, precision agriculture adoption, specialty crop cultivation, technological advancements, and government support. These factors collectively contribute to the sustained product demand, ensuring a stable and thriving market in the U.S.

The market plays a critical role in global agriculture, as potash is a primary source of potassium, an essential nutrient for plant growth. It is most commonly used in the form of potassium chloride (KCl), accounting for most of the potash consumed worldwide. The market is primarily driven by the increasing global demand for food, which necessitates higher crop yields and soil fertility management. Potash improves plant health, enhances drought and disease resistance, and increases crop production quality and quantity. Key consuming regions include Asia Pacific (especially China and India), Latin America, and North America, where large-scale commercial farming dominates.

Major potash producers include Canada, Russia, Belarus, and China, with Canada’s Saskatchewan region holding the largest reserves and production capacity globally. Production capacities, export policies, geopolitical risks, and long-term supply contracts influence market dynamics. In recent years, the market has also seen volatility due to sanctions on Belarusian potash exports and supply disruptions from the Russia-Ukraine conflict, tightening global supply. Furthermore, growing interest in sustainable agriculture and specialty fertilizers drives demand for low-chloride potash types, such as potassium sulfate (SOP) and potassium nitrate, opening up new opportunities in premium crop segments like fruits, vegetables, and horticulture.

Drivers, Opportunities & Restraints

The growing global population is increasing the demand for food, which drives the need for higher agricultural productivity. Potash, as a key source of potassium, helps improve crop yield, water retention, and resistance to pests and diseases. This makes it essential for intensive farming practices, particularly in nutrient-depleted soils. Due to expanding cultivation needs, large agricultural economies like India, China, and Brazil are major growth drivers.

A significant portion of the global potash supply comes from a few countries, notably Canada, Russia, and Belarus. Geopolitical tensions, such as sanctions on Belarus or conflicts affecting Russian exports, can severely disrupt global supply chains. This concentration creates price volatility, supply insecurity, and dependency risks for importing nations, particularly in Asia and Africa.

Rising demand for high-value crops like fruits, vegetables, and nuts creates opportunities for specialty potash types, such as potassium sulfate (SOP) and potassium nitrate, which have lower chloride content and are more suitable for sensitive crops. Additionally, the push toward sustainable and precision agriculture is boosting the adoption of tailored nutrient solutions, opening new avenues for value-added potash products.

Product Insights

The potassium chloride product segment dominated the market with a revenue share of 53.0% in 2024. This is attributed to the rise in agricultural activities. Potassium chloride is commonly known as Muriate of Potash (MOP), and it is mainly used to produce nitrogen, phosphorus, and potassium (NPK) fertilizer as a source of potassium and as a raw material for industrial use. The growing population globally drives considerable demand for food, ultimately enhancing food production. Consequently, the agricultural sector increasingly depends on potash products to boost crop yields. Countries like China and India critically influence global market demand.

The vast size of their agricultural industries necessitates significant market adoption to cater to the increasing food requirements of their enormous populations. In recent years, there has been a notable surge in demand for sulfate, commonly known as sulfate of potash (SOP), mainly due to its unique qualities that make it highly suitable for specific soil types and crops. This fertilizer has witnessed significant growth in demand, especially among high-value crops like fruits, vegetables, and specialty crops. The growing emphasis on sustainable farming methods has increased the demand for potassium sulfate.

This has subsequently caused a significant upswing in the potassium sulfate industry, as agricultural producers actively seek efficacious chemical inputs to enhance crop productivity and quality. Potassium nitrate is a specialized potash product that has gained popularity in specific applications, particularly in horticulture and greenhouse farming. It provides a balanced supply of potassium and nitrogen, making it suitable for crops that require simultaneous uptake of these nutrients. The increasing trend towards greenhouse and controlled-environment agriculture has contributed to the rising demand for potassium nitrate.

End Use Insights

The agriculture end use segment dominated the market with a revenue share of 93.1% in 2024. This growth is attributed to the agricultural industry’s ability to improve crop growth, maximize yields, and ensure global food security. This critical nutrient helps facilitate plant growth, root development, and overall crop health. Potash has become an essential ingredient in modern farming practices, as it is now a key component of fertilizer blends used to enhance agricultural productivity in response to rising demand. Given the growing global population and the consequent increase in food demand, farmers equally strive to augment agricultural productivity, creating an unrelenting and significant need for potash-based fertilizers.

This demand is exceptionally high in key agriculture-focused regions specializing in cultivating crops, such as soybeans, corn, wheat, cotton, and various vegetables and fruits. Farmers constantly look for ways to enhance their crop yields and improve productivity. Potash is vital in achieving these goals by promoting root development, increasing drought resistance, and improving overall plant health. As agricultural activities expand into previously unused or underutilized land, the need for potash fertilizers increases. These lands often lack sufficient nutrient content, and potash application becomes necessary to ensure optimal crop growth. While agriculture is the primary consumer of the market, there is also demand for products in non-agricultural industries.

These industries include industrial applications, animal feed supplements, and specialized non-agricultural applications. Companies in the chemical manufacturing, glass production, metallurgy, and water treatment sectors rely on the availability of potash compounds to carry out their distinct operations. The manufacturing of detergents, soaps, ceramic materials, and other chemical products constitutes some of the vast array of applications of these compounds. The overall demand for the market in these industries is subject to several factors, such as industrial production rates, manufacturing activities, and end-market requirements, all of which collectively influence the level of demand for the commodity.

Regional Insights

The Asia Pacific region dominated the market with a revenue share of more than 38.4% in 2024. This is attributable to the rising demand for products in leading countries, namely China and India. In these countries, the extensive agricultural sector catering to their vast population necessitates a significant enhancement in food production. China's demand for potash is primarily attributed to the cultivation of crops, such as rice, wheat, corn, and vegetables. In addition, India's agricultural focus is on crops such as rice, wheat, sugarcane, and cotton. The demand for potash primarily stems from many factors, such as the growing population, rapid urbanization, and an ever-growing push toward sustainable agriculture, all of which ultimately influence product demand in the Asia Pacific region.

China America Potash Market Trends

The China potash market is expected to grow significantly over the forecast period. Substantial oil reserves in China are likely to contribute to the Asia Pacific market's growth. As a result, key market players are concentrating their focus on expanding capacity in the Asia Pacific region and meeting growing demand across regions.

North America Potash Market Trends

The potash market in North America is essentially driven by both the U.S. and Canada. The agricultural industries in these countries are sizeable, catering to a broad range of crops. The cultivation of major crops like corn, soybeans, wheat, and canola is fundamental to the region's demand. Furthermore, adopting cutting-edge farming practices and precision agriculture techniques further heightens the necessity for potash in North America. The Europe region observes considerable product demand, predominantly from countries such as Russia, Germany, and France. The agricultural sector in this region holds paramount importance, emphasizing cultivating vital crops like wheat, corn, barley, and rapeseed.

Europe Potash Market Trends

The potash market in Europe is relatively mature, with stable demand driven by intensive agriculture and the production of high-value crops. Countries like Germany, France, and Poland are key consumers, utilizing potash to enhance soil fertility and crop yields. The region is also focusing on sustainable farming practices, which is boosting interest in low-chloride and specialty potash fertilizers. However, Europe's limited domestic production increases reliance on imports from Canada, Russia, and Belarus, making it vulnerable to geopolitical disruptions.

Latin America Potash Market Trends

The potash market in Latin America is experiencing robust growth, driven by the region’s vast agricultural activity, particularly in Brazil and Argentina, which are major producers of soybeans, corn, and sugarcane. Brazil alone accounts for a significant share of global potash imports due to its potassium-deficient soils. The region’s push to enhance crop yields and reduce fertilizer import dependency is spurring investment in local potash mining projects. However, logistical challenges and infrastructure gaps continue to pose hurdles to market expansion.

Middle East & Africa Potash Market Trends

The potash market in the Middle East & Africa is gradually expanding, supported by the region's focus on improving food security and agricultural productivity in arid climates. Countries like Saudi Arabia, Egypt, and South Africa are increasing fertilizer usage to enhance crop output. While the region relies heavily on potash imports, ongoing investments in controlled environment agriculture and irrigated farming are expected to drive future demand. Limited domestic production remains a key constraint for long-term supply security.

Key Potash Company Insights

Some key players operating in the market include Dow and Linde Plc.

-

K+S Aktiengesellschaft is a mining and chemicals company with a presence across Europe, North America, Latin America, Asia Pacific, and the Middle East & Africa. The company operates through key business segments: Potash and Magnesium Products and Salt. The Potash and Magnesium Products segment includes fertilizers for agriculture, industrial potash products, and products for animal nutrition and pharmaceuticals. The Salt segment covers de-icing salts, food-grade salts, industrial salts, and salt for water softening applications. K+S serves a broad range of end markets, including agriculture, food processing, chemical manufacturing, pharmaceuticals, and water treatment. The company plays a critical role in the global fertilizer market through its extensive portfolio of potassium chloride, magnesium sulfate, and specialty fertilizers.

Key Potash Companies:

The following are the leading companies in the potash market. These companies collectively hold the largest market share and dictate industry trends.

- JSC Belaruskali

- Compass Minerals Intl. Ltd.

- Mosaic Company

- Uralkali

- Rio Tinto Ltd.

- BHP Billiton Ltd.

- Eurochem

- Red Metal Ltd.

- Encanto Potash Corp. (EPC)

- Intrepid Potash Inc,

- K+S Aktiengesellschaft

- Nutrien

Recent Developments

-

In March 2025, the Indian government announced plans to begin potash mining in Rajasthan. These mining blocks aim to reduce reliance on imports for fertilizer production. The government has relaxed bidding conditions to facilitate this initiative, addressing a critical need for domestic potash availability. This move comes in response to changing import dynamics due to diplomatic tensions with Canada.

Potash Report Scope

Report Attribute

Details

Market size value in 2025

USD 65,058.8 million

Revenue forecast in 2032

USD 93,501.2 million

Growth rate

CAGR of 5.3% from 2025 to 2032

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2032

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2032

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

JSC Belaruskali; Compass Minerals Intl. Ltd.; Mosaic Company; Uralkali; Rio Tinto Ltd.; BHP Billiton Ltd.; Eurochem; Red Metal Ltd.; Encanto Potash Corp. (EPC); Intrepid Potash Inc; K+S Aktiengesellschaft; Nutrien

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Potash Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global potash market report based on product, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2032)

-

Potassium Chloride

-

Potassium Sulphate

-

Potassium Nitrate

-

Other Products

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2032)

-

Agriculture

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2032)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global potash market size was valued at USD 62,374.0 million in 2024 and is expected to reach USD 65,058.8 million in 2025.

b. The global potash market expanded at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2032, reaching USD 93,501.2 million by 2032.

b. The potassium chloride product segment dominated the market with a revenue share of 38.4% in 2024. This is attributable to the surge in agricultural activities.

b. Some of the prominent players in the potash market include JSC Belaruskali; Compass Minerals Intl. Ltd.; Mosaic Company; Uralkali; Rio Tinto Ltd.; BHP Billiton Ltd.; Eurochem; Red Metal Ltd.; Encanto Potash Corp. (EPC); Intrepid Potash Inc; K+S Aktiengesellschaft; Nutrien

b. The increasing population directly impacts the demand for food and agricultural products, which, in turn, influences the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.