- Home

- »

- Pharmaceuticals

- »

-

Postpartum Depression Drugs Market Size Report, 2030GVR Report cover

![Postpartum Depression Drugs Market Size, Share & Trends Report]()

Postpartum Depression Drugs Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Postpartum Blues, Anxiety, PTSD), By Treatment (Pharmacotherapy, Hormonal Therapy), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-319-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Postpartum Depression Drugs Market Summary

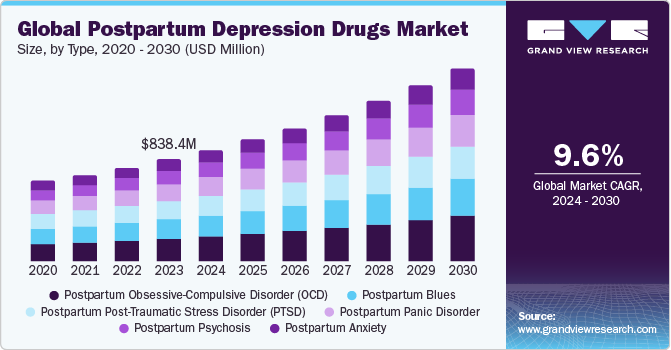

The global postpartum depression drugs market size was estimated at USD 838.4 million in 2023 and is anticipated to reach USD 1.59 billion by 2030, growing at a CAGR of 9.63% from 2024 to 2030. The increasing prevalence ofpostpartum depression, growing research and development efforts, and a rise in new product launches are supporting the market expansion for postpartum depression drugs (PPD).

Key Market Trends & Insights

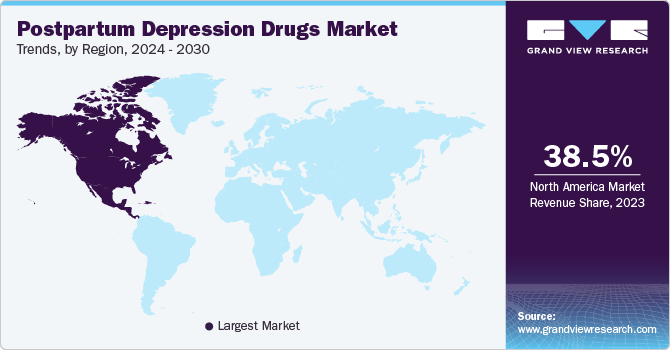

- North America postpartum depression drugs market accounted for 38.45% share in 2023.

- By type, postpartum anxiety segment dominated the market and accounted for a share of 22.16% in 2023.

- By treatment, the pharmacotherapy segment held the largest share of 55.92% in 2023.

- By Route of Administration, the oral segment held the largest share of 66.18% in 2023.

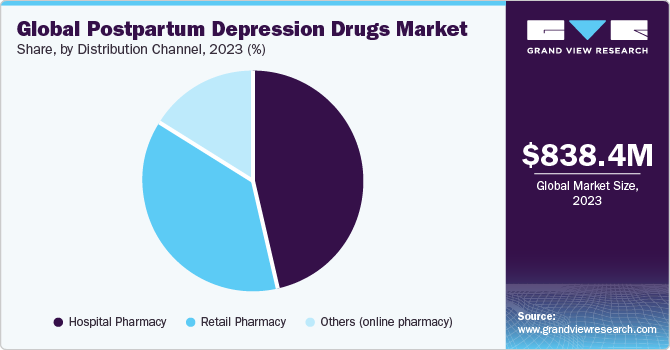

- By distribution channel, the hospital pharmacy segment held the largest share of 46.85% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 838.4 Million

- 2030 Projected Market Size: USD 1.59 Billion

- CAGR (2024-2030): 9.63%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, an increase in awareness about the treatment options for PPD is driving market growth. For the first time, the U.S. Congress formally acknowledged Maternal Mental Health Awareness Week when it passed a resolution designating May 5th to 11th, 2024 as “Maternal Mental Health Awareness Week.”

Research on postpartum depression (PPD) frequency and incidence around the globe indicates a steady increase in PPD among mothers of children. According to PostpartumDepression.org article published in April 2024, one in seven women may have postpartum depression within a year of giving a child. In the U.S., there are around about 600,000 diagnoses of postpartum depression every year. In addition, postpartum depression symptoms are also commonly experienced by women who miscarry or give birth to a stillbirth. In the U.S., it affects about 900,000 women a year when miscarried or stillborn mothers are included in the statistics. Thus, the demand for postpartum depression drugs is rising due to the rising prevalence of PPD worldwide.

Several clinical studies are being conducted to identify new medications for postpartum depression treatment. For instance, in August 2023, the American Journal of Psychiatry published the results of the SKYLARK research, which adds support to the idea that severe PPD may be effectively and safely treated with a 14-day course of Zuranolone. The results were derived based on an analysis of 196 patients who were taking either a placebo or Zuranolone medication. In contrast to the placebo group, a new mother receiving Zuranolone treatment saw a significant 35% reduction in depressed symptoms. The result of this study is anticipated to open new opportunities for products in the market.

Moreover, there is a rise in initiatives undertaken by government and non-government bodies to support PPD patients by offering preventive treatment. For instance, the government of Pakistan introduced The "Happy Mother, Healthy Baby" (HMHB) initiative to lower cases of anxiety and postpartum depression among new mothers. This initiative demonstrated significant success due to its organized and approachable method of treating these common mental diseases (CMDs). The launch of such initiatives worldwide is anticipated to boost market growth during the forecast period.

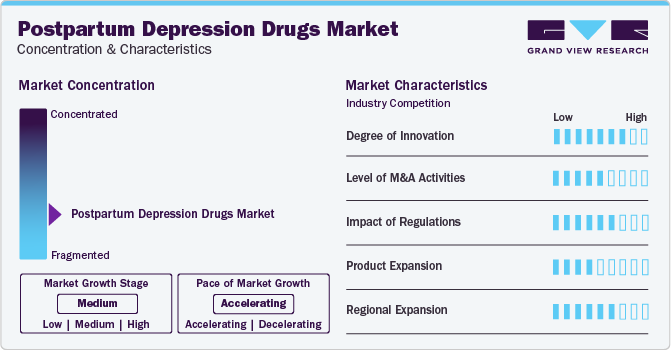

Market Characteristics & Concentration

The degree of innovation is high in the market due to growing research and development of novel drugs. Innovations include the focus on the rapid onset of action drugs, addressing the critical need for immediate relief in severe cases of PPD. For instance, both Zuranolone and Brexanolone have demonstrated significant improvements in postpartum depression symptoms within a few days of administration to the patient.

To improve their market position, several companies participate in mergers and acquisitions. These activities boost their market expertise, diversify their product offerings, and enhance their skills. For instance, in May 2020, Catalent announced the acquisition of a packaging facility in Japan. This strategic acquisition broadened the company’s distribution and manufacturing hub to support clinical trials. This acquisition is expected to boost R&D efforts for new PPD drugs.

Regulatory agencies like the FDA have created accelerated approval pathways for breakthrough therapies. This approach has been critical for PPD drugs, allowing promising treatments like Brexanolone (Zulresso) to reach the market more quickly. This regulatory support encourages pharmaceutical companies to invest in developing innovative treatments by reducing the time and cost associated with bringing new PPD drugs to patients.

This market has large number of substitutes which includes Psychotherapy like Cognitive Behavioral Therapy (CBT) and Interpersonal Therapy (IPT), lifestyle interventions like diet and nutrition and exercise, mindfulness and relaxation techniques, and acupuncture and acupressure treatment.

North America and Western Europe currently lead the PPD drugs market due to their advanced healthcare treatment types and supportive regulatory environments, significant growth opportunities exist in emerging markets across Asia-Pacific, Latin America, and the Middle East. Addressing cultural stigma and improving healthcare infrastructure will be key to unlocking the full potential of these markets.

Type Insights

Postpartum anxiety segment dominated the market and accounted for a share of 22.16% in 2023. Postpartum anxiety is a prevalent issue worldwide, affecting a significant proportion of new mothers. The rates of prevalence vary widely depending on regional, cultural, and socioeconomic factors. According to Postpartum Support International, anxiety affects 6% of expectant mothers and 10% of women after giving birth to child. They have been reported to feel anxiety by itself or in conjunction with depression at different times. Thus, increasing awareness, improving access to mental health care, and addressing cultural stigmas are crucial steps in better managing and supporting mothers experiencing postpartum anxiety and driving adoption drugs available for its treatment.

The postpartum blues segment is projected to grow at a significant rate over the forecast period. It is characterized by a low mood and moderate, self-limiting depression symptoms that are temporary. According to 2023 research published by the NCBI, Postpartum blues are quite prevalent and expected to impact at least 50% of women in the first few weeks of baby delivery. Furthermore, the three predisposing factors most frequently identified in women who experienced postpartum blues include at least one prior episode of clinical depression and a history of premenstrual depression. Thus, presence of significant population of Postpartum Blues is anticipated to boost demand for drugs used for treatment and drive segment growth.

Treatment Insights

The pharmacotherapy segment held the largest share of 55.92% in 2023. In the treatment of postpartum depression (PPD), pharmacotherapy is vital because it offers several important advantages, including the ability to treat serious cases, address biological factors, and provide rapid symptom relief. Furthermore, advancements in pharmacotherapy treatment, such as growing use in conjunction with psychotherapy, such as cognitive-behavioral therapy (CBT) or interpersonal therapy (IPT), provide a comprehensive treatment approach. This combination can be more effective than either treatment alone, addressing both the biological and psychological aspects of PPD and driving segment growth.

The hormonal therapy segment is anticipated to grow significantly during the forecast period. During pregnancy, levels of estrogen and progesterone rise significantly, only to drop sharply after childbirth. These hormonal fluctuations can contribute to the development of PPD in susceptible women. Hormonal therapies, especially neurosteroids like Brexanolone, can provide rapid relief from depressive symptoms, which is crucial for severe cases of PPD. This can significantly improve the mother’s ability to function and care for her baby. In addition, hormonal therapy can be used in conjunction with other treatments such as antidepressants, psychotherapy, and lifestyle interventions. This multimodal approach enhances overall treatment efficacy and provides comprehensive support to the patient.

Route of Administration Insights

The oral segment held the largest share of 66.18% in 2023 and is anticipated to grow rapidly over the forecast period. The oral route of administration offers flexibility in dosing and can accommodate a variety of formulations, from tablets and capsules to liquids and suspensions, making it suitable for a wide range of medications. Additionally, oral administration often enhances patient compliance, as it eliminates the need for injections or other more invasive methods, leading to better treatment outcomes. This factor is anticipated to drive segment growth.

The parenteral route of administration is the second largest segment in the market. This can be attributed to development and commercialization of novel parenteral-administered drugs. For instance, in 2019, the U.S. FDA approved Zulresso (brexanolone) developed by Sage Therapeutics, Inc. for the treatment of patients with PPD. This drug is intravenously administered to patients. Due to its administration requirements, it is available only through a restricted distribution program at certified healthcare facilities, where healthcare providers can closely monitor the patient.

Distribution Channel Insights

The hospital pharmacy segment held the largest share of 46.85% in 2023. Many hospital pharmacies offer clinical pharmacy services, including medication therapy management (MTM) and pharmacotherapy consultations. These services involve comprehensive medication reviews, assessment of treatment efficacy and safety, and recommendations for therapy optimization, tailored to the individual needs of patients with PPD. Additionally, the expansion of specialty pharmacy services and integration with value-based care models contribute to the evolving role and importance of hospital pharmacy departments within healthcare treatment types. These above-mentioned factors are driving segment growth during the forecast period.

The retail pharmacy segment is anticipated to witness significant growth over the forecast period. Retail pharmacies are widely accessible to the general population, offering convenient locations in communities and often extended hours of operation. This accessibility ensures that patients with PPD can easily access their prescribed medications close to home, promoting adherence to treatment regimens. Thus, the growing number of retail pharmacies that offer PPD drugs is expected to boost market growth.

Regional Insights

North America postpartum depression drugs market accounted for 38.45% share in 2023. Postpartum depression is a prevalent condition in North America, affecting a significant proportion of new mothers. The awareness and diagnosis of PPD have increased over the years, leading to a growing demand for effective pharmacological treatments.

U.S. Postpartum Depression Drugs Market Trends

The postpartum depression drugs market in the U.S. held the largest share in the North American region in 2023 and is expected to grow rapidly over the forecast period. Pharmaceutical research and development have led to the discovery and introduction of new medications for the treatment of postpartum depression. The approval of novel antidepressants, such as brexanolone (Zulresso) and esketamine (Spravato), by regulatory authorities in recent years has expanded treatment options for PPD in the U.S.

Europe Postpartum Depression Drugs Market Trends

Europe postpartum depression drugs market was a lucrative region in this industry. Changes in healthcare policies and insurance coverage have a significant impact on the availability and accessibility of postpartum depression treatments in Europe. Expanded insurance coverage for mental health services, including pharmacotherapy for PPD, has improved access to treatment for affected individuals, driving regional growth.

The postpartum depression drugs market in UK is projected to expand in the future due to technological advancement. The adoption of telemedicine and remote healthcare services has facilitated access to postpartum depression treatment for individuals across the UK, particularly those residing in rural or underserved areas. Telepsychiatry and virtual mental health consultations enable new mothers to receive timely assessment, diagnosis, and pharmacological management of PPD.

France postpartum depression drugs market is expected to grow rapidly during the forecast period. Some of the factors influencing market growth is the availability of universal healthcare treatment type that provides comprehensive coverage for medical services, including mental health care. Access to healthcare services, including pharmacotherapy for PPD, is generally good, which contributes to the utilization of PPD drugs in the country and drives market growth.

The postpartum depression drugs market in Germany due to strong healthcare infrastructure. The healthcare treatment in Germany, known for its high standards and comprehensive coverage, ensures that patients have access to necessary medical services, including mental health care. This accessibility facilitates the use of pharmacotherapy for PPD, supporting market growth.

Asia Pacific Postpartum Depression Drugs Market Trends

Asia Pacific postpartum depression drugs market is anticipated to witness fastest growth over the forecast period. Increased awareness and education about postpartum depression in many countries within the Asia Pacific region have led to better recognition and diagnosis of the condition. Public health campaigns and educational programs aimed at healthcare providers and the public contribute to this growing awareness.

The postpartum depression drugs market in China is growing as the Chinese government has been implementing policies and initiatives to improve mental health care, including maternal mental health. These initiatives include screening programs for PPD, funding for mental health services, and integrating mental health care into primary healthcare settings. These factors are expected to drive market in China.

Japan postpartum depression drugs market is expected to grow over the forecast period. The gradual cultural shift in Japan where mental health issues, including postpartum depression, are becoming less stigmatized. Reduced stigma encourages more women to seek help and adhere to treatment, thereby driving demand for PPD medications.

Latin America Postpartum Depression Drugs Market Trends

The postpartum depression drugs market in Latin America is expected to grow rapidly. Many countries in Latin America are investing in improving their healthcare infrastructure. Enhanced healthcare facilities and services, especially in urban areas, mean better access to diagnosis and treatment for mental health conditions, including PPD.

Brazil postpartum depression drugs market is expected to grow over the forecast period due to the socioeconomic challenges, including poverty, unemployment, and economic instability, contribute to mental health issues among new mothers in Brazil. These factors can increase the incidence of PPD, driving the need for effective pharmacological treatments.

MEA Postpartum Depression Drugs Market Trends

The postpartum depression drugs market in MEA was identified as a lucrative region in this industry. The pharmaceutical industry in the Middle East and Africa is growing, with increased investments from both local and international companies. This expansion leads to better distribution networks, making PPD drugs more accessible across the region.

Saudi Arabia postpartum depression drugs market shows opportunities. Saudi Arabia’s Vision 2030 initiative aims to diversify the economy and develop public service sectors, including healthcare. As part of this vision, there is a significant focus on modernizing healthcare infrastructure and services, which includes mental health care. This modernization supports the availability and distribution of PPD treatments.

Key Postpartum Depression Drugs Company Insights

Some of the key market players operating include Sage Therapeutics, Inc., Pfizer Inc., Lilly (Eli Lilly and Company), GSK plc., Merck & Co., Inc, and Novartis AG, and Teva Pharmaceutical Industries Ltd. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of drugs worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Marinus Pharmaceuticals, Axsome Therapeutics, and Forendo Pharma are some of the emerging players in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel launches to capitalize on untapped avenues.

Key Postpartum Depression Drugs Companies:

The following are the leading companies in the postpartum depression drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Sage Therapeutics, Inc.

- Pfizer Inc.

- Eli Lilly and Company

- GSK plc.

- Merck & Co., Inc.

- Biogen Inc.

- Bausch Health Companies Inc.

- Cipla Inc.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

Recent Developments

-

In April 2024, The Centre for Addiction and Mental Health (CAMH) invented, researched, developed, and commercialized a novel natural supplement that prevents postpartum blues and reduces symptoms of postpartum depression in the six months that follow giving birth, according to a new study published in the Lancet discovery science journal eClinicalMedicine

-

In October 2023, the U.S. FDA approved Zurzuvae (zuranolone) developed by Sage Therapeutics, Inc. for the treatment of adult patient with postpartum depression in U.S. This is the first FDA approved orally administered drug. This approval is expected to drive market growth

-

In November 2020, Biogen Inc. and Sage Therapeutics, Inc. signed licensing agreement to co develop and market zuranolone (SAGE-217) for major depressive disorder (MDD), postpartum depression (PPD), and other mental diseases, and SAGE-324 for essential tremor and other neurological illnesses

Postpartum Depression Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 915.6 million

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 9.63% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa;Saudi Arabia; UAE; Kuwait

Key companies profiled

Sage Therapeutics, Inc.; Pfizer Inc.; Eli Lilly and Company; GSK plc.; Merck & Co., Inc.; Biogen Inc.; Bausch Health Companies Inc.; Cipla Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Postpartum Depression Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global postpartum depression drugs market report based on type, treatment, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Postpartum Blues

-

Postpartum Anxiety

-

Postpartum Obsessive-Compulsive Disorder (OCD)

-

Postpartum Post-Traumatic Stress Disorder (PTSD)

-

Postpartum Panic Disorder

-

Postpartum Psychosis

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacotherapy

-

Hormonal Therapy

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others (online pharmacy)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global postpartum depression drugs market size was estimated at USD 838.4 million in 2023 and is expected to reach USD 915.6 million in 2024.

b. The global postpartum depression drugs market is expected to grow at a compound annual growth rate of 9.63% from 2024 to 2030 to reach USD 1.59 billion by 2030.

b. North America postpartum depression drugs market accounted for 38.45% share in 2023 owing to its well-established healthcare infrastructure, high healthcare expenditures, and high prevalence of postpartum depression.

b. Key factors that are driving the postpartum depression drugs market growth include increasing prevalence of postpartum depression, advancements in drug development, and growing awareness and diagnosis.

b. Some key players operating in the postpartum depression drugs market include Sage Therapeutics, Inc.; Pfizer Inc.; Eli Lilly and Company); GSK plc.; Merck & Co., Inc.; Biogen Inc.; Bausch Health Companies Inc.; Cipla Inc.; Novartis AG; Teva Pharmaceutical Industries Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.