- Home

- »

- Automotive & Transportation

- »

-

Postal Services Market Size, Share & Growth Report, 2030GVR Report cover

![Postal Services Market Size, Share & Trends Report]()

Postal Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Standard, Express), By Destination (Domestic, International), By Service, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-454-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Postal Services Market Summary

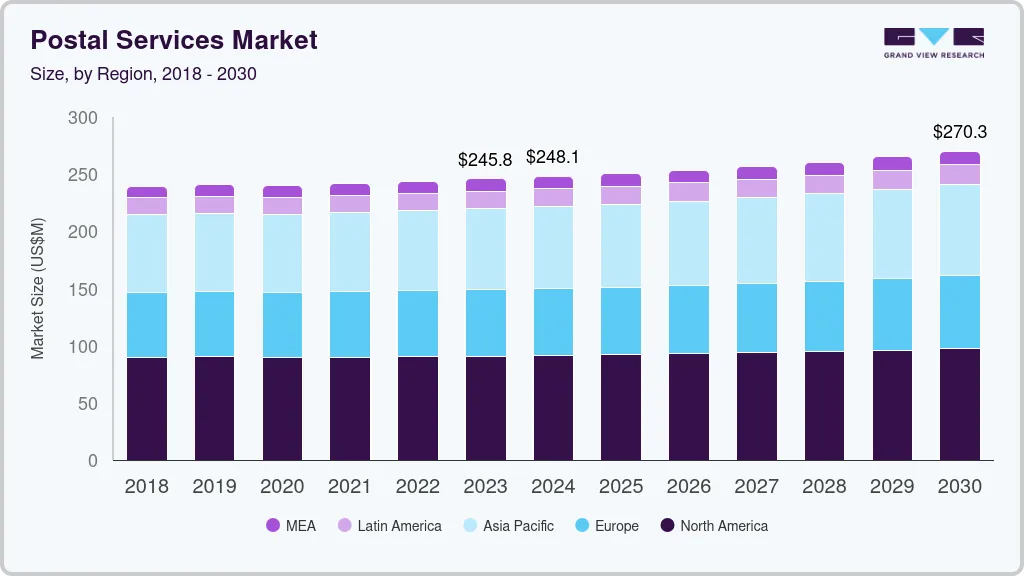

The global postal services market size was estimated at USD 245.8 billion in 2023 and is projected to reach USD 270.3 billion by 2030, growing at a CAGR of 1.4% from 2024 to 2030. The market encompasses a broad range of activities related to the collection, processing, transportation, and delivery of mail items, including letters, parcels, and various postal products.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, standard accounted for a revenue of USD 245.8 billion in 2023.

- Standard is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 245.8 billion

- 2030 Projected Market Size: USD 270.3 billion

- CAGR (2024-2030): 1.4%

- North America: Largest market in 2023

Letter mail services involve the collection, sorting, and delivery of letters and other small items. Parcel delivery services encompass the handling of packages and larger items, often involving more complex logistics due to varying weights and sizes. This market is an essential component of global and national communication networks, facilitating the exchange of information and goods across different regions.

The market is composed of both government-owned postal authorities and private courier companies, which provide services to individuals, businesses, and other organizations.

The market has experienced significant changes over the past few decades, driven by technological advancements, changes in consumer behavior, and the globalization of trade. One of the most notable trends is the decline in traditional letter mail volumes, which has been largely offset by the explosive growth in parcel delivery, particularly due to the rise of e-commerce. The proliferation of online shopping has led to a substantial increase in the demand for parcel delivery services, as consumers and businesses alike require fast and reliable shipping options. Another key trend is the increasing adoption of digital technologies by postal service providers. Many organizations are investing in automation, artificial intelligence, and data analytics to optimize their operations and enhance customer service. For instance, automation in sorting centers has improved efficiency and reduced costs, while AI and data analytics are being used to predict demand, manage logistics, and offer personalized services to customers.

The market operates under a variety of regulatory frameworks, depending on the country and region. In many countries, postal services are subject to universal service obligations (USOs), which require providers to offer certain services at a uniform price and quality, regardless of the location. These obligations are typically imposed on government-owned postal authorities, ensuring that all citizens have access to essential mail services. Regulations also govern issues such as pricing, service quality, and competition. In some regions, postal services are heavily regulated to prevent monopolistic practices and ensure fair competition between public and private providers. For instance, in the European Union, the Postal Services Directive aims to create a single postal market by liberalizing the sector and ensuring that all operators adhere to minimum service standards.

The market is driven by several key factors, including the growth of e-commerce, technological advancements, and changing consumer preferences. E-commerce has been a significant driver of the market, as the increasing volume of online transactions necessitates efficient and reliable delivery services. The rise of online shopping platforms, coupled with the growing trend of cross-border e-commerce, has expanded the market for parcel delivery services, creating new opportunities for postal operators. Technological advancements present another major driver for market growth. Innovations in automation, artificial intelligence, and data analytics are transforming the way postal services are delivered, making them faster, more reliable, and cost-effective. For example, the use of drones and autonomous vehicles for last-mile delivery is an emerging trend that has the potential to revolutionize the industry. These technologies not only improve operational efficiency but also enhance customer satisfaction by providing faster and more accurate deliveries.

Type Insights

The standard segment dominated the market in 2023 and accounted for more than 75% share of global revenue. Standard postal services are typically used for the delivery of letters, documents, and parcels that do not require expedited shipping. The dominance of standard services is largely attributed to their established infrastructure and the universal service obligation (USO) in many countries, which mandates the provision of basic postal services at a uniform rate across all regions. This ensures that even remote and rural areas have access to reliable mail services. Despite the decline in traditional letter mail, standard postal services maintain a strong presence in the market due to the ongoing need for affordable delivery options, particularly for small businesses and individual consumers. The robustness of standard services also benefits from the extensive postal networks and distribution systems that have been built over decades, making them a reliable choice for both national and international mail delivery.

The express segment is anticipated to grow at a faster CAGR during the forecast period 2024 to 2030. As consumers and businesses prioritize quick delivery times, particularly for e-commerce and time-sensitive shipments, express services have become more popular. This segment is characterized by premium pricing, offering expedited delivery options that often include same-day or next-day services. The growth of express services is further fueled by advancements in logistics technology, which enables more accurate tracking, better route optimization, and enhanced customer experience. In addition, express services are increasingly favored in the business-to-business (B2B) sector, where timely delivery of critical documents and products is essential. The rise of cross-border e-commerce has also contributed to the expansion of express services, as international shipments require faster transit times to meet customer expectations. As a result, express postal services are expected to continue outpacing the growth of standard services in the coming years.

Service Insights

The shipping & package services segment dominated the market in 2023. As consumers increasingly shop online, the demand for reliable and efficient shipping services has grown exponentially. This segment encompasses the transportation and delivery of parcels and packages of various sizes, making it a critical component of the e-commerce ecosystem. The dominance of this segment is also supported by the growing trend of home delivery services, which has become a preferred option for many consumers. Major players in the market have invested heavily in expanding their logistics and distribution networks to accommodate the increasing volume of packages. Innovations such as automated sorting centers, real-time tracking, and last-mile delivery solutions have further strengthened the position of shipping and package services in the market. Moreover, businesses, particularly small and medium-sized enterprises (SMEs), rely heavily on these services to reach customers efficiently and cost-effectively, solidifying the segment's dominance.

The marketing mail (standard mail) segment is projected to grow at the fastest CAGR during the forecast period 2024 to 2030. Despite the rise of digital marketing, direct mail remains an effective way for businesses to reach targeted audiences. This segment includes bulk mailing services used by companies to send promotional materials, catalogs, brochures, and other marketing communications. The growth of marketing mail is fueled by its ability to generate high response rates and its effectiveness in reaching customers who prefer physical mail over digital advertisements. Moreover, advancements in data analytics and customer segmentation have made it easier for businesses to tailor their marketing campaigns, further boosting the appeal of marketing mail. While it is a more traditional form of advertising, many businesses view direct mail as a complementary strategy to digital marketing, particularly for reaching older demographics and local customers.

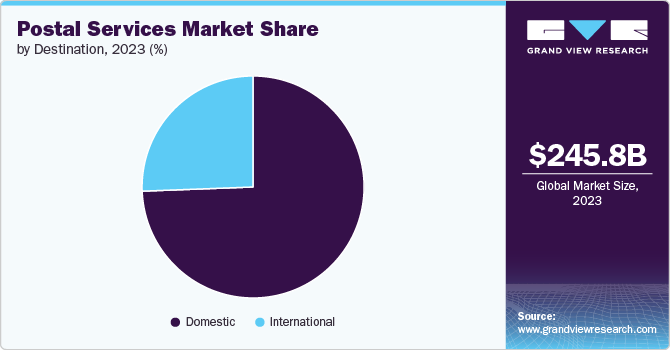

Destination Insights

The domestic segment dominated the market in 2023 and is anticipated to register the fastest CAGR during the forecast period. This segment covers the delivery of mail and packages within a country's borders, making it a critical component of national logistics and communication networks. The dominance of domestic services is bolstered by the extensive infrastructure that supports timely and efficient deliveries across urban, suburban, and rural areas. Moreover, the growth of e-commerce has significantly boosted the demand for domestic parcel services as consumers increasingly opt for home deliveries. The convenience, speed, and reliability offered by domestic postal services make them the preferred choice for both individual consumers and businesses. The rise in same-day and next-day delivery options has further fueled the growth of this segment, particularly in densely populated areas where quick delivery times are highly valued. In addition, the COVID-19 pandemic has accelerated the adoption of domestic delivery services as consumers and businesses shifted towards online shopping and contactless delivery options. As a result, domestic postal services are not only dominating but also experiencing rapid growth, driven by the evolving needs of the market.

The international segment is projected to grow significantly during the forecast period. This segment involves the delivery of mail and parcels across international borders, making it a vital part of global logistics and supply chains. The growth of international postal services is supported by the increasing demand for fast and reliable shipping options for goods purchased from overseas vendors. As more businesses and consumers engage in cross-border transactions, the need for efficient international postal services has grown, leading to increased investments in global logistics networks and partnerships. Innovations in tracking and customs clearance processes have also improved the efficiency of international deliveries, thus reducing transit times and enhancing customer satisfaction. Furthermore, the growth of this segment is driven by the proliferation of international e-commerce platforms, which allow consumers to purchase goods from around the world with ease. Despite challenges such as varying customs regulations and tariffs, international postal services are expected to continue expanding as global trade and e-commerce activities increase.

Regional Insights

The postal services market in North America region dominated globally in 2023 and accounted for a 36.9% share of the global revenue. This dominance is largely attributed to the well-established infrastructure, robust logistics networks, and high consumer demand for efficient mail and parcel delivery services in the region. The presence of major players like the United States Postal Service (USPS) and Canada Post, along with leading private courier companies such as FedEx and UPS, has contributed to North America's leading position in the market. In addition, the rapid growth of e-commerce in the region has fueled the demand for reliable and fast shipping services, further solidifying North America's market share. The region's emphasis on technological innovation, including the adoption of automation, real-time tracking, and advanced data analytics, has also played a critical role in maintaining its competitive edge. Moreover, North America's strong economic environment and high levels of consumer spending have supported the continuous expansion of the market.

U.S. Postal Services Market Trends

The postal services market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030, driven by the continued expansion of e-commerce, which has drastically increased the volume of parcels requiring efficient and timely delivery. The U.S. postal market is also benefiting from technological advancements that enhance operational efficiency, such as automation in sorting facilities and the use of advanced tracking systems. In addition, there is a growing demand for faster delivery options, such as same-day and next-day shipping, particularly in urban areas where consumer expectations for quick service are high. The rise of small and medium-sized enterprises (SMEs) that rely heavily on postal services for reaching their customer base also contributes to market growth. Furthermore, the U.S. government’s investments in modernizing the United States Postal Service (USPS), alongside the competitive landscape created by private couriers, are expected to drive significant growth in the market.

Europe Postal Services Market Trends

The postal services market in Europe is expected to witness steady growth from 2024 to 2030. This growth is underpinned by the region’s strong regulatory framework, which ensures high standards of service quality and reliability across member states. The European market is characterized by a mix of government-owned postal services, such as Deutsche Post in Germany and La Poste in France, and private courier companies that offer a range of services catering to both individuals and businesses. One of the key drivers of growth in Europe is the rising demand for cross-border e-commerce, which necessitates efficient and reliable international postal services. Moreover, the increasing adoption of digital technologies in logistics and the integration of sustainable practices, such as the use of electric vehicles for deliveries, are enhancing the efficiency and environmental footprint of postal services across Europe. The region's focus on innovation, coupled with strong consumer protection laws, ensures that postal operators continue to adapt to the evolving needs of the market.

The postal services market in the UK is expected to grow at a significant CAGR from 2024 to 2030. This anticipated growth is driven by the ongoing transformation of the retail landscape, with a significant shift towards e-commerce and online shopping. As consumers increasingly prefer online purchasing, the demand for efficient and reliable parcel delivery services has surged, creating substantial opportunities for postal operators. The UK market is also characterized by intense competition among major players, including Royal Mail and various private couriers, all of whom are investing in technological advancements to enhance service offerings. Innovations such as automated sorting facilities, real-time tracking, and the expansion of parcel locker networks are expected to drive market growth. In addition, the UK government’s initiatives to promote sustainable delivery practices, including the adoption of electric vehicles, are contributing to the modernization of the postal services.

Asia Pacific Postal Services Market Trends

The postal services market in Asia Pacific is expected to grow at a significant CAGR from 2024 to 2030, driven by the region’s rapid economic development and the explosive growth of e-commerce. Countries such as China, Japan, and South Korea are at the forefront of this growth, with their advanced logistics networks and strong consumer demand for online shopping. The Asia Pacific region is also experiencing a surge in cross-border e-commerce, which is increasing the demand for efficient international postal services. Moreover, the rising middle class in many Asia Pacific countries is driving greater consumption of goods, further boosting the demand for postal and parcel delivery services. The region’s postal operators are increasingly adopting technological innovations, such as automation and AI-driven logistics, to enhance efficiency and meet the growing demand. In addition, the push for sustainable practices, including the use of electric delivery vehicles and energy-efficient sorting facilities, is gaining traction in the region.

The postal services market in India is expected to grow at the fastest CAGR from 2024 to 2030. With a vast and diverse population, India represents a significant opportunity for growth in the market. The rise of digital literacy and internet penetration across urban and rural areas has led to a surge in online shopping, fueling the demand for efficient parcel delivery services. In addition, the Indian government’s initiatives to modernize the postal network, such as the digitization of postal services and the expansion of last-mile delivery capabilities, are contributing to the market’s rapid growth. The introduction of innovative services, such as drone delivery and parcel lockers, is also expected to drive the market forward. Moreover, India’s large and growing population, coupled with rising disposable incomes, is leading to increased consumer spending, further boosting the demand for postal services.

Key Postal Services Company Insights

The competitive landscape of the postal services industry is characterized by the presence of both government-owned postal authorities and private courier companies, each vying for market share in an increasingly dynamic and evolving industry. Government postal operators, such as the United States Postal Service (USPS), Royal Mail in the UK, and Deutsche Post in Germany, maintain a strong presence due to their established infrastructure and universal service obligations, which ensure nationwide coverage at standardized rates. These entities often enjoy a monopoly on certain services, particularly in the delivery of letters and basic postal services. On the other hand, private courier companies like FedEx, UPS, and DHL have carved out significant market shares by offering faster, more specialized services, particularly in the express delivery and logistics sectors. These companies are highly competitive, leveraging technological innovations, extensive logistics networks, and premium service offerings to attract business clients and e-commerce companies.

The rise of e-commerce has intensified competition, with both public and private operators expanding their capabilities to handle the growing volume of parcels. Furthermore, the increasing emphasis on sustainability and the adoption of green technologies is becoming a key competitive differentiator as companies seek to align with consumer preferences for environmentally friendly services. As a result, the market is marked by ongoing innovation, strategic partnerships, and a focus on customer-centric solutions as companies strive to stay ahead in this competitive landscape.

Key Postal Services Companies:

The following are the leading companies in the postal services market. These companies collectively hold the largest market share and dictate industry trends.

- Australia Post

- Canada Post Corporation

- China Post Group Corporation

- FedEx

- JAPAN POST Co., Ltd.

- Koninklijke PostNL

- La Poste

- Poczta Polska SA

- Royal Mail Group Limited

- Singapore Post Limited (SingPost)

- Sociedad Estatal Correos y Telégrafos, S.A., S.M.E (Correos)

- TNT Holdings B.V.

- United Parcel Service (UPS), Inc.

- United States Postal Service (USPS)

Recent Developments

-

In July 2024, MOS Logconnect Private Limited, a subsidiary of MOS Utility Limited, partnered with India Post to offer a variety of postal services nationwide. MOS Logconnect has received a Master Franchisee License from India Post to operate these services through India Post's network. This partnership will allow MOS Logconnect to expand its service offerings and leverage India Post's extensive network to provide efficient and seamless service delivery.

-

In July 2024, the Department of Posts launched a beta version of the National Addressing Grid, called DIGIPIN, for public feedback. Developed with IIT Hyderabad, DIGIPIN aims to create a standardized, geo-coded addressing system in India. This system is designed to simplify addressing solutions for both public and private service deliveries.

Postal Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 248.06 billion

Revenue forecast in 2030

USD 270.25 billion

Growth rate

CAGR of 1.4% from 2024 to 2030

Actual Data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, service, destination, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Australia Post; Canada Post Corporation; China Post Group Corporation; Deutsche Post AG (DHL Group); FedEx; JAPAN POST Co.,Ltd.; Koninklijke PostNL; La Poste; Poczta Polska SA; Royal Mail Group Limited; Singapore Post Limited (SingPost); Sociedad Estatal Correos y Telégrafos, S.A.; S.M.E (Correos); TNT Holdings B.V.; United Parcel Service (UPS), Inc.; United States Postal Service (USPS)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Postal Services Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global postal services market report based on type, service, destination, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Standard

-

Express

-

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Shipping & Package Services

-

First-class Mail

-

Marketing Mail (Standard Mail)

-

International Mail

-

Periodicals

-

Others

-

-

Destination Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global postal services market size was estimated at USD 245.82 billion in 2023 and is expected to reach USD 248.06 billion in 2024.

b. The global postal services market is expected to grow at a compound annual growth rate of 1.4% from 2024 to 2030, reaching USD 270.25 billion by 2030.

b. The North America region dominated the postal services market in 2023 and accounted for a 36.9% share of the global revenue. This dominance is largely attributed to the well-established infrastructure, robust logistics networks, and high consumer demand for efficient mail and parcel delivery services in the region.

b. Some key players operating in the postal services market include Australia Post, Canada Post Corporation, China Post Group Corporation, Deutsche Post AG (DHL Group), FedEx, JAPAN POST Co.,Ltd., Koninklijke PostNL, La Poste, Poczta Polska SA, Royal Mail Group Limited, Singapore Post Limited (SingPost), Sociedad Estatal Correos y Telégrafos, S.A., S.M.E (Correos), TNT Holdings B.V., United Parcel Service (UPS), Inc., and United States Postal Service (USPS).

b. The postal services market is driven by several key factors, including the growth of e-commerce, technological advancements, and changing consumer preferences. E-commerce has been a significant driver of the market, as the increasing volume of online transactions necessitates efficient and reliable delivery services. The rise of online shopping platforms, coupled with the growing trend of cross-border e-commerce, has expanded the market for parcel delivery services, creating new opportunities for postal operators.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.