- Home

- »

- Agrochemicals & Fertilizers

- »

-

Post-harvest Treatment Market Size, Industry Report, 2033GVR Report cover

![Post-harvest Treatment Market Size, Share & Trends Report]()

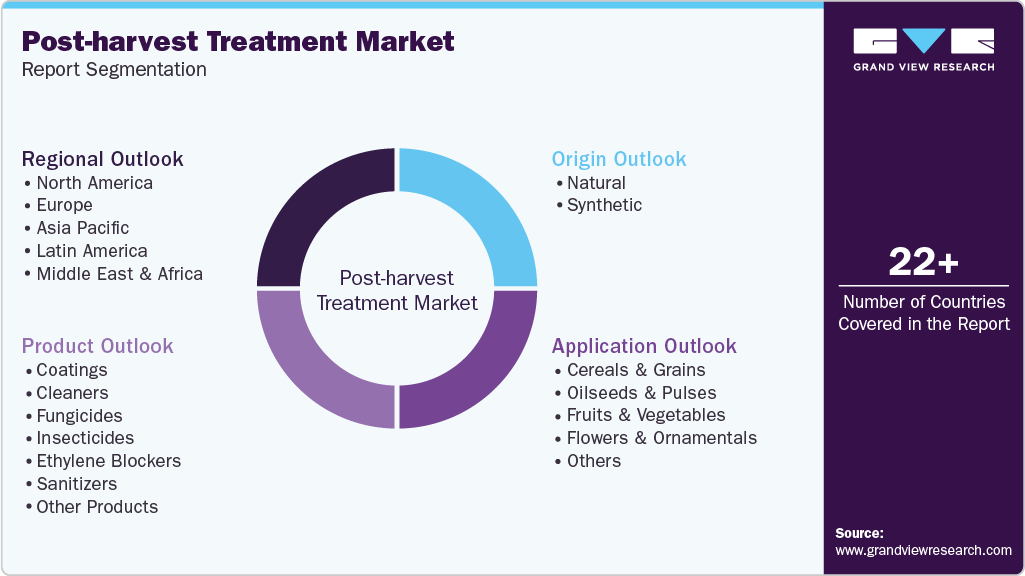

Post-harvest Treatment Market (2025 - 2033) Size, Share & Trends Analysis Report By Origin (Natural, Synthetic), By Product (Coatings, Cleaners, Fungicides, Insecticides), By Application (Cereals & Grains, Oilseeds & Pulses), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-265-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Post-harvest Treatment Market Summary

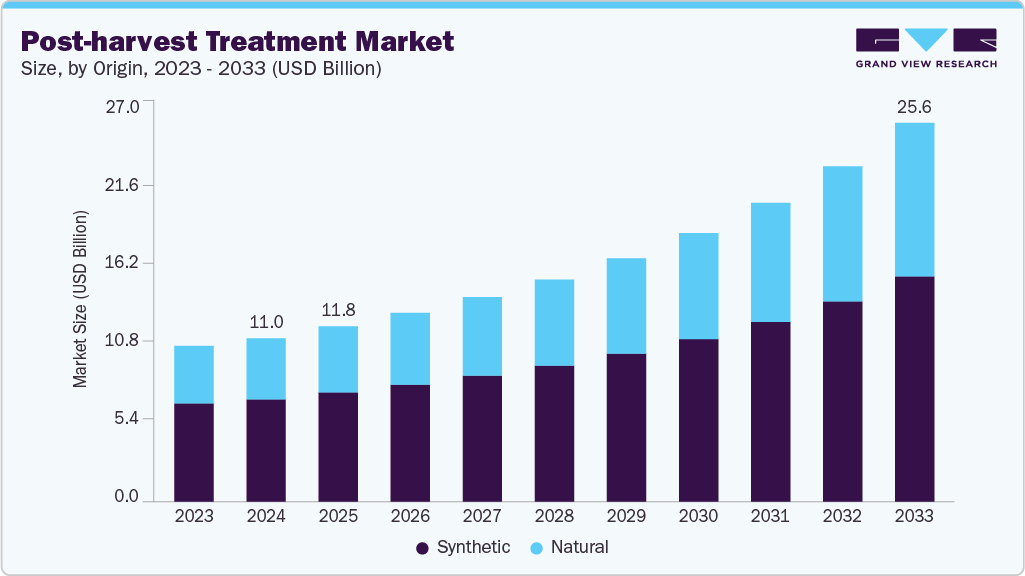

The global post-harvest treatment market size was estimated at USD 11,025.5 million in 2024 and is projected to reach USD 25,606.7 million by 2033, growing at a CAGR of 10.1% from 2025 to 2033. The market is primarily driven by the increasing demand for fresh and high-quality produce, rising concerns over food loss and waste, and the expansion of global trade in perishable agricultural commodities.

Key Market Trends & Insights

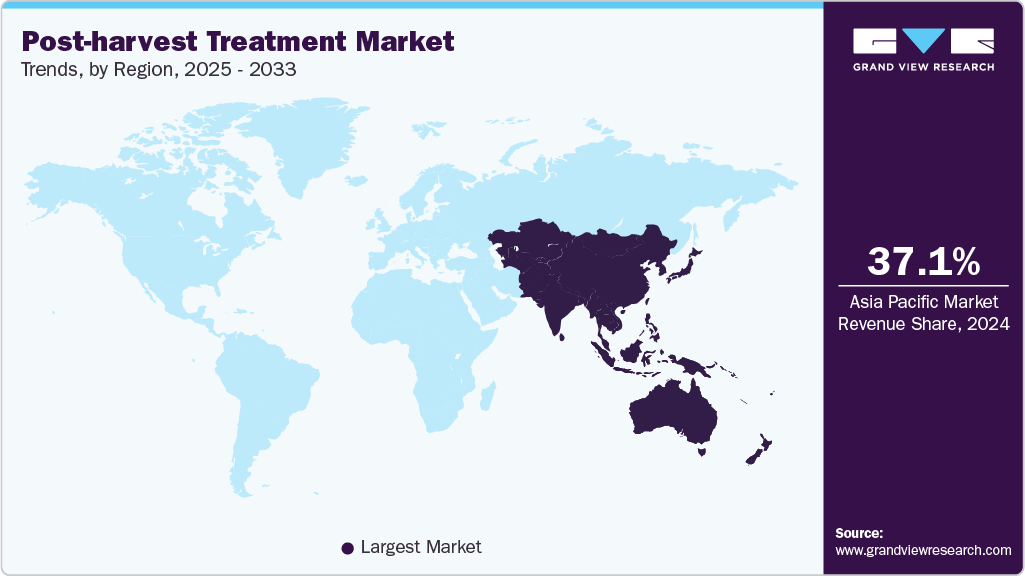

- Asia Pacific dominated the post-harvest treatment market with the largest revenue share of 37.1% in 2024.

- The market in China is expected to grow at a significant CAGR of 9.4% from 2025 to 2033.

- By origin, the synthetic post-harvest treatments accounted for the largest revenue share of 62.7% in 2024.

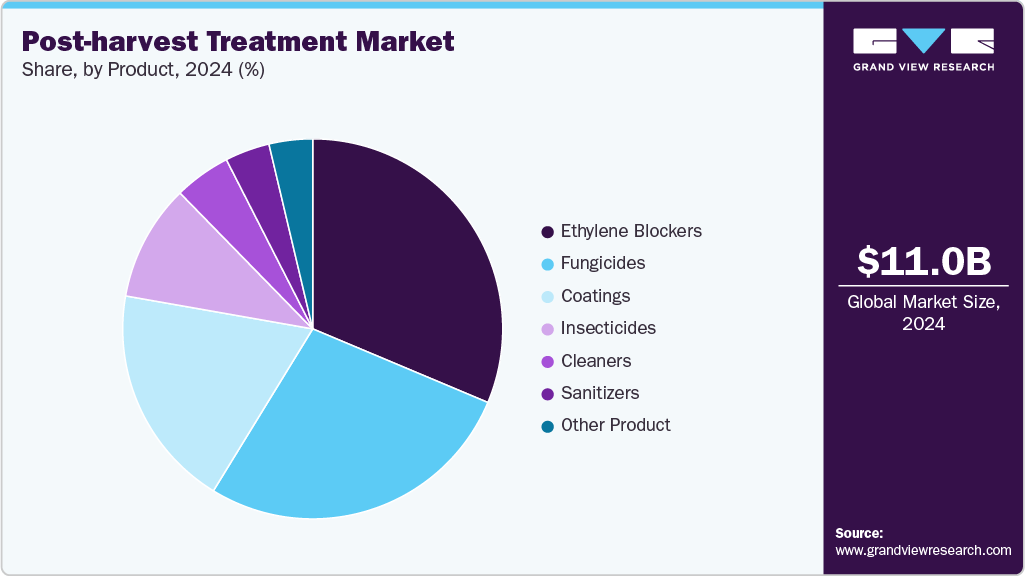

- By product, the ethylene blockers segment held the largest revenue share of 31.3% in 2024 in terms of value.

- By application, the fruits & vegetables segment held the largest revenue share of 46.7% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 11,025.5 Million

- 2033 Projected Market Size: USD 25,606.7 Million

- CAGR (2025-2033): 10.1%

- Asia Pacific: Largest market in 2024

In addition, growing consumer preference for residue-free and organic fruits and vegetables, coupled with stringent food safety regulations, is accelerating the adoption of both natural and synthetic post-harvest solutions. Advancements in post-harvest technologies and cold chain infrastructure are further supporting market growth across developed and emerging economies.The market presents significant growth opportunities driven by increasing global demand for fresh produce, expanding international trade of perishables, and heightened focus on reducing food loss across the value chain. Emerging markets in Asia Pacific, Latin America, and Africa offer strong potential due to the modernization of agricultural practices, rising investments in cold chain infrastructure, and favorable government initiatives to minimize post-harvest wastage. The growing shift toward sustainable agriculture and organic produce is creating demand for bio-based and residue-free treatment solutions, opening doors for innovation and product differentiation.

Despite its growth potential, the market faces several challenges, including stringent regulatory frameworks surrounding the use of chemical-based treatments and growing scrutiny over pesticide residues and food safety. High dependency on synthetic products in cost-sensitive markets poses a barrier to the adoption of natural alternatives, which are often more expensive. The lack of awareness and inadequate infrastructure in developing regions limit the implementation of effective post-harvest solutions. The variability in climatic and logistical conditions complicates uniform application across diverse geographies and crop types.

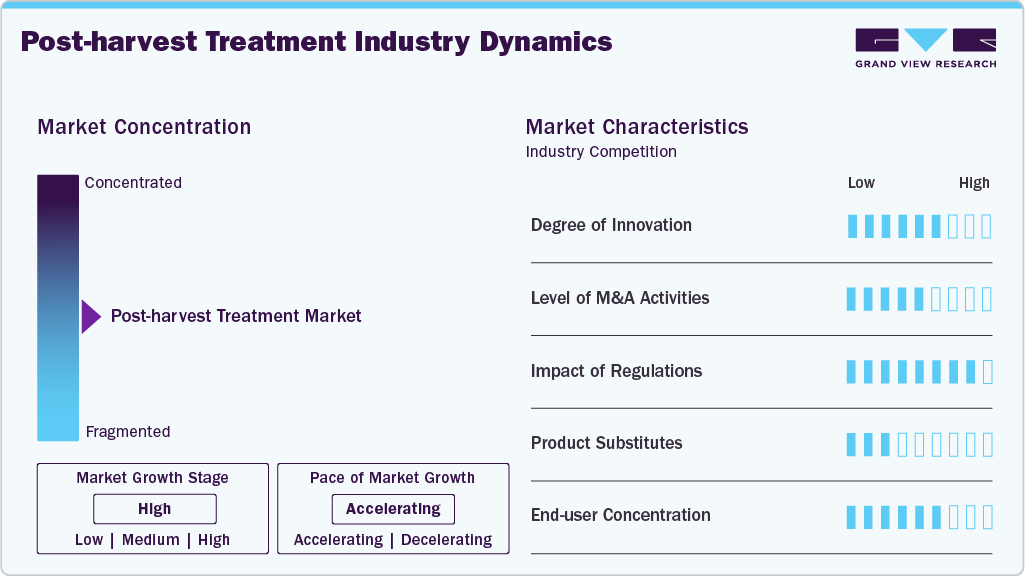

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as JBT, Syngenta Crop Protection, and Nufarm, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the industry are actively pursuing a combination of strategies to strengthen their market position, including product innovation, strategic acquisitions, and geographic expansion. Companies are increasingly investing in the development of sustainable and bio-based treatment solutions to meet evolving regulatory standards and consumer demand for residue-free produce. Strategic partnerships with growers, exporters, and cold chain logistics providers are also being leveraged to enhance value delivery and end-to-end service offerings. These players are expanding their footprint in emerging markets through localized production facilities and tailored product portfolios to capture untapped growth potential and build long-term customer loyalty.

Origin Insights

Synthetic post-harvest treatments accounted for the largest revenue share of 62.7% in 2024, owing to their broad-spectrum efficacy, cost-effectiveness, and widespread availability. These treatments, including chemical fungicides, insecticides, and sanitizers, remain the preferred choice across large-scale commercial operations and export-driven supply chains. Their proven ability to minimize post-harvest losses and maintain produce quality during extended storage and transit has reinforced their dominance in both developed and emerging markets. However, tightening global regulations on pesticide residues and growing consumer demand for sustainable practices are compelling manufacturers to reformulate their offerings with lower toxicity and improved environmental profiles.

Natural post-harvest treatments, derived from plant extracts, microbial agents, essential oils, and biopolymers, are gaining traction due to rising consumer preference for organic and residue-free produce. These treatments offer an environmentally sustainable alternative to conventional synthetic chemicals, aligning well with global trends toward clean-label and eco-friendly food production. Governments and regulatory bodies across North America and Europe are promoting the adoption of bio-based inputs through favorable policies and funding for sustainable agriculture initiatives. Although currently holding a smaller market share, the natural segment is projected to witness robust growth over the forecast period, supported by increasing R&D investments and the introduction of innovative biological formulations that ensure efficacy and regulatory compliance.

Application Insights

The fruits & vegetables segment accounted for the largest market share of 46.7% in 2024, owing to the highly perishable nature of these crops and the growing global demand for fresh, high-quality produce. Treatments such as coatings, fungicides, ethylene blockers, and sanitizers are widely used to preserve freshness, reduce spoilage, and meet stringent export standards. The expansion of cold chain infrastructure and the surge in cross-border trade of produce, especially from Latin America, Asia Pacific, and Africa to Europe and North America, are further propelling demand in this segment. In addition, rising health consciousness and the shift toward plant-based diets are encouraging investment in advanced post-harvest solutions to enhance shelf-life and visual appeal.

The cereals & grains and oilseeds & pulses segments are also witnessing growing adoption of post-harvest treatments, particularly insecticides, fungicides, and sprout inhibitors to minimize storage losses and preserve grain quality. Increased grain storage capacities and food security concerns in developing economies are driving treatment uptake. The flowers & ornamentals segment continues to benefit from treatments such as ethylene blockers, hydration solutions, and anti-wilt agents, driven by the expanding global floriculture trade. The others category, which includes tubers, herbs, and spices, relies on niche treatments tailored to specific storage and quality preservation needs. As global food demand rises and supply chains become more integrated, post-harvest application strategies are becoming more crop-specific, sophisticated, and regionally targeted.

Product Insights

The ethylene blockers segment accounted for the largest revenue share of 31.3% in 2024, driven by its widespread use in extending the shelf life of climacteric fruits such as bananas, avocados, and mangoes, as well as in flowers and ornamentals. With growing global fruit trade and the need for quality retention during long-distance shipping, technologies like 1-Methylcyclopropene (1-MCP) have gained significant traction, particularly in export-heavy regions such as North America, Latin America, and Southeast Asia. Meanwhile, coatings, including edible films and wax emulsions, are increasingly adopted to reduce respiration rates and microbial spoilage in fresh produce. Demand for biodegradable and plant-based coatings is rising, fueled by the clean-label movement and sustainability goals.

Fungicides and insecticides remain vital in preventing fungal decay and insect infestation during storage and transit, especially in fruits, vegetables, and grains. While synthetic variants continue to dominate, the shift toward bio-based formulations is accelerating in response to regulatory scrutiny. Sanitizers are gaining importance with heightened emphasis on food safety and hygiene across processing and packaging stages, particularly in high-volume retail and export chains. Cleaners, used to remove dirt, pesticide residues, and microbial contaminants, are witnessing steady adoption in pre-packaging treatment lines. Other products, such as sprout inhibitors, desiccants, and anti-browning agents, cater to specialized applications across tubers, leafy greens, and ornamentals, offering targeted solutions for post-harvest quality preservation. Together, these diverse product categories reflect a dynamic market adapting to evolving consumer expectations, trade requirements, and sustainability imperatives.

Regional Insights

Asia Pacific Post-harvest Treatment Market Trends

Asia Pacific post-harvest treatment industry dominated globally with a 37.1% share in 2024, driven by the region’s vast agricultural output, growing exports of fresh produce, and increasing focus on reducing post-harvest losses. Rapid urbanization, rising demand for high-quality fruits and vegetables, and expanding cold chain infrastructure across countries like India, Vietnam, Thailand, and Indonesia are fueling market growth. Government support for post-harvest management practices and the emergence of domestic solution providers are further contributing to market expansion.

China Post-harvest Treatment Market Trends

Chinapost-harvest treatment industry captured the largest market share in the Asia Pacific region in 2024, supported by its massive fruit and vegetable production base and growing export potential. The government’s push for modern agricultural practices and reduction of food wastage has led to increased adoption of advanced post-harvest technologies. Chinese players are also investing heavily in research and partnerships to develop bio-based treatments aligned with rising consumer demand for safe and sustainable food products.

North America Post-harvest Treatment Market Trends

North America post-harvest treatment industry accounted for a global share of 19.0% in 2024, driven by high-value crop production, technological advancements in agricultural practices, and strong regulatory oversight. The region’s emphasis on food quality, supply chain efficiency, and sustainability is leading to widespread adoption of both synthetic and natural post-harvest treatments. The presence of key global players and a well-developed distribution network also supports continued market growth.

The U.S. post-harvest treatment industry dominated the North American regional market because of its large-scale commercial agriculture sector, robust export activities, and early adoption of innovative preservation technologies. Demand for residue-free, organic produce is prompting a shift toward biocontrol agents and bio-based coatings. The country also serves as a major hub for R&D and commercialization of advanced post-harvest solutions.

Europe Post-harvest Treatment Market Trends

The post-harvest treatment industry in Europe held a 26.4% global market share in 2024, due to stringent food safety regulations, a well-established cold chain ecosystem, and high consumer demand for organic and minimally processed food products. Countries across Western and Northern Europe are leading adopters of bio-based coatings, ethylene blockers, and sanitizers to maintain produce quality and meet strict compliance standards. Sustainability and traceability are key focus areas, driving innovation in natural post-harvest treatment solutions.

Germany Post-harvest Treatment Market Trends

Germany post-harvest treatment industry remained a prominent market in Europe, backed by its advanced food processing industry, strong export orientation, and high standards for food quality and hygiene. The country is witnessing growing demand for clean-label and organic post-harvest solutions, prompting both local and global companies to expand their product portfolios. Investments in R&D and sustainable agriculture are further shaping the German post-harvest treatment landscape.

Latin America Post-harvest Treatment Market Trends

Latin America post-harvest treatment industry emerged as a high-potential market, driven by increasing exports of fruits, vegetables, and flowers, particularly from countries such as Brazil, Mexico, Chile, and Peru. Rising investments in cold storage and packaging technologies, along with growing awareness about post-harvest losses, are driving market growth. The region is also witnessing a shift toward natural and eco-friendly solutions to align with global export standards.

Middle East & Africa Post-harvest Treatment Market Trends

The Middle East & Africa post-harvest treatment industry is experiencing gradual growth, supported by government efforts to enhance food security, reduce post-harvest waste, and strengthen supply chain infrastructure. Increasing imports and intra-regional trade of perishable produce are boosting demand for sanitizers, coatings, and temperature-sensitive packaging. While the market is still developing, rising agricultural investments in countries like South Africa, Kenya, and the UAE are expected to open new opportunities for post-harvest solution providers.

Key Post-harvest Treatment Company Insights

Key players, such as JBT, Syngenta Crop Protection, Nufarm, and Bayer AG, are dominating the market.

JBT

-

JBT is a leading global provider of technology solutions for the food and beverage industry, including comprehensive post-harvest treatment systems. The company offers a wide range of equipment and solutions aimed at improving food quality, extending shelf life, and reducing waste across the supply chain. JBT's post-harvest portfolio includes fruit and vegetable coatings, cleaning and waxing systems, and produce handling automation, catering primarily to the citrus, apple, avocado, and tropical fruit segments. Leveraging its global footprint, strong R&D capabilities, and focus on sustainability, JBT continues to expand its market presence through strategic acquisitions and innovations in natural, biodegradable treatment solutions that align with evolving regulatory standards and consumer preferences.

Key Post-harvest Treatment Companies:

The following are the leading companies in the post-harvest treatment market. These companies collectively hold the largest market share and dictate industry trends.

- JBT

- Syngenta Crop Protection

- Nufarm

- Bayer AG

- BASF SE

- Citrosol

- Hazel Technologies Inc.

- Lytone Enterprise Inc.

- Janssen PNP

- Futureco Chemicals Inc.

Recent Developments

-

In May 2023, KitoZyme and Janssen PMP, signed an Exclusive Collaboration Agreement to evaluate and develop KitoZyme technologies for post-harvest use on fresh produce.

-

In January 2022, Syngenta AG launched a new fungicide named Archive to control the diseases occurring during the post-harvest.

Post-harvest Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,837.4 million

Revenue forecast in 2033

USD 25,606.7 million

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Origin, product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

JBT; Syngenta Crop Protection; Nufarm; Bayer AG; BASF SE; Citrosol; Hazel Technologies Inc.; Lytone Enterprise Inc.; Janssen PNP; Futureco Chemicals Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Post-harvest Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global post-harvest treatment market report based on origin, product, application, and region.

-

Origin Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Coatings

-

Cleaners

-

Fungicides

-

Insecticides

-

Ethylene Blockers

-

Sanitizers

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Flowers & Ornamentals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global post-harvest treatment market size was estimated at USD 11,025.5 million in 2024 and is expected to reach USD 11,837.4 million in 2025.

b. The global post-harvest treatment market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 to reach USD 25,606.7 million by 2033.

b. The synthetic segment held the largest revenue share in 2024 due to its proven efficacy, cost-effectiveness, and widespread availability across large-scale commercial operations. Its reliability in minimizing post-harvest losses and preserving crop quality during extended storage and transit continues to drive strong demand globally.

b. Some of the key players operating in the post-harvest treatment market include JBT, Syngenta Crop Protection, Nufarm, Bayer AG, BASF SE, Citrosol, Hazel Technologies Inc. and Lytone Enterprise Inc.

b. The post-harvest treatment market is driven by rising global demand for fresh and high-quality produce, along with increasing efforts to reduce food loss across the supply chain. Stringent food safety regulations and the expansion of cold chain logistics are accelerating the adoption of advanced post-harvest solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.