Post-consumer Recycled Plastics In Electrical & Electronics Market Size, Share & Trends Analysis Report By Product (rPC, rABS, rPP, rPE, rPVC, rPS), By Application (Consumer Electronics, Home & Kitchen Appliances), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-545-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

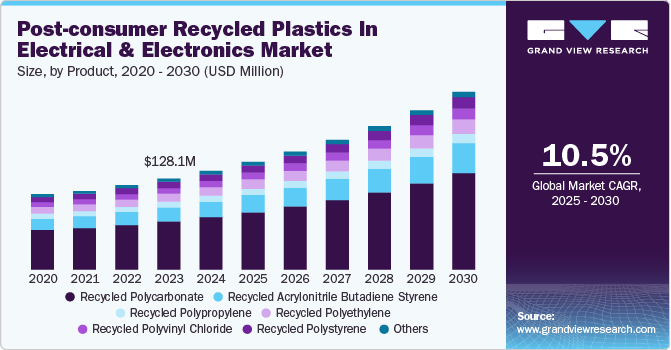

The global post-consumer recycled plastics in electrical & electronics market size was valued at USD 138.86 million in 2024 and expected to expand at a CAGR of 10.53% from 2025 to 2030. The growth of the market is primarily driven by the increasing restrictions on the utilization of single-use non-biodegradable plastics in developed regions such as North America and Europe, as well as in emerging economies of Asia Pacific.

The electrical and electronics industry is witnessing a shift toward integrating post-consumer recycled (PCR) plastics in high-performance components such as circuit boards, connectors, and casings. Manufacturers are increasingly developing advanced recycling technologies, such as chemical recycling, to enhance the quality of PCR plastics to match the performance of virgin materials. This trend is driven by regulatory pressures, consumer demand for sustainable electronics, and the need for manufacturers to achieve circular economy targets. Additionally, the rising adoption of modular and repairable electronics is further pushing the demand for high-quality recycled plastics that offer both durability and compliance with industry safety standards.

Drivers, Opportunities & Restraints

Governments and regulatory bodies worldwide are imposing stringent sustainability mandates that necessitate the use of recycled materials in electrical and electronic products. The European Union’s Waste Electrical and Electronic Equipment (WEEE) Directive, the Restriction of Hazardous Substances (RoHS) Directive, and China’s Circular Economy Promotion Law are pushing manufacturers to incorporate PCR plastics into their supply chains. Extended Producer Responsibility (EPR) programs further compel electronics manufacturers to take accountability for end-of-life product management, driving investment in PCR plastic sourcing, recycling infrastructure, and closed-loop systems. These regulatory frameworks are significantly accelerating the transition toward recycled plastics in the electrical and electronics sector.

Emerging markets, particularly in Asia-Pacific and Latin America, present a significant growth opportunity for post-consumer recycled plastics in electronics. Rapid urbanization, increasing disposable incomes, and the expansion of the middle-class consumer base are fueling demand for eco-friendly electronic products. Companies are strategically positioning themselves by launching sustainable product lines that incorporate recycled plastics, catering to the growing segment of environmentally conscious consumers. Additionally, corporate sustainability commitments and green branding efforts in these regions are providing new avenues for partnerships between electronic manufacturers and PCR plastic suppliers, creating long-term growth potential in these fast-developing markets.

Despite advancements in recycling technologies, the use of PCR plastics in electrical and electronic applications still faces technical challenges, particularly in high-performance components that require superior mechanical strength, thermal stability, and electrical insulation properties. Unlike virgin plastics, PCR plastics often exhibit inconsistencies in quality, leading to potential issues such as lower impact resistance, color variations, and contamination risks. These limitations hinder their adoption in critical applications such as semiconductors, high-voltage insulation, and precision engineering components. As a result, manufacturers are forced to invest heavily in material optimization, rigorous testing, and innovative additive formulations, which can drive up production costs and slow down large-scale adoption.

Product Insights

Recycled polycarbonate (rPC) dominated the post-consumer recycled plastics in electrical & electronics market across the product segmentation in terms of revenue, accounting for a market share of 53.22% in 2024. rPC is a high-performance thermoplastic that has gained substantial traction in the electrical and electronics market due to its exceptional impact resistance, heat stability, and optical clarity. Derived from post-consumer sources such as discarded electronic housings, automotive components, and optical discs, rPC is increasingly integrated into manufacturing enclosures for consumer electronics, lighting systems, and battery casings. The material's high dielectric strength and superior flame retardancy make it a viable alternative to virgin polycarbonate, particularly for applications requiring compliance with stringent regulatory standards such as UL 94 V-0 and RoHS.

rABS is gaining prominence in the electrical and electronics sector due to its balance of toughness, rigidity, and chemical resistance. This post-consumer recycled thermoplastic is widely repurposed from discarded IT equipment, household appliances, and automotive dashboards, contributing to circular economy initiatives in the plastics industry. With increasing regulatory mandates, such as the EU's WEEE (Waste Electrical and Electronic Equipment) Directive, electrical & electronics manufacturers are incorporating rABS into electronic housings, bezels, and structural components.

Application Insights

Consumer electronics dominated the post-consumer recycled plastics in electrical & electronics market across the application segmentation in terms of revenue, accounting for a market share of 32.40% in 2024. The consumer electronics industry is undergoing a paradigm shift driven by rapid technological advancements, increasing digital adoption, and growing sustainability mandates. As manufacturers innovate to create thinner, lighter, and more powerful devices, they are simultaneously pressured to integrate eco-friendly materials to address environmental concerns. PCR plastics are emerging as a key solution, enabling brands to meet sustainability goals while maintaining the high-performance standards expected in modern electronics. rPC, rABS, and rPET are increasingly being utilized in the manufacturing of consumer electronics due to their durability, heat resistance, and ability to support complex designs.

The home and kitchen appliances sector is witnessing significant expansion, driven by increasing disposable incomes, urbanization, and evolving consumer lifestyles. With higher purchasing power, consumers are investing in technologically advanced and energy-efficient appliances that enhance convenience while promoting sustainability. This trend has accelerated the adoption of PCR plastics, as manufacturers focus on reducing environmental impact while maintaining product durability, safety, and design aesthetics. rPP, rPC, and rABS are being widely used in the production of household appliances, ensuring structural integrity and resistance to heat, moisture, and chemicals.

Regional Insights

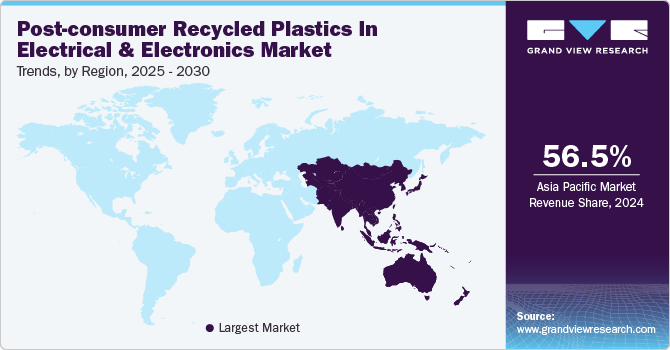

Asia Pacific dominated the global post-consumer recycled plastics in electrical & electronics market and accounted for largest revenue share of 56.51% in 2024. Asia Pacific's rapid industrialization and urbanization are key drivers of the expanding PCR plastics market in the electrical and electronics sector. With manufacturing output surging across the region, electronics production has scaled up, leading to a corresponding rise in e-waste and a growing need for sustainable material solutions. Governments are implementing stringent waste management policies, such as China’s National Sword policy and India’s E-Waste Management Rules, to promote recycling and reduce landfill waste.

China Post-consumer Recycled Plastics In Electrical & Electronics Market Trends

China’s dominance in semiconductor production and lithium-ion battery technology is prompting the development of innovative recycling processes to recover plastics from discarded electronic devices. As global brands demand greater supply chain sustainability, Chinese manufacturers are at the forefront of scaling up PCR plastics adoption, reinforcing the country's leadership in both electronics production and environmental responsibility.

North America Post-consumer Recycled Plastics In Electrical & Electronics Market Trends

The North American market for PCR plastics in electrical and electronics is experiencing significant growth due to rapid technological advancements and infrastructural modernization. As the region intensifies efforts to transition towards a circular economy, key industry players are leveraging cutting-edge recycling technologies, such as advanced polymer separation, AI-driven material sorting, and chemical recycling, to enhance the quality and usability of PCR plastics in high-performance applications.

The U.S. is at the forefront of the post-consumer recycled plastics market in the electrical and electronics sector, with Silicon Valley acting as a catalyst for innovation and material development. Home to some of the world’s largest tech giants and startups, the region is pioneering sustainable material integration through extensive R&D investments in eco-friendly product design. Companies such as Apple, HP, and Dell are incorporating recycled plastics into their devices to meet sustainability targets while maintaining high-quality standards.

Europe Post-consumer Recycled Plastics In Electrical & Electronics Market Trends

Europe's push toward sustainability is fundamentally reshaping the PCR plastics market in the electrical and electronics sector. With the European Green Deal setting ambitious targets for carbon neutrality and circular economy integration, electrical and electronics manufacturers are increasingly turning to high-quality PCR plastics to reduce their environmental footprint. Stringent regulatory frameworks such as the WEEE Directive and the Single-Use Plastics Directive are driving companies to incorporate recycled content in their products to meet compliance requirements.

Key Post-consumer Recycled Plastics In Electrical & Electronics Company Insights

The Post-consumer Recycled Plastics In Electrical & Electronics Market is highly competitive, with several key players dominating the landscape. Eastman Chemical Company, MBA Polymers, Inc., LAVERGNE, Inc., Polyvisions Inc., Trinseo, SABIC, Veolia Environnement S.A., Covestro AG, Dow Inc., and Banyan Nation. The post-consumer recycled plastics in electrical & electronics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their material products.

Key Post-consumer Recycled Plastics In Electrical & Electronics Companies:

The following are the leading companies in the post-consumer recycled plastics in electrical & electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Eastman Chemical Company

- MBA Polymers, Inc.

- LAVERGNE, Inc.

- Polyvisions Inc.

- Trinseo

- SABIC

- Veolia Environnement S.A.

- Covestro AG

- Dow Inc.

- Banyan Nation

Recent Developments

-

In March 2025, Lotte Chemical supplied recycled plastic to Samsung Electronics for use in the Galaxy S25 series. Collaborating with Samsung's Circular Economy Research Institute, Lotte Chemical repurposed waste wafer trays into polycarbonate for parts like the SIM tray and keys. Additionally, recycled polyamide from discarded fishing nets was used in internal components. This initiative, part of Lotte Chemical's 'ECOSEED' program, highlights a commitment to environmental protection and corporate social responsibility, with plans for further expansion in sustainable recycling materials.

-

In June 2024, Dow Inc. announced an agreement to acquire Circulus, a North American polyethylene recycler, in a deal expected to close in the third quarter of 2024. The acquisition includes two facilities with a total capacity of 50,000 metric tons per year and aims to combine Dow's materials science technology with Circulus' recycling expertise.

Post-consumer Recycled Plastics In Electrical & Electronics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 151.30 million |

|

Revenue forecast in 2030 |

USD 249.64 million |

|

Growth rate |

CAGR of 10.53% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE |

|

Key companies profiled |

Eastman Chemical Company; MBA Polymers, Inc.; LAVERGNE, Inc.,; Polyvisions Inc.; Trinseo; SABIC; Veolia Environnement S.A.; Covestro AG; Dow Inc.; Banyan Nation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Post-consumer Recycled Plastics In Electrical & Electronics Market Report Segmentation

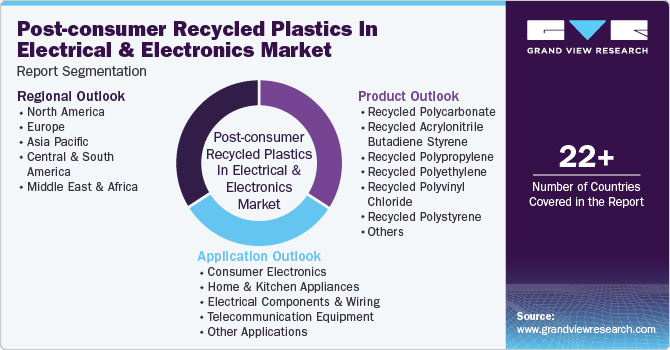

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented Post-consumer Recycled Plastics In Electrical & Electronics Market report on the basis of Product, Application, and Region:

-

Product Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Recycled Polycarbonate (rPC)

-

Recycled Acrylonitrile Butadiene Styrene (rABS)

-

Recycled Polypropylene (rPP)

-

Recycled Polyethylene (rPE)

-

Recycled Polyvinyl Chloride (rPVC)

-

Recycled Polystyrene (rPS)

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

Consumer Electronics

-

TV Frames

-

Laptop Enclosures

-

LCD Panels

-

Portable Hand-held Devices

-

Other consumer electronics

-

-

Home & Kitchen Appliances

-

Washing Machines & Dryers

-

Refrigerators and Freezers

-

Electric Kettles and Toasters

-

Dishwashers

-

Air Conditioners and Fans

-

Other home & kitchen appliances

-

-

Electrical Components & Wiring

-

Power Cords and Wiring

-

Cables and Connectors

-

Switches & Power Outlets

-

Battery Casings

-

Other electrical components & wirings

-

-

Telecommunication Equipment

-

Routers & Modems

-

Smartphones & Landline Phones

-

Circuit Board Mounts & Brackets

-

Set-Top Boxes & Media Streaming Devices

-

Other telecommunication equipment

-

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global post-consumer recycled plastics in electrical & electronics market size was estimated at USD 138.86 million in 2024 and is expected to reach USD 151.30 million in 2025.

b. The global post-consumer recycled plastics in electrical & electronics market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030 to reach USD 249.64 million by 2030.

b. Consumer electronics dominated the post-consumer recycled plastics in electrical & electronics market across the application segmentation in terms of revenue, accounting for a market share of 32.40% in 2024. The consumer electronics industry is undergoing a paradigm shift driven by rapid technological advancements, increasing digital adoption, and growing sustainability mandates.

b. Some key players operating in the post-consumer recycled plastics in electrical & electronics market include Eastman Chemical Company, MBA Polymers, Inc., LAVERGNE, Inc., Polyvisions Inc., Trinseo, SABIC, Veolia Environnement S.A., Covestro AG, Dow Inc., and Banyan Nation.

b. The growth of the market is primarily driven by the increasing restrictions on the utilization of single-use non-biodegradable plastics in developed regions such as North America and Europe, as well as in emerging economies of Asia Pacific.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."