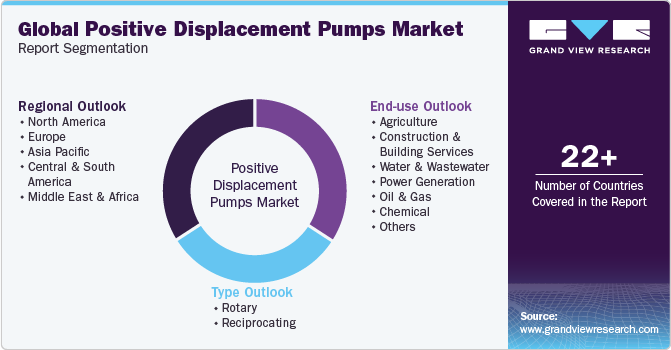

Positive Displacement Pumps Market Size, Share & Trends Analysis Report By Type (Rotary, Reciprocating), By End-use (Agriculture, Power Generation, Oil & Gas, Chemical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-678-3

- Number of Report Pages: 167

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global positive displacement pumps market size was estimated at USD 19.06 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. The market is anticipated to experience growth due to an increasing number of newly established chemical processing plants, coupled with a rising emphasis on wastewater treatment to eliminate harmful effluents. Furthermore, positive displacement pumps are particularly effective with high-viscosity fluids. They provide a consistent flow rate regardless of changes in viscosity, making them suitable for applications involving thick or sticky liquids. These aforementioned factors are anticipated to drive market growth. Positive displacement pumps can generate high pressures.

This makes them suitable for applications where a high-pressure output is required, such as in hydraulic systems or processes that involve pumping fluids over long distances or through pipelines. Moreover, positive displacement pumps find widespread usage across diverse applications due to their versatility and precision. In industries, such as oil & gas, these pumps play a vital role in the transfer of viscous crude oil, while in chemical processing, they are employed for accurate dosing and metering of various chemicals. With a robust presence in applications, such as oil & gas, chemicals, water & wastewater treatment, and manufacturing, positive displacement pumps have become integral to various processes.

In the oil & gas sector, these pumps are crucial for the transfer of crude oil, hydraulic fracturing, and other upstream and downstream activities. The growing shale gas exploration and production activities in the U.S. further amplify the product demand in this sector. In addition, the chemical industry relies on these pumps for precise dosing and transferring of chemicals in the manufacturing processes. The versatility of positive displacement pumps to handle fluids with varying viscosities, corrosive substances, and abrasive materials contributes to their widespread adoption in the U.S. market. For instance, as per the U.S. Department of Homeland Security, the chemical industry in the U.S. constitutes a substantial enterprise valued at USD 768 billion. This industry, which contributes to over 25% of the nation's gross domestic product (GDP), plays a key role in manufacturing nearly all commercial & household products.

Furthermore, it is deemed indispensable for fostering economic growth. These aforementioned factors are expected to propel market demand. Technological advancements play a pivotal role in shaping the U.S. market. Innovations in materials, design, and smart pump technologies enhance efficiency, reliability, and overall performance. Moreover, a focus on energy efficiency and sustainability aligns with the growing demand for environmentally friendly solutions in the U.S. industrial landscape. As industries continue to evolve and demand for precision fluid handling grows, the positive displacement pumps industry in the U.S. is poised for further expansion. Continuous investments in infrastructure development, coupled with the exploration of new applications in emerging industries, contribute to the optimistic outlook for the U.S. market.

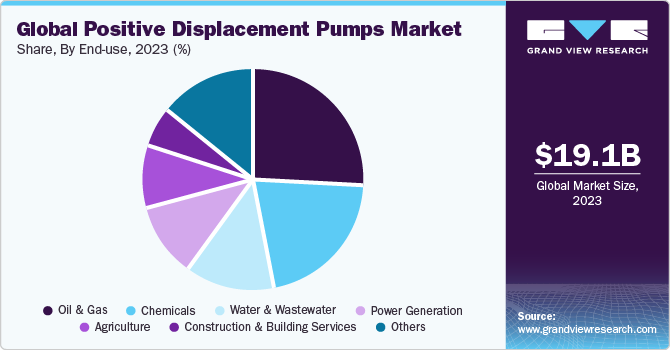

End-use Insights

The oil & gas segment led the market and accounted for 26.0% of the global revenue share in 2023. Positive displacement pumps play a crucial role in oil & gas applications, where the reliable and precise transfer of fluids is essential. These pumps are extensively utilized for tasks, such as crude oil transfer, hydraulic fracturing, and chemical injection. Furthermore, in upstream operations, positive these pumps, including reciprocating and screw pumps, are employed for well-stimulation, ensuring the efficient extraction of hydrocarbons. Their ability to handle varying viscosities and provide consistent flow rates makes them indispensable in downstream processes, such as pipeline transfer and refining, contributing to the overall efficiency and reliability of fluid handling systems in the oil & gas industry.

Chemical segment is expected to witness a CAGR of 6.0% over the forecast period. Positive displacement pumps are extensively utilized in the chemical industry for precise fluid handling and metering. These pumps play a critical role in transferring a variety of chemicals, including corrosive liquids and viscous substances, ensuring a controlled and consistent flow. Moreover, whether tasked with transferring abrasive substances, handling high-viscosity chemicals, or contributing to intricate chemical reactions through reliable metering, positive displacement pumps are integral components in chemical processing, guaranteeing efficiency, reliability, and the precise control necessary for diverse chemical applications.

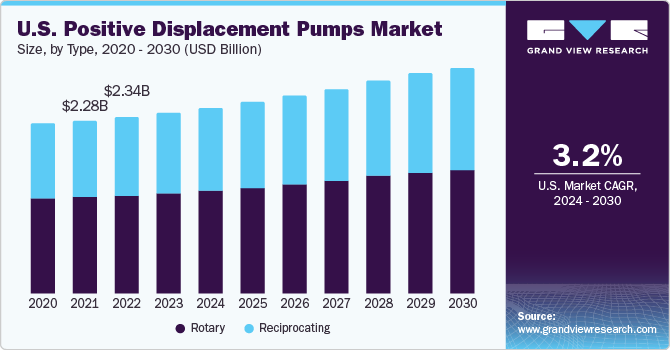

Type Insights

Rotary type segment led the market and accounted for 56.6% of the global revenue share in 2023. The demand for rotary pumps is on the rise, driven by their versatile applications across various industries. Rotary pumps, including gear pumps and screw pumps, are witnessing increased adoption due to their efficiency in providing a continuous and pulsation-free fluid flow. In sectors, such as manufacturing, oil & gas, and chemical processing, these pumps are favored for their ability to handle diverse fluids, from low to high viscosity, making them suitable for a wide range of applications.

Furthermore, rising demand for precision in fluid transfer, coupled with the need for reliable and consistent performance, positions rotary pumps as essential components in processes, such as lubrication, fuel transfer, and the handling of viscous substances. As industries continue to emphasize efficiency and reliability in fluid handling systems, the upward trajectory of demand for rotary pumps is expected to persist, making them integral to modern industrial processes. Reciprocating type segment is expected to witness a CAGR of 5.1% from 2024 to 2030. Reciprocating pumps are experiencing a surge in demand driven by their versatility and reliability in critical applications across industries.

Particularly in sectors like oil & gas, chemical processing, and manufacturing, there is an increasing need for high-pressure pumping solutions, which reciprocating pumps excel at providing. These pumps, including piston and plunger variants, are sought after for tasks, such as hydraulic fracturing, well injection, and precision dosing in chemical manufacturing. The ability of reciprocating pumps to handle a wide range of viscosities and operate at varying pressures makes them indispensable in processes where accuracy and consistency are paramount. With ongoing advancements in pump technology and a growing emphasis on efficiency in industrial operations, reciprocating pumps are positioned to continue experiencing robust demand, playing a key role in ensuring the reliability of fluid transfer in critical applications.

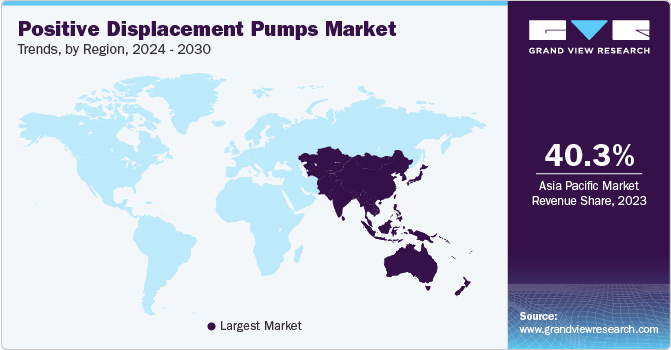

Regional Insights

Asia Pacific region dominated the market in 2023 with a revenue share of 40.3%. Rising infrastructure development, especially in countries like China and India, further propels the product demand in applications ranging from crude oil transfer to precise chemical dosing. The market benefits from technological advancements enhancing pump efficiency, as well as a heightened focus on sustainable and energy-efficient solutions. As the region continues to witness economic development and infrastructure investments, the Asia Pacific regional market is poised for sustained expansion in future. Growing manufacturing activities and infrastructure development activities in North America contribute to region’s growth.

As industries prioritize precision, reliability, and energy efficiency in fluid handling systems, positive displacement pumps continue to be indispensable components in North America's industrial landscape. The ongoing exploration of applications in emerging sectors, coupled with a commitment to sustainable practices, positions the North America market for sustained growth and technological advancements. Middle East & Africa, particularly GCC countries, is a significant hub for the oil & gas industry. The product is extensively used in this sector for applications, such as well stimulation, crude oil transfer, and chemical injection. The ongoing exploration & production activities, coupled with the need for reliable fluid handling in extraction and refining processes, contribute to product demand.

Key Companies & Market Share Insights

Key manufacturers use a range of strategies, including geographic expansions, product launches, and mergers & acquisitions, to broaden their market penetration and adapt to shifting technical demands. For instance, in April 2023, Packo unveiled the ZLC rotary lobe pump, certified as 3A compliant, targeting the pharmaceutical, biotech, and cosmetic industries. The ZLC pump is ideal for a wide range of applications, from cosmetic and personal hygiene products to medical and pharmaceutical substances, ensuring the highest safety and hygiene standards.

Furthermore, in March 2023, KSB Limited acquired proprietary technology from Bharat Pumps and Compressors Ltd., granting exclusive ownership and rights to the technology of BP&CL's product line. This strategic move enables KSB Limited to leverage its strengths and market potential, expanding its product offerings in both new pump systems and aftermarket markets.

Key Positive Displacement Pumps Companies:

- Ingersoll Rand

- SPX Flow

- Alfa Laval

- Viking Pump, Inc.

- Grundfos

- IDEX Corporation

- Schlumberger Limited

- Weir Group PLC

- KSB Group

- Sulzer Ltd.

- HERMETIC-Pumpen GmbH

- Flowserve Corporation

- Dover Corporation

- Goulds Pumps

- Moyno

- Netzsch Pumps

- Blackmer

- Wilden Pump & Engineering Company

- PCM Pumps

- SEEPEX

Positive Displacement Pumps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.85 billion |

|

Revenue forecast in 2030 |

USD 26.53 billion |

|

Growth rate |

CAGR of 4.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; UAE |

|

Key companies profiled |

Ingersoll Rand; SPX Flow; Alfa Laval; Viking Pump, Inc.; Grundfos; IDEX Corp.; Schlumberger Ltd.; Weir Group PLC; KSB Group; Sulzer Ltd.; HERMETIC-Pumpen GmbH; Flowserve Corp.; Dover Corp.; Goulds Pumps; Moyno; Netzsch Pumps; Blackmer; Wilden Pump & Engineering Company; PCM Pumps; SEEPEX |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Positive Displacement Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the positive displacement pumps market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Rotary

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

Reciprocating

-

Diaphragm

-

Piston

-

Plunger

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Construction & Building Services

-

Water & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemical

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the positive displacement pumps market include Ingersoll Rand, SPX Flow, Alfa Laval, Viking Pump, Inc., Grundfos IDEX Corporation, Schlumberger Limited, Weir Group PLC, KSB Group, Sulzer Ltd., HERMETIC-Pumpen GmbH, Flowserve Corporation, Dover Corporation, Goulds Pumps, Moyno, Netzsch Pumps, Blackmer, Wilden Pump & Engineering Company PCM Pumps, SEEPEX.

b. The market is anticipated to experience growth due to an increasing number of newly established chemical processing plants, coupled with a rising emphasis on wastewater treatment to eliminate harmful effluents. Further, positive displacement pumps are particularly effective with high-viscosity fluids. They provide a consistent flow rate regardless of changes in viscosity, making them suitable for applications involving thick or sticky liquids. These aforementioned factors are anticipated to drive the market demand over the forecast period.

b. The global positive displacement pumps market size was estimated at USD 19.06 billion in 2023 and is expected to be USD 19.85 billion in 2024.

b. The global positive displacement pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 26.53 billion by 2030.

b. Asia Pacific region dominated the market in 2023 by accounting for a share of 40.3% of the global market. Rising infrastructure development, especially in countries like China and India, further propels the demand for positive displacement pumps in applications ranging from crude oil transfer to precise chemical dosing.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."