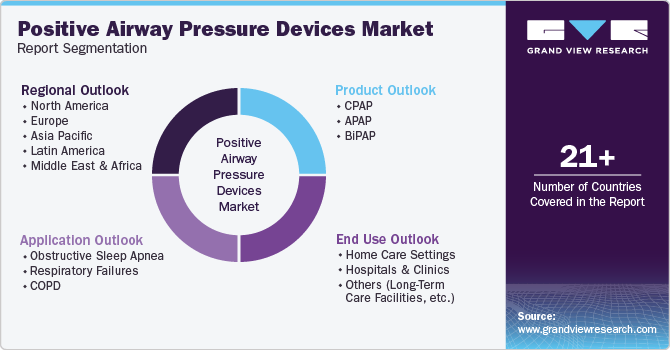

Positive Airway Pressure Devices Market Size, Share & Trends Analysis Report By Product (CPAP, APAP, BiPAP), By Application (Obstructive Sleep Apnea, Respiratory Failure), By End-use (Home & Care Settings, Hospitals & Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-910-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

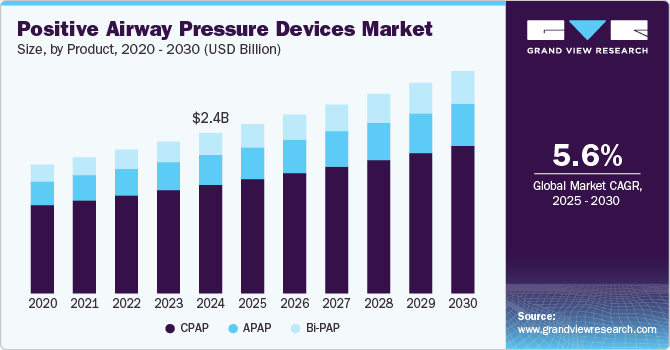

The global positive airway pressure devices market size was estimated at USD 2.62 billion in 2024 and is projected to grow at a CAGR of 5.59% from 2025 to 2030. This growth is attributed to the increasing prevalence of sleep apnea, advancements in technology, rising awareness and diagnosis of sleep disorders, and improving healthcare infrastructure. These factors are fueling the demand for PAP devices globally. Growing health concerns, better diagnostic methods, and technological innovations are shaping the market's future growth prospects.

Obstructive sleep apnea is a respiratory disorder wherein the patient faces irregular breathing patterns with reduced oxygen supply to the brain. According to the Saudi Journal of Otorhinolaryngology-Head and Neck Surgery estimates on the global prevalence of obstructive sleep apnea published in 2023, approximately 936 million people are suffering from mild to severe sleep apnea, and among these, 425 million individuals in the age group of 30 to 69 years are suffering from moderate to severe sleep apnea. Rapid globalization, changing lifestyles, and unhealthy dietary habits are a few factors contributing to the prevalence of sleep apnea. In addition, growing obesity levels and lack of physical activities are driving the incidence rate of obstructive sleep apnea.

Rising awareness and diagnosis of sleep disorders are crucial factors propelling market growth. As people become more educated about sleep apnea and its potential risks, they are more likely to seek diagnosis and treatment. Public health campaigns run by organizations such as the American Sleep Apnea Association helped improve awareness. In addition, improved diagnostic methods such as polysomnography and home sleep tests have made identifying sleep apnea in its early stages easier. The increasing recognition of sleep apnea as a significant health concern drives more individuals to pursue PAP therapy, thus fueling market demand.

The COVID 19 pandemic had a positive impact on the PAP devices market According to a study published by the National Centre for Biotechnology Information in 2022, obstructive sleep apnea treated with home CPAP was not associated with worse outcomes in hospitalized COVID-19 patients, suggesting that CPAP can be safely continued during the pandemic. Telehealth services improved CPAP adherence, with some reports showing increased usage during lockdowns as patients received better remote support. The pandemic has highlighted the importance of PAP devices in managing sleep disorders and supporting respiratory health in critically ill patients.

Furthermore, according to ResMed's annual report for the fiscal year ending June 30, 2024, the COVID-19 pandemic impacted the company's sales, particularly in its sleep and respiratory care segment. The report indicates an increased demand for ResMed's PAP devices due to the heightened awareness of respiratory health during the pandemic. This surge in demand was driven by the need for practical, non-invasive ventilation options for patients with respiratory issues related to COVID-19. Market players such as ResMed experienced strong revenue growth in its PAP device sales, reflecting its critical role in managing sleep apnea and respiratory complications associated with COVID-19.

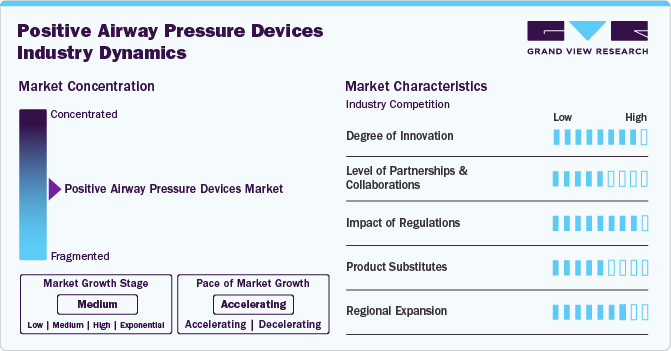

Market Concentration & Characteristics

The degree of innovation in the PAP devices market is high. Manufacturers are introducing advanced features such as mobile app connectivity, improved comfort, and quieter operation. For instance, in March 2024, React Health introduced the Luna TravelPAP, a compact and lightweight travel-positive airway pressure device. It offers a pressure range of 4-20 hPA, a ramp time of 0-60 minutes, and operates at a noise level below 30 dBA.

The market has a moderate level of partnerships and collaborations. Companies partner with regional players to expand their market reach and incorporate innovative technologies. For instance, in September 2023, Nyxoah SA partnered with ResMed Germany to boost OSA awareness and treatment in Germany. The collaboration aims to create a continuous care model, enhance patient education and therapy guidance, and improve patient identification and setup for appropriate treatments.

Regulations in the market have a high impact, as strict standards ensure product safety and efficacy. Regulatory bodies such as the FDA and EMA closely evaluate new devices, significantly focusing on clinical trials and patient outcomes.

The presence of product substitutes is moderate in the PAP device industry, particularly with the introduction of pharmacological treatments for obstructive sleep apnea. For instance, in December 2024, the FDA approved the first medication for treating obstructive sleep apnea. In addition, the emerging role of GLP 1 (glucagon-like peptide) receptor, which regulates respiratory function and has been linked to improved airway patency, presents a potential substitute for traditional PAP devices, particularly for patients who may not tolerate continuous positive airway pressure (CPAP) therapy. However, PAP devices remain essential for many patients, especially those who prefer non-invasive treatment options or have severe cases that require continuous airway pressure support.

Regional expansion is high, particularly in emerging markets such as Asia Pacific and Latin America. As awareness of sleep disorders increases, companies target these regions for growth opportunities. Factors such as urbanization, a growing middle-class population, and a higher prevalence of sleep apnea contribute to market growth.

Impact of GLP-1 Medications on the Positive Airway Pressure (PAP) Devices Market

The introduction of GLP-1 receptor agonists, such as Eli Lilly's Zepbound, has shown promise in reducing the severity of obstructive sleep apnea (OSA) in individuals with obesity. Clinical studies indicate that these medications can significantly decrease the number of apnea events per hour, even when used alongside traditional continuous positive airway pressure (CPAP) therapy.

Despite these findings, the impact of GLP-1 drugs on the Positive Airway Pressure (PAP) devices market is expected to be nuanced. As per the Informa Markets, May 2024 studies, some analysts suggest that while GLP-1 therapies may reduce the incidence of OSA by promoting weight loss, they could also increase awareness and diagnosis of sleep apnea, potentially leading to higher demand for PAP devices.

Industry leaders like ResMed have observed that patients on GLP-1 medications exhibit a higher propensity to initiate and adhere to PAP therapy. This trend suggests that GLP-1 drugs may complement rather than replace existing sleep apnea treatments. For instance, in January 2025, following the U.S. Food and Drug Administration's approval of Zepbound. ResMed intensified its outreach to high-volume GLP-1 drug prescribers, emphasizing that PAP therapy continues to be the gold standard treatment

“We are looking forward to addressing the educational gap on the prevalence and treatment of obstructive sleep apnea with continuing medical education or CME programs that we are aiming specifically at primary care physicians. And we're especially targeting those who are currently high-volume GLP-1 prescribers. They will be the frontline for the patients that pharmaceutical companies will attract as they ramp up their own consumer advertising throughout calendar year 2025 and beyond.”

-said Mick Farrell, chairman and CEO

Moreover, ResMed's research unveiled that as of January 2025, they track 1.2 million patients, indicating that individuals with prescriptions for both GLP-1 medications and PAP therapy are over 10% more likely to initiate PAP treatment. In addition, after one year, these patients demonstrate a more than 3% higher adherence rate to PAP therapy.

Product Insights

Continuous Positive Airway Pressure (CPAP) devices segment dominated the market with a share of 67.70% in 2024. The segment grew at a significant CAGR from 2025 to 2030. This can be attributed to the rising prevalence of sleep apnea, particularly obstructive sleep apnea (OSA), which has significantly increased the demand for CPAP devices as the primary treatment option. Technological advancements, such as auto-adjusting pressure settings, integrated humidifiers, and enhanced comfort features, are improving patient compliance and driving adoption. Moreover, the introduction of portable and travel-friendly CPAP devices, along with the integration of smart connectivity features for remote monitoring, is enhancing user experience and increasing market penetration.

Bi-level positive airway pressure (BiPAP) devices segment is anticipated to grow at the fastest rate of 6.9% over the forecast years, owing to the rising incidence of obstructive sleep apnea-associated comorbidities and the widespread adoption of PAP devices in disease management. BiPAP devices are the second line of treatment for patients who face difficulties using CPAP devices. BiPAP devices offer a more efficient breathing pattern and a variable/alternate airflow. The availability of technologically advanced PAP devices and favorable reimbursement policies are a few driving factors anticipated to strengthen the adoption and growth of BiPAP devices.

Application Insights

The obstructive Sleep Apnea segment held the largest revenue share in 2024. The rising prevalence of Obstructive Sleep Apnea (OSA), which is estimated to affect millions worldwide, is an effective driver for this market. The condition occurs when the muscles in the throat relax excessively during sleep, causing airway obstruction and disrupting breathing patterns. PAP devices, particularly CPAP, provide a constant airflow to keep the airway open, improving sleep quality and preventing related health issues like heart disease, hypertension, and stroke. The growing awareness of OSA symptoms and the importance of treatment, coupled with advances in PAP technology, is driving the segment's growth.

The respiratory failure segment is driven by the increasing prevalence of conditions that cause respiratory insufficiency, such as central sleep apnea and other chronic lung diseases. Respiratory failure occurs when the lungs fail to provide adequate oxygen to the body or remove carbon dioxide, and PAP devices, especially BiPAP, play a critical role in managing these patients. BiPAP delivers two pressure levels: a higher pressure during inhalation and a lower pressure during exhalation, offering better support for individuals with respiratory failure. The segment is benefiting from the rising incidence of conditions such as obesity hypoventilation syndrome (OHS) and the aging population, which is more prone to respiratory disorders.

Chronic Obstructive Pulmonary Disease (COPD) segment drives the demand for PAP devices. COPD, a group of lung diseases including emphysema and chronic bronchitis, is characterized by long-term respiratory issues, making it difficult for patients to breathe. As COPD is a leading cause of respiratory-related hospitalizations worldwide, the use of PAP devices, particularly BiPAP and CPAP, is typical for managing patients with COPD exacerbations. These devices help reduce the work of breathing and improve oxygenation by providing continuous or bilevel pressure to keep the airways open. The segment’s growth is influenced by the increasing prevalence of COPD, particularly in regions with high smoking rates or aging populations.

End-use Insights

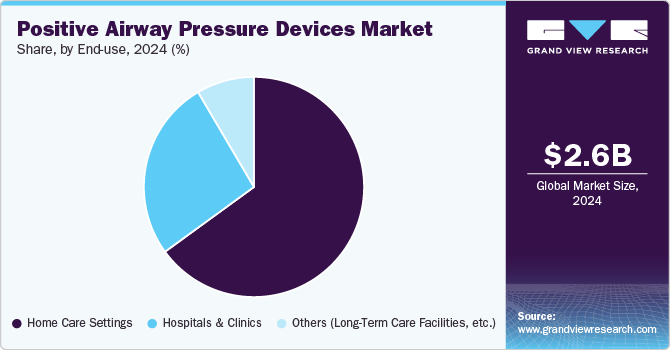

The hospitals and clinics segment dominated the market in 2024, driven by the increasing prevalence of sleep apnea and the rising demand for professional diagnosis and treatment. These healthcare facilities are crucial for accurate diagnosis through polysomnography and other sleep studies, where PAP devices play a central role in therapy. Hospitals and sleep labs provide a controlled environment for sleep therapy initiation and monitoring, ensuring better patient compliance and treatment outcomes. The segment's growth is supported by advances in healthcare infrastructure, enabling more comprehensive sleep disorder services.

Home care settings segment for PAP devices is experiencing substantial growth, driven by the increasing preference for at-home healthcare and its convenience to patients. Many individuals with sleep apnea opt for home-based treatments as PAP devices become more user-friendly, portable, and equipped with remote monitoring capabilities. This segment benefits from the growing trend of telemedicine and digital health solutions, allowing healthcare providers to track patient progress and adjust therapy as needed remotely. The rising awareness of sleep apnea and the comfort of receiving treatment at home fuel the market.

Regional Insights

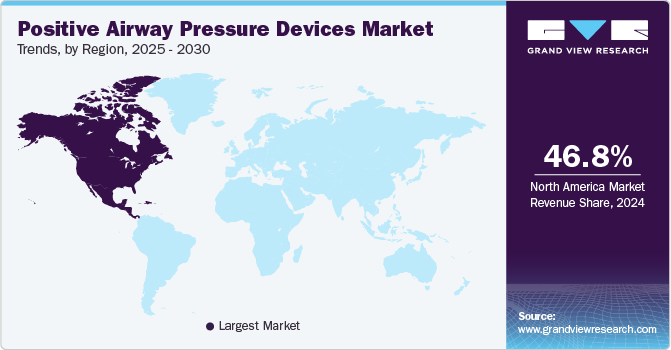

North America positive airway pressure devices market dominated the global market with a share of 46.84%in 2024. The growing prevalence of respiratory diseases, such as obstructive sleep apnea, coupled with increasing awareness about the available treatment solutions, is driving the growth. According to the Houston Sleep Solutions statistics published in March 2024, Sleep apnea affects around 18 million people in the U.S., meaning roughly 1 in every 15 Americans, or 6.62% of the population, suffers from the condition. In addition, rapid globalization, changing lifestyles, and rising disposable income have contributed to the regional market growth.

U.S. Positive Airway Pressure Devices Market Trends

Positive airway pressure (PAP) devices market in U.S. is encouraged by favorable healthcare reimbursement policies and rising healthcare spending, which makes treatment more accessible. In addition, the aging population in the U.S. is another factor driving the demand for PAP devices, as older adults are to suffer from sleep apnea, further driving the market growth. According to the Population Reference Bureau, Americans aged 65 and older are expected to grow from 58 million in 2022 to 82 million by 2050, representing a 47% increase. Hence, the proportion of this age group in the overall population is projected to rise from 17% to 23%.

Asia Pacific Positive Airway Pressure Devices Market Trends

Positive airway pressure (PAP) devices market in Asia Pacific is growing due to increasing healthcare awareness and the rising prevalence of sleep apnea. Innovation in the market focuses on developing quieter, more comfortable machines with advanced features, including smart connectivity for remote monitoring. These technological advancements aim to enhance patient compliance and treatment efficacy, addressing diverse consumer needs across the region. For instance, in January 2025, ResMed announced the launch of AirSense 11 in India, a next-generation Continuous PAP (CPAP) device aimed at making it easier for individuals with Obstructive Sleep Apnea (OSA) to begin and maintain therapy.

Positive airway pressure (PAP) devices market in China is expanding rapidly, driven by increasing awareness of sleep apnea and the rising adoption of advanced treatment options. A key trend is the continuous innovation in PAP devices, with manufacturers enhancing comfort through quieter machines, improved ergonomics, and the integration of advanced remote monitoring features. Additionally, the expansion of healthcare services, including improved access to sleep apnea diagnosis, is fueling market growth. Another significant factor is China’s growing aging population, which is driving demand as older adults are more prone to sleep disorders.

Positive airway pressure (PAP) devices market in India is growing due to rising awareness of sleep disorders and an increasing focus on healthcare. A study by AIIMS New Delhi, published by Bennett, Coleman & Co. in October 2023, reveals that 11% of Indian adults suffer from OSA, with men at higher risk. Approximately 104 million people are affected, including 47 million with moderate to severe OSA. The market is further driven by expanding healthcare infrastructure and improved access to sleep disorder diagnosis.

Europe Positive Airway Pressure Devices Market Trends

The positive airway pressure (PAP) devices market in Europe is driven by innovation, with manufacturers focusing on advanced technologies such as remote monitoring and mobile app connectivity. A rising focus on patient-centered care and enhanced user experience is pushing the adoption of these devices. In addition, the aging population and growing awareness of sleep apnea fuel demand. In several European countries, expanding healthcare systems enhances access to sleep apnea diagnosis and treatment, driving the market's growth.

Latin America Positive Airway Pressure Devices Market Trends

The Positive airway pressure (PAP) devices market in Latin America is gaining momentum due to improved healthcare infrastructure and increased awareness of sleep apnea. The rising prevalence of the condition, particularly among the aging population, is a key driver for the market. Manufacturers are introducing affordable, user-friendly devices to cater to the region's diverse needs. Expansion of healthcare access, particularly in rural areas, is enhancing diagnosis and treatment options.

Middle East & Africa Positive Airway Pressure Devices Market Trends

Middle East & Africa market for positive airway pressure (PAP) devices is characterized by expanding healthcare facilities, particularly in the Gulf Cooperation Council (GCC) countries, with a growing emphasis on healthcare modernization. This expansion is increasing the availability of sleep disorder diagnoses and treatments. Innovation in device design, including enhanced portability and quieter operation, is also becoming a key trend. Moreover, the aging population and rising rates of chronic conditions such as sleep apnea are contributing to increased demand for PAP devices. Companies are pursuing strategic partnerships to expand their regional presence and enhance technology integration. For instance, in March 2021, Philips partnered with the Middle East Healthcare Company (MEAHCO) to introduce advanced sleep disorder management services in Saudi Arabia via the Saudi German Health Group.

Key Positive Airway Pressure Devices Company Insights

Key players focus on product innovation, incorporating features such as enhanced comfort, noise reduction, portability, and connectivity with mobile apps for remote monitoring. In addition, strategic collaborations, acquisitions, and regional expansions help maintain a strong foothold in developed and emerging markets. For instance, in February 2021, Philips and the Dutch SAZ group entered a strategic partnership to offer a complete suite of monitoring, observation, and self-management services to patients diagnosed with obstructive sleep apnea. The market is characterized by increasing investments in research and development to improve PAP devices' efficacy and user experience.

Key Positive Airway Pressure Devices Companies:

The following are the leading companies in the positive airway pressure devices market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Fisher & Paykel Healthcare Limited

- Curative, Inc.

- ResMed

- Medtronic

- Servona GmbH

- Armstrong Medical Inc.

- Smiths Group plc

- Löwenstein Medical UK Ltd.

Exit Strategies of Key Market Players

- Koninklijke Philips N.V.

In June 2021, Philips recalled certain BiPAP, CPAP, and mechanical ventilator devices due to potential health hazards linked to the polyester-based polyurethane (PE-PUR) sound-dampening foam utilized in these products. Since the recall, Philips, the FDA, and other organizations have provided various resources.

In March 2024, Philips Respironics announced that it would discontinue several products, including the NightBalance device for positional sleep apnea therapy and the DreamStation Go travel CPAP machine. In addition, the company reached a consent agreement with the U.S. Department of Justice, which is anticipated to halt the sale of all Respironics CPAP devices for the next few years.

- Fisher & Paykel Healthcare Limited.

In April 2024, Fisher & Paykel Healthcare has decided to stop selling its F&P SleepStyle CPAP device in the U.S. The SleepStyle CPAP, designed to treat OSA, was positioned as a convenient and user-friendly option for patients seeking at-home therapy. Due to regulatory hurdles, market challenges, and evolving company strategies, Fisher & Paykel discontinued this product in the U.S. market. This move comes amid increasing competition from major players such as ResMed and Philips, major players in the PAP device market with highly advanced and widely adopted products.

- Drive DeVilbiss Healthcare

Drive DeVilbiss Healthcare stopped producing its DV5 CPAP units in August 2021, just a few months after the large-scale recall of Philips CPAP devices. On June 29, 2021, the company acknowledged that their machines contained polyester-based polyurethane foam. The company chose not to initiate a voluntary recall, as they had not received any reports of health issues linked to the devices.

This decision was driven by challenges such as raw material shortages, difficulties sourcing necessary components, and rising parts prices. In light of these issues, Drive DeVilbiss shifted its focus to its leading oxygen products, responding to the increased demand during the pandemic.

Recent Developments

- In June 2024, React Health, a manufacturer and distributor of sleep & respiratory devices, introduced the IntelliPAP feature for its V+Pro, V*Home, V+C, and VC+Pro ventilators. This feature enables physicians to automatically adjust PEEP levels during noninvasive ventilation for patients with respiratory insufficiency and OSA in response to detected sleep-disordered breathing events.

“React Health is committed to advancing healthcare solutions that contribute to improved patient outcomes and operational efficiency. The most recent launch of IntelliPAP, along with the new E0468 HCPCS code for our V+C ventilator with integrated cough assist (ICAT™), further reflects that commitment to our partners and patients.”

-Jeff Ward, EVP of Ventilation for React Health.

- In February 2024, ResMed introduced its AirCurve 11 series bilevel devices, offering inspiratory and expiratory pressure support. These devices integrate digital technology, simplifying sleep apnea treatment for healthcare providers while helping patients initiate and maintain effective therapy.

“Patient care is our top priority, and that includes their comfort and compliance with PAP therapy. We’ve seen patient compliance improve from 70% to 87% through the use of coaching features and the ability to track and view their nightly sleep data via MyAir and AirView, so we’ve incorporated these digital health applications into the new AirCurve11 series to enable maximum comfort and support throughout the therapy experience.”

-ResMed chief medical officer Carlos M. Nunez, MD

- In July 2024, the FDA issued a final rule on October 19, 2018, reclassifying positive airway pressure (PAP) delivery systems from Class III to Class II, though they remain available by prescription only.

- In May 2021, AR Medical Technologies introduced MaskFit AR. This AI-powered mobile app solves the 30-year challenge of improper CPAP/BiPAP mask fitment for OSA patients. Using a vast CPAP mask database and intelligent algorithms, it offers personalized mask recommendations based on facial measurements and demographic data.

Positive Airway Pressure Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.76 billion |

|

Revenue forecast in 2030 |

USD 3.63 billion |

|

Growth rate |

CAGR of 5.59% from 2025 to 2030 |

|

Actual Data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK.; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Asia Pacific; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Middle East & Africa; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Koninklijke Philips N.V.; Fisher & Paykel Healthcare Limited; Curative, Inc.; ResMed; Medtronic; Servona GmbH; Armstrong Medical Inc.; Smiths Group plc; Löwenstein Medical UK Ltd. |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Positive Airway Pressure Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global positive airway pressure devices market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CPAP

-

APAP

-

BiPAP

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstructive Sleep Apnea

-

Respiratory Failures

-

COPD

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Home Care Settings

-

Hospitals & Clinics

-

Others (Long-Term Care Facilities, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the rising sleep apnea awareness, advanced treatment adoption, continuous device innovation, improved ergonomics, remote monitoring features, expanding healthcare services, better diagnosis access, and an aging population more prone to sleep disorders.

b. The global positive airway pressure devices market size was estimated at USD 2.62 billion in 2024 and is expected to reach USD 2.76 billion in 2025.

b. The global positive airway pressure devices market is expected to grow at a compound annual growth rate of 5.59% from 2025 to 2030 to reach USD 3.63 billion by 2030.

b. CPAP devices dominated the positive airway pressure devices market with a share of 67.70% in 2024. This is attributable to the increasing adoption of these devices due to their low cost as compared to other PAP devices.

b. Some key players operating in the positive airway pressure devices market include Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Curative, Inc., ResMed, Medtronic, Servona GmbH, Armstrong Medical Inc., Smiths Group plc, Löwenstein Medical UK Ltd.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."