- Home

- »

- Medical Devices

- »

-

Portable Ultrasound Devices Market Size, Share Report 2030GVR Report cover

![Portable Ultrasound Devices Market Size, Share & Trends Report]()

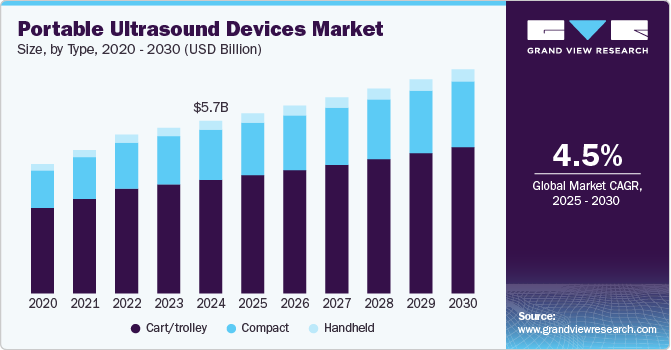

Portable Ultrasound Devices Market Size, Share & Trends Analysis Report By Type (Handheld, Compact, Cart/Trolley), By Application, By Technology, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-006-8

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Portable Ultrasound Devices Market Trends

The global portable ultrasound devices market size was estimated at USD 5.67 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The market for portable ultrasound devices is being driven by several key factors, including significant advancements in medical technology, increasing demand for point-of-care diagnostics, rising prevalence of chronic disorders, an inclined preference among patients for minimally invasive treatments, and the widespread adoption of imaging systems in emergency care settings.

Recent technological advancements in the development of portable ultrasound devices are expected to drive the market's growth. For instance, in July 2023, Konica Minolta Healthcare Americas, Inc. announced the launch of the PocketPro H2, a wireless handheld ultrasound device designed for general imaging in point-of-care applications. As a reputable provider of primary imaging solutions, Konica Minolta Healthcare has collaborated with Healcerion to distribute the PocketPro H2 across the United States, catering to both human and veterinary applications. This partnership aims to enhance flexibility and affordability in ultrasound technology.

The increasing prevalence of chronic disorders worldwide is a significant factor contributing to the growth of the ultrasound devices market. Chronic conditions, such as cardiovascular diseases, diabetes, and various cancers, often necessitate regular monitoring and diagnostic imaging for effective management and treatment. For instance, according to World Health Organization, cardiovascular diseases (CVDs) are the leading global cause of death, accounting for approximately 17.9 million fatalities annually. This group of disorders affects the heart and blood vessels, including conditions such as coronary heart disease and strokes. Over 80% of CVD deaths result from heart attacks and strokes, with one-third occurring prematurely in individuals under 70 years of age.

The widespread adoption of imaging systems in emergency care settings significantly drives the growth of the portable ultrasound devices market. For instance, as of 2022, around 30% of emergency departments in the U.S. reported using portable ultrasound devices regularly, a figure expected to rise as technology advances and training becomes more accessible. Integrating portable ultrasound devices has proven beneficial for rapid diagnosis in emergency departments. Studies indicate that these devices can reduce the time to diagnosis by up to 50%, allowing for quicker decision-making in critical situations. Integrating portable ultrasound devices in emergency departments has been transformative, facilitating rapid diagnosis in situations where time is of the essence. Traditional diagnostic methods often involve lengthy processes that can delay critical care, though portable ultrasound devices provide immediate imaging capabilities right at the point of care. This immediacy is crucial in emergency scenarios, where quick decision-making can significantly impact patient outcomes.

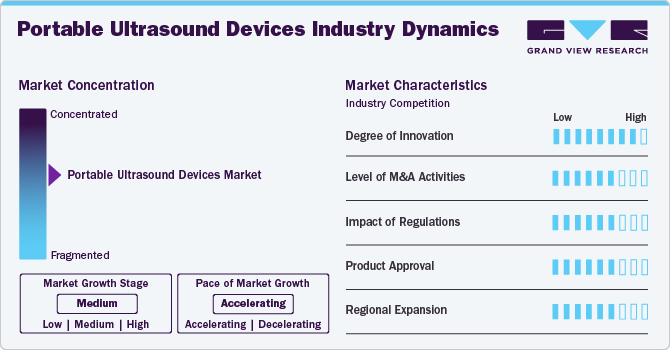

Market Concentration & Characteristics

The portable ultrasound devices market is characterized by moderate industry concentration and a mix of established multinational companies and emerging players. Major companies dominate, with advanced technology, extensive distribution networks, and substantial R&D investments. These include leaders such as GE HealthCare and Siemens. The market features highinnovation driven by technological advancements such as advanced portable ultrasound devices. In addition, there is a strong focus on precision and minimally invasive procedures. Emerging players contribute by introducing novel solutions and driving competition. The market is influenced by regulatory standards and the need for continuous product development to meet evolving clinical demands.

The degree of innovation in the portable ultrasound devices market is notably high, driven by advancements in technology and growing demands for precision and efficiency. For instance, in November 2023, Siemens launched the Acuson Maple1, a sophisticated and versatile ultrasound system designed to facilitate swift diagnosis and assessment across various clinical environments. This system incorporates artificial intelligence (AI)--powered features that enhance routine clinical performance, making it accessible for users of all proficiency levels.This innovative system is designed to enhance the speed and accuracy of diagnosis and assessment across various clinical settings, from hospitals to outpatient facilities.

Regulations are integral to developing the portable ultrasound devices industry, as they ensure the safety, efficacy, and quality of these products. Demanding regulatory standards set forth by the FDA and CE marking requirements in Europe mandate thorough testing and compliance before market entry. These regulations guarantee that portable ultrasound devices meet stringent safety and performance benchmarks, thereby enhancing patient outcomes. In addition, compliance with these regulations can drive innovation within the industry, as manufacturers are encouraged to integrate advanced technologies and materials into their designs. This regulatory framework protects patients and fosters the continual advancement of medical imaging technologies.

Mergers and acquisitions in the portable ultrasound devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Mergers and acquisitions in the portable ultrasound devices industry are increasingly prevalent, primarily driven by the pressing need for enhanced research and development (R&D) capabilities. For instance, in July 2024, GE HealthCare announced an agreement to acquire the clinical artificial intelligence (AI) software business of Intelligent Ultrasound Group PLC for a total consideration of approximately USD 51 million. Intelligent Ultrasound is recognized as a leader in developing integrated AI-driven image analysis tools to enhance the efficiency and intelligence of ultrasound procedures.

In the portable ultrasound devices market, product substitutes include a range of imaging technologies that offer alternative diagnostic capabilities. These substitutes primarily consist of handheld or compact imaging systems such as pocket-sized ultrasound devices, traditional stationary ultrasound machines, and advanced imaging modalities such as magnetic resonance imaging (MRI) and computed tomography (CT) scans. In addition, emerging technologies such as point-of-care ultrasound (POCUS) systems and smartphone-based imaging applications are gaining traction, providing clinicians with flexible, cost-effective options for patient assessment.

The regional expansion of the portable ultrasound devices market is driven by increasing demand for accessible healthcare solutions, particularly in emerging economies. As healthcare infrastructure improves and the need for diagnostic imaging rises, manufacturers actively target regions such as Asia-Pacific, Latin America, and parts of Africa. This expansion is facilitated by partnerships with local distributors, investments in training programs for healthcare professionals, and the introduction of cost-effective, user-friendly devices tailored to the needs of diverse populations. For instance, in April 2024, GE HealthCare announced the inauguration of its A1-Sure refurbishing ultrasound systems facility in Bangladesh. This facility is designed to enhance access to advanced diagnostic and clinical technologies for the rural population in Tier 2 and Tier 3 cities, which are often underserved. By refurbishing medical equipment, the facility facilitates the repurposing of ultrasound systems, significantly improving access to quality healthcare for a broader demographic.

Type Insights

The cart/trolley segment dominated, with a market share of 65.9% in 2024, owing to the increasing demand for these devices among healthcare providers. This dominance can be attributed to its versatility and ease of use, as cart-based systems provide a stable platform for advanced imaging while maintaining mobility. Cart-based ultrasound systems typically feature larger screens and integrated software capabilities, making them suitable for various clinical applications, including obstetrics, cardiology, and emergency medicine. Their design facilitates mobility within hospitals and clinics, enabling healthcare professionals to conduct ultrasounds in multiple locations without compromising image quality or functionality.

The handheld ultrasound devices segment is expected to grow fastest over the forecast period owing to advancements in imaging quality. Handheld ultrasound devices, being compact enough to fit within a physician's coat pocket, offer a more affordable alternative to console ultrasound units and provide greater convenience for healthcare professionals. The segment is expected to grow exponentially owing to recent launches made by the leading players in the market. For instance, Konica Minolta Healthcare Americas, Inc. has launched the launch of PocketPro H2, a new wireless handheld ultrasound device designed for general imaging in point-of-care applications. As a trusted provider of primary imaging solutions, Konica Minolta Healthcare has partnered with Healcerion to distribute the PocketPro H2 in the United States for both human and veterinary applications. This collaboration aims to provide a new level of flexibility and affordability in ultrasound technology.

Application Insights

The obstetrics/gynecology segment significantly dominated the ultrasound market, capturing a revenue share of over 46.6% in 2024. This dominant performance can be attributed to several factors, including the increasing prevalence of conditions requiring prenatal and gynecological imaging, advancements in ultrasound technology, and heightened awareness among healthcare providers and patients regarding the benefits of routine imaging. This segment is expected to grow steadily, driven by rising birth rates and the growing incidence of reproductive health issues. For instance, according to the World Health Organization (WHO), approximately 385,000 babies are born daily, underscoring the ongoing need for effective prenatal monitoring. In addition, the American College of Obstetricians and Gynecologists (ACOG) recommends routine ultrasound scans during pregnancy, further boosting demand in this segment.

The cardiovascular segment is expected to grow exponentially over the forecast period. This expansion is driven by the rising prevalence of cardiovascular diseases. For instance, the World Health Organization (WHO) identifies it as the leading cause of mortality globally. With an estimated 17.9 million deaths attributed to cardiovascular conditions each year, the demand for effective diagnostic tools is more critical than ever. Portable ultrasound devices, particularly those equipped with Doppler imaging capabilities, are increasingly utilized in cardiology to assess blood flow and detect conditions such as arterial blockages and heart valve disorders. The convenience of point-of-care ultrasound allows healthcare professionals to perform immediate evaluations, facilitating timely diagnosis and treatment decisions.

Technology Insights

The Doppler portable ultrasound segment dominated the market, capturing a revenue share of over 46.8% in 2024. This dominance is attributable to its high-resolution medical screen, which utilizes sub-array component transducers and multi-beam parallel technology. Doppler ultrasound imaging is a non-invasive diagnostic procedure that employs high-frequency sound waves to assess blood flow by detecting the movement of red blood cells. This technique is an effective alternative to invasive procedures such as angiography, which requires dye injection into blood vessels for visualization on X-ray images. Physicians utilize Doppler ultrasound to evaluate arterial damage and to monitor specific venous and arterial therapies, further underscoring its clinical significance.

The Doppler ultrasound segment is expected to witness the fastest growth over the forecast period, driven by its critical role in assessing blood flow and diagnosing cardiovascular conditions. This technology enables healthcare professionals to evaluate vascular health noninvasively, making it an invaluable tool in various clinical settings, including emergency medicine and cardiology. Doppler ultrasound is also increasingly utilized in obstetrics and gynecology, particularly for monitoring fetal health and detecting complications during pregnancy. For instance, the American College of Obstetricians and Gynecologists (ACOG) recommended using Doppler ultrasound to assess fetal heart rates and blood flow, which is crucial for identifying potential issues early on.

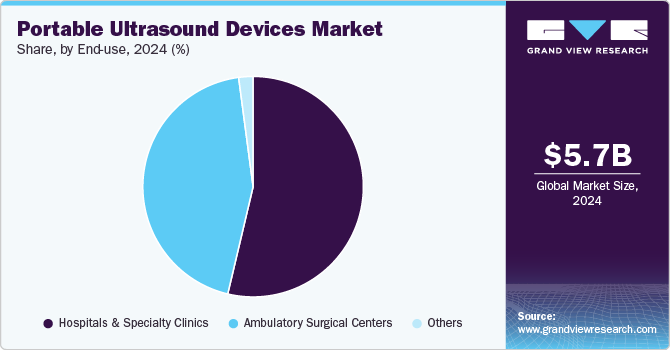

End Use Insights

Hospitals & specialty clinics dominated the ultrasound market and held a revenue share of over 53.7% in 2024. This can be attributed to portable ultrasound devices' compact size and enhanced image quality. As healthcare providers increasingly adopt mobile imaging solutions, many doctors utilize portable ultrasounds in remote medical facilities, improving access to diagnostic services. In addition, the versatility of portable ultrasound technology enables its use in various clinical applications, from obstetrics and gynecology to cardiology and emergency medicine. For instance, a study published in the Journal of the American College of Cardiology found that portable ultrasound can be effectively used in cardiac assessments, demonstrating its adaptability in different healthcare scenarios.

The ambulatory surgical centers (ASC) segment is projected to experience the fastest growth over the forecast period. This rapid expansion is attributed to the increasing preference for outpatient procedures, which are more cost-effective and convenient for patients. As ASCs adopt portable ultrasound technology for various applications, including diagnostic imaging and guided procedures, the demand for these devices is expected to rise significantly. As ASCs continue to embrace advancements in medical technology, the adoption of portable ultrasound devices has become increasingly prevalent. These devices are particularly advantageous in outpatient settings, where the need for mobility and efficiency is paramount. Portable ultrasound enables healthcare professionals to perform immediate assessments and guided procedures, such as injections or biopsies, directly in the ASC environment.

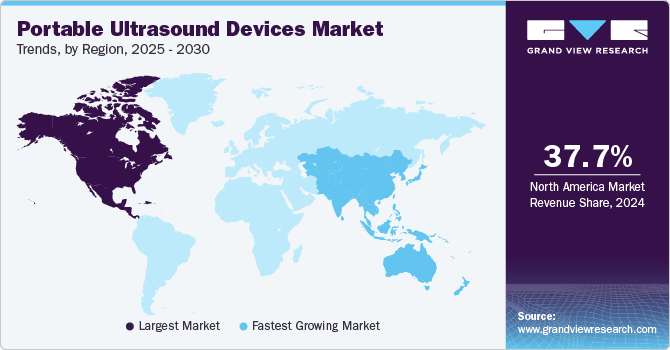

Regional Insights

North America portable ultrasound devices market dominated the overall global market and accounted for 37.7% of revenue share in 2024. The market is significantly driven by advancements in medical technology and a growing preference for point-of-care diagnostics. Innovations in ultrasound technology, such as improved imaging capabilities, enhanced portability, and user-friendly interfaces, have made these devices increasingly attractive to healthcare providers. In addition, the preference for point-of-care diagnostics is reflected in the rising number of healthcare facilities adopting portable ultrasound devices. For instance, a study by the American Institute of Ultrasound in Medicine reported that nearly 80% of hospitals in the United States have integrated portable ultrasound systems into their clinical practices. This trend is particularly evident in emergency departments and outpatient clinics, where the ability to provide immediate diagnostic information can significantly impact patient outcomes.

U.S. Portable Ultrasound Devices Market Trends

The portable ultrasound devices market in the U.S. held a significant share of North America's portable ultrasound devices market in 2024. The U.S. market is driven by factors such as the increasing adoption of the imaging system in emergency care facilities. For instance, a study conducted by the American College of Emergency Physicians indicated that over 90% of emergency departments now utilize point-of-care ultrasound, underscoring the critical role of rapid and accurate diagnostics in urgent situations. This capability is particularly vital in trauma cases, where timely diagnosis can be lifesaving. Reduction

Europe Portable Ultrasound Devices Market Trends

The portable ultrasound devices market in Europeis experiencing significant growth, driven by an expanding healthcare infrastructure and recent launches made by key players in the market. For instance, Koninklijke Philips N.V., a global leader in health technology, announced the launch of its next-generation compact portable ultrasound solution. The Philips Compact 5000 Series is designed to extend the diagnostic quality typically associated with premium cart-based ultrasound systems to a broader patient population. This new series emphasizes portability and versatility while maintaining high image quality and performance standards. The Compact 5000 Series facilitates first-time-right ultrasound examinations, improving access to more patients' effective diagnostic care.

The UK portable ultrasound devices market is experiencing exponential growth driven by technological advancements and a growing emphasis on point-of-care diagnostics. The increasing demand for rapid and accurate imaging solutions, particularly in emergency and outpatient settings, has prompted healthcare providers to adopt portable ultrasound systems. These devices offer the advantage of mobility and ease of use, enabling healthcare professionals to conduct examinations at the patient's bedside. For instance, according to the National Health Service (NHS), the use of portable ultrasound has risen by approximately 15% over the past few years, particularly in primary care and emergency departments. This trend reflects a shift towards more efficient healthcare delivery models prioritizing immediate diagnostic capabilities.

The portable ultrasound devices market in France is expected to grow due to the advancements in medical technology and an increasing focus on point-of-care diagnostics. The demand for quick and reliable imaging solutions is rising in various healthcare settings, including emergency departments, outpatient clinics, and primary care facilities. For instance, according to the French Ministry of Health, the adoption of portable ultrasound devices has increased by approximately 20% over the last few years, reflecting a broader trend toward enhancing patient care through accessible diagnostic tools. This shift is particularly important in rural areas, where traditional imaging services may be limited, thereby improving healthcare accessibility for diverse populations.

The Germany portable ultrasound devices market is poised for significant growth, driven by the increasing demand for accessible and efficient diagnostic solutions across various healthcare settings. In addition, integrating advanced technologies such as artificial intelligence and cloud connectivity enhances the functionality and appeal of portable ultrasound devices. In addition, the COVID-19 pandemic has accelerated the adoption of these devices, as healthcare providers sought to minimize patient transport and reduce the risk of infection. For instance, a survey conducted by the German Medical Association found that over 70% of practitioners reported increased reliance on portable ultrasound during the pandemic. As healthcare professionals continue to recognize the benefits of portable ultrasound technology in delivering timely and accurate diagnoses, the market in Germany is expected to expand further, supporting the overall goals of enhancing healthcare delivery in the country.

Asia Pacific Portable Ultrasound Devices Market Trends

Asia-Pacific portable ultrasound devices market is experiencing substantial growth, primarily driven by initiatives made by the leading players in the market. For instance, in June 2023, Fujifilm Business Innovation Thailand Foundation donated portable ultrasound and X-ray equipment to the Princess Mother’s Medical Volunteer Foundation (PMMV) to support medical professionals in their mobile medical missions. This initiative aims to enhance healthcare quality in underserved areas, facilitating better diagnostic capabilities for medical volunteers during their outreach efforts. The company is concentrating on delivering advanced solutions that address the evolving needs of its customers and improve operational efficiency.

The portable ultrasound devices market in Japan is set for rapid growth due to the rising utilization of portable ultrasound devices in the country. For instance, according to a report by the Ministry of Health, Labour and Welfare, the use of portable ultrasound devices in hospitals has increased by around 25% over the past few years, highlighting their growing acceptance among healthcare professionals. In addition, a survey conducted by the Japan Medical Imaging and Radiological Systems Industries Association found that nearly 70% of clinicians reported enhanced diagnostic capabilities and improved patient outcomes through the use of portable ultrasound systems.

China portable ultrasound devices market is highly competitive due to varied launches made by the local players in the market. For instance, Shenzhen Mindray Bio-medical Electronics Co., Ltd., a prominent worldwide innovator in healthcare solutions and ultrasound technologies, launched its TE Air Wireless Handheld Ultrasound, a novel imaging tool enhancing ultrasound availability. This small, wireless technology allows healthcare providers to have portable scanning capabilities for a variety of medical situations, fitting in their pockets. The TE Air is the first handheld ultrasound device in the industry that can link to a mobile device or the touch-based TE X Ultrasound System, increasing its usefulness and ease of use.

The portable ultrasound devices market in India is highly competitive and driven by factors such as the availability of affordable portable ultrasound devices. For instance, according to a survey conducted by the National Health Systems Resource Centre, nearly 60% of healthcare providers in rural India reported using portable ultrasound devices due to their affordability and ease of use. This trend underscores the pivotal role of price-sensitive innovations in driving market growth and improving diagnostic capabilities nationwide. As healthcare infrastructure expands, the demand for portable ultrasound devices is expected to increase further, enhancing overall healthcare delivery in India. In addition, the proliferation of cost-effective portable ultrasound devices has made them more accessible to smaller clinics and primary healthcare centers.

Latin America Portable Ultrasound Devices Market Trends

The Latin American portable ultrasound devices market is highly competitive, driven by the increasing demand for accessible and affordable diagnostic solutions. As healthcare systems in the region evolve, there is a growing emphasis on point-of-care diagnostics, particularly in underserved areas where traditional imaging facilities may be limited. The availability of affordable portable ultrasound devices is a key factor contributing to this growth. Several local and international manufacturers are introducing budget-friendly models that maintain quality while meeting the specific needs of healthcare providers in the region. For instance, a Pan American Health Organization survey found that over 70% of healthcare professionals in rural areas reported using portable ultrasound devices to enhance their diagnostic capabilities.

MEA Portable Ultrasound Devices Market Trends

The portable ultrasound devices market in Middle East and Africa is anticipated to witness significant growth over the forecast period owing to recent launches made by key players in the market. For instance, in January 2024, GE HealthCare launched the Vscan Air at Arab Health 2024, a handheld wireless ultrasound imaging system to facilitate rapid cardiac and vascular assessments to speed up diagnoses and treatment decisions. This device utilizes GE's proprietary SignalMax and XDclear imaging technologies, which enhance penetration, resolution, and sensitivity through a single crystal transducer. In addition, increasing demand for portable and efficient imaging solutions in diverse healthcare settings across the region, thereby contributing to the anticipated growth of the market.

The portable ultrasound devices market in Saudi Arabia is anticipated to experience significant growth over the forecast period, largely due to the increasing acceptance of portable ultrasound devices nationwide. For instance, a survey by the Saudi Health Council found that more than 60% of clinicians reported increased usage of portable ultrasound during the pandemic. This trend highlights the critical role of these devices in facilitating rapid diagnosis and effective patient management. As healthcare professionals continue to recognize the advantages of portable ultrasound technology, the market in Saudi Arabia is poised for continued growth and innovation.

Key Portable Ultrasound Devices Company Insights

The competitive scenario in the portable ultrasound devices market is highly competitive, with key players such as GE HealthCare, Siemens, and others. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Portable Ultrasound Devices Companies:

The following are the leading companies in the portable ultrasound devices market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Siemens

- Koninklijke Philips N.V.

- SAMSUNGHEALTHCARE.COM

- FUJIFILM Holdings Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Canon Inc.

- BenQ.

View a comprehensive list of companies in the Portable Ultrasound Devices Market

Recent Developments

-

In September 2024, GE HealthCare announced the launch of enhanced Venue ultrasound systems, including a new solution that sets the standard for point-of-care ultrasound (POCUS): Venue Sprint. The Venue Sprint is designed for maximum portability and integrates the powerful, familiar Venue software with AI-enabled tools, ensuring high-quality imaging. It features wireless probe capabilities that are compatible with Vscan Air handheld ultrasound systems

-

In August 2022, Echonous partnered with Samsung to enhance ultrasound imaging through AI-guided technology. This collaboration aims to improve the usability and accuracy of ultrasound procedures, making them more accessible for healthcare providers. By integrating artificial intelligence into their systems, the partnership seeks to assist clinicians in delivering more precise diagnostics and ultimately enhance patient care, reflecting the ongoing trend of utilizing AI in medical imaging.

-

In April 2022, GE HealthCare and Elekta announced the signing of a global commercial collaboration agreement in radiation oncology. This partnership enables both companies to deliver a comprehensive solution that encompasses imaging and treatment for hospitals that serve cancer patients requiring radiation therapy.

Portable Ultrasound Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.91 billion

Revenue forecast in 2030

USD 7.36 billion

Growth rate

CAGR of 4.5% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, end Use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

GE HealthCare; Siemens; Koninklijke Philips N.V.; SAMSUNGHEALTHCARE.COM; FUJIFILM Holdings Corporation; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Canon Inc.; BenQ.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the portable ultrasound devices market report based on type, application, technology, end use and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld

-

Compact

-

Cart/Trolley

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstetrics/Gynecology

-

Cardiovascular

-

Urology

-

Gastric

-

Musculoskeletal

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Ultrasound

-

3D & 4D Ultrasound

-

Doppler Ultrasound

-

High-intensity Focused Ultrasound

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global portable ultrasound devices market size was estimated at USD 5.67 billion in 2024 and is expected to reach USD 5.1 billion in 2025.

b. The global portable ultrasound systems market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 7.36 billion by 2030.

b. North America dominated the portable ultrasound devices market with a share of 38% in 2024. This is attributable to rising healthcare awareness coupled with cloud-based technology acceptance and research and development initiatives.

b. Some key players operating in the portable ultrasound devices market include GE Healthcare, Siemens, Koninklijke Philips N.V., Samsung, FUJIFILM Holdings Corporation, Shenzhen Mindray Bio-medical Electronics Co., Ltd, Canon Inc, and BenQ, among others.

b. Key factors driving the market growth include increased advancements in medical technology, a rise in a patient’s preference for minimally invasive treatments, and extensive adoption of imaging systems in emergency care.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."