- Home

- »

- Medical Imaging

- »

-

Portable Ultrasound Bladder Scanner Market Report, 2030GVR Report cover

![Portable Ultrasound Bladder Scanner Market Size, Share & Trends Report]()

Portable Ultrasound Bladder Scanner Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (2D Scanner, 3D Scanner), By End-use (Hospitals, Diagnostic Imaging Centers), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-264-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

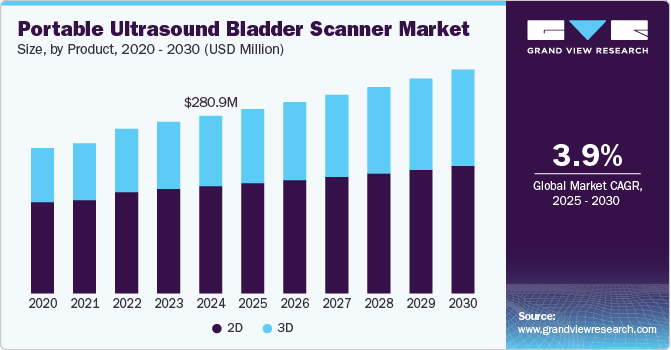

The global portable ultrasound bladder scanner market size was estimated at USD 280.9 million in 2024 and is expected to grow at a CAGR of 3.97% from 2025 to 2030. Growing incidence of urological disorders, technological advancements, the growing adoption of point-of-care diagnostic devices and increasing awareness and education are the major factors contributing to the industry growth. For instance, as reported in Medscape, Urinary Tract Infections (UTIs) are significantly more prevalent in women, with approximately 8 million visits to various healthcare facilities in the U.S. each year attributed to this condition.

Technological advancements, such as increased compactness, reduced weight, and user-friendly designs, are enhancing the portability and usability of portable ultrasound bladder scanners across various clinical settings, thereby driving market growth. Furthermore, advancements in transducer technology have led to improved image quality and resolution. Many modern scanners also offer wireless connectivity and cloud-based data storage capabilities, facilitating seamless integration with electronic medical records.

Additionally, the integration of Artificial Intelligence (AI) is a significant factor propelling industry expansion. For instance, in January 2024, Clarius obtained FDA approval for its Clarius Bladder AI, a non-invasive tool that measures bladder volume within seconds. This innovative solution is currently available in the U.S., compatible with the Clarius PAL HD3, Clarius PA HD3, and the Clarius C3 HD3 wireless handheld ultrasound scanners.

The growing prevalence of urological disorders has increased the adoption of bladder ultrasound machines among end users. These disorders, ranging from urinary tract infections to bladder cancer, necessitate accurate and efficient diagnostic tools for timely intervention and treatment. Bladder ultrasound machines offer a non-invasive method for assessing bladder health, providing detailed images of the bladder's structure and function without the need for invasive procedures. As healthcare providers strive to improve patient care and outcomes, the integration of bladder ultrasound technology has become increasingly vital in the diagnosis and management of urological conditions. Its ease of use, portability, and ability to deliver real-time results make it a valuable asset in urology departments, clinics, and even point-of-care settings, facilitating prompt and effective decision-making for patients with bladder-related issues.

Industry Concentration & Characteristics

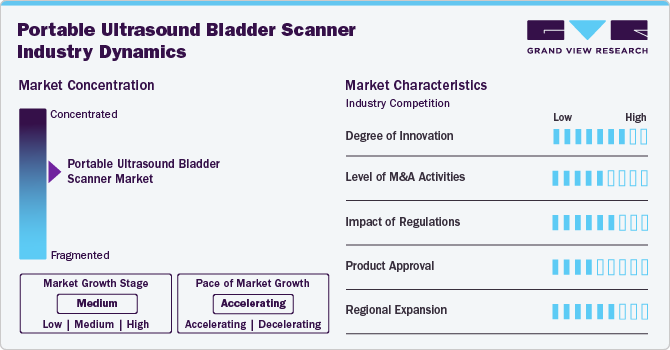

Theindustry growth stage is high, and the pace of the industry growth is accelerating. The industry has seen significant innovation, characterized by advancements in technology that have led to more accurate and efficient imaging results, ultimately improving treatment planning. Moreover, advancements in software capabilities have led to the development of features such as automated measurements and 3D reconstruction, further streamlining the imaging process and improving diagnostic accuracy.

In order to expand their customer base and gain a larger share, major players in the industry are continuously working to improve their product offerings. This involves upgrading their products, exploring acquisitions, obtaining government clearances and engaging in important cooperation activities. In May 2023, CHISON Medical Technologies Co., Ltd., introduced the CHISON SonoFamily, which consists of SonoMax, SonoAir, and SonoEye, revolutionizing the ultrasound imaging market by offering patients & medical professionals more sophisticated, intelligent, and all-encompassing imaging solutions.

Portable ultrasound bladder scanners have achieved a high degree of innovation, owing to remarkable technological advancements that have positioned them at the forefront of medical diagnostics. For instance, in September 2023, Mindray introduced the TE Air Wireless Handheld Ultrasound, an advanced imaging solution designed to enhance accessibility to ultrasound. This compact and wireless technology empowers healthcare providers to conveniently carry extensive scanning capabilities, to diverse clinical scenarios.

Companies that manufacture portable ultrasound bladder scanners are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand market reach, and maintain competitiveness. For instance, in February 2023, GE HealthCare announced an agreement to acquire privately held AI healthcare provider Caption Health, Inc. Caption Health develops clinical applications to enable early disease diagnosis and enhance ultrasound scans with AI.

Regulatory bodies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play a crucial role in shaping the development and utilization of medical portable ultrasound bladder scanners. These regulations are aimed at guaranteeing the safety and efficacy of such medical devices for patient use.

New product launches by manufacturers to stay competitive in the portable ultrasound bladder scanner market industry and the growing demand and adoption of medical imaging devices for orthopedic applications an important factors driving growth. For instance, in January 2024, Butterfly Network, Inc. announced that its latest handheld point-of-care ultrasound (POCUS) system, Butterfly iQ3, has received clearance from the FDA.

The geographical reach of portable ultrasound bladder scanners has been expanding at a moderate to high level owing to population growth, growing healthcare expenditure, and regulatory environments.

Product Type Insights

The 2D segment held the largest market share of over 60.4% in 2024. Its ease of use makes it well-suited for regular exams and quick evaluations. The 2D imaging technology produces sharp, detailed real-time images that fulfill most diagnostic requirements. This functionality allows healthcare providers to swiftly identify common bladder issues such as urinary retention, bladder stones, or abnormalities in bladder wall thickness. Furthermore, 2D ultrasound scanners are usually more affordable and readily available compared to their 3D counterparts.

The 3D segment is expected to grow at the fastest rate from 2025 to 2030. This can be attributed to various factors, including advancements in technology and growing preferences in clinical practice. A significant factor contributing to this growth is the improved diagnostic capabilities provided by 3D imaging technology. Offering volumetric data and multiplanar views allows for a more thorough understanding of bladder morphology and pathology. This three-dimensional visualization capability enables healthcare professionals to evaluate anatomical structures, identify subtle abnormalities, and enhance diagnostic precision more effectively.

End-use Insights

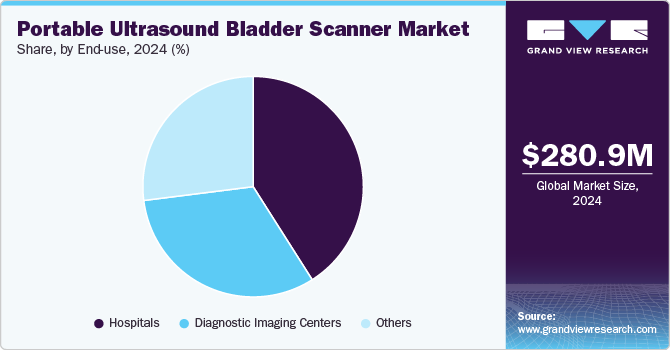

The hospital segment dominated the market with a share of over 40.5% in 2024 and is further expected to grow at the fastest CAGR over the forecast period. Hospitals remain the primary option for patients seeking medical care, particularly for conditions like urinary tract infections (UTIs) and urinary incontinence, which require frequent bladder assessments. The increasing occurrence of these conditions highlights the importance of conducting evaluations within hospital settings. Moreover, hospitals have larger budgets allocated for procuring medical equipment, enabling them to adopt advanced technologies such as portable ultrasound bladder scanners.

Diagnostic imaging centers are also expected to grow at a significant rate over the forecast period. The growing preference for outpatient care and minimally invasive procedures has resulted in a surge of patients seeking diagnostic services at imaging centers. Portable ultrasound bladder scanners present a convenient and economical solution for these centers to address the rising demand for bladder assessments without requiring larger, more expensive imaging equipment.

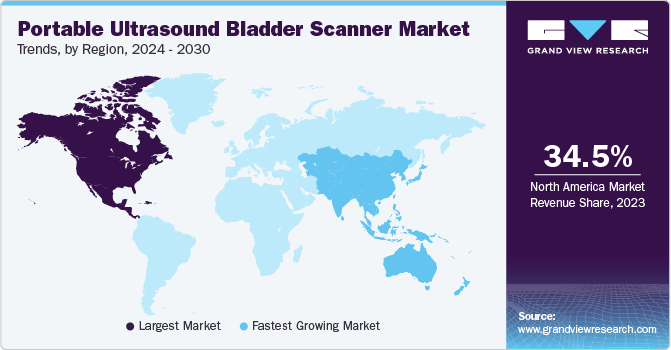

Regional Insights

North America held the largest market share of 34.5%, in 2024. Several factors contribute to this trend, such as the expanded use of ultrasound technology in primary care settings, enhanced accessibility, and robust healthcare spending in countries with efficient reimbursement policies. Additionally, the rising prevalence of urological diseases in the region is anticipated to bolster market growth further.

U.S. Portable Ultrasound Bladder Scanner Market Trends

The portable ultrasound bladder scanner industry in the U.S. held the largest market share in 2024 in the North American region. The growth can be attributed to the presence of major market players in this country such as GE Healthcare, Verathon Inc., and others.

Europe Portable Ultrasound Bladder Scanner Market Trends

The portable ultrasound bladder scanner market in Europe held a significant share in 2024. The growing focus on R&D activities and various strategic initiatives undertaken by market players in the region is a major factor contributing to regional market growth. For instance, in January 2024, Clarius Mobile Health obtained a CE mark for its wireless handheld whole-body ultrasound scanner, known as the Clarius PAL HD3.

The UK portable ultrasound bladder scanner market is expected to grow owing to the growing cases of urological disorders in the country. Additionally, the rising awareness and adoption of medical imaging are anticipated to fuel market growth. As stated by data from NHS England, approximately 43.3 million imaging tests were conducted in England between April 2021 and March 2022, highlighting the growing utilization of medical imaging services.

The portable ultrasound bladder scanner market in France is expected to grow over the forecast period due to the growing cases of urological diseases in the country necessitating the use of ultrasound imaging.

Germany portable ultrasound bladder scanner market is expected to grow over the forecast period this can be attributed to a rapid aging of the population, which increases the prevalence of urological disorders. Germany's sophisticated healthcare system, coupled with a highly skilled workforce and substantial healthcare spending, also contribute to this growth.

Asia Pacific Portable Ultrasound Bladder Scanner Market Trends

The portable ultrasound bladder scanner market in Asia Pacificis estimated to witness the fastest CAGR during the forecast period, due to the growing aging population, which is more prone to urological disorders, and the growing demand for advanced imaging devices is further expected to increase the growth of portable ultrasound bladder scanner market in Asia Pacific.

China portable ultrasound bladder scanner market is expected to grow over the forecast period. This growth can be attributed to the presence of numerous market players in the country, each employing various strategies to maintain competitiveness.

The portable ultrasound bladder scanner market in Japan is expected to grow, over the forecast period. This expansion is primarily due to the country's emphasis on technological innovation and the widespread adoption of advanced solutions within the country.

Latin America Portable Ultrasound Bladder Scanner Market Trends

The portable ultrasound bladder scanner market in Latin America is anticipated to undergo moderate growth throughout the forecast period. Growing awareness of urological disorders in the region has resulted in a significant increase in diagnosed cases, driving demand for early disease detection. Furthermore, substantial investments by key market players in the emerging economy, coupled with a large target population, are anticipated to fuel market expansion.

MEA Portable Ultrasound Bladder Scanner Market Trends

The Middle Eastern countries, notably the United Arab Emirates (UAE) and Saudi Arabia, with their higher spending capacity, are driving up the demand for portable ultrasound bladder scanners. However, despite this growing demand, the region's market share in the global portable ultrasound bladder scanners industry is declining. This is primarily due to a shortage of experienced specialists capable of operating high-end ultrasound systems. To address this issue, government initiatives such as providing training for medical staff are anticipated to boost the adoption of portable ultrasound bladder scanners in the region.

Key Portable Ultrasound Bladder Scanner Company Insights

The key players operating in the portable ultrasound bladder scanner industry are working to improve their product offerings by upgrading their products, leveraging important cooperative drives, as well as considering acquisitions and government approvals to increase their client base and get a larger part of the market share. Some of the major market players operating in the portable ultrasound bladder scanner market are GE Healthcare, Philips Healthcare, Siemens Healthineers, Clarius, and Laborie.

Key Portable Ultrasound Bladder Scanner Companies:

The following are the leading companies in the portable ultrasound bladder scanner market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Verathon Inc.

- Infinium Medical

- Laborie

- Advin Health Care

- Caresono Technology Co.,Ltd.

- Becton, Dickinson and Company

- EchoSon

- Vitacon

- Medzer

- Clarius

Recent Developments

-

In September 2024, GE HealthCare introduced enhanced Venue ultrasound systems along with a new point-of-care ultrasound (POCUS) solution, Venue Sprint. Designed for maximum portability, Venue Sprint integrates the robust and familiar Venue software with AI-powered tools, high-quality imaging, and wireless probe capability, seamlessly working alongside Vscan Air handheld ultrasound systems.

-

In May 2023, GE HealthCare announced that Voluson Expert 22 was awarded "Best New Ultrasound Technology Solution" in the medical device category of the 7th Annual MedTech Breakthrough Awards.

-

In June 2022, Petco Health and Wellness Company, Inc., a full-service partner in pet health and wellness, and Butterfly Network, Inc., a digital health company revolutionizing care with handheld, whole-body ultrasound, announced an agreement to deploy Butterfly iQ+ Vet to Petco's expanding network of nearly 200 full-service veterinary hospitals at Petco pet care centers.

-

In October 2022, Philips introduced the Compact 5000 Series of ultrasound systems, which enables first-time-right diagnosis for patients, at RSNA 2022. The System provides high-quality images to support a reliable and confident diagnosis through small portable units.

Portable Ultrasound Bladder Scanner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 291.2 million

Revenue forecast in 2030

USD 353.8 million

Growth Rate

CAGR of 3.97% from 2025 to 2030

Actual period

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Philips Healthcare; Siemens Healthineers; Verathon Inc.; Infinium Medical; Laborie; Advin Health Care; Caresono Technology Co.,Ltd.; Becton; Dickinson and Company; EchoSon; Vitacon; Medzer; Clarius

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Ultrasound Bladder Scanner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global portable ultrasound bladder scanner market report on the basis of product type, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

2D

-

3D

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global portable ultrasound bladder scanner market size was estimated at USD 280.9 million in 2024 and is expected to reach USD 291.2 million in 2025.

b. The global portable ultrasound bladder scanner market is expected to grow at a compound annual growth rate of 3.97% from 2025 to 2030 to reach USD 353.8 million by 2030.

b. 2D segment dominated the portable ultrasound bladder scanner market with a share of 60.4% in 2024. This is attributable to factors such as advancements in technology and growing preferences in clinical practice.

b. Some key players operating in the portable ultrasound bladder scanner market include GE Healthcare, Philips Healthcare, Siemens Healthineers, Verathon Inc., Infinium Medical, Laborie, Advin Health Care, Caresono Technology Co.,Ltd., Becton, Dickinson and Company, EchoSon, Vitacon, Medzer, Clarius

b. Key factors that are driving the portable ultrasound bladder scanner market growth include growing incidence of urological disorders, technological advancements, the growing adoption of point-of-care diagnostic devices and increasing awareness and education.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.