- Home

- »

- Power Generation & Storage

- »

-

Portable Generator Market Size, Share, Industry Report 2030GVR Report cover

![Portable Generator Market Size, Share & Trends Report]()

Portable Generator Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Diesel Generator, Gaseous Generator), By Power Range (Low Power, Medium Power, High Power), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-112-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Portable Generator Market Summary

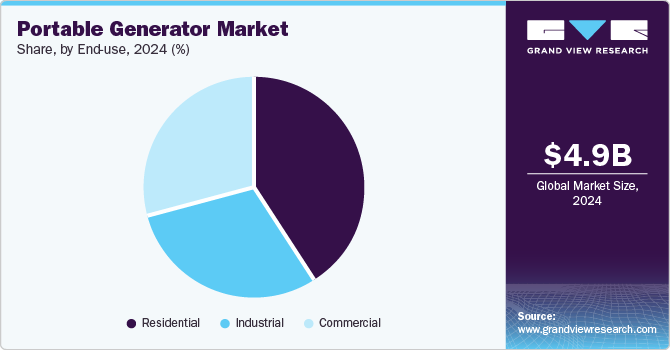

The global portable generator market size was estimated at USD 4.96 billion in 2024 and is projected to reach USD 6.78 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The industry is driven by a number of factors, including the increasing need for backup power solutions in the event of natural disasters and power outages.

Key Market Trends & Insights

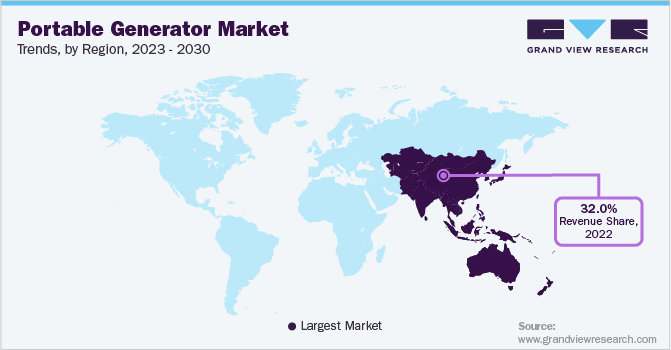

- The portable generator market in Asia Pacific dominated the global industry and accounted for the largest share of 33.2% in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- By product, the gasoline generator segment accounted for the largest share of 42.4% in 2024.

- By power range, the low-power segment dominated the market in 2024.

- By application, the emergency segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.96 Billion

- 2030 Projected Market Size: USD 6.79 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

With severe weather events becoming more frequent and more intense, consumers are looking for reliable generators that can keep their homes and businesses powered in times of crisis. At the same time, the growing popularity of outdoor activities, such as camping and tailgating, which require portable power sources for appliances and electronic devices, is also a significant factor driving the growth of the industry.

Several portable generator solution providers are increasingly focusing on developing dual-fuel capable portable solutions to offer customers an efficient portable solution. For instance, in May 2022, Generac Power Systems, Inc., an energy technology solution provider, introduced two new dual-fuel capable Powermate portable generators such as the Powermate 7500 Watt Dual Fuel Portable Generator and the Powermate 4500 Watt Dual Fuel Portable Generator. Both variants are intended to run on either gasoline or compressed natural gas. The Powermate 4500 Watt Dual Fuel Portable Generator has 4,500 starting watts and 3,600 operating watts (gas), making it powerful enough to power small electrical appliances at any campground or picnic spot while also being versatile enough to power equipment for home-based chores.

In recent years, there has been a significant rise in the instances of power outages in the U.S. owing to extreme weather conditions. With climate change leading to more frequent and severe weather events, such as hurricanes, tornadoes, and wildfires, power grids are being increasingly challenged to keep up with the demands of a changing climate. For instance, according to the U.S. Energy Information Administration's annual power industry report of 2021, the average electricity customer was without power for 7 hours and 20 minutes that year, with more than 5 of those hours (72%) attributed to major weather events such as hurricanes, wildfires, and snowstorms. As a result, there is a growing need for backup power solutions, such as portable generators, to help keep homes and businesses powered during outages.

Solar-based portable generators are used in emergencies, providing a reliable power source during power outages or other disasters. With climate change becoming an increasing concern, consumers are looking for renewable and sustainable alternatives to traditional gasoline generators, and solar-based portable generators fit the bill perfectly. While they may be more expensive upfront than traditional gasoline generators, solar-based portable generators can save cost over time, as they do not require fuel and have minimal ongoing maintenance costs. Additionally, the increasing popularity of outdoor activities, such as camping and tailgating, has created a demand for portable power solutions that can be used in remote locations where access to traditional power sources may be limited.

The demand for portable generators powered by biofuel, a sustainable energy source, has increased as awareness of global warming has increased. Due to its chemical similarities to petroleum-based fuels, biofuel can be used as a straight replacement for diesel fuel. Moreover, biofuel gives nations like Japan and Italy-which buy natural gas and petroleum from other nations-energy independence. Canola, soybean, corn, leftover cooking oil, and animal fats may all be utilized to make biofuels. Hence, the participants in the market for portable generators would benefit from the rising demand for generators that run on biofuel. However, key reasons constraining market expansion are stringent environmental restrictions aimed at reducing carbon emissions.

Product Insights

The gasoline generator segment accounted for the largest share of 42.4% in 2024. The driving factors for the gasoline based portable generator market include their affordability, versatility, and convenience. Gasoline generators are often less expensive than other types of backup power solutions, making them a popular choice for consumers on a budget. Additionally, gasoline generators can be used in a wide range of applications, from powering outdoor events to providing backup power for homes and businesses during power outages. Hence the convenience of gasoline-based portable generators makes them a popular choice for consumers seeking reliable backup power solutions.

The gaseous generator segment is poised to witness the fastest growth during the forecast period. Factors such as lower emissions, fuel efficiency, and reliability offered by natural gas portable generators are the major factors driving the segment's growth. Natural gas offers cleaner burning fuels than gasoline, producing fewer emissions and pollutants. This makes them a popular choice for consumers concerned about their power usage's environmental impact. Additionally, gaseous-based portable generators are typically more fuel-efficient than gasoline generators, meaning they can run for more extended periods of time on a smaller amount of fuel. Such factors bode well for the growth of the segment over the forecast period.

Power Range Insights

The low-power segment dominated the market in 2024 as these generators are widely used for residential and commercial purposes for powering air conditioners, water pumps, and refrigerators. These generators are often used as a reliable backup power source for small businesses and other settings where access to grid power may be limited or unavailable. They are also popular for outdoor events and job sites where power tools and equipment may need to be used. Low-power portable generators in this range are typically more affordable than larger standby generators and can provide enough power to run essential appliances and electronics during a power outage.

The medium power segment is expected to grow at a significant CAGR over the forecast period. The primary driving factors for the demand for these generators are the need for reliable backup power and remote power generation. Businesses and organizations rely on continuous power supply to keep their operations running in the event of power outages, and these medium power generators provide a reliable solution to ensure that they do not face any interruptions. Additionally, medium power generators are often used in remote locations where grid power is not available, such as construction sites, mining operations, and outdoor events. The compact and portable nature of these generators makes them a versatile power source for a variety of applications, thereby contributing to the growth of the segment.

Application Insights

The emergency segment dominated the market in 2024. The demand for emergency portable generators is primarily driven by the need for reliable backup power in the event of power outages or emergencies. Emergency generators are primarily designed to provide backup power in the event of an outage or power failure, and they are typically used in residential and commercial settings. These generators are often smaller in size and portable, making them easy to transport and install. Additionally, the aging power infrastructure in many areas has led to an increased risk of power failures, further fueling the demand for emergency generators.

The prime/continuous segment is anticipated to register a significant CAGR over the forecast period. One of the main driving factors for the use of prime/continuous portable generators is the growth of the construction industry, which relies heavily on portable generators to power tools and equipment on job sites. Additionally, the expansion of the oil and gas industry, which requires reliable power for drilling and extraction operations in remote locations, is another driving factor for the use of prime/continuous portable generators. Furthermore, the need for emergency power in critical facilities, such as hospitals, data centers, and airports, has also contributed to the growth of the prime/continuous portable generator market, as these facilities require continuous and reliable power to function properly.

End-use Insights

The residential segment dominated the market in 2024. The segment growth can be attributed to the increasing frequency of severe weather events, such as hurricanes and snowstorms, which can cause power outages and leave homeowners without electricity for days or even weeks. As a result, many homeowners are turning to portable generators as reliable backup power sources to ensure they can continue to power their essential appliances and electronics during these outages. Additionally, another trend driving the segment growth is the growing demand for portable generators that are easy to use, compact, and portable, allowing homeowners to take them on camping trips or use them for outdoor events.

The industrial segment is anticipated to register the fastest CAGR over the forecast period. The segment growth can be attributed to the need for reliable backup power in industries that rely on continuous operations, such as manufacturing and data centers. Portable generators provide a reliable source of backup power to ensure that these operations can continue in the event of a power outage. At the same time, the increasing demand for clean and sustainable power has led to the development of new portable generators that use alternative fuels, such as propane and natural gas, and are more fuel-efficient and emit fewer emissions than traditional diesel generators are driving the segment growth. The growth of the construction industry and the need for portable power solutions on job sites have also contributed to the increasing adoption of portable generators for industrial use.

Regional Insights

North America portable generator market is expected to grow at a significant CAGR during the forecast period. The rising need for reliable backup power is due to the increasing frequency of natural disasters and extreme weather events. This has led to more consumers seeking portable generators to ensure uninterrupted power supply for their homes and businesses during power outages. Moreover, as per the International Energy Agency reports of 2021, the U.S. is the world's second-largest energy user behind China, with a massive electrical consumption. Despite the country's sophisticated energy grid architecture and 100% electricity availability, concerns such as power outages and rising demand for standby power sources are likely to increase demand for the portable generator industry.

U.S. Portable Generator Market Trends

The portable generator market in the U.S. held a dominant position in 2024. The growth of the market can be attributed to factors such as the increasing need for backup power solutions in the event of natural disasters and power outages.

Asia Pacific Portable Generator Market Trends

The portable generator market in Asia Pacific dominated the global industry and accounted for the largest share of 33.2% in 2024. The regional growth can be attributed to the increasing demand for reliable and accessible power in emerging markets, such as India and China, where grid power is often unreliable or inaccessible in rural areas. Portable generators provide a reliable and cost-effective solution for powering homes, small businesses, and farms in these areas. The growing construction industry in the region is also driving demand for portable generators for use on job sites to power tools and equipment. The increasing number of natural disasters, such as typhoons and earthquakes, in the region has also contributed to the growing demand for portable generators for emergency backup power.

China portable generator market is rising due to frequent power outages in rural areas and increasing reliance on backup power for businesses and households, especially during natural disasters. This trend is driven by a growing awareness of energy security and enhanced government support for emergency preparedness measures.

The portable generator market in Japan is impacted by strict energy regulations and a strong emphasis on sustainability that are prompting consumers to favor low-emission, fuel-efficient models. These generators are increasingly valued as dependable backup solutions, especially as the country faces challenges from aging infrastructure and frequent extreme weather events.

Europe Portable Generator Market Trends

The portable generator market in Europe is witnessing strong growth, driven by a rising need for backup power solutions due to increasing instances of grid instability and unpredictable weather patterns. Businesses and households are turning to portable generators to maintain energy resilience during outages and peak demand periods. Additionally, there is growing consumer preference for eco-friendly, fuel-efficient models as the region’s environmental regulations tighten, encouraging manufacturers to innovate with low-emission technologies that align with Europe’s sustainability goals.

The U.K. portable generator market is experiencing growth driven by the rising frequency of power disruptions, particularly in rural areas and during extreme weather conditions. As concerns about energy security increase, both consumers and businesses are seeking reliable backup power solutions.

The portable generator market in Germany held a substantial share in 2024 owing to heightened demand for backup power in response to frequent power outages and extreme weather events. The growing reliance on portable generators is fueled by concerns over energy security and the need for continuous power supply, particularly in rural areas and critical industries.

Key Portable Generator Company Insights

Some of the key companies in the portable generator market include GENERAC HOLDINGS INC., Caterpillar, Inc., Cummins Inc., and others. These players are focusing on investing in research and development activities to create new and innovative products that offer improved features and benefits to customers. This can help them to differentiate their products from competitors and attract new customers.

-

GENERAC HOLDINGS INC. offers portable generators for backup, recreational, and work power needs. The company's portable generators ensure that essential items, such as lights, freezers, refrigerators, sump pumps, and even space heaters and window air conditioners, remain operational, minimizing any disruptions. The company is strengthening its hold on the market by investing in R&D and product development.

-

Caterpillar, Inc. offers a wide array of portable generators designed for optimal performance, reliability, and durability. The company’s generators are designed for a variety of uses involving construction sites, outdoor gatherings, and emergency backup power situations.

Key Portable Generator Companies:

The following are the leading companies in the portable generator market. These companies collectively hold the largest market share and dictate industry trends.

- Briggs & Stratton Corporation

- Champion Power Equipment

- Caterpillar, Inc.

- Cummins Inc.

- Generac Power Systems, Inc.

- Kohler Co.

- Multiquip Inc.

- WINCO

- Yamaha Motor Corporation, U.S.A.

- Duromax Power Equipment

Recent Developments

-

In May 2023, Generac Power Systems, Inc. unveiled its latest offering, the Generac GP7500E Dual Fuel portable generator. With 9,400 starting watts and 7,500 running watts, this generator was designed to handle a wide range of tasks, from powering tools and sump pumps to handling other essential loads within the household.

-

In October 2022, Cummins Inc. announced the launch of Onan Power Stations, offering sustainable, battery-powered electricity suitable for activities such as camping, tailgating, and RV usage, as well as powering electronics and appliances.

Portable Generator Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.22 billion

Revenue forecast in 2030

USD 6.79 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, power range, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K, France, China, India, Japan, South Korea, Australia, Brazil, Mexico, KSA, UAE, South Africa

Key companies profiled

Briggs & Stratton Corporation; Champion Power Equipment; Caterpillar, Inc.; Cummins Inc.; Generac Power Systems, Inc.; Kohler Multiquip Inc.; WINCO; Yamaha Motor Corporation, U.S.A.; Duromax Power Equipment.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Portable Generator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global portable generator market report based on product, power range, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel Generator

-

Gaseous Generator

-

Gasoline Generator

-

Others

-

-

Power Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power (8 - 20KW)

-

Medium Power (21 - 370KW)

-

High Power (371 - 450KW)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Prime/Continuous

-

Emergency

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Construction

-

Mining

-

Oil & Gas

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global portable generator market size was estimated at USD 4.96 billion in 2024 and is expected to reach USD 5.22 billion in 2025.

b. The global portable generator market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 6.79 billion by 2030.

b. Asia Pacific dominated the portable generator market with a share of 33.2% in 2024. This is attributable to an increase in the consumption of electric power by residential users in countries such as China and Singapore.

b. Some key players operating in the portable generator market include , Briggs & Stratton Corporation; Champion Power Equipment; Caterpillar, Inc.; Cummins Inc.; Generac Power Systems, Inc.; Kohler Co.; Multiquip Inc.; WINCO; Yamaha Motor Corporation, U.S.A. ; Duromax Power Equipment.

b. Key factors that are driving the market growth include increasing business downtime across the globe, owing to rise in weather-related power outages, has resulted in an increasing demand for uninterrupted power supply. This is a major factor in driving product demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.