- Home

- »

- Alcohol & Tobacco

- »

-

Port Wine Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Port Wine Market Size, Share & Trends Report]()

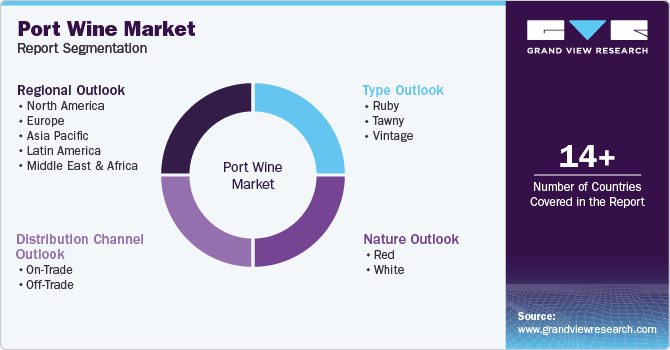

Port Wine Market Size, Share & Trends Analysis Report By Nature (Red, White), By Type (Ruby, Tawny, Vintage), By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-861-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Port Wine Market Size & Trends

The global port wine market size was valued at USD 970.8 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The market is driven by increasing awareness of nutritional advantages of port wines, growing demand for premium drinks, and presence of the antioxidant resveratrol in these beverages. It is a fortified sweet wine known for its sweat and delightful taste, primarily made in the Douro Valley of Portugal. The main types of port wine are ruby and tawny.

The port wine industry has witnessed significant growth in recent years, driven by the demand for premium beverages among the younger generation. The market is expected to continue its upward trajectory as major players focus on product innovation and diversification to cater to the evolving preferences of millennials. The production process, which involves the addition of grape spirits to increase the alcohol content, results in a unique product that is rich in antioxidants and offers several health benefits, including weight management, improved heart function, and relief from stomach inflammation.

The market share of port wine is poised for significant growth due to the increasing popularity of premium beverages among the younger demographic. To capitalize on this trend, major players are introducing new products and flavors, such as white ports, rosé ports, and fruit-flavored ruby ports. These innovations are designed to appeal to the changing tastes and preferences of younger consumers.

The industry is expected to expand rapidly as companies adapt their strategies to meet the growing demand for premium and unique products. The industry is characterized by a growing number of players focusing on product development and marketing efforts to attract and engage younger consumers. As a result, the market is expected to experience significant growth over the forecast period, driven by the increasing popularity of port wine among millennials.

Nature Insights

Red wine dominated the market and accounted for a share of 65.8% in 2023. Red port’s rich color and smooth taste, resulting from the use of grape skins in its production, appeals to a growing customer base. The presence of tannins and resveratrol, which offer potential health benefits, further enhances its appeal. With fewer acidity levels compared to whiskey or beer, red port wine is poised for growth in the global market, driven by consumer demand for premium and flavorful products.

White wine is expected to grow significantly with a CAGR of 4.8% during the forecast period. White port offers a lighter and refreshing taste compared to red port, making suitable for aperitifs or lighter meals. This caters to a growing desire for variety and exploration in the beverage market. White port’s light and crisp character makes it a versatile drink pairing with various dishes, especially seafood or lighter cheeses. This wider food pairing range broadens its appeal in the global market.

Type Insights

Ruby accounted for the largest market revenue share of 46.2% in 2023. Ruby port’s affordability makes it a gateway to the port wine category, appealing to a broader audience, including new consumers. Its shorter aging process in stainless steel or concrete tanks enables faster production and wider availability, facilitating easier purchasing for consumers and consistent supply for retailers. This accessibility drives market growth, positioning ruby port as a key entry point for port wine enthusiasts.

Tawny is expected to register the fastest CAGR of 5.5% during the forecast period. Tawny port’s aging process in smaller barrels results in a complex flavor profile, featuring notes of dried fruit and nuts, with a spicy aroma. Younger consumers, prioritizing quality over quantity, seek value-driven options, making tawny port an attractive choice. As a result, the growth rate in this segment is accelerating, driven by its reputation for delivering premium quality and value.

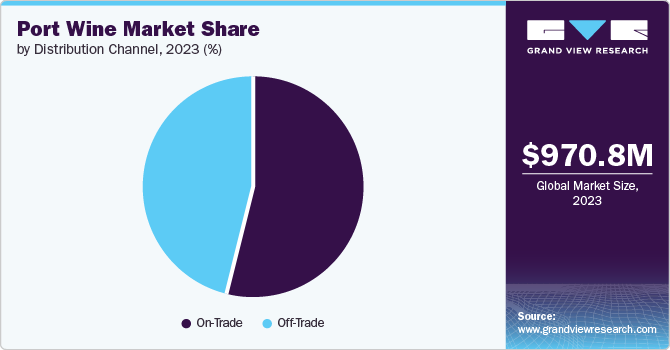

Distribution Channels Insights

On-trade distribution channels dominated the market and accounted for a share of 54.0% in 2023, driven by the expanding reach of internet platforms to non-urban areas and advancements in internet technology. Online purchasing, offering personalized recommendations and targeted marketing, has also contributed to market growth. The pandemic has accelerated the shift to on-trade sales, providing key players with diversified distribution channels, ultimately driving industry expansion.

Off-trade distribution is expected to register the fastest CAGR of 5.5% over the forecast period. The dominance of the off-trade sector, such as supermarkets and liquor stores, is credited to its focus on customer convenience and accessibility. Customers can find and purchase their preferred port wine options from a wide variety available in these stores, contributing to the off-trade sector’s important role in the overall market landscape.

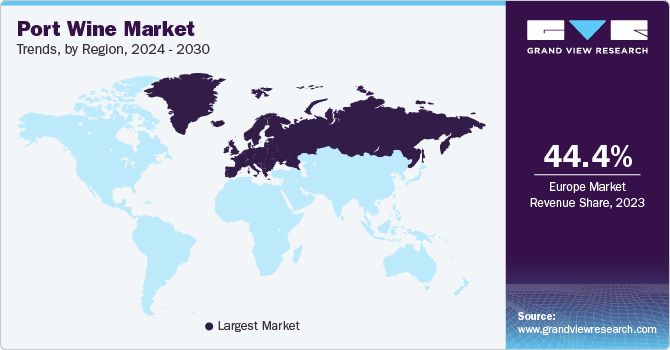

Regional Insights

North America port wine market was identified as a lucrative region in 2023 due to increasing consumer favor for a variety of high-quality wine choices. Moreover, effective marketing strategies and established distribution channels contribute to maintaining the region’s leading role in the port wine sector.

U.S. Port Wine Market Trends

Port wine market in the U.S. is expected to grow rapidly in the coming years. The U.S. has a vibrant cocktail culture, and ruby port’s fruity character makes it a suitable ingredient for innovative cocktails. This can be a gateway for younger consumers to discover port and explore it beyond traditional consumption methods.

Europe Port Wine Market Trends

Europe port wine market dominated the global port wine market with a share of 44.4% in 2023. Europe has traditionally been the primary market for port wine, driven by its association with sophistication and refinement. As the key producers are primarily based in Europe, the region’s market has been shaped by these factors. However, a shift in customer demographics is now driving European port wine exports to other regions, and local companies are expected to experience increased market share in the industry.

Port wine market in Germany dominated Europe port wine market in 2023 due to the current trend of fragrant wines being in high demand. Young wine enthusiasts in the country are drawn to trendy whites, light rosés, and sweet whites, as they gain confidence in their preferences. Notably, Germans are more open to trying wines from various regions globally, reflecting a growing willingness to experiment. As consumer knowledge of wine increases, new world wines are gaining prominence in the port wine sector, with Germany leading the way in Europe.

Asia Pacific Port Wine Market Trends

Asia Pacific port wine market is anticipated to witness the fastest growth in the global port wine market, recording a CAGR of 6.5% over the forecast period. Market growth in the region is fueled by rising consumer wealth, shifting preferences, and a growing demand for high-end products. Wine tourism is also on the rise, with countries promoting their wine regions as destinations, increasing consumer appreciation and demand for port wine in the Asia Pacific market.

Port wine market in India is expected to experience rapid growth, driven by the country’s large population and rising affluence. The shift towards wine consumption is attributed to increased purchasing power, rapid urbanization, availability of affordable local wines, perceived health benefits of lower-alcohol content wines, and changing consumer preferences. This presents an attractive opportunity for wine producers and importers.

Key Port Wine Company Insights

Some key companies in port wine market include La Martiniquaise, Sogrape, Fladgate Partnership, GRUPO SOGEVINUS FINE WINES. The competitive landscape is driven by product diversity, regional dominance, and new entrants. E-commerce and wine tourism boost accessibility and consumer engagement, intensifying competition among established and emerging brands.

-

Sogrape Vinhos, a prominent wine manufacturer and seller, boasts a portfolio of renowned brands such as Mateus Rosé and Barca Velha. The company produces and sources high-quality Portuguese wines through a combination of own production and grape purchasing from local growers for global distribution.

-

La Martiniquaise is a French spirits company that focuses on producing a diverse range of premium products, including Scotch whiskies, ports, brandies, wines, rums, and craft spirits. Its Roussillon-based vineyard and distillery produces calvados, a renowned French apple-based brandy, as well as other fine spirits.

Key Port Wine Companies:

The following are the leading companies in the port wine market. These companies collectively hold the largest market share and dictate industry trends.

- La Martiniquaise

- Sogrape

- Fladgate Partnership

- GRUPO SOGEVINUS FINE WINES

- A ACálem

- C N Kopke

- Symington Family Estates

- DELAFORCE

- Adriano Ramos Pinto - Vinhos S.A.

Recent Developments

-

In March 2024, Kopke launched The Library Collection, a curated selection of rare wines, featuring three exceptional bottles honoring the company’s heritage. These wines have been aging together in 400-liter barrels at Vila Nova de Gaia cellars since the early 1900s.

-

In February 2024, Sogrape announced a successful harvest in the Douro region, where cutting-edge techniques and aging processes were employed. The company made a strategic decision to release Barca-Velha 2015 for sale in the summer.

Port Wine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.0 billion

Revenue forecast in 2030

USD 1.4 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD MILLION/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, South Korea, Australia & New Zealand, Brazil, South Africa

Key companies profiled

La Martiniquaise; Sogrape; Fladgate Partnership; GRUPO SOGEVINUS FINE WINES; A ACálem; C N Kopke; Symington Family Estates; DELAFORCE; Adriano Ramos Pinto - Vinhos S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Port Wine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global port wine market report based on nature, type, distribution channel, and region.

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Red

-

White

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ruby

-

Tawny

-

Vintage

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."